The LNG shipping market is characterised by unusual terms such as ‘demurrage’, ‘ballast’ and ‘bunkering’. It features interesting conventions such as ‘canal transit costs’ and is impacted by the very real threat of modern day piracy.

While all of this is interesting trivia, these factors all play a role in determining the cost of moving gas between locations. The market for LNG vessels is a different animal to the more homogenous traded markets for delivered gas. The costs of shipping gas are determined by very physical considerations around logistics and constraints.

LNG shipping costs have an important influence on global gas flows and pricing dynamics. LNG shipping costs are a key driver of:

- The value that can be generated from moving gas between different locations

- The level of price spreads between regions across the global gas market

Shipping costs have played a particularly important role over the last two years in determining the cargo diversion decisions to higher priced markets, as global prices have diverged post Fukushima. They are also a key consideration in understanding to what extent global prices may converge in the future.

In this article we provide an overview of the build up of LNG shipping costs and their influence on gas flows and pricing. We will then follow up with an assessment of global LNG shipping supply and demand dynamics and the implications of these on shipping costs.

Shipping cost components

The key components that make up the cost of shipping LNG are as follows:

Chartering fee: This is the payment for securing access to shipping capacity by chartering a vessel. There are broadly three ways to secure access to shipping capacity: (1) own vessel capacity (2) time charter and (3) single voyage or spot charter. Spot charter rates are generally higher and certainly more volatile than longer term time charter rates. We will look in more detail at the drivers and evolution of charter rates in an article to follow.

Brokerage: Vessel charters are typically arranged through specialist brokers and attract a 1-2% fee.

Fuel consumption: The voyage fuel or ‘bunker’ consumption is directly proportional to the distance and speed of the vessel. This is typically the second largest cost component after the chartering cost. The added complication for LNG vessels is the different propulsion mechanisms and fuel burn options. Most LNG vessels can burn fuel oil, boil-off gas or a blend of both in their boilers. As a result the calculation of fuel cost is closely tied to that of boil-off gas. Natural boil-off occurs at a rate of approximately 0.15% of inventory per day and at times boil off is forced above this level to further reduce the fuel oil requirements. Some modern LNG vessels also have the ability to re-liquefy boil-off gas, keeping the cargo whole (and allowing the use of more efficient diesel engines). Calculation of the direct fuel consumption is fairly straightforward but the opportunity cost of LNG boil-off is also an important consideration.

Port costs: The components and level of the costs of loading and unloading at ports can vary widely depending on location. For example, ports in less stable regions can levy large security charges associated with ensuring the safety of the vessel.

Canal costs: Transit costs have to be paid for using the cross-continental Suez and Panama canals. Only a small fraction of the current LNG tanker fleet can squeeze through the Panama canal making the Suez is the most common canal transit. Suez canal transit costs are a complex function of vessel dimensions and cargo (laden voyages being more expensive) and LNG vessels are entitled to a 35% discount after which the costs are in the region of USD 300-500k per transit. The Panama canal widening project, due for completion in 2015, will allow up to 80% of LNG vessels to make the transit. This will reduce the distance from 16,000 to 9,000 miles from the US gulf coast to premium Asian markets. The impact on shipping costs to Asia is less clear as the tariffs have yet to be published. However, any reduction will increase the competitiveness and influence of Henry Hub priced US Exports on Asian pricing.

Insurance costs: Insurance is required for the vessel, cargo and to cover demurrage (liabilities for cargo loading and discharge overruns).

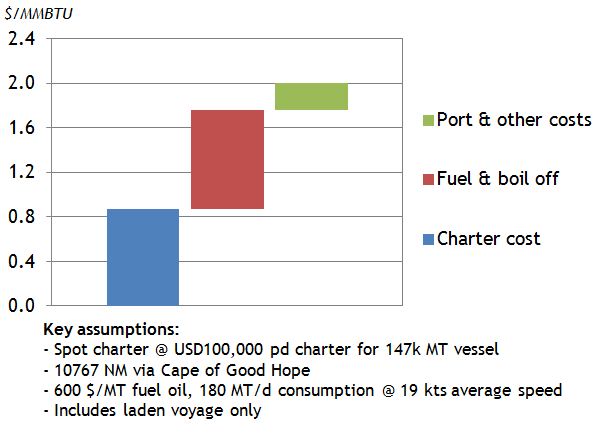

In order to get an understanding of how these components combine to determine the overall cost of an LNG voyage, it is helpful to consider an example. Chart 1 shows the shipping cost build up of a spot charter voyage from Nigeria to Japan.