“These 4 charts show the power of market balancing”

European energy markets have been buffeted by major swings in gas market balance across the last 5 years.

The Covid demand slump, Russian supply cuts and weak demand last winter have all triggered pronounced shifts in market balance & prices. This has had a significant knock-on impact on power market prices.

In today’s article we look at a GB case study of how flexibility has acted to clear the gas market. The GB market is a particularly interesting case study because of the ‘island’ nature of the system. Many of the dynamics in play are relevant for the broader European gas market & in turn the LNG market.

We take you on a tour across the last 5 years, using load duration curve charts to show the shift in market balance & clearing mechanisms. As context before we dive into the charts, lets start with a 1 min overview of the GB gas market (feel free to skip if you know the market well already).

GB gas market 101

GB gas demand in 2023 was 67 bcm. About 50% of this was supplied from the UK & Norwegian Continental Shelves (UKCS & NCS). The remaining supply comes from a combination of LNG imports & net imports via pipeline interconnectors (which fluctuate significantly depending on seasonal drivers & market balance).

Given GB’s island geography, it has high levels of regas & interconnector supply flexibility:

- 58 bcma of regas capacity (Grain, South Hook & Dragon)

- 40 bcma (import) / 28 bcma export capacity across the Interconnector (NL to GB) & BBL (BE to GB) pipelines

Gas storage capacity volume on the other hand is relatively low, dominated by the reopened offshore Rough facility (0.8 bcm).

Now let’s have a look at some load duration charts to see how market supply & demand clearing dynamics work.

