“Auctions are starting to deliver meaningful electrolyser volumes”

The European Hydrogen Bank has now completed two competitive auctions, awarding funding to 21 renewable hydrogen projects across the EU.

The first auction (2024) backed 7 projects with €720m in support (one later withdrawn), while the second (2025) added 15 more with €992m in grants. Together, they are set to deploy nearly 3.8 GW of electrolysis capacity, underpinned by around €1.7 billion in EU and national funding deployed over a 10-year horizon.

Impact of awarded projects

If all selected projects reach FID, they could in theory double Europe’s currently committed electrolysis capacity to approximately 5 GW. However, a number of these projects still face material hurdles to deliver, including permitting delays, cost inflation and broader policy support issues.

Effective sourcing of green power is also key issue impacting green hydrogen project economics as we set out recently.

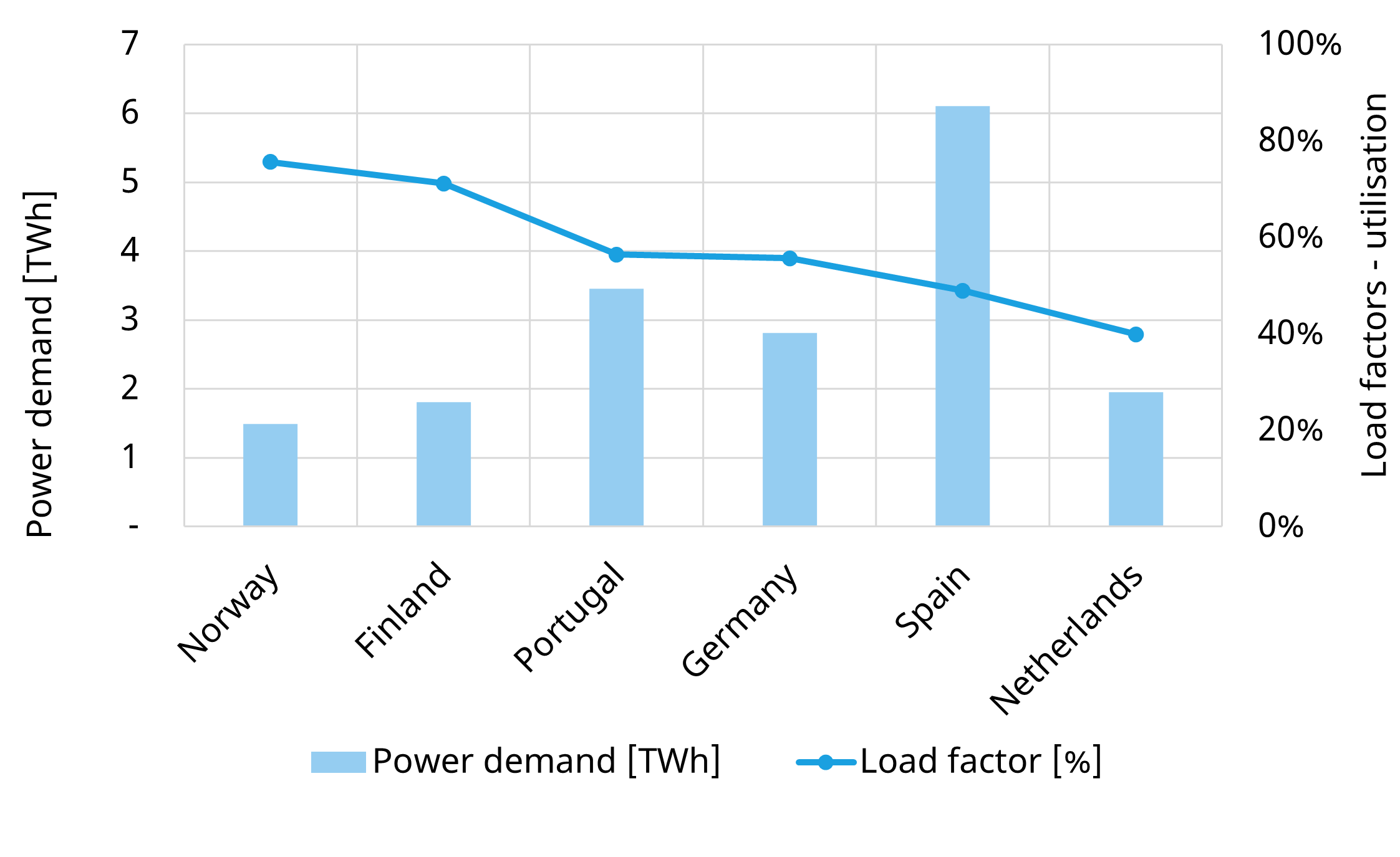

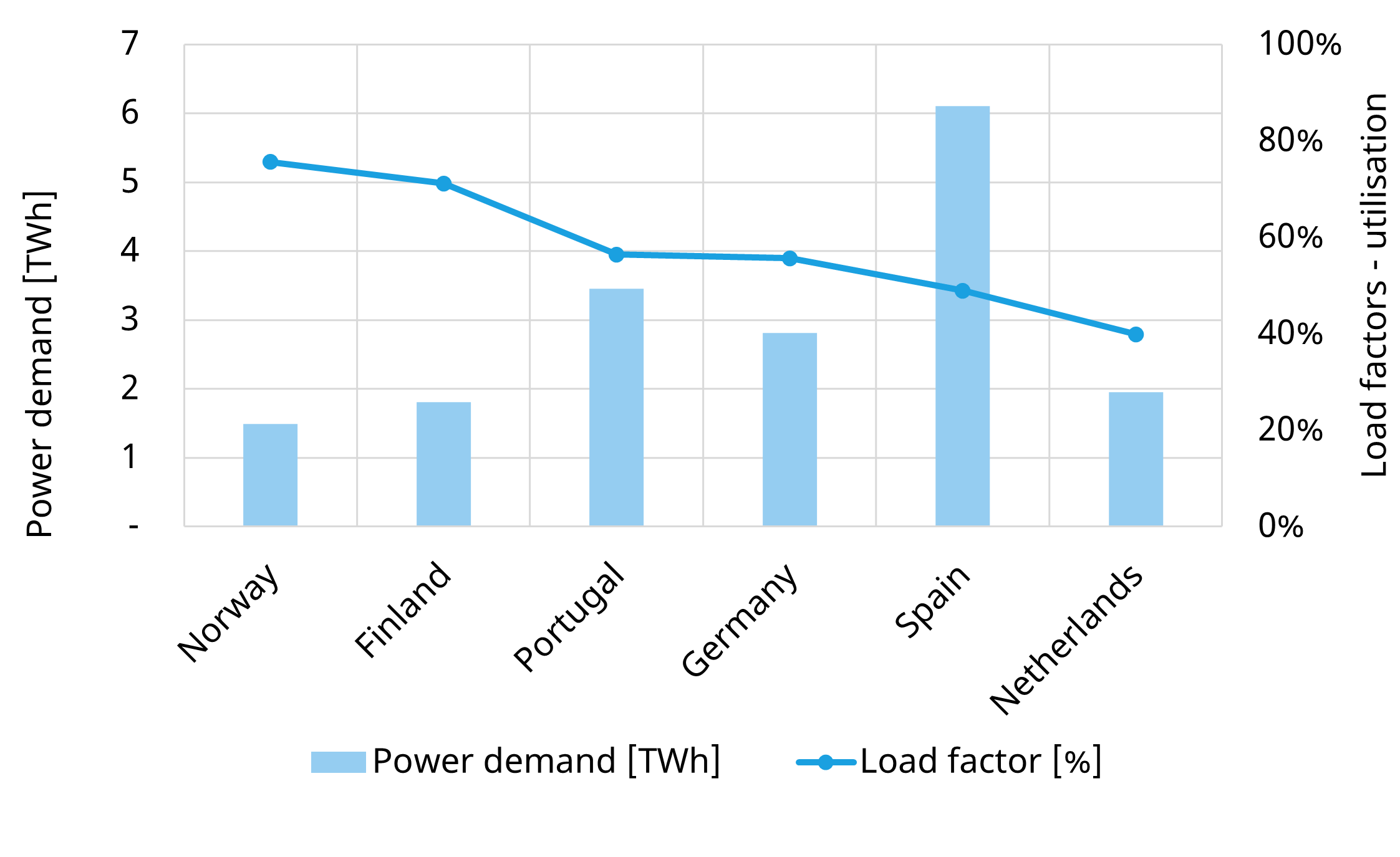

In Chart 1 we set out projected electrolyser load factors and impact on power demand across the 21 hydrogen projects we describe above.

Chart 1: Estimated power demand & load factor by country for awarded H2 projects

Source: Timera Energy; note chart is based on simple assumptions of an electrolyser efficiency of 70% and hydrogen energy intensity of 33.3 MWh/ton

Six takeaways from the auction results

1. Electrolyser capacity is scaling

