“RES growth will drive up wholesale price volatility, supporting BESS revenue capture.”

This assertion is a key driver underpinning BESS investment cases across Europe. But where is the evidence to support it?

In today’s article we use a German power market case study to demonstrate the substantial increase in power price volatility across the next decade.

Current power price volatility level

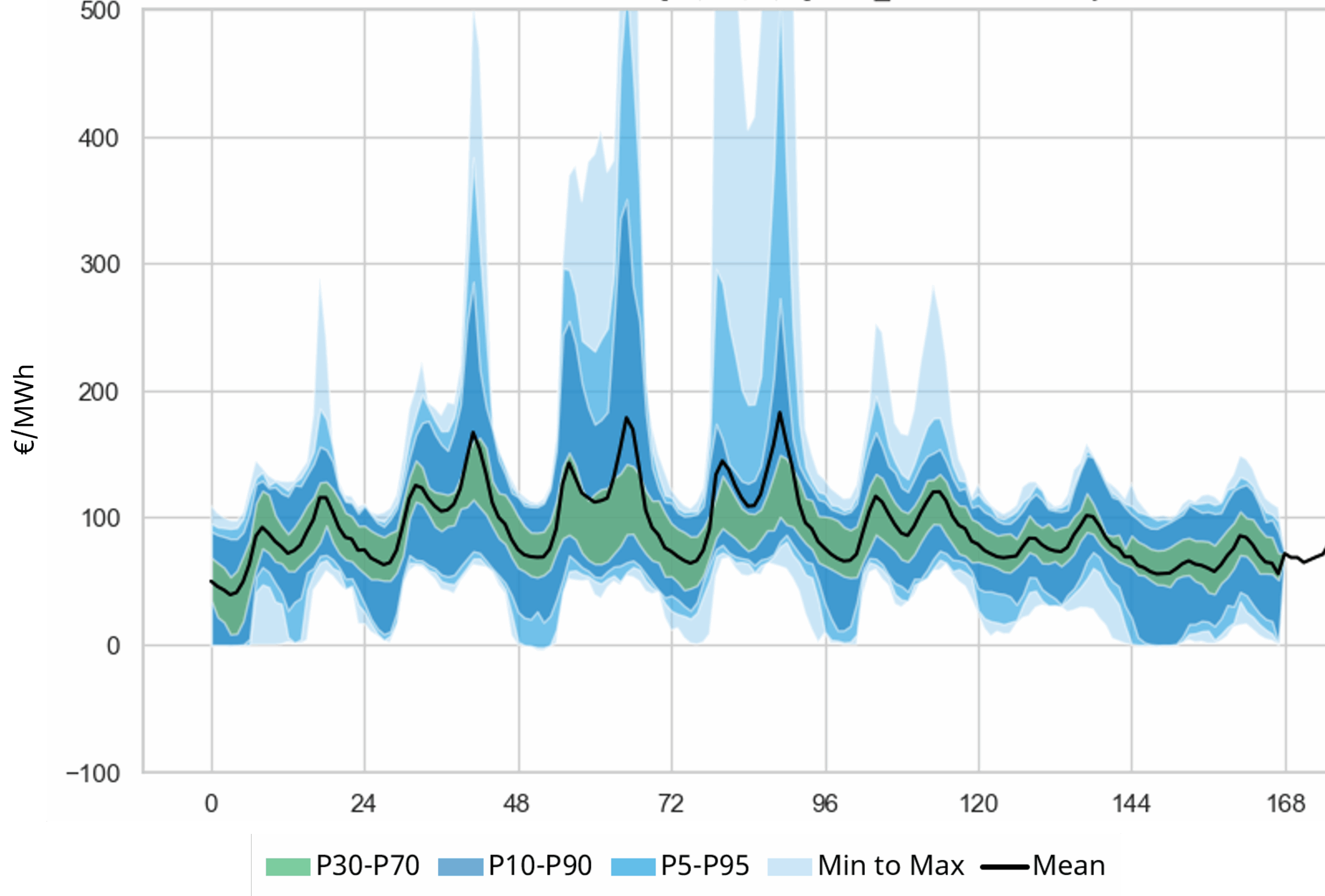

To frame the evolution of price volatility let’s start with some history. Chart 1 show the distribution of German power prices from Winter 2024 across the hours of the week (Mon – Sun).

Chart 1: Weekly power price distribution – Winter 2024

Source: Timera Energy, EPEX

The black line represents the average price, with the coloured bands showing percentile ranges around the mean. The impact of Dunkelflaute events in driving price spikes in Winter 2024-25 can clearly be seen.

