As the summer heats up spot gas prices have continued to slump. Asian LNG cargoes are changing hands at under 11 $/MMBtu, price levels not seen since Fukushima. The reaction of European hub prices illustrates the global gas price linkage that has evolved with the LNG market. UK NBP spot gas prices are now around 35 p/th (TTF spot around 15 €/MWh), a 50% fall from the end of last year. As surplus gas continues to flow into Europe and re-shape the hub price landscape, we are publishing a two part series on European hub pricing dynamics.

In this article we look at the linkage between Asian LNG prices and European hub prices, as well as some of the characteristics and implications of the current hub price decline. In next week’s article we look at some of the factors driving European gas supply flexibility value, specifically hub price volatility and price divergence across hubs. In both articles we again apply the framework we set out previously for understanding European hub price dynamics.

The price slump continues

A mild European winter and spring has blossomed into a warm summer. Good for the holiday season but not for European gas demand. Asian LNG demand has also been weak and falling spot prices have resulted in an increase in LNG flow into European hubs. This is partly the result of surplus Qatari LNG flow (as we explained here) and partly due to a decline in the diversion of European LNG supply given low Asian spot price levels.

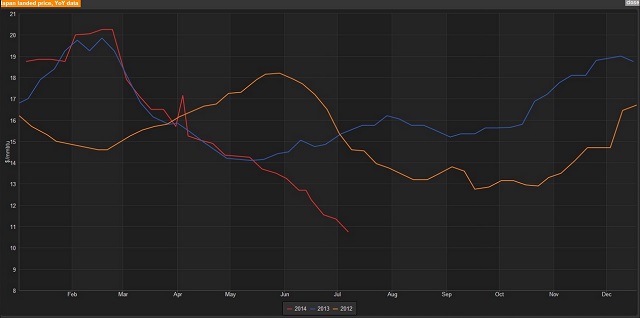

The power and gas team at Reuters have put out some good charts recently that illustrate the current price moves in an historical context. Chart 1 shows the 2014 Asian spot price decline against the context of 2012 and 2013 LNG spot price seasonal shape. Previously Asian spot prices have found support in the 12-14 $/MMBtu range as at these levels European hubs start to soak up surplus cargoes. But weakness in European pricing this summer has seen a continued decline in Asian spot prices.

What is driving hub prices now

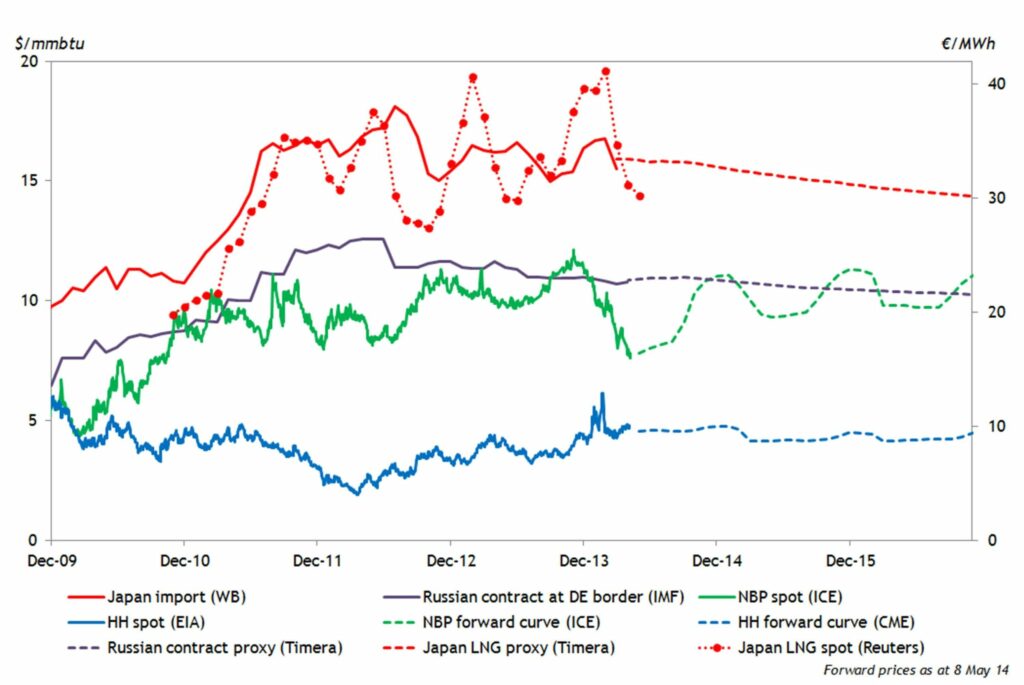

Our framework for European hub pricing revolves around understanding the marginal sources of flexible supply that drive hub price dynamics. Gas prices tend to be anchored in a loose band around oil-indexed contract prices, with contract swing, production flex (e.g. Statoil) and storage the main drivers of marginal pricing. The current market dynamics have knocked European hub pricing dynamics out of this state of relative stability, as shown in Chart 2.

