“A high volume increase in Russian flows could trigger gas market regime shift”

To start with an understatement: the prospect of an increase in Russian gas flows to Europe is politically complex.

On one hand, payments for gas effectively support Russia’s military capability. An increase in flows would also revive Europe’s energy dependence on a hostile neighbour.

Any significant increase in import volumes would also likely require a new Ukraine transit agreement, given constraints on other flow routes.

Sanctions may be lifted on the Russian Arctic LNG project, but an increase in Russian pipeline flows into Europe remains unlikely. However, a ‘flow return’ scenario warrants consideration given several key factors:

- US pressure: US heavy handed brokering of a peace deal may pressure both Ukraine and the EU to make major concessions

- Gas negotiating lever: It is reasonable to envisage gas as a key negotiating point on the table given its economic impact on both the EU and Russia

- EU benefits: Reduced energy costs could provide significant economic benefits to a weakening European economy, particularly for energy-intensive industries (e.g. in Germany)

- Russian benefits: For Russia, restoring some level of gas exports may be vital for its economic stability.

In today’s article we set out 3 scenarios for a return of Russian gas and consider their impact on gas & power market prices & asset value.

What could a Russian flow return look like?

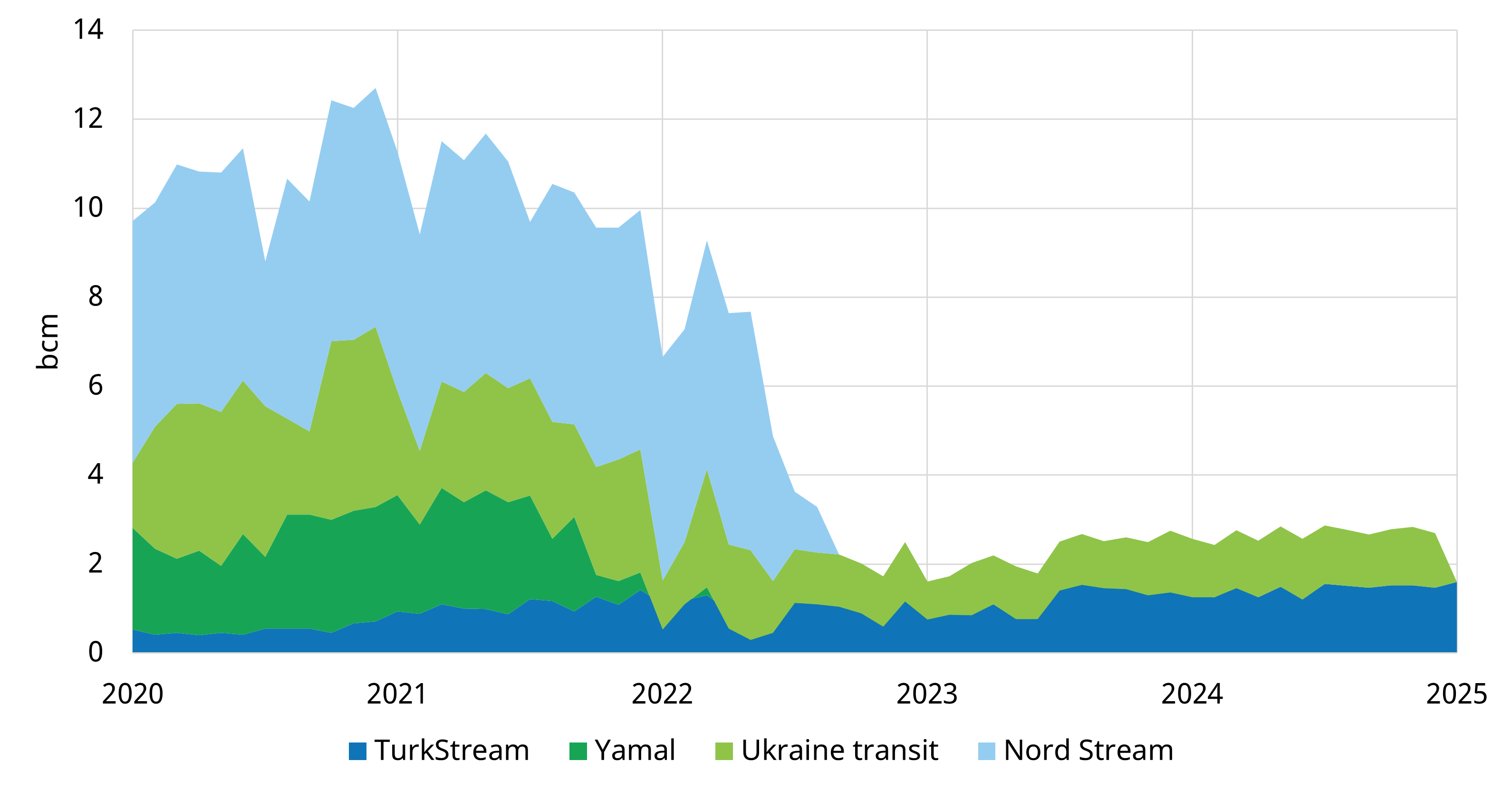

To frame analysis of a return of Russian flows its useful to look at historical European import volumes in Chart 1.

