On the 8th April 2025, Ofgem published a decision to open the first application window for its cap and floor scheme in Long Duration Electricity Storage (LDES). The scheme is designed to provide investors with revenue certainty through a minimum floor to de-risk downside exposure, while placing a cap on excess returns to protect consumers. This marks a tangible step forward in the UK’s bid to secure reliable, low-carbon power amid rapidly shifting energy market dynamics. Here’s a quick snapshot of what’s happening and why it matters:

Long-duration storage technologies have struggled to develop at scale, hampered by high upfront costs and uncertain revenue streams. Ofgem’s decision to launch a structured application window helps encourage more players to build and operate large-scale storage facilities, filling a crucial gap in the country’s power system during “Dunkelflaute” type events.

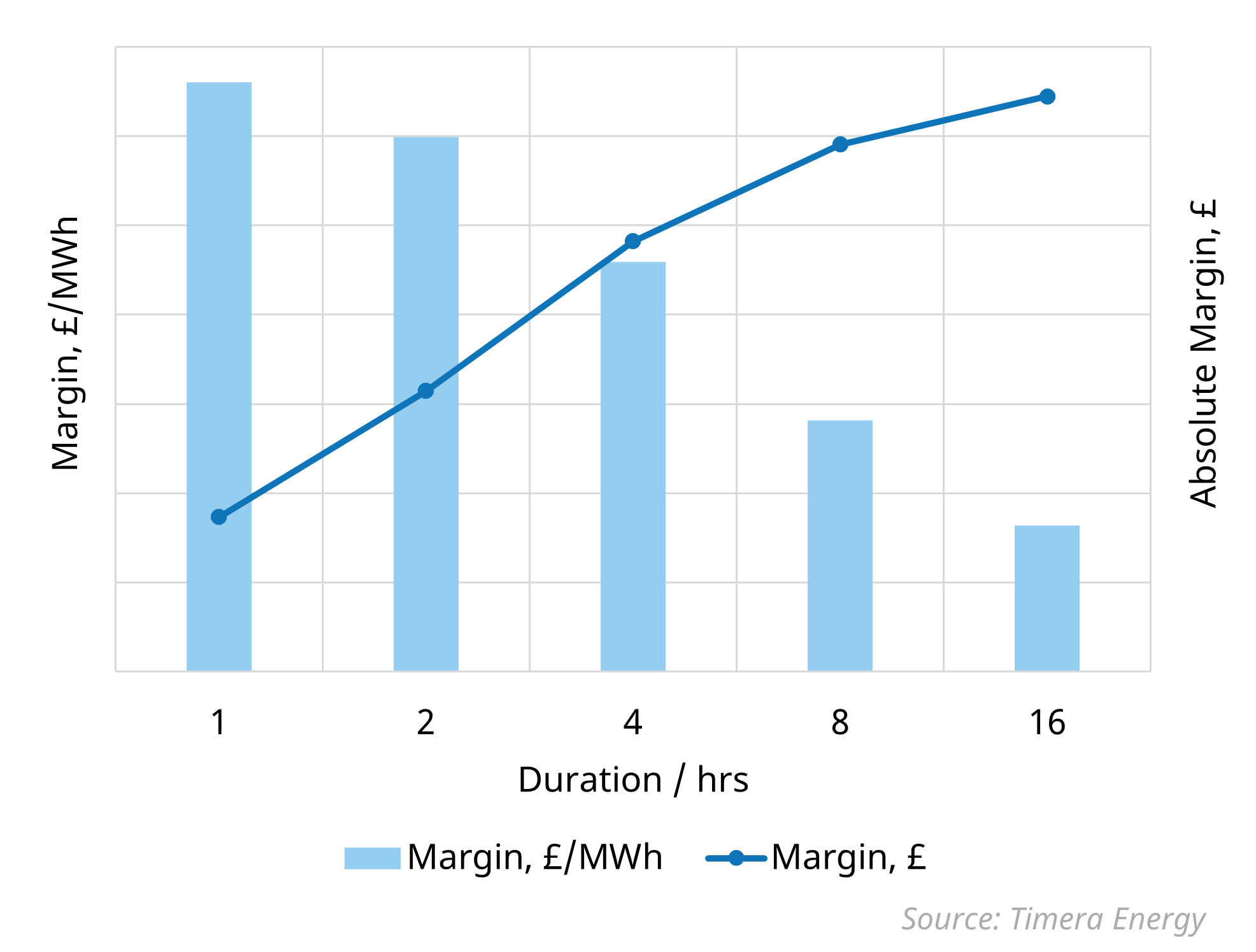

The chart shows a simple Day Ahead backtest for storage assets of different durations and highlights that as the duration of energy storage increases, the potential for capturing higher price spreads diminishes, negatively impacting £/MWh storage revenues. As storage duration increases, the system may be more likely to charge during high price periods and discharge during lower price periods, thus capturing a narrower price spread.

This reduction in the average capturable spread results in lower overall revenues per megawatt-hour stored, which is a key challenge for long-duration storage technologies and prompts the need for cap and floor support. The market is currently not structured to support longer duration storage as highlighted by the fall in margin / MWh at higher durations.

Ofgem has laid out several key dates to keep in mind over the coming months & years:

- 22nd April 2025 – Deadline to notify Ofgem of intent to apply (now passed)

- 9th June 2025 – Final deadline for (first window) applications to be submitted to Ofgem

- 10th June to 9th August 2025 – Ofgem eligibility assessment period

- Q3 2025 – Eligibility assessment decision publication

- Q2 2026 – Successful projects expected to be approved

Ofgem’s decision sends a clear message to investors that regulatory support is moving in favour of long-duration storage with this being the first targeted revenue support mechanism in the UK designed to unlock commercial-scale deployment of novel technologies such as compressed air energy storage (CAES) and flow batteries, offering a viable pathway for their development beyond demonstration stages. Expect to see growing developer and investor interest, particularly in large-scale battery and other innovative storage technologies that can offer extended energy discharge times.

The next few months are likely to reveal more details around project criteria, funding mechanics, and timelines. Reach out to find out more about how we model long duration storage technologies at Timera and how we could support your investment strategy in the upcoming auction.