Gas Year 2020-21 – Covid shock

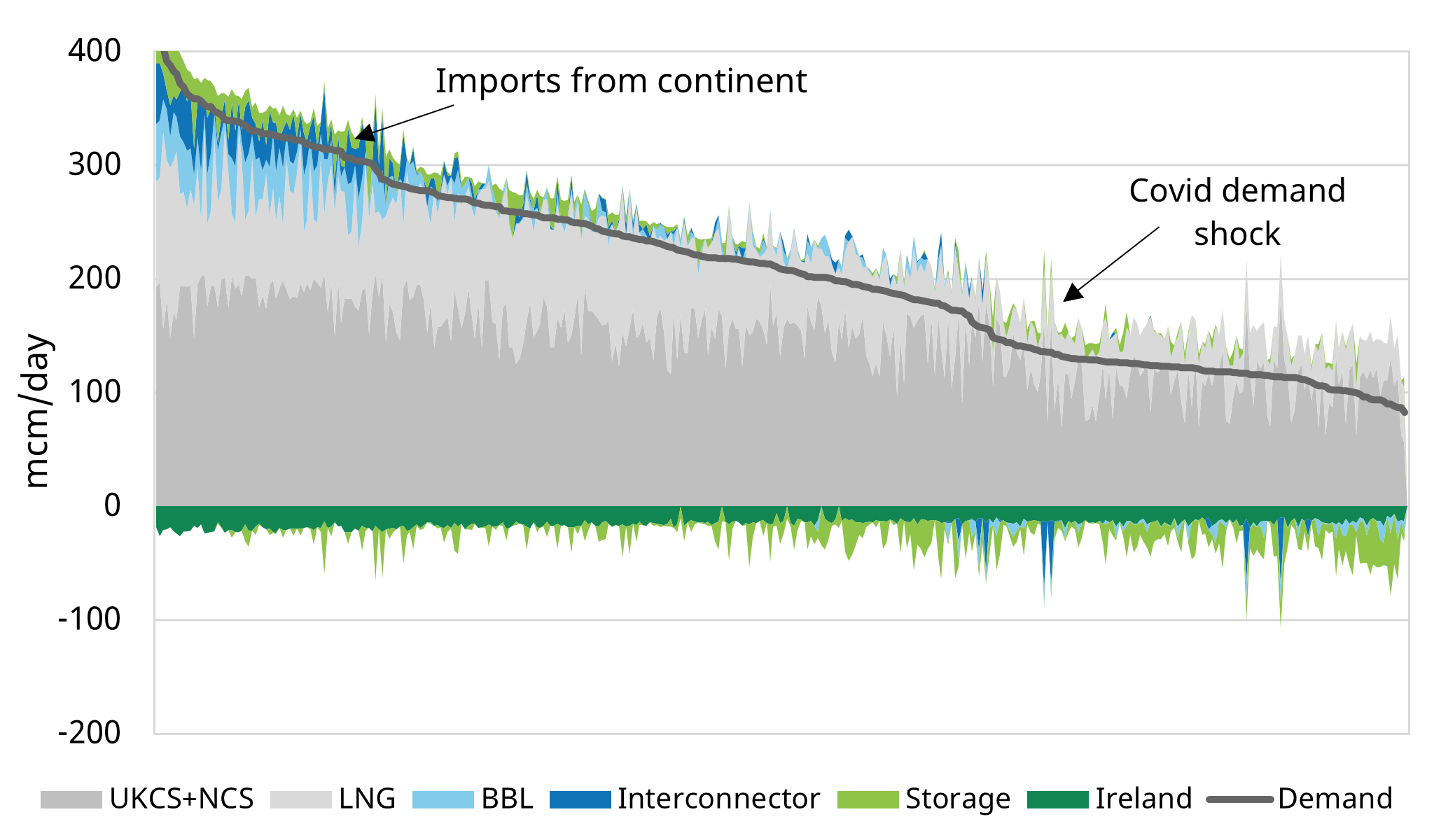

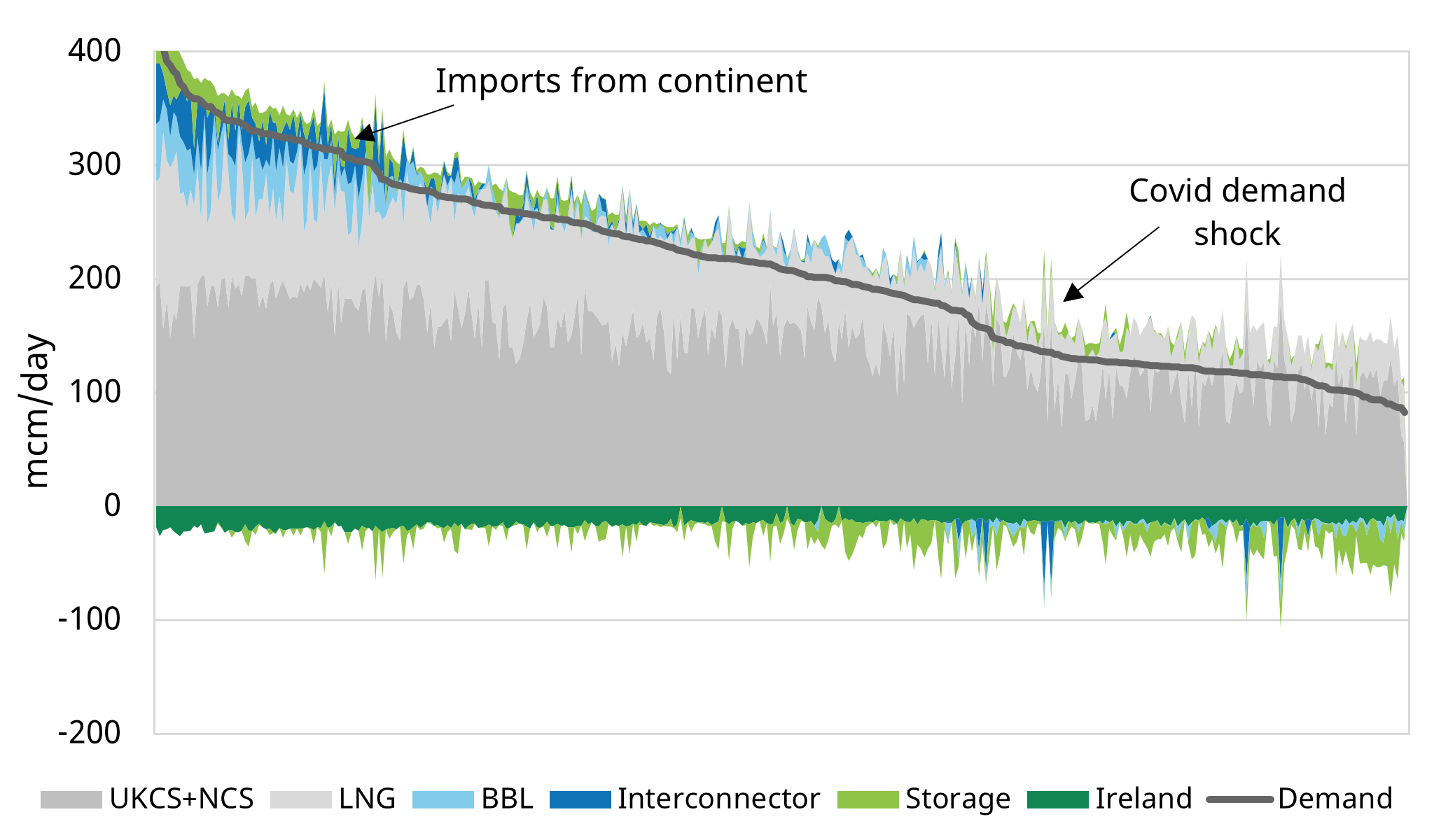

Chart 1 shows the GB load duration curve (LDC) for Gas Year 2020 (Apr 2020 – Mar 2021).

