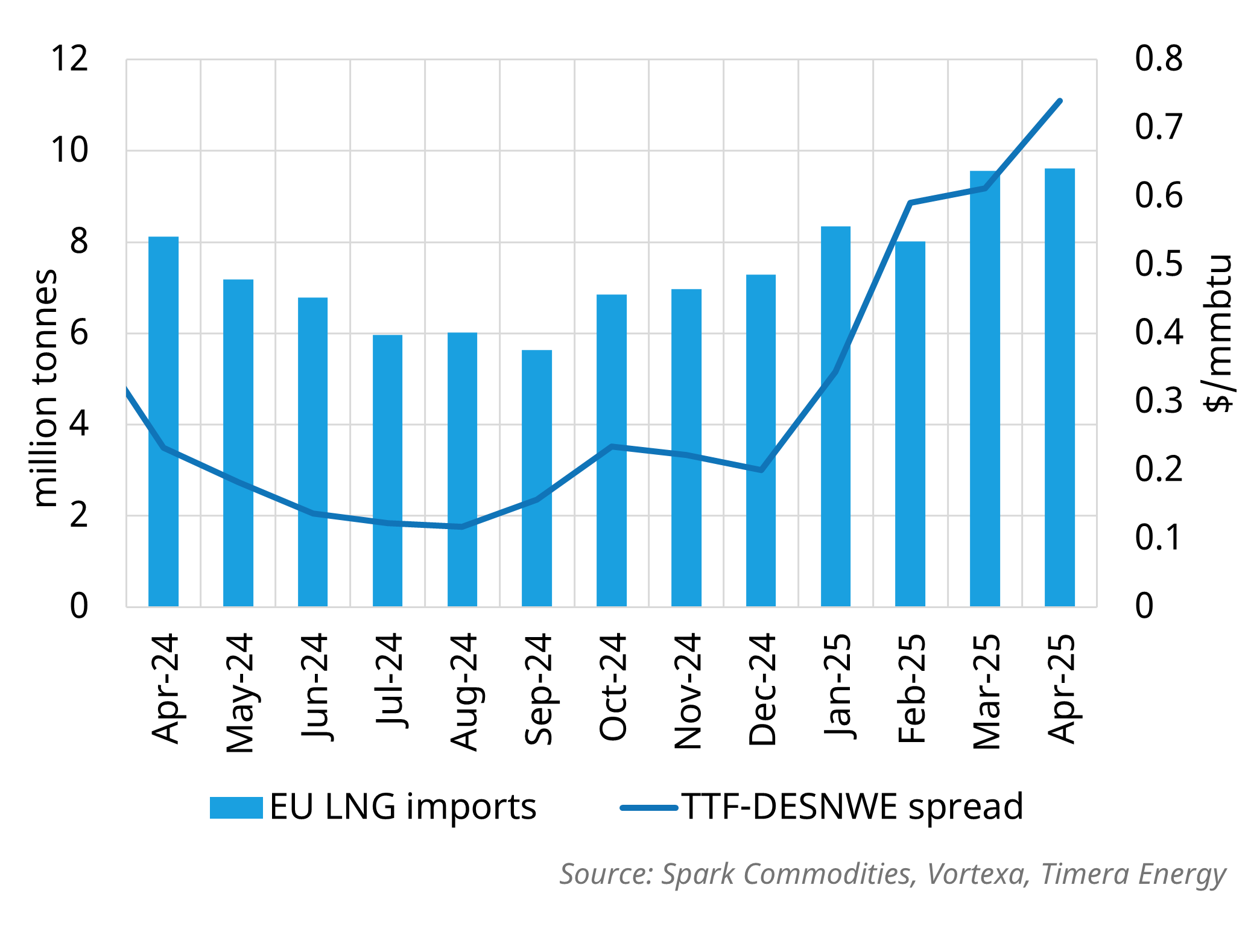

EU LNG imports have rebounded in March and April from February 2025 levels, with April imports increasing by 18% year on year.

Higher European regas utilisation rates have driven a wider spread between offshore LNG prices, and onshore gas hub prices, as more expensive terminals are called upon to import. At -0.74$/mmbtu, the April Spark DESNWE-TTF spread was more than double the 2024 average of -0.32$/mmbtu and 20% wider than the peak level attained in winter 2024-2025.

Storage injections are fuelling increased European demand for LNG. If current rates are sustained, European storage will be 100% full before November. A return to contango seasonal spreads has encouraged injections, despite ongoing talks of relaxing EU storage mandates. EU imports have been further supported by weaker Asian demand, with Asian LNG imports falling by nearly 10% from January to April 2025.

If you are interested in a sample copy of our Global Gas Quarterly Report & Databook, or further information on the bespoke services we offer, feel free to contact David Duncan (Director, Gas & LNG) david.duncan@timera-energy.com or David Stokes (Managing Director) david.stokes@timera-energy.com