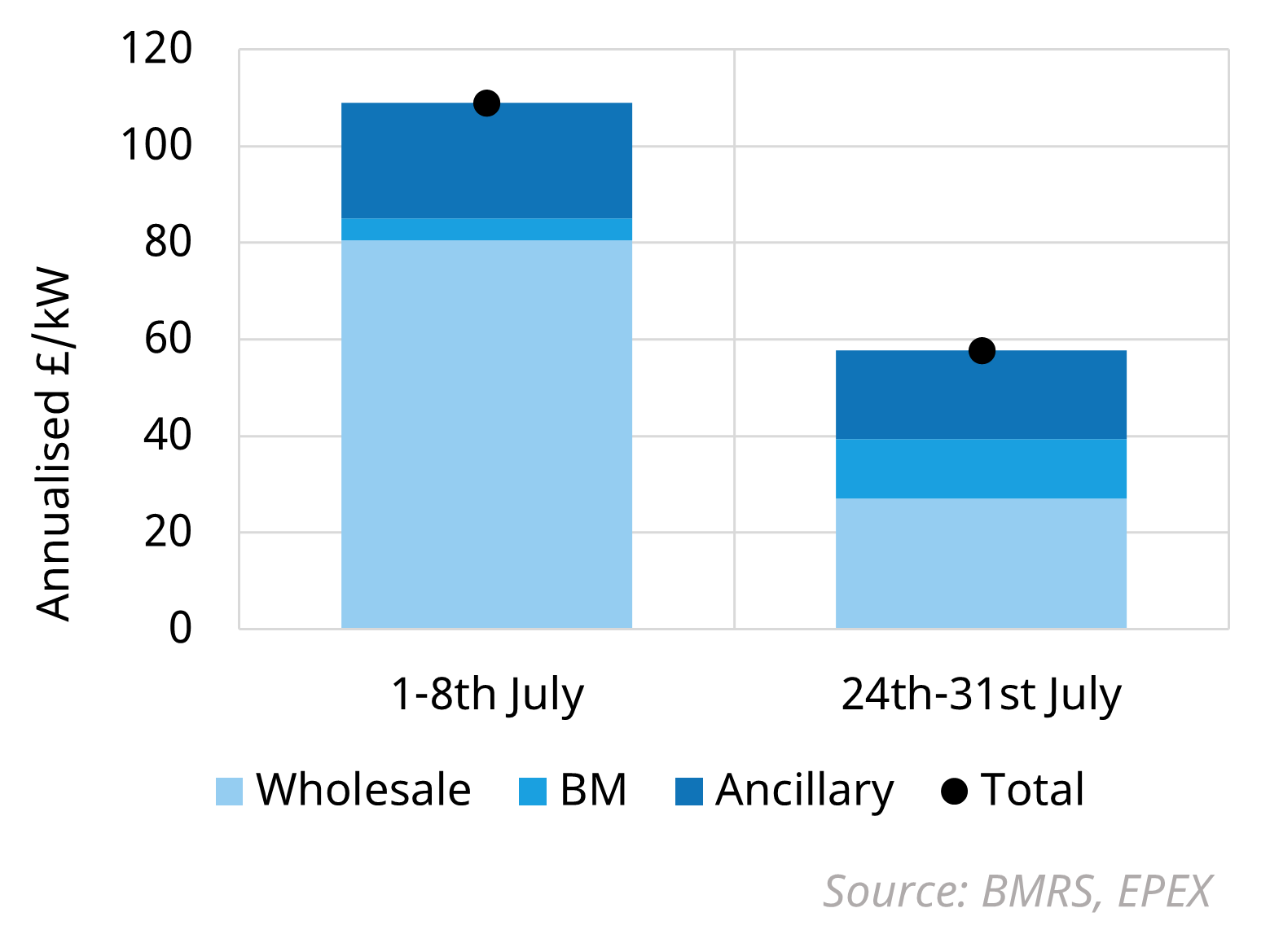

GB BESS revenues have remained strong through 2025 so far, particularly when compared to the damp revenue environment observed across the first half of 2024. However, into late July, revenues saw a significant drop from ~90 £/kW to ~55 £/kW across the 2hr fleet. This was driven by a variety of factors as summarised below:

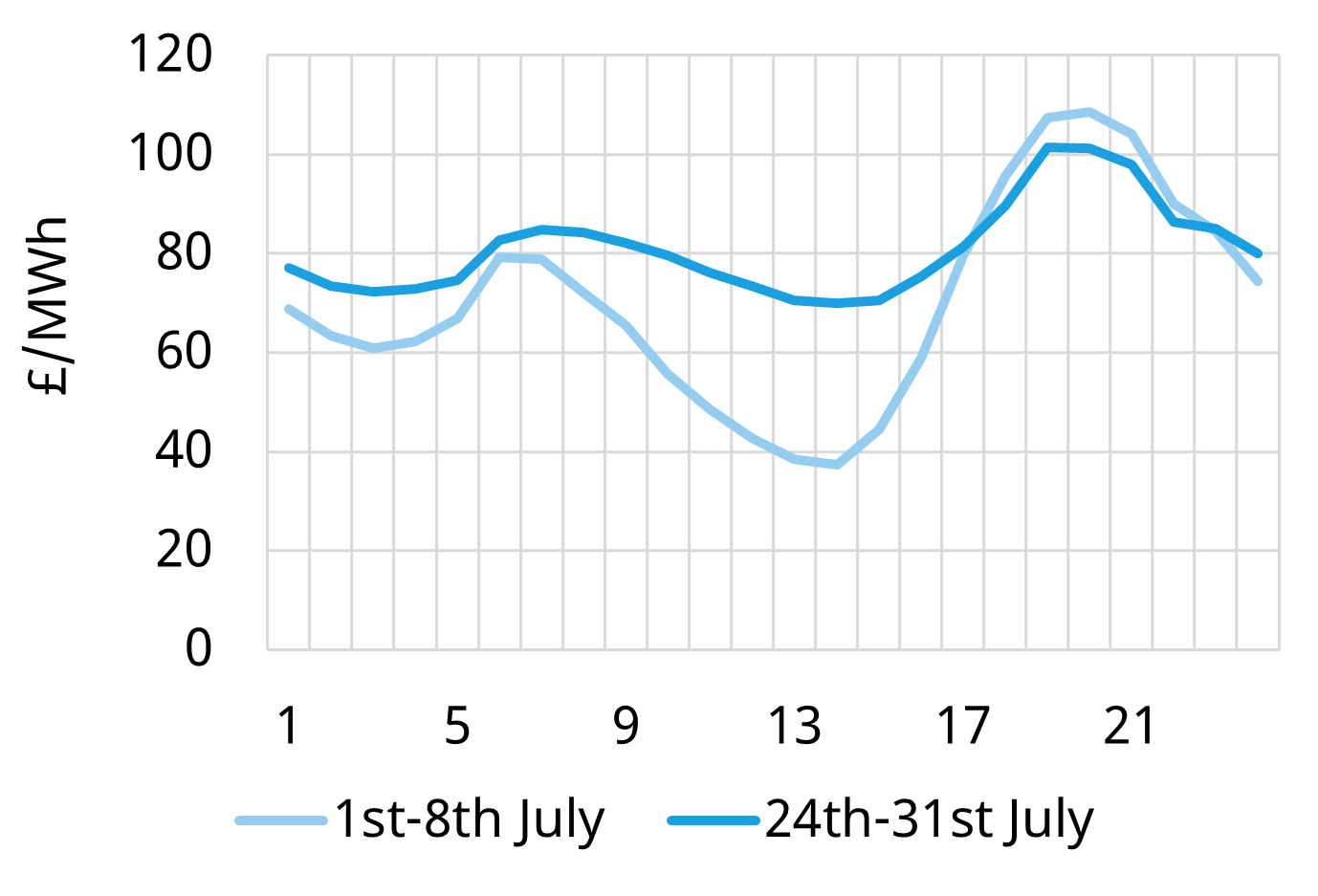

- Day ahead spreads compress on weaker RES output

Wind output fell sharply (~55%) from the first to last week of July, with solar also down (~22%). This drove an increase in gas generation, flattening the midday price dip in the average shape as shown in the chart. As a result, 1hr Day ahead spreads halved, falling from ~73 £/MWh to ~36 £/MWh. - Lower RES drives BM rebalancing volumes down

The decline in wind also filtered through to the BM. Accepted BESS volumes fell by ~40% as reduced wind output lessened the requirement for rebalancing actions, for example from congestion management. - Ancillary prices ease as competition rises

Ancillary markets have seen a recovery as a revenue source through 2025, supported by higher procurement volumes. But as wholesale and BM revenues softened, bidding for contracts in ancillary markets became more competitive, leading to reduced clearing prices across reserve and the dynamic suite relative to early July.

The revenues for the asset in the chart show these effects with wholesale revenues seeing a large drop on falling price spreads, ancillary revenues declining on reduced clearing prices and a rise in BM revenues as bid acceptances fall (which are a net cost for the asset) but allow for charging at a discount to wholesale prices therefore boosting overall revenues.

July highlights how changes in RES output can rapidly reshape BESS revenue outcomes. Periods of weak wind and solar not only impact wholesale spreads but can also filter through to BM activity and ancillary service pricing. This shows the importance of stochastic modelling to capture the full range of revenue variability when forecasting BESS revenues.

We have more detailed analysis of the 2025 BESS revenue landscape and a broad range of analysis of other BESS value drivers, market & stochastic revenue projections as part of our GB BESS subscription service. Reach out to Arshpreet Dhatt (Senior Analyst) if you would like a free sample copy of our subscription service report (arshpreet.dhatt@timera-energy.com).