Chart 1: GB market LDC Gas Year 2020-21

Source: ENTSOG, Timera Energy

Load duration curve charts illustrate how a market balances supply against demand. Demand days across the year are ordered from highest to lowest demand on the x axis. Supply, interconnector, and storage flow volumes are then stacked against this demand line, using a variable cost based merit order by source. The leftmost days on the chart show how high demand days balanced, while rightmost days show how low demand days balanced.

Key takeaways for GY 2020-21:

- Strong GB import flows from the Continent across high demand winter days

- Balancing role for Interconnector & BBL across Covid demand shock

- Relatively steady LNG imports across high-medium demand days

- Seasonal storage flows, but with some price signal driven fluctuations to help balance the market

GB market supply flexibility coped just fine through the Covid shock.

Gas Year 2021-22 – onset of Russian supply cuts

As demand gradually recovered from the Covid shock, the market was hit by the start of a major supply shock as Russia dialled back its pipeline exports to Europe.

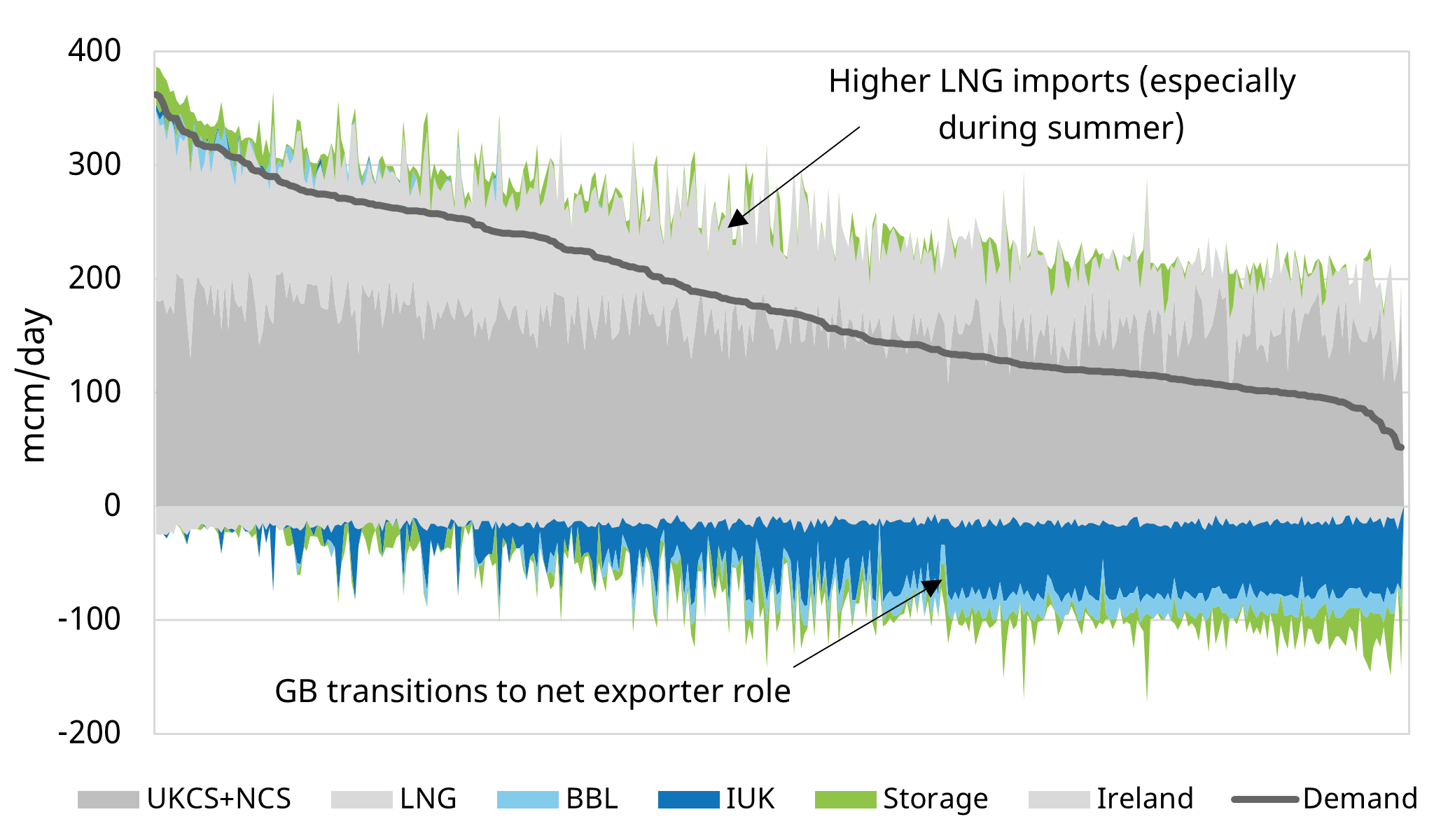

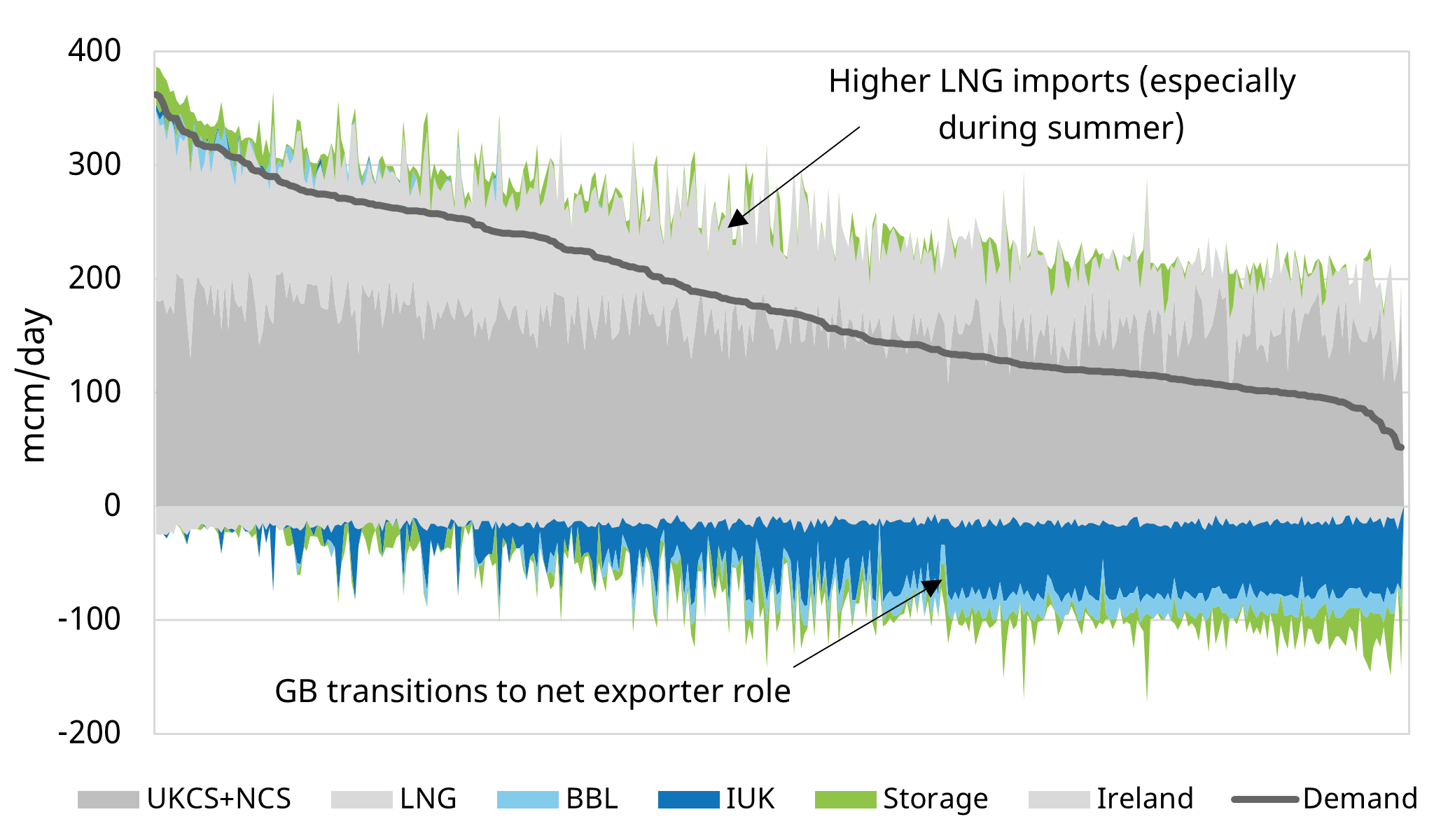

Chart 2: GB market LDC Gas Year 2021-22

Source: ENTSOG, Timera Energy

Key takeaways for GY 2021-22:

- Fall in Russian gas supply induces significant increase in LNG imports across Europe (causing regas capacity constraints on the Continent)

- GB becomes a structural exporter, with pipelines operating at full export across lower demand days

- Spare GB regas capacity is utilised to transport LNG, which is exported via interconnectors to fill storages on the Continent

- Pipeline constraints lead to price dislocations between NBP and TTF, with NBP falling significantly below TTF (which in turn widened the NBP-DES NWE LNG spread) signalling the inability for the market to deliver additional LNG to the continent via GB.

The GB market’s substantial import / export infrastructure not only enables it to navigate a major supply shock, but also allows GB to provide key supply flexibility to balance Continental markets.