The extent of any return of Russian gas is limited by physical and political constraints:

- Nord Stream 1: Severely damaged by sabotage. Any recommissioning would require substantial capex investment.

- Nord Stream 2: One completed string (27.5 bcma) remains undamaged but the operating company declared bankruptcy in 2022 and the pipeline would need significant commissioning & permitting work.

- Yamal pipeline: Strong political opposition from Poland makes use of this route highly unlikely.

- TurkStream: Currently operating above nameplate capacity.

- Ukraine transit (Velke Kapusany): Flows ceased in Jan 2025 with end of transit deal. Upstream constraints and potential compressor investment requirements restrict flow capacity, but this remains the most viable route.

The most plausible scenario for increased flows is via a renewed Ukraine transit deal (or short term capacity access), allowing volumes similar to 2024 (~ 15 bcma) to pass through Velke. Even that faces significant contractual challenges given unresolved disputes between Gazprom & key European customers.

Velke flow resumption could potentially be helped by a fracturing of EU policy solidarity e.g. via more ‘Russian friendly’ countries such as Hungary & Slovakia.

If any increase in Russian flows occurs, it would most likely be within the 2025-27 window, providing a short-term price relief to EU markets ahead of a major LNG supply ramp-up in 2027 and the EU’s target to eliminate Russian energy dependence.

Framing impact via three scenarios

In Table 1 we set out 3 potential scenarios for the return of Russian flows.

Table 1: 3 potential scenarios for the return of Russian flows

Framing the price impact of higher Russian flows

We are currently working with multiple clients to analyse & quantify the price & asset value impact across a range of return of Russian flow scenarios using our global gas market model.

