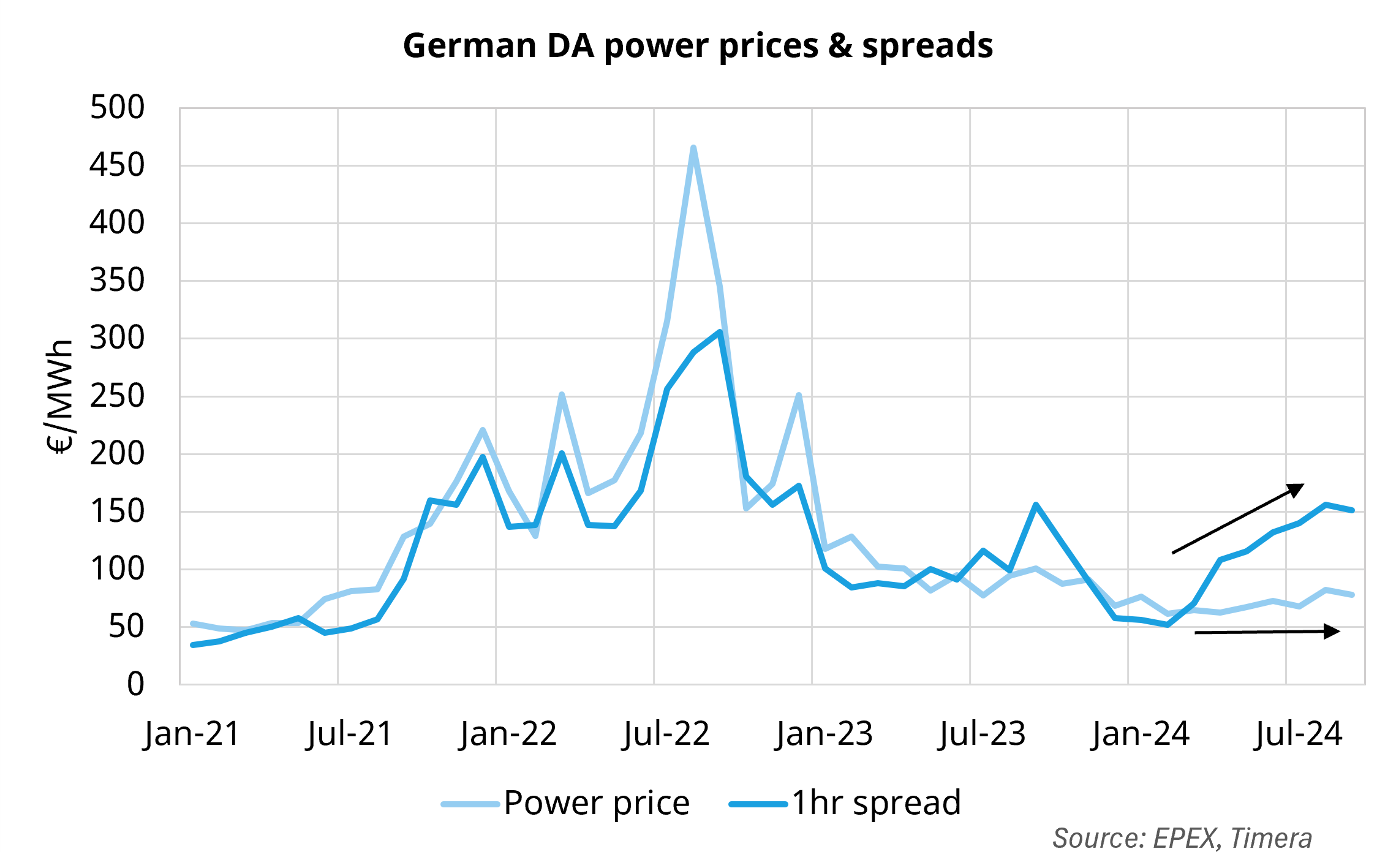

The recent decoupling of German power prices and spreads highlights the shift in market dynamics driven by growing renewable penetration. Historically, power prices and spreads have been closely linked, with spreads typically reflecting peak power prices and, by extension, the average power price. However, increasing renewable output is driving down average prices, while variability is widening spreads, resulting in a divergence of the two. Widening spreads offer greater revenue opportunities for storage assets, reflecting the system’s growing need for flexibility to balance increasingly volatile supply and demand dynamics.

German power prices & spreads diverge with growing RES penetration