The awarded 3.8 GW reflects what may only be a portion of the total pipeline likely to reach operation by 2030, as EU and national policy support investment cases.

That said, there remains a growing gap between policy ambition and actual project execution, especially given long lead times and limited deployment of electrolyser systems at industrial scale so far.

2. 17 TWh of power demand expected — 35% in Spain

With ~70% electrolyser efficiency, full deployment of awarded projects would drive over 17 TWh/year of power demand by 2030, with 35% in Spain — confirming Iberia’s central role in green hydrogen buildout.

3. Power sourcing shapes project viability

Project economics and RFNBO compliance depend heavily on power sourcing strategy. National differences in RES integration and policy create divergent paths to project competitiveness and financing.

4. Shipping needs higher support

Maritime projects required premiums up to €1.88/kg, compared to 0.2–0.6 €/kg in other applications, highlighting the tougher economics of RFNBO fuels in shipping vs. chemical usage.

This underscores the importance of targeted support for hard-to-abate sectors where hydrogen has few alternatives but faces economic headwinds.

5. Electrolysers shift power price signals

New flexible demand from large-scale electrolysis can help contain intraday volatility, contributing to balancing of intermittent renewable energy.

However this flexibility depends on electrolysers being truly responsive to price signals, a design and operational feature not yet standardised across projects.