Gas Year 2022-23 – peak crisis & high volatility

Europe’s energy crisis peaked in the late summer of 2022 after which conditions began to ease but against a very uncertain & volatile backdrop.

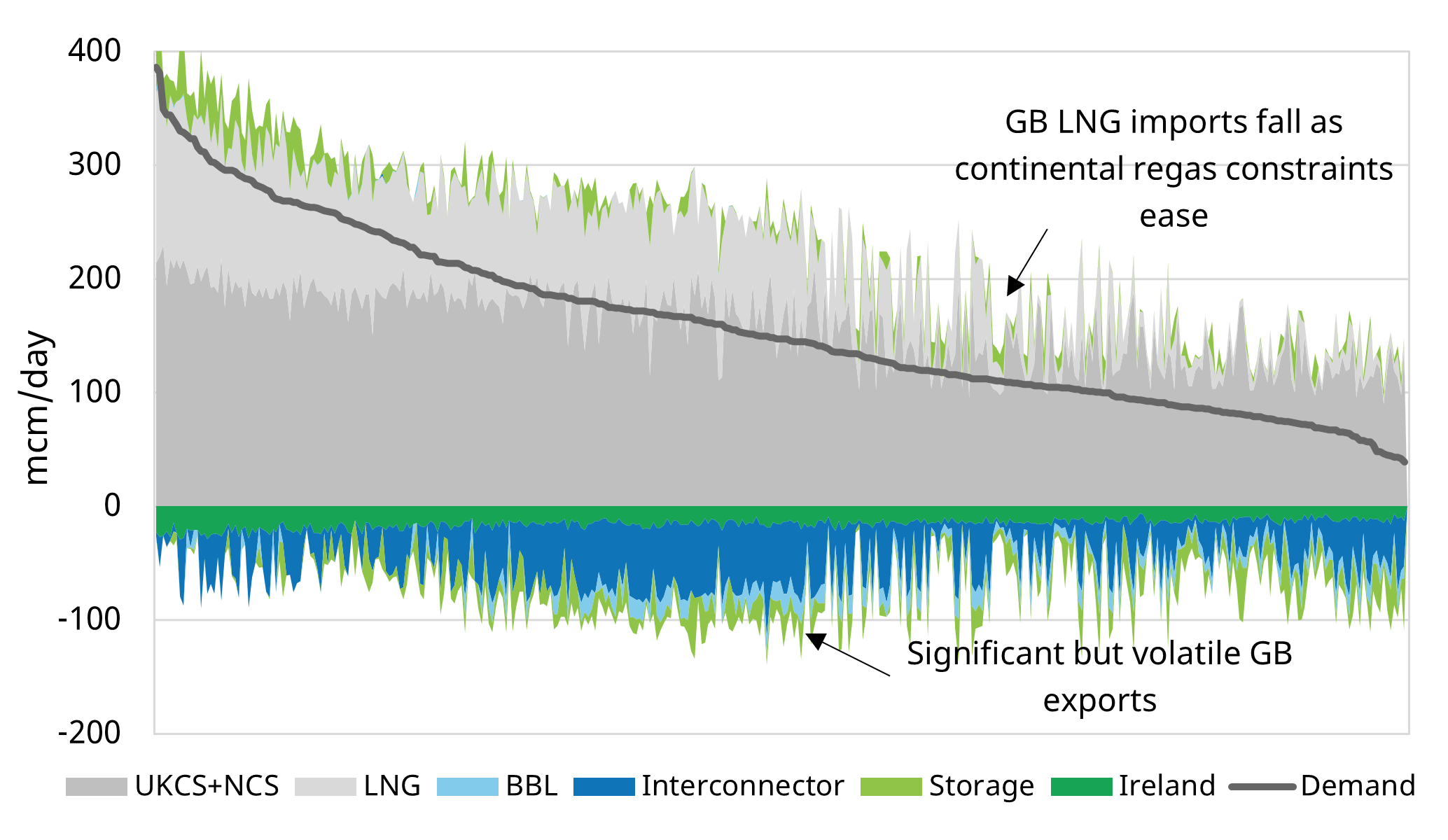

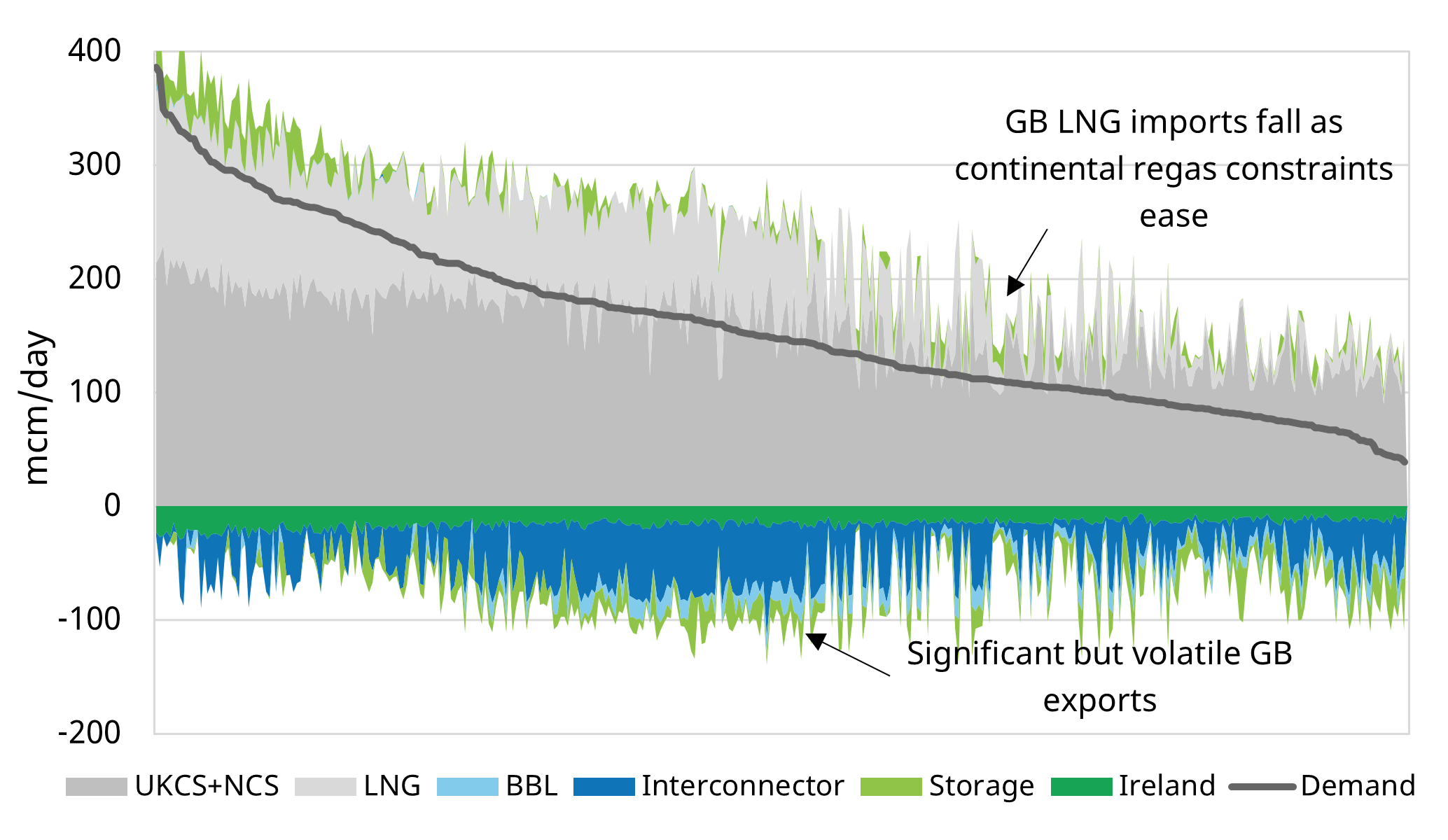

Chart 3: GB market LDC Gas Year 2022-23

Source: ENTSOG, Timera Energy

Key takeaways for GY 2022-23:

- High export volumes through the summer of 2022 gives way to more volatile flow patterns as the crisis starts to ease

- GB exports fall (regas and pipeline constraints ease) but increasingly dynamic volumes reflect ongoing market tightness

- LNG imports no longer continue at high levels on low demand days

- Higher BBL tariffs see the Interconnector utilisation increase

2022 saw huge extrinsic value capture of flexible supply assets (e.g. storage, interconnectors & regas) as the result of extreme price volatility.

Gas Year 2023-24 – crisis dissipates given weak demand

By the start of Gas Year 2023-24 (Apr 2023), it was clear that Europe had not only survived the winter without Russian gas, but that market tightness had eased significantly given weaker than expected demand.

