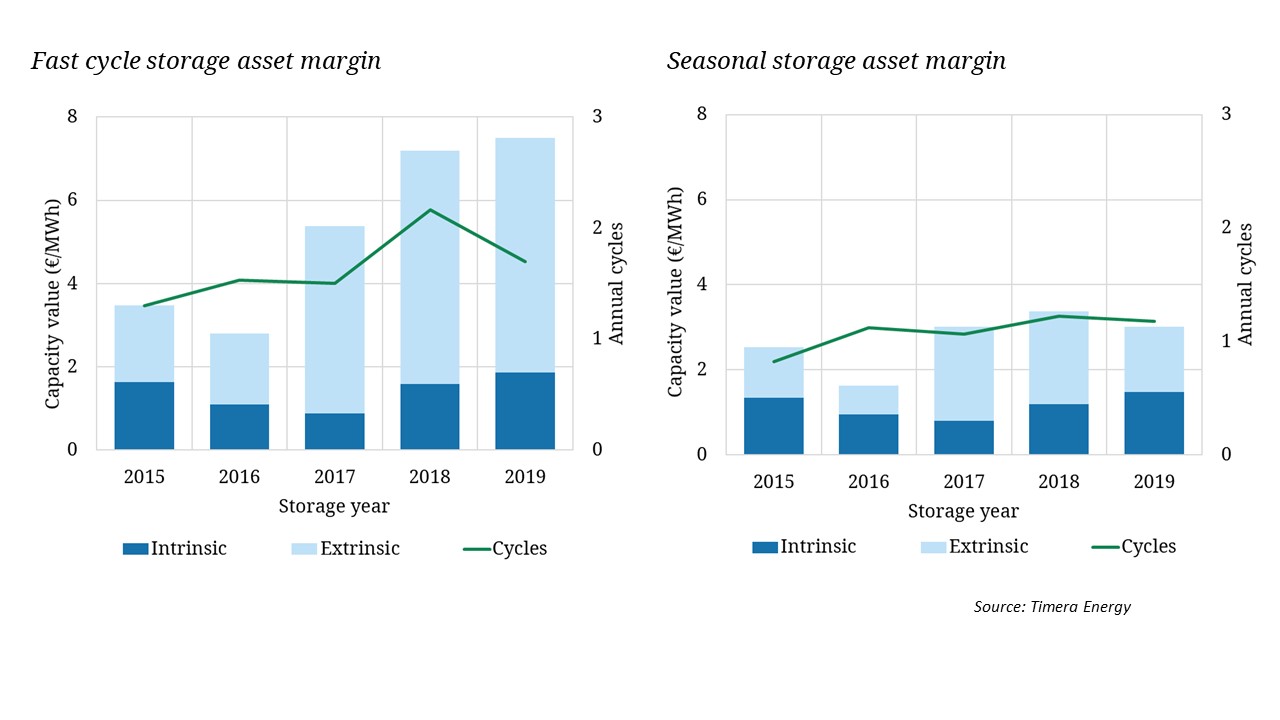

Despite low hub prices across the last two years, European gas storage asset margins have continued their structural recovery. The charts show estimated asset margins for a generic fast cycle storage asset (left hand) and seasonal storage asset (right hand) optimised against TTF using a rolling intrinsic strategy across the last 5 years. Both spot price volatility and seasonal price spreads, the key price signals for storage flexibility, have been on a recovery path since 2017. The correlation between traded forward market contracts has also fallen, driving an increase in achievable margin from hedging in the forward market. The greater increase in extrinsic value for fast cycle storage reflects the impact of faster injection & withdrawal enabling capture of a larger portion of value from prompt time spread volatility. The storage margin recovery trend looks set to continue into the 2020s.

Gas storage margins continue to rise