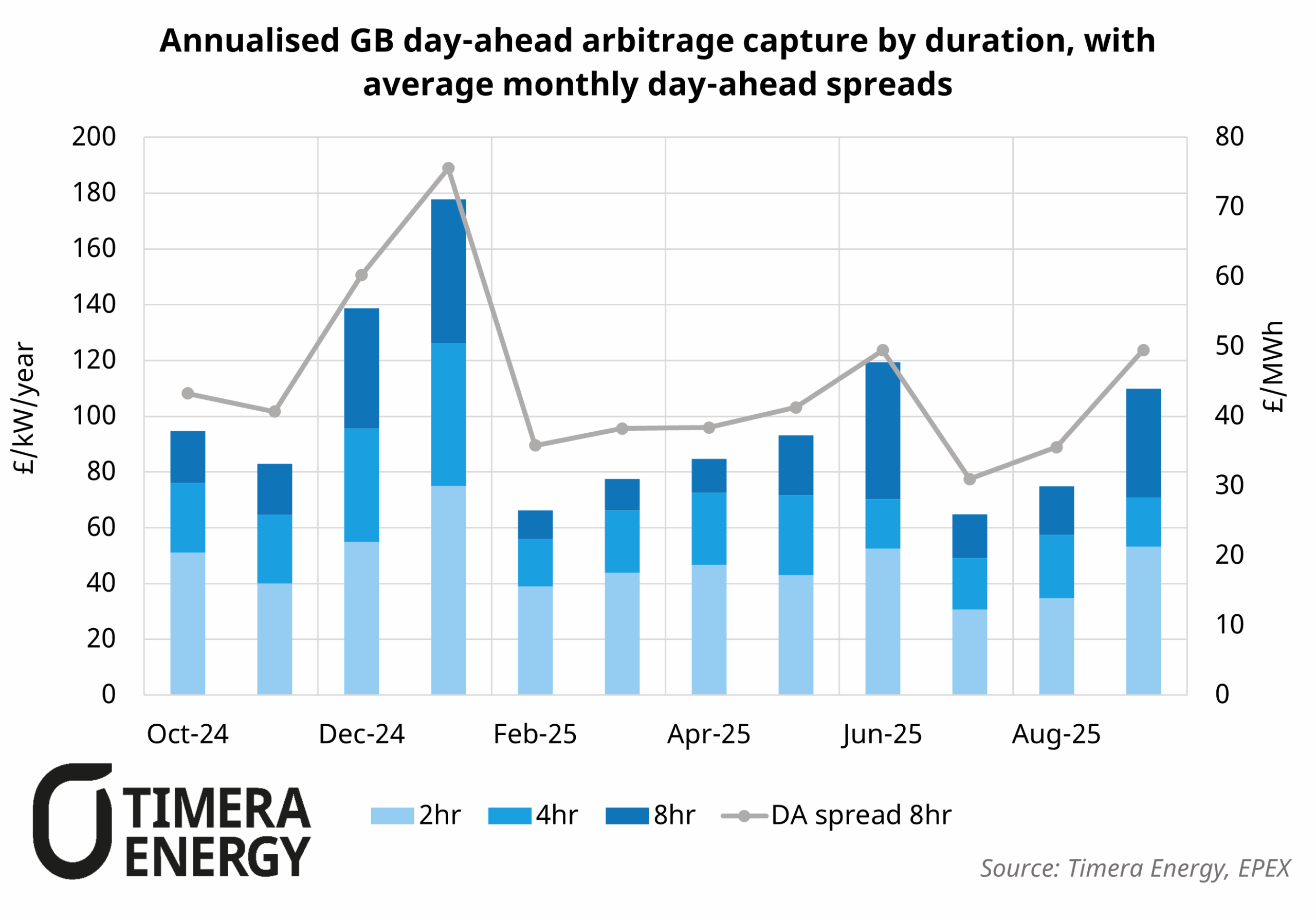

European interest in long duration storage (LDES) has surged across recent months with GB’s LDES cap and floor and the first MACSE auction in Italy. The chart above shows a backward look at 8-hour BESS margins in the GB Day Ahead market, highlighting how DA value does not scale linearly with duration as each extra hour adds less incremental margin than the last. Longer duration does, however, open additional value from some revenue streams:

- Congestion management can become increasingly lucrative with longer duration given many constraints can bind for many consecutive hours, but that upside comes with regulatory reform risk as congestion management costs grow (see our recent webinar on congestion value uplift here: Registration).

- Some ancillary markets can also require longer durations, with options like spin gen for pumped hydro widening the revenue base.

- Capacity market sees significantly more favourable de-ratings for longer duration storage (~80% for 8hr vs ~20% for 2hr), which can be particularly beneficial given high clearing prices (60 £/kW+) seen in recent auctions.

Timera Energy has deep experience in modelling and supporting investment across BESS, PHES and emerging technologies, using a stochastic modelling approach that provides a realistic view of asset optimisation and investment risk. If you’d like to learn more about our LDES modelling capability, feel free to reach out to our Power Director, Steven Coppack (steven.coppack@timera-energy.com).