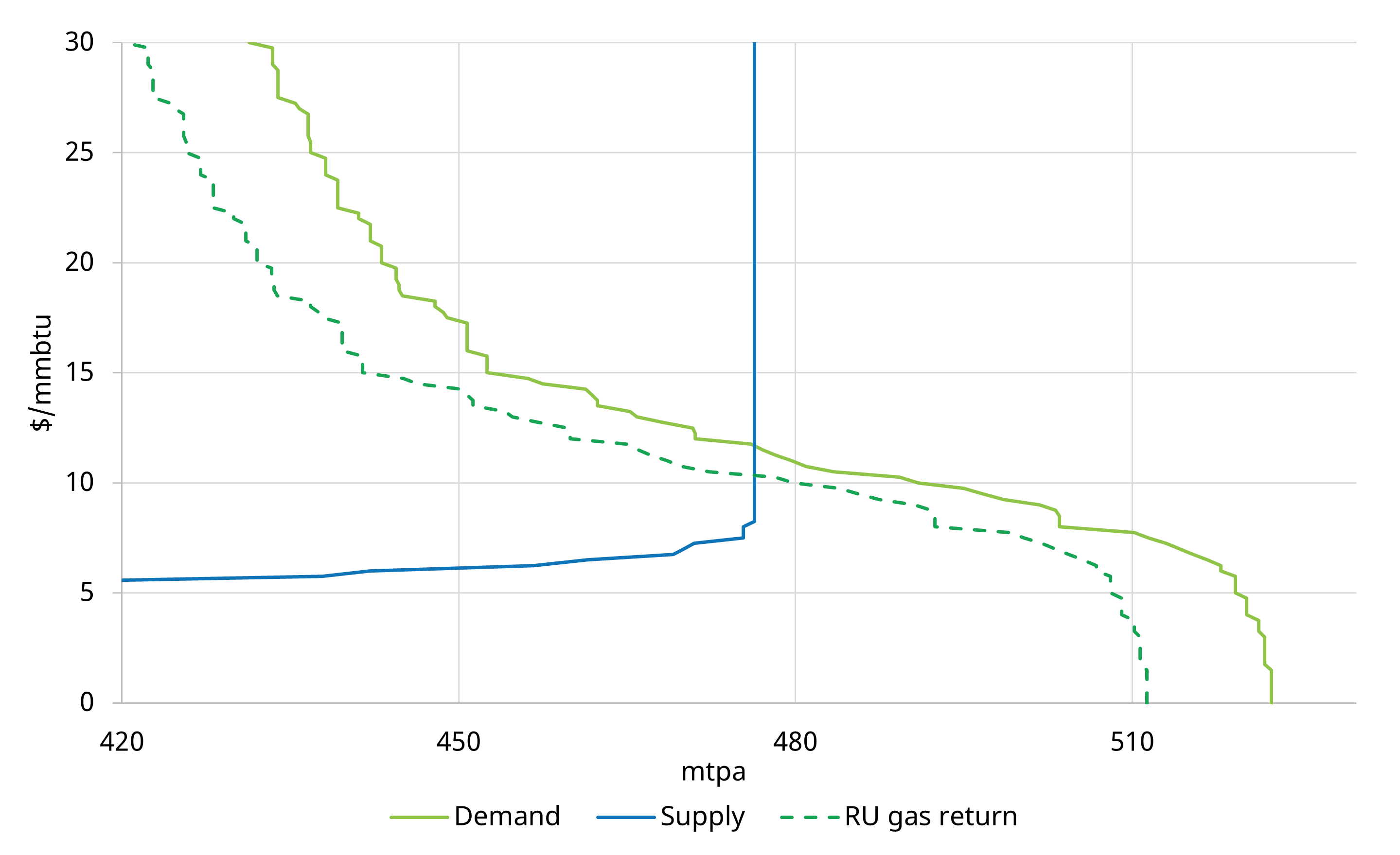

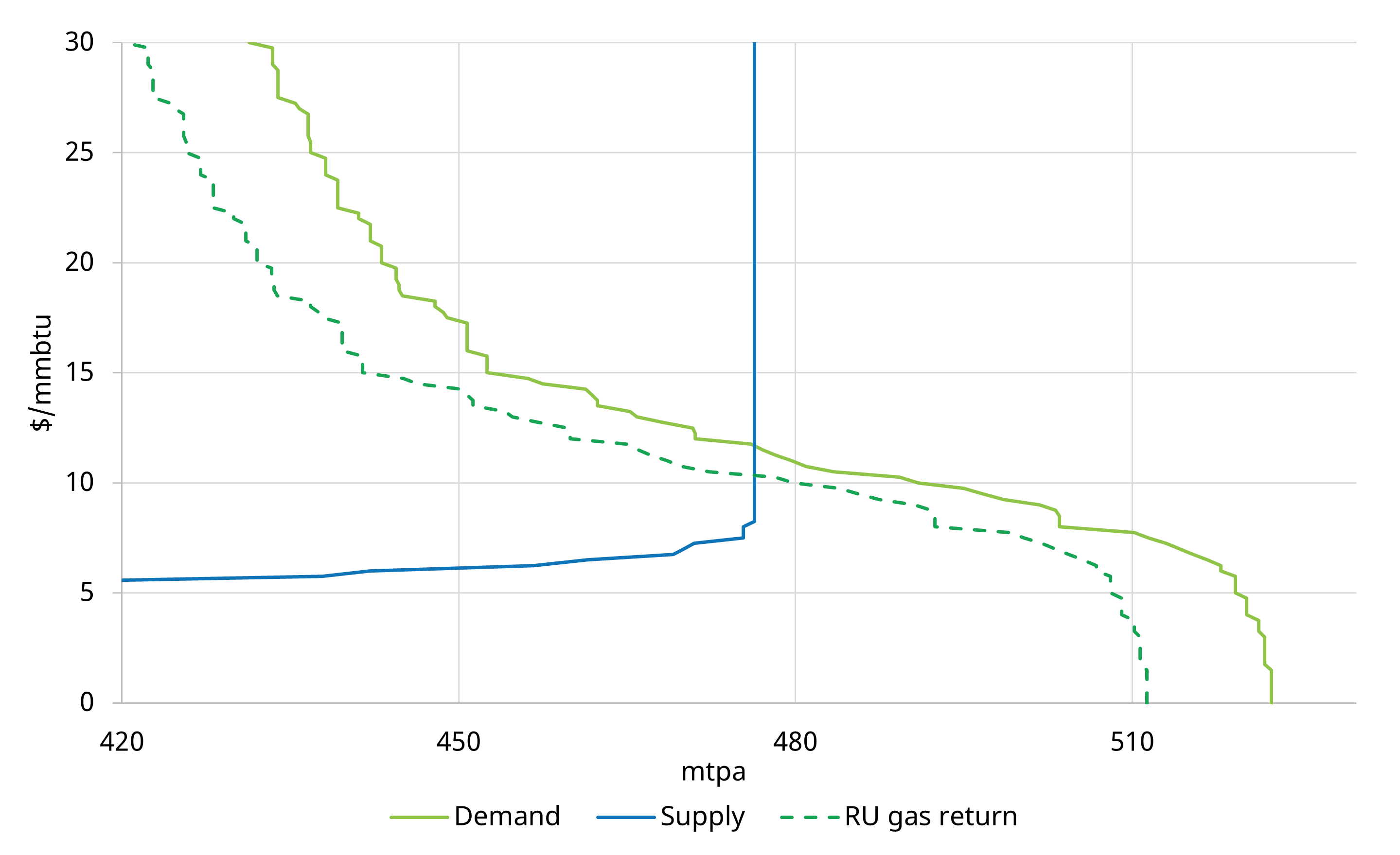

Our model contains a detailed build up of supply & demand balance in (i) the European gas market & (ii) the global LNG market (both of which have a close interlinkage given LNG cargo arbitrage). Chart 2 illustrates the dynamics in play.

Chart 2: Global LNG supply & demand curves (2026)

Source: Timera Global Gas Model

The chart shows an illustrative impact of an increase in Russian pipeline imports on the LNG market supply & demand balance. A rise in Russian imports acts to reduce European demand for LNG (shifting the demand curve left), causing a resulting decline in price. Lifting Arctic LNG sanctions would act to move the LNG supply curve marginally to the right (not shown in the chart).

It is important to note from Chart 2 that:

- Small shifts in market balance can have a material impact on price given relatively inelastic supply & demand curves near the margin

- The price impact of a substantially higher volume increase in Russian gas is dampened by US cargo cancellation flexibility, particularly into 2027 as the blue supply curve moves to the right with new supply coming online.

The supply & demand curves in Chart 2 help frame the potential impact of the 3 scenarios we set out in Table 1.

Price impact of our 3 scenarios

‘Return high’ scenario

Let’s start by considering the lowest probability but highest impact scenario from Table 1 (‘Return high’):

- Significant drop in European hub prices. TTF drops to bottom of coal switching range, but Asia LNG is the dominant source of induced demand at lower prices to rebalance the market.

- Widened price spreads between JKM and TTF/DES Europe LNG, incentivising marginal cargo diversions to Asia. Tighter spread between TTF & DES NWE (with a decline in EU regas utilisation).

- Reduced volatility in European gas and LNG markets as tightness eases.

- Lower power prices and intraday price spreads (important for flexible power assets such as batteries).

