“Value capture remains strong but it is not all accruing to asset owners”

Prior to 2021, Russian gas contracts played a key role in providing supply flexibility to the European gas market. This key source of flexibility virtually disappeared in 2022 with post invasion supply cuts of Russian gas imports.

Value capture by gas storage capacity across Europe surged as a result. We look at analysis today that shows that storage value capture remains well above pre-crisis levels, albeit more focused on within year price movements. We also consider what this means for the value of storage assets and for capacity sales strategies.

Backtesting storage value capture

The cleanest way to analyse storage value capture is via backtesting analysis. Backtesting should reflect revenue capture from a realistic storage optimisation strategy against historical gas price data across a range of spot & forward contracts.

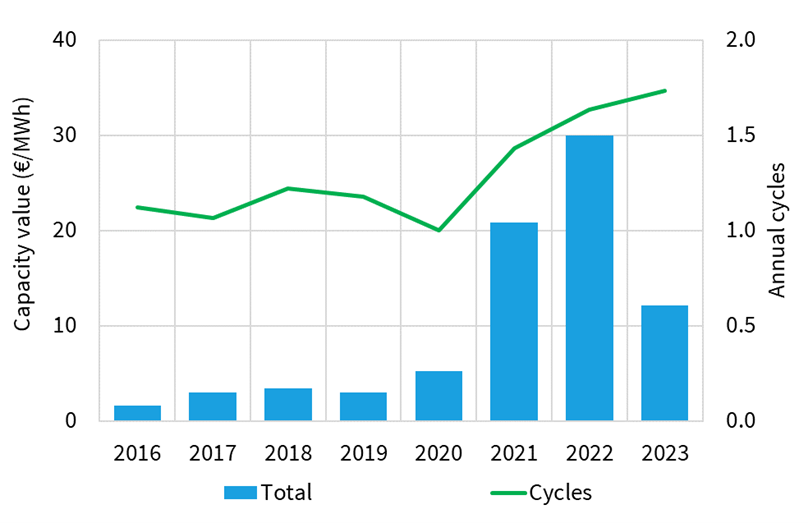

Chart 1 shows the evolution of backtested capacity value for a generic seasonal storage asset (180 day cycling time) with access to the TTF price hub.

Note the chart shows storage years (which run from 1st Apr to 31st Mar) ie the 2023 storage year has just ended on 31 Mar 2024.

We have done the analysis in Chart 1 using our gas storage optimisation model to analyse value capture from a rolling intrinsic strategy based on available spot & forward price information across each day of the storage year. We assume modelled storage capacity starts and finishes the storage year with zero inventory (consistent with a one year storage contract).

Several key initial takeaways before we dig into specific value drivers in 2023:

- Storage value capture went through a tough period pre 2020 as summer – winter price spreads remain subdued given ample seasonal supply flexibility across Europe

- Rapid reduction in Russian supply volumes & flexibility in 2021-22 saw storage value capture increase substantially (roughly 10 x pre 2020 levels), as price spreads & volatility surged with the energy crisis

- Storage revenue capture in 2023 has remained structurally higher than pre-crisis levels, despite a significant easing in gas market tightness across the last 12 months.

Let’s now explore that last point on 2023 returns in more detail, because it points to some useful information on the potential evolution of storage value.

Volatility is playing a key role in driving value

The key difference between 2023 vs 2022 price dynamics was a much lower level of structural price divergence between contracts. This is illustrated in Chart 2 which shows a comparison of the Day-Ahead (D-A) minus Month-Ahead (M-A) price spreads across both years.

This is one of the key spreads storage capacity owners can use to generate value e.g. via buying D-A contracts and selling higher priced M-A gas. 2022 saw huge price spreads particularly in Q4 where spreads blew out to over 50 €/MWh as adequate near term supply pushed down prompt prices relative to forward prices (which remained elevated due to risks of market tightness).

While there were some periods of temporary D-A vs M-A price divergence in 2023, these were much less pronounced. The story of 2023 value capture for storage was more one of persistent volatility in price spreads across the year (relative to pre-crisis levels).

