The word ‘Dunkelflaute’ became a prominent new addition to the energy market lexicon in late 2024. It translates from German as ‘dark doldrums’, referring to multi-day periods of low wind & solar output.

This may be a German word, but it is not just a German problem. The growing impact of gaps in renewable output is highlighting a flexibility deficit across Europe.

Europe experienced two significant Dunkelflaute events in the first week of November 2024 and the second week of December 2024. These periods of low wind & solar generation provided a clear demonstration of the growing importance of flexible thermal and storage assets in balancing power markets.

This article examines the impact of Dunkelflaute events on baseload prices, price volatility, and the value of flexible power assets.

What is Dunkelflaute?

Dunkelflaute describes periods characterized by:

- Low wind generation and

- Limited solar output (due to seasonal darkness or heavy cloud cover).

These ‘dark doldrum’ events are a challenge that is becoming increasingly common across many European power markets as renewable penetration increases.

When renewable generation falters, the grid relies on thermal generation and flexible assets to meet demand. The bidding strategy of flexible assets such as gas-fired plants and storage can have a major impact in setting marginal power prices.

Two Dunkelflaute case study events: Nov & Dec 2024

Two recent Dunkelflaute events in Q4 2024 in Germany make good case studies for this increasingly common phenomena. German thermal generation ramped up significantly to compensate for the shortfall in renewable output. The resulting dynamics drove a sharp increase in:

- Baseload power prices

- Clean spark spreads (CSS – gas plant generation margins)

- Within-day price volatility, which supported flexible asset value capture.

