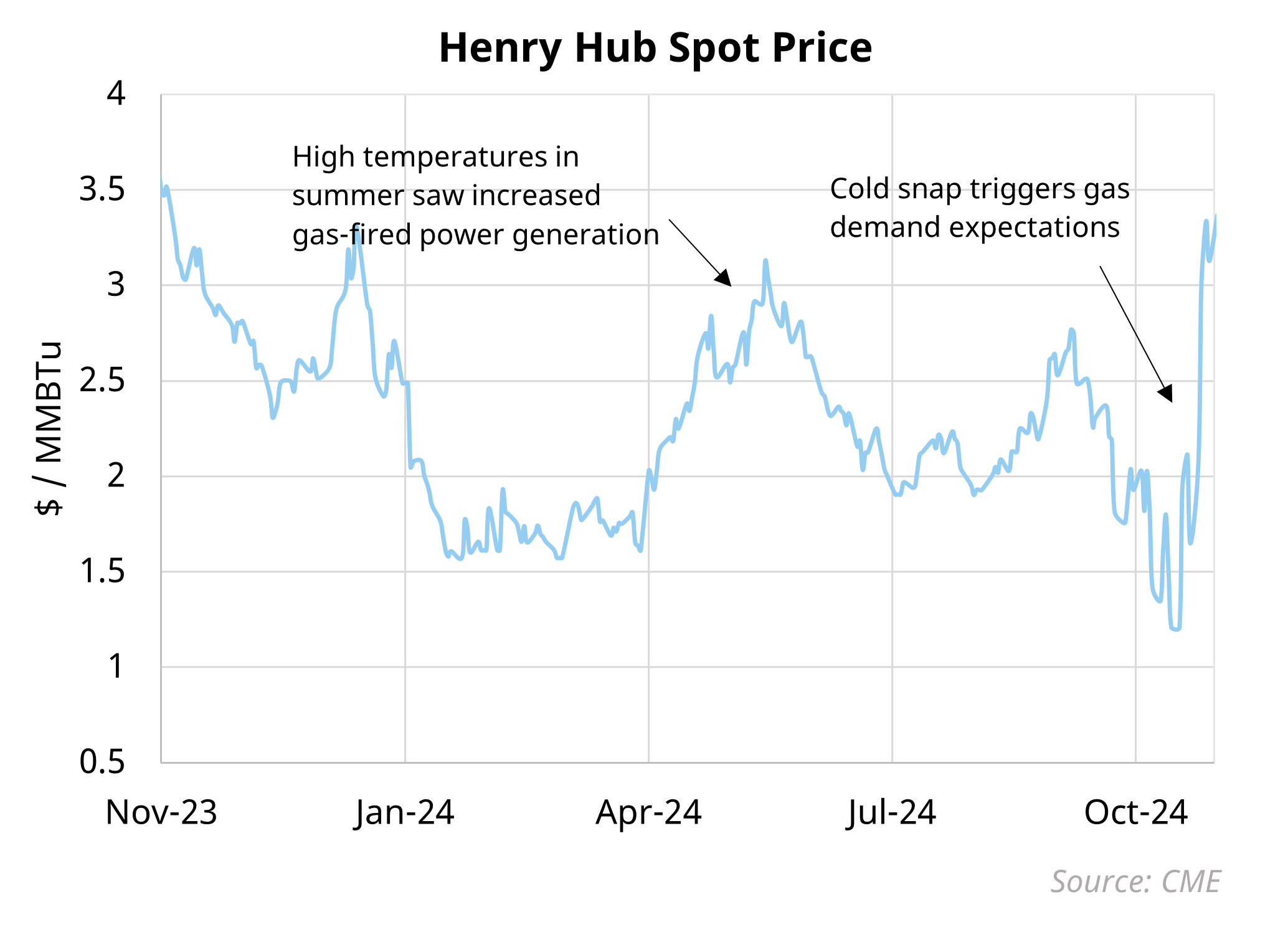

The Henry Hub index has gone through a rapid increase of around 100% since the 15th November 2024. A forecasted period of cold weather in the North East and Mid West has strengthened domestic gas prices on increased demand expectations, with Henry Hub front-month prices closing above $3.3/MMBtu on the 21st November. This projection of increased heating demand, coupling with the US’ increasing dependence on gas-fired power places have ticked up withdrawals, creating pressures on storage.

We have previously analysed on our blog about what could happen if Henry Hub prices rose, and the affect this could have in supporting global LNG prices. This week, we will be hosting a webinar discussing the current state of the global gas market and the impact of the approaching wave of new LNG supply.

Webinar recording available

Thank you for attending our webinar “Absorbing the supply wave” – how demand and supply side flex mechanisms will balance the global LNG market, which took place on Wednesday 27th November 2024 09:00 GMT (10:00 CET, 17:00 SGT).

The webinar was focussed on:

- What’s been setting global gas prices?

- Importance of market flex in the coming regime

- Overview of LNG supply response & Asian demand flexibility

- Demonstrating market flex impact on marginal price formation through (i) HH price impact (ii) Asian demand growth trajectory

Click here for a recording of the webinar.

Click here for a copy of the webinar slidepack.

If you are interested in a sample copy of our Global Gas Quarterly Report & Databook, or further information on the bespoke services we offer, feel free to contact David Duncan (Director) david.duncan@timera-energy.com or David Stokes (Managing Director) david.stokes@timera-energy.com