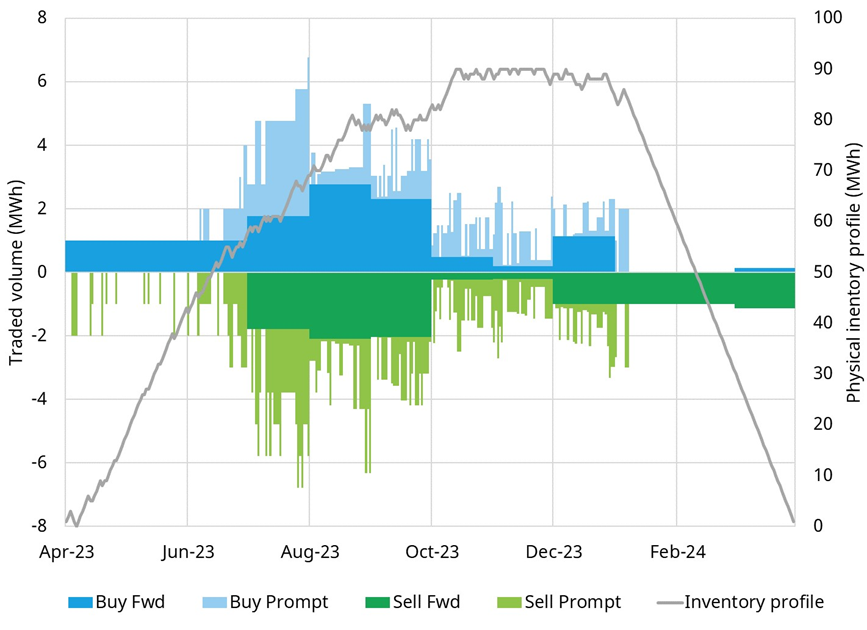

Chart 3 shows a summary of how the Timera storage model analyses backtested value capture across the 2023 storage year based on a rolling intrinsic optimisation strategy. This illustrates the inventory profile (grey line) as well as prompt (within month) and forward contract trades to capture value.

Chart 3: Rolling intrinsic value capture & storage inventory profiles

Source: Timera Energy gas storage model

The chart illustrates the interaction between (i) more structural forward hedge positions e.g. implemented to hedge seasonal shape at the start of the storage year and (ii) prompt trading to create value uplift from price volatility across the year. Significant contract churn can be seen, particularly in Q3 and Q4, creating value capture uplift from within-year volatility in price spreads.

Implications for storage operators & investors

The rapid loss of Russian supply flexibility has structurally boosted the value of storage capacity relative to pre-crisis levels, but this value is not necessarily flowing to storage asset owners. The reason is that many storage asset sales strategies are focused on selling capacity contracts on a year-ahead basis. As a result, a significant amount of value capture from within-year value price spread volatility accrues to capacity buyers (e.g. trading desks).

This dynamic is causing a number of storage asset commercial teams to re-assess capacity sales strategies with the aim of capturing a greater portion of value given market conditions post crisis. Considerations here include e.g.

- Retaining higher capacity volumes to sell within-year to enable higher value capture

- Different ways of structuring price indexation of contracts to enhance value capture

- Profit share structures with capacity buyers.

There are also a range of other value drivers & uncertainties that are triggering owners to review asset strategy & ownership e.g.

- Changing role of storage & associated policy shifts e.g. storage mandate levels; German gas neutrality charge

- Shifts in transport tariffs / costs e.g. driven by falling demand & flow changes post crisis

- Impact of increase renewable penetration on gas plant flex requirements

- Broader decarbonisation risks

- The evolving impact of requirement for hydrogen infrastructure.

These factors are combining to challenge the commercial models, risk appetite & ownership structure adopted by storage investors.

Timera is recruiting

Given strong demand for our services, we are actively looking to recruit:

See our Careers page for more information on available roles, life at Timera and how to apply.