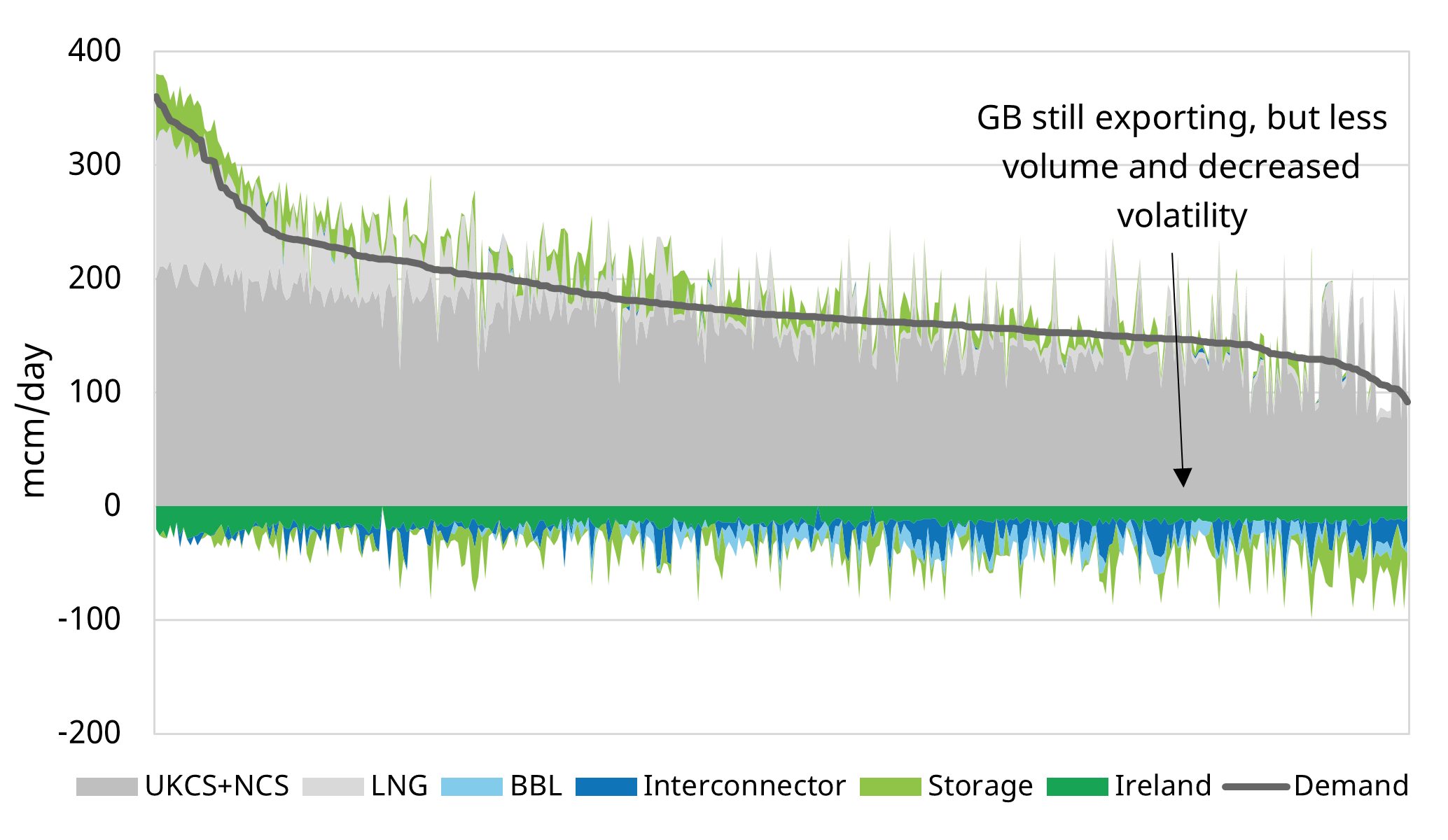

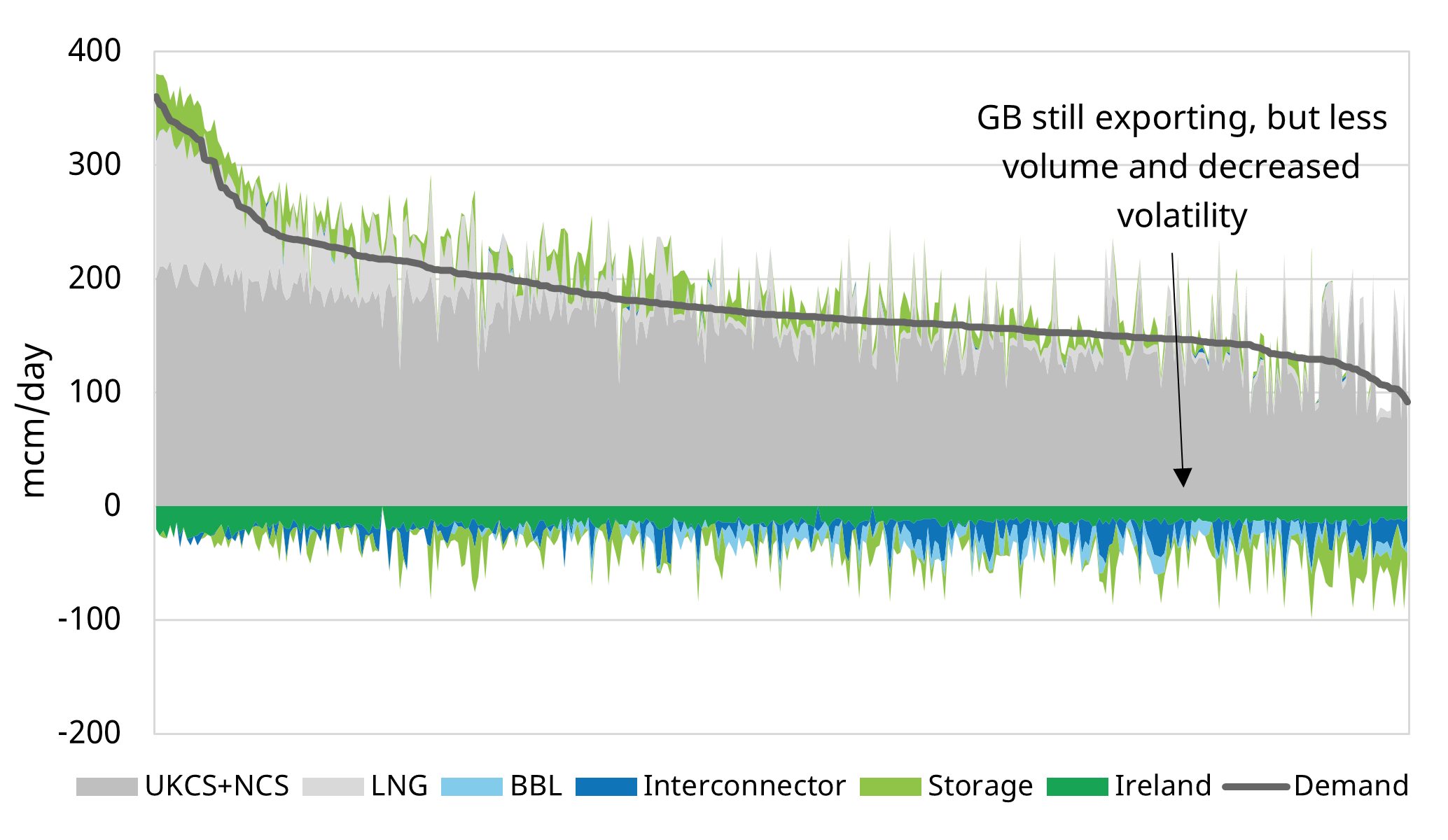

Chart 4: GB market LDC Gas Year 2023-24

Source: ENTSOG, Timera Energy

Key takeaways for GY 2023-24:

- GB market becomes more self sufficient with baseload sources of supply mostly meeting demand and storage providing short term balancing

- GB still structurally exports to the Continent, but volumes fall as market continues to rebalance – pipelines revert to a balancing role vs structuraly exporting

- IUK continues to achieve higher utilisation than BBL, given tariff differences.

Some sense of normality has returned as the crisis has eased over the last 18 months. However the market remains structurally tighter than pre-crisis with significant short term flow variability (& price volatility).

Takeaways looking forward

The predominantly self sufficient balance of the GB market is set to continue across the next few years. The major forces shaping market balance into the 2030s are (i) production declines at UKCS & NCS fields and (ii) demand declines as decarbonisation gathers pace.

We leave you with 3 takeaways from the gas market balance journey we set out above:

- Markets work – the last 5 years is a powerful illustration of the effectiveness of gas markets to ensure security of supply even under periods of extreme market stress.

