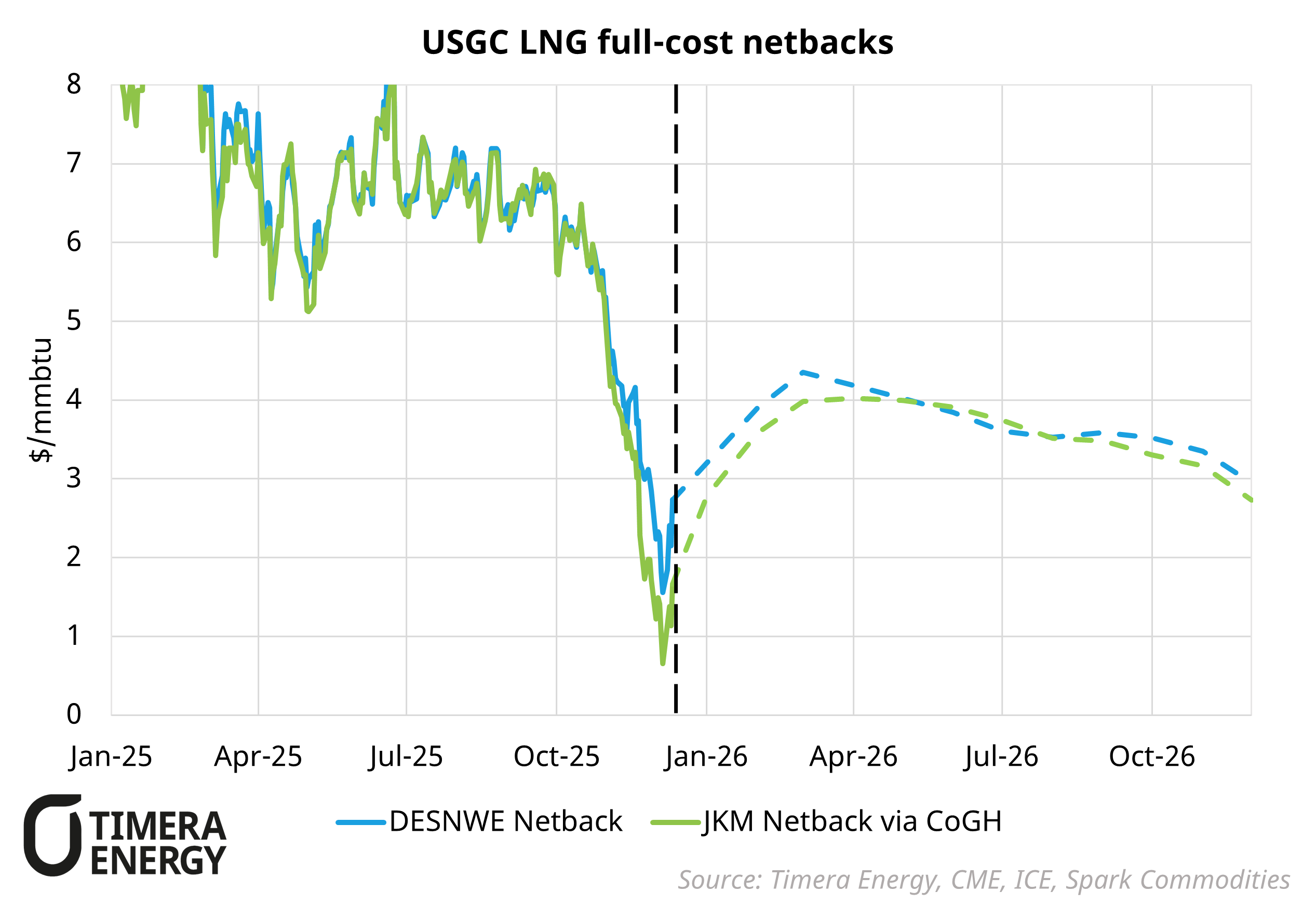

USGC LNG netbacks have compressed sharply since October, with netbacks to JKM via CoGH briefly breaking below $1/mmbtu. This reflects a dual squeeze from a tight US domestic market spiking Henry Hub, and softer Europe and Asia benchmarks. Structural support for HH is stemming from rising US gas demand, notably from LNG feedgas and data centre load growth. This has kept the forward curve on a bullish tilt.

The past week has offered some relief, with Henry Hub pulling back from its early winter rally as mid-December weather expectations moderated and the prompt market repriced heating demand risk. However, this pullback does little to alter the broader narrative given new supply volumes coming online.

US tolling contracts are increasingly transitioning towards at-the-money economics, with limited intrinsic value and a growing reliance on flexibility and optionality. Within this environment, contract structuring is becoming an increasingly important risk management lever. This includes greater Henry Hub indexation on sale legs and shifting global gas price exposure back to US producers via global gas indexed feedgas deals (as discussed in our recent note).