Evolution of volatility 10 years forward

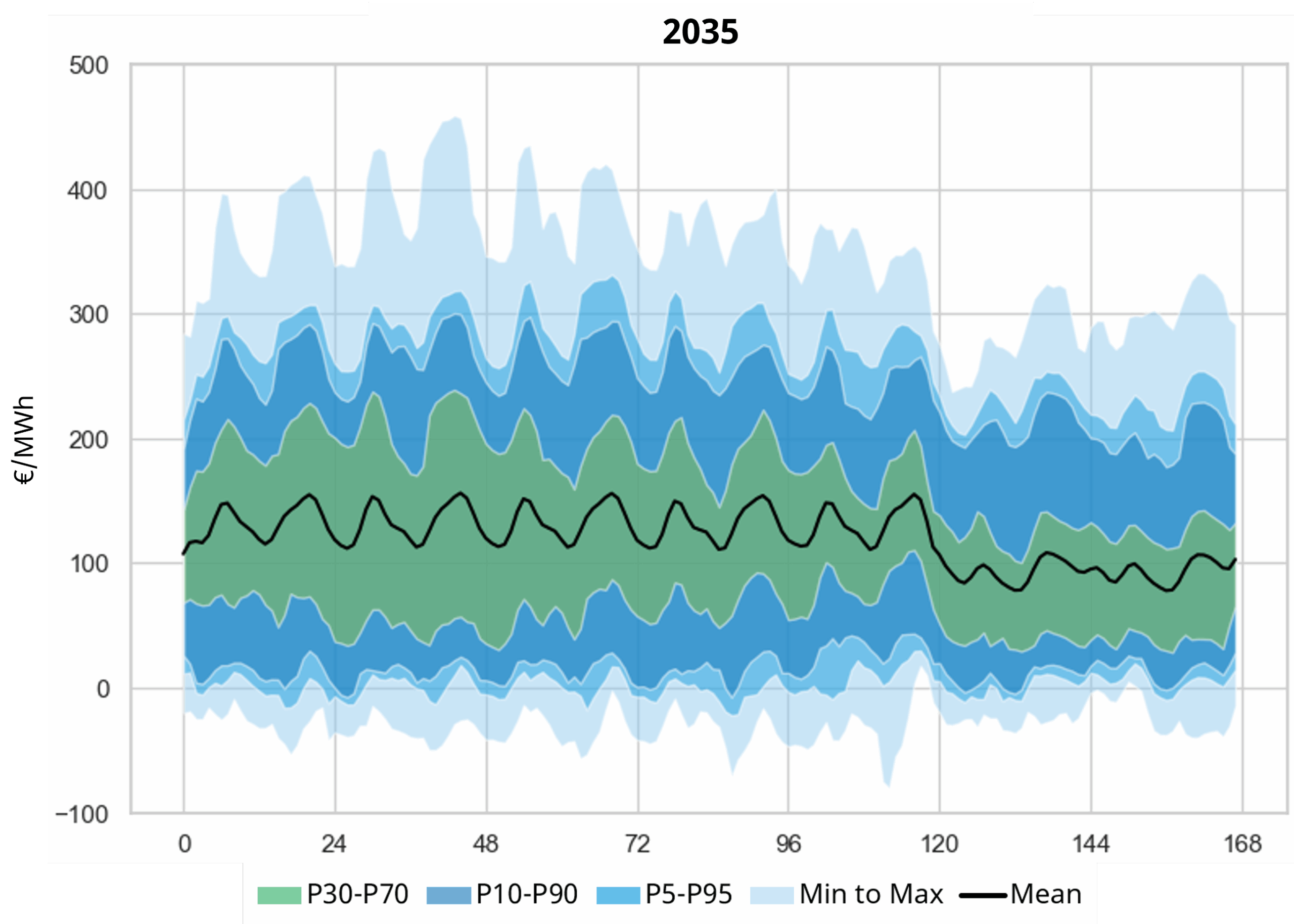

In Chart 2 we show a 2035 projected price distribution is produced from hundreds of correlated simulations of load, wind, solar & commodity price paths. Each of these simulations is run through our pan-European power market supply & demand model (capturing unit level bidding dynamics & cross border flows).

It is important to note that Chart 1 is based on the distribution of a single set of historical price outcomes (across winter 2024). Chart 2 is based on hundreds of correlated simulations of credible price outcome paths.

Even taking that into account, it is quite clear that our 2035 projection shows a structural rise in price volatility.

5 key takeaways for BESS investors

- Let’s summarise some key conclusions from the analysis above for BESS investors.

- RES trumps BESS – the impact of RES output fluctuations on price volatility, structurally outpaces the price dampening impact of investment in storage & new flex

- Higher volatility – the combination of increasing wind & solar penetration and retiring thermal asset flexibility is driving a structural increase in power price volatility

- Distribution skew – the upside skew of price distributions is increasing as the capacity mix evolves (i.e. impact of price spikes greater than troughs)

- Wind vs solar impact – wind impact on price volatility is greater than solar and more focused in winters (solar has greater summer price shape impact)

- BESS revenue floor – there is a rising inherent level of background price volatility which can be harvested by BESS assets, creating a structural revenue floor.

The last takeaway, on a structural revenue floor for BESS, is a key consideration for downside protection of both debt & equity investors.

More on German power market & BESS investment?

Timera has extensive experience supporting equity and debt investors in flexible German power assets, including BESS. We also have a quarterly German BESS subscription service. Feel free to reach out to Sam Kayne (sam.kayne@timera-energy.com) for further details.