- Reflexivity – the GB market is strongly impacted by overall European gas market balance given high levels of interconnection & LNG import infrastructure; GB in turn plays a key role in helping to balance Continental hubs.

- Volatility – significant uncertainty in short term fundamental drivers remains, supporting price volatility; this is magnified by the increasingly important role of LNG supply which is relatively inflexible within a 4-6 week logistics window.

These drivers continue to support the value of flexible gas supply infrastructure in the GB market & more broadly across Europe.

Webinar recording available

Thank you for attending our webinar “Absorbing the supply wave” – how demand and supply side flex mechanisms will balance the global LNG market, which took place on Wednesday 27th November 2024 09:00 GMT (10:00 CET, 17:00 SGT).

The webinar was focussed on:

- What’s been setting global gas prices?

- Importance of market flex in the coming regime

- Overview of LNG supply response & Asian demand flexibility

- Demonstrating market flex impact on marginal price formation through (i) HH price impact (ii) Asian demand growth trajectory

Click here for a recording of the webinar.

Click here for a copy of the webinar slidepack.

If you are interested in a sample copy of our Global Gas Quarterly Report & Databook, or further information on the bespoke services we offer, feel free to contact David Duncan (Director) david.duncan@timera-energy.com or David Stokes (Managing Director) david.stokes@timera-energy.com