If you’d just landed from Mars, with no prior knowledge of power markets, Germany would look like a prime candidate for the largest BESS market in Europe. The German power market has rapid wind & solar penetration, a growing flexibility deficit as thermal plants close and major transmission constraint issues.

“Within-Day value capture underpins the German BESS investment case”

As an illustration, German power today has traded at hugely negative prices (up to – 500 €/MWh). In other words batteries are being paid large sums to consume energy that they can resell at big premium only hours later.

This sounds like the backdrop for a battery party! But this has not been the case. Could this be about to change?

In today’s article we look at German BESS revenue stack drivers and how to value BESS assets.

The current state of play in Germany

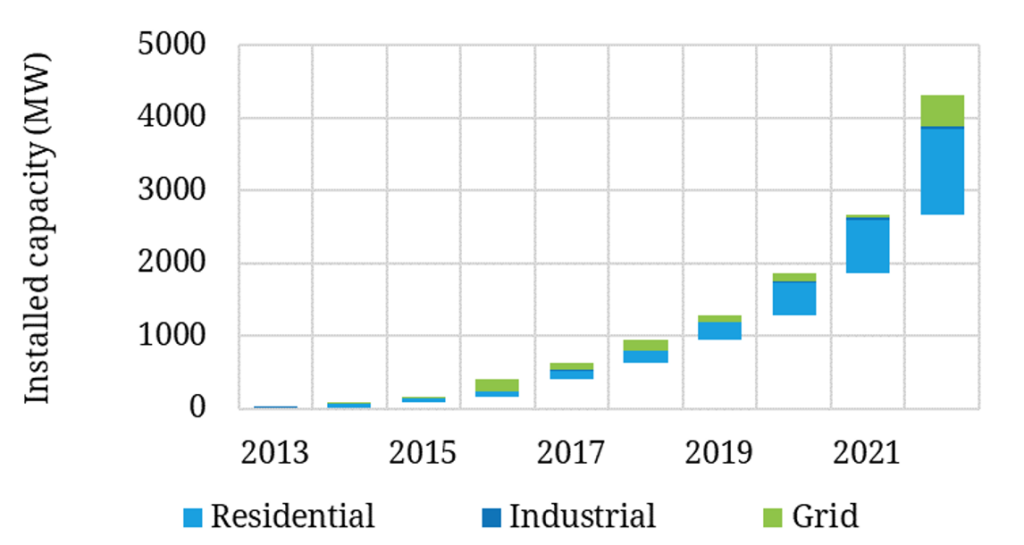

Unlike other countries in Europe, German BESS deployment to date has focused on residential installations. Higher energy costs in 2021-22 have supported residential deployment across the last 2 years, but with relatively low volumes of grid scale BESS investment, as can be seen in Chart 1.

At a residential level BESS is being paired with solar PV with a focus on household energy independence… despite questionable economics. Commercial & industrial deployment of BESS has been driven by avoided network charges but has been in much smaller volumes.

Going forward, efficiencies of scale are set to see grid scale BESS investment dominate deployment.

Grid scale BESS to surge past residential

There is only 1GW of operational grid scale BESS capacity in Germany. But we have seen a step change in German BESS investment momentum from our client base in 2022-23, spurred by higher price volatility.

Investment to date has been dominated by Stadtwerke (municipalities) and utilities spread across a range of smaller sites (e.g. 15-40 MW). But strong BESS revenues in 2022 are spurring interest from new entrant investors, with established GB BESS platforms looking to build German portfolios.

There are however some nuances in the German BESS revenue stack that make it quite different from other established BESS markets such as GB and Italy.

5 components of German BESS revenue stack

In chart 2 we illustrate the proportional build-up of asset lifetime value contribution from the key components of the German BESS revenue stack for a 2 hour duration asset.

Chart 2: Asset lifetime revenue breakdown for 2 hour German BESS

Source: Timera Energy stochastic battery dispatch optimisation model

In Table 1 we dig into the components of the revenue stack & what drives value.

Table 1: German BESS revenue stack components

The most important difference between the German BESS revenue stack and other markets is the scale of the value capture opportunity from volatile & liquid 15 minute granularity Within-Day market.

Valuing German BESS

The structure of the BESS revenue stack in Germany has important implications for asset valuation.

Within 3-5 years the volume of BESS capacity in Germany is set to structurally saturate system operator demand for ancillary services. This is already happening with FCR and aFRR will follow. If you doubt this logic look at GB market ancillary revenues for confirmation.

Opportunistic value capture from ancillary services will remain (although relatively small & focused on shorter duration BESS). But it is energy arbitrage value that underpins the German BESS investment case.

This is where modelling methodology becomes very important for realistic valuation of German BESS assets. This depends on capturing optimisation of batteries against simulated within-day prices.

We summarise our modelling approach in Diagram 1 below.

Our modeling methodology maps on to the challenge facing a German battery optimiser:

- Decide whether to commit the battery into FCR or aFRR at the D-A stage vs pursue an energy arbitrage strategy

- Decide whether to lock in an initial cycling profile against the D-A hourly auction prices

- Dynamically optimise contracted positions & battery cycling profile in the W-D market (the source of greatest value capture)

- Re-optimise again against real-time aFRR utilisation prices as opportunities arise.

These steps need to be replicated in a battery valuation model. It is also important that the reality of imperfect foresight of market evolution is properly captured within the model – post modelling assumptions on % haircuts of ‘perfect foresight’ are a big red flag of an inadequate BESS model.

The pace of grid scale BESS growth in Germany across the next 5 years is likely to surprise to the upside. And the BESS investment case is firmly focused on Within-Day value capture given strong growth in RES balancing requirements.

Timera is recruiting

As the energy transition and focus on flexibility gathers pace, we are seeing a strong increase in client demand for our services. As a result we are actively looking to expand our team by recruiting Analysts with 1-4 years experience.

We currently have several Commercial Analyst position vacancies (click on link for more details).