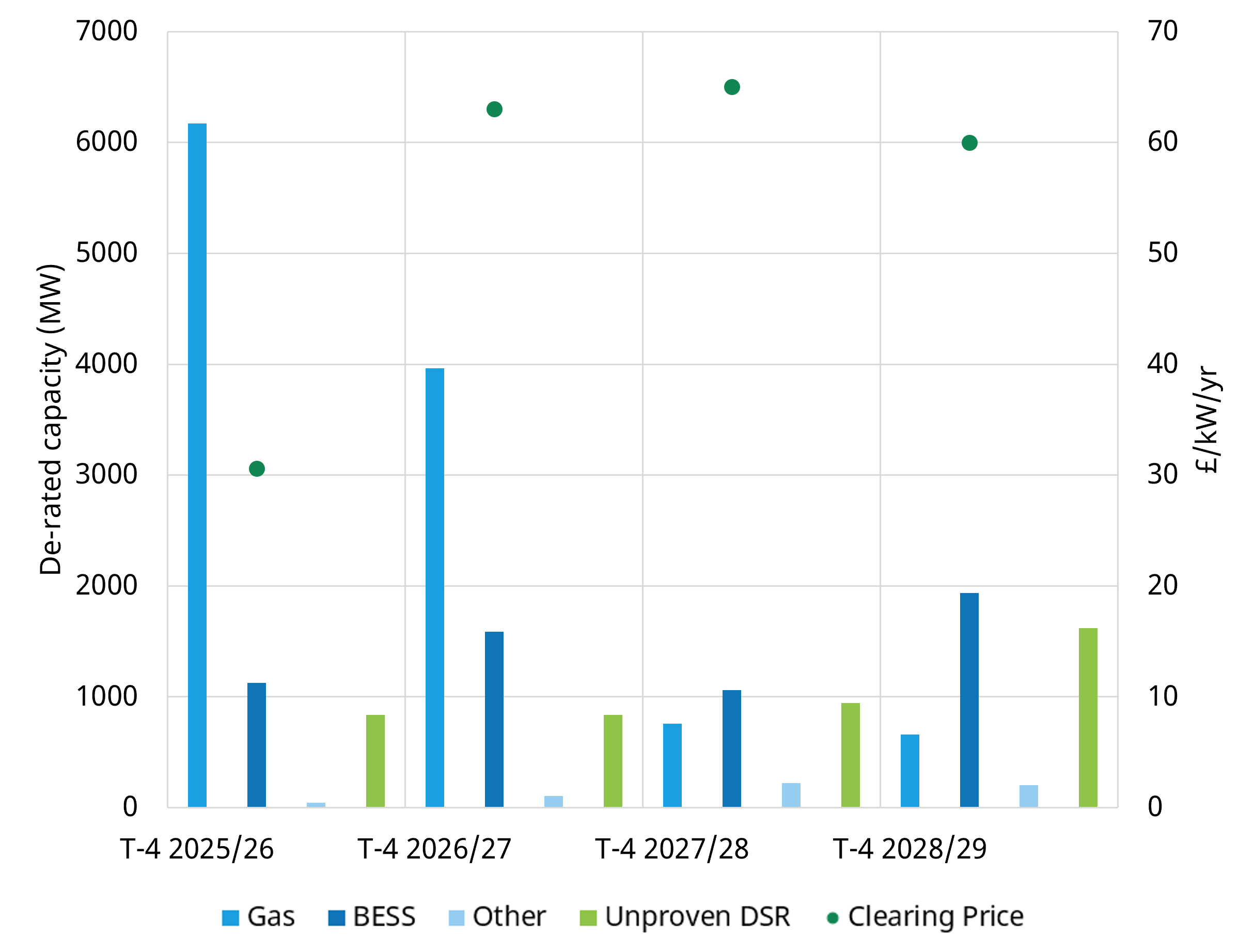

The T-4 auction for 28/29 cleared at £60/kW/yr on the 11th March, continuing the trend of tight auctions in recent years following last year’s record-breaking £65/kW. The importance of securing CM contracts has increased with NESO’s proposed grid connection reforms. Projects with CM contracts are now set to receive protected status for grid connection timelines, adding a potential advantage in the queue for connection over non-CM projects.

BESS emerged as a key winner in this auction, with 1.9GW of de-rated capacity clearing (~6GW nominal). The challenge for BESS now shifts to project delivery as falling revenues post-energy crisis and the risk of overbuild remain critical hurdles for BESS developers.

Gas-fired capacity, in contrast, continues to face investor scepticism. Despite multiple years of elevated clearing prices, new-build gas investment remains weak. This year saw limited new gas capacity securing contracts, reflecting a lack of appetite to deploy capital into gas assets given policy risks and uncertain long-term returns. EPH remain one of few players securing longer term gas contracts with Langage CCGT and one South Humber Bank unit securing 15-year refurbishment contracts.

Demand Side Response (DSR) had one of its strongest auctions to date, with the vast majority of prequalified unproven DSR securing contracts. This shows the growing role of flexible demand in balancing the system.

Overall, the auction results reinforce key structural trends: the rise of BESS (though build out of pipeline remains uncertain), continued weak investment for new gas, and the growing role of demand-side flexibility.