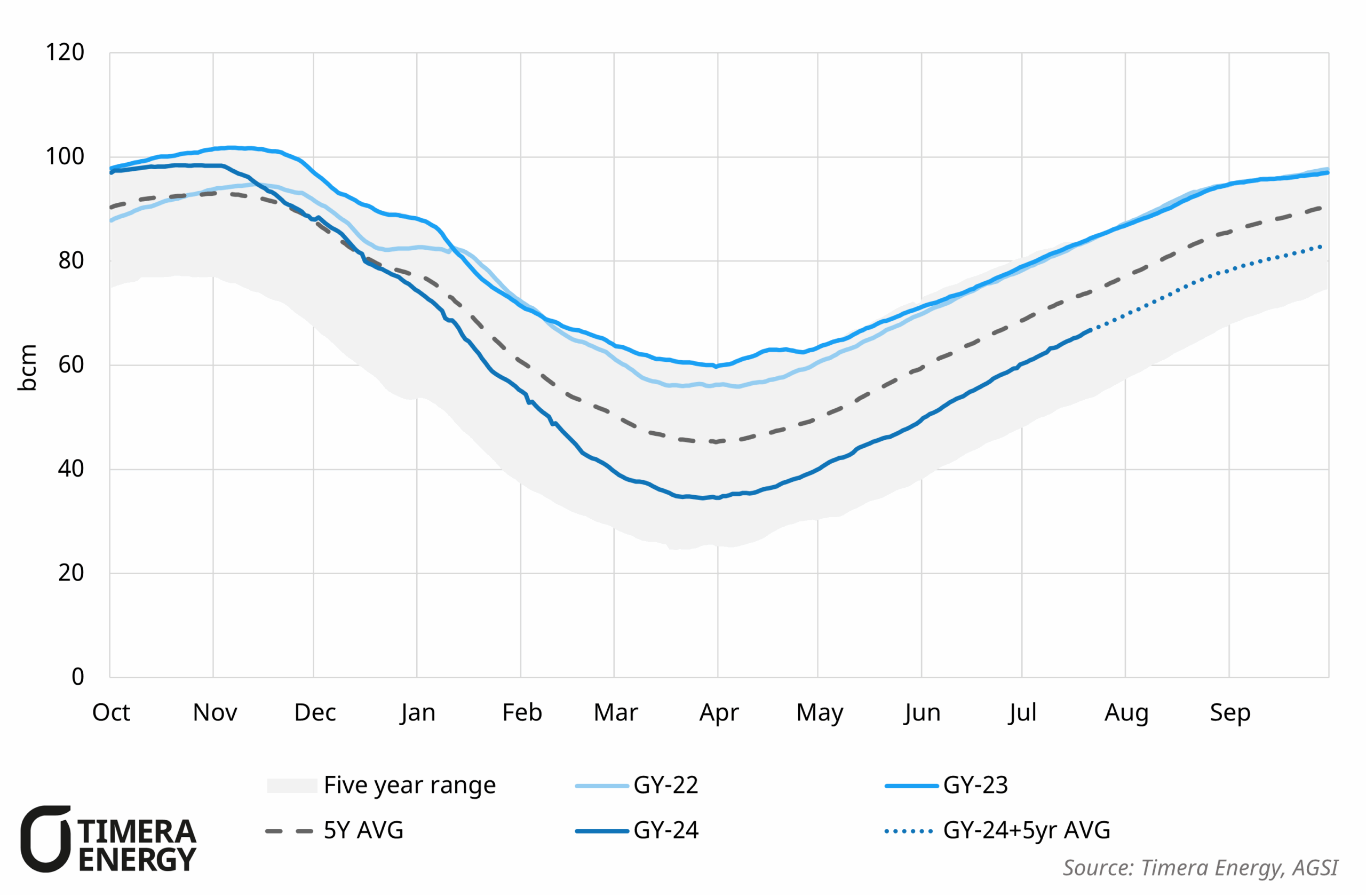

Underground gas stocks in Europe currently sit at ~67 bcm, or 65% full, after exiting winter at 35 bcm. This is 18 bcm lower year on year, a slight reduction in the 25 bcm deficit that stocks exited winter at.

Since the start of the new gas storage year on the 1st April 2025, injections have averaged ~315 mcm/d across Europe, above the five year average of 258 mcm/d over the equivalent period. This has been underpinned by higher than-usual LNG deliveries, with Europe importing 6.2mt more LNG over Q2 2025 compared to the same period last year.

As seen in the chart, maintaining 5-year average injection rates would see Europe entering the upcoming gas-year with ~83 bcm in storage, or ~81% full. This leaves injections well on track to hit the EU’s proposed gas storage target of 83% within the 1st October and 1st December.

Despite overall progress, Germany is facing issues at Rehden, its largest underground storage facility. The facility is only around 5% full, as seasonal spreads have failed to offer sufficient incentive for capacity bookings.

Winter 2025 – Q3 2025 spreads on the THE have averaged just €1.44/MWh since the 1st April 2025, compared to a significantly stronger €5.08/MWh spread for winter 2024 – summer 2024 during the same period last year.