This scenario would likely bring forward a major regime shift in LNG & European gas market balance, with a move from tight to well supplied market pulled forward to 2025 from later in the decade.

‘Return low’ scenario

For the ‘Return low’ scenario, the impact is more muted but directionally similar, with an analogy to 2023-24 when 13-15 bcma was flowing via Velke (although Scenario 2 also includes additional output from Arctic LNG).

This scenario is not enough to induce rapid regime shift but it would likely dampen prices and ‘right tail’ price risk across 2025-26.

‘Lift sanctions’ scenario

The ‘Lift sanctions’ scenario impact drives incremental LNG supply volumes into the market (i.e. there is no direct increase in European pipeline imports). The price impact of commissioning of Arctic LNG’s Train 1 (6.6 mtpa, 9 bcma) in 2025 and a similar size Train 2 by 2027 would likely be relatively small. Unlike the “return high” scenario, lifting Arctic LNG sanctions wouldn’t have a negative impact on TTF – DESNWE spreads ( & therefore EU regas utilisation). It is also increasingly likely this is reflected in market prices already.

Asset value impact

Asset value impacts of a return of Russian flows are complex. They often involve offsetting drivers and asset specific idiosyncrasies.

However there are some generic value impact conclusions that are useful to consider. We finish we 5 high level takeaways from our analysis in Table 2.

Table 2: Summary of asset value impact from increase in Russian flows

Upcoming webinar

Register today for our free upcoming webinar “European flexible gas asset value in a post crisis world” – hosted on Tuesday 18th March at 09:00 – 09:30 GMT (10:00 – 10:30 CET, 17:00 – 17:30 SGT).

Our panel will be discussing the following:

- How EU gas flow patterns have changed since Russian supply cuts

- Structural changes in flexible gas asset use since the crisis

- The role of flexible gas assets in balancing European markets

- Impact on flexible gas asset revenue and extrinsic value capture

- Our views on how asset value will evolve

Register here