Weak demand and surplus LNG flow have caused hub prices to disconnect from oil-indexed contract levels. This disconnection has happened previously (e.g. post financial crisis in 2009) and it tends to be a temporary or transitional effect (as can be seen in Chart 2). What is important, is to understand the marginal sources of supply that can react to stem the hub price decline, for example:

- Storage typically provides summer price support as facilities inject in preparation for the winter. But after a mild winter, storage balances are relatively high (e.g. average levels above 80% across Germany, the UK and the Netherlands) so injection demand is weaker.

- Flexibility within supplier portfolios has increased in price responsiveness as trading functions optimise flexibility against hub prices (e.g. substituting cheap spot gas into the portfolio where possible to replace higher cost sources). However most of this flexibility is likely to have already been utilised (e.g. swing contract volume take minimised).

- LNG flow is typically relatively price insensitive in times of weak prices, given limited production flexibility. Although the Qataris are reportedly taking some steps to curb production to alleviate further pressure on prices.

That leaves the power sector to play an important price support role. Since 2010, coal plants have enjoyed a substantial competitive advantage over gas plants in Europe, given declining coal prices. This year’s gas price slump has eroded that advantage and coal and gas plants are starting to compete again to set marginal power prices. This is most visible in the UK power market where new high efficiency CCGT plants are starting to displace older coal plants in the merit order, increasing power sector gas demand. It is worth keeping an eye on gas vs coal switching levels going forward, because if hub prices continue to decline these will become a key price support benchmark.

Some implications of the price slump

Gas producers are nervously observing the current price decline for an indication as to whether this is a one summer phenomenon or a more structural change. The deeper the slump and the longer it continues the broader the commercial implications are likely to be. Of primary interest is the threat of another round of European long term gas contract price re-openers. Over recent years, suppliers have been relatively successful in recovering concessions from producers as they have suffered the impact of spot (and hence retail) prices falling relative to their contract cost base.

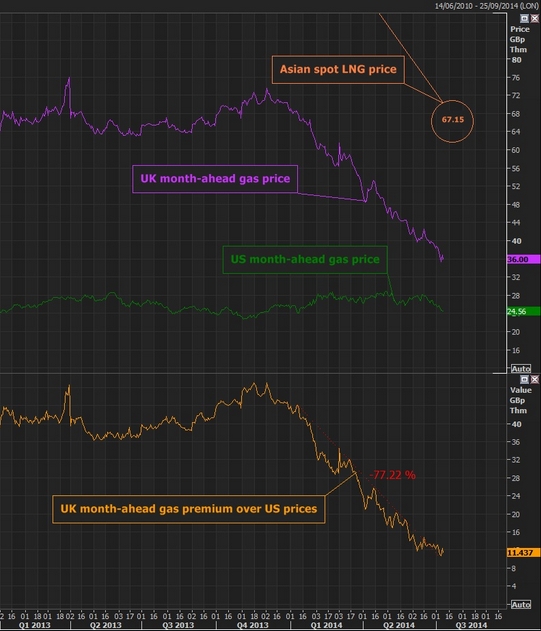

Another key consideration is the impact of the global spot price slump on LNG liquefaction projects. A number of projects without long term contract cover are feeling the squeeze on both sides. The spot price slump is reducing their bargaining power with buyers at the same time they are trying to control project cost blowouts. This is an issue across Australia, Canada and the US. The Reuters team have provided some interesting background on the impact of falling spot LNG prices here as well as an illustration of the US vs UK spot price spread in Chart 3.

All eyes in the gas market will be on how spot prices recover into this winter. Weather will of course play an important role (just as it has done this year). But it is worth noting that consecutive warm winters have been observed in Europe over the last decade (i.e. they can come in groups). But just as important as the weather will be the way that large portfolio players react to the price declines and how this impacts the marginal sources of supply flexibility. One of the interesting dynamics that can be observed over the last few months is that hub price volatility is increasing despite the price declines. We come back to explore that dynamic in more detail next week.