6. Country-level impacts vary

National differences in capacity and utilisation point to where electrolysers may run hardest and reshape local price dynamics.

The way forward

Despite recent cooling of market expectations, hydrogen and electrolysers are considered key to Europe’s decarbonisation strategy. However hydrogen will likely remain an expensive source of energy for decades to come.

High costs underpin a specific focus of green hydrogen use cases on hard to abate industrial and transport energy needs, currently met by fossil fuels. They can also act as flexible demand-side resources in increasingly volatile power markets.

What is unlikely to happen is the large scale displacement of gas-fired power plants by hydrogen. This is one of the themes we explore in our upcoming webinar on the role & investment economics of gas plants (see details below).

The role of hydrogen in the European energy system will start to become clearer across the next 5 years.

Join our webinar: on why “Gas plant investment remains key to transition”

Time & access: Tue, Jun 17, 2025 10:00 – 10:30 AM CET (09:00 – 09:30 UKT)

Topics covered:

- Changing role of gas powerplants in enabling energy transition

- Summary of investment options across Europe

- Breakdown of a viable CCGT margin stack structure

- Gas peaker vs CCGT margins

- 5 key drivers of a viable gas plant investment case

Registration: Pre-registration required (access is free): https://attendee.gotowebinar.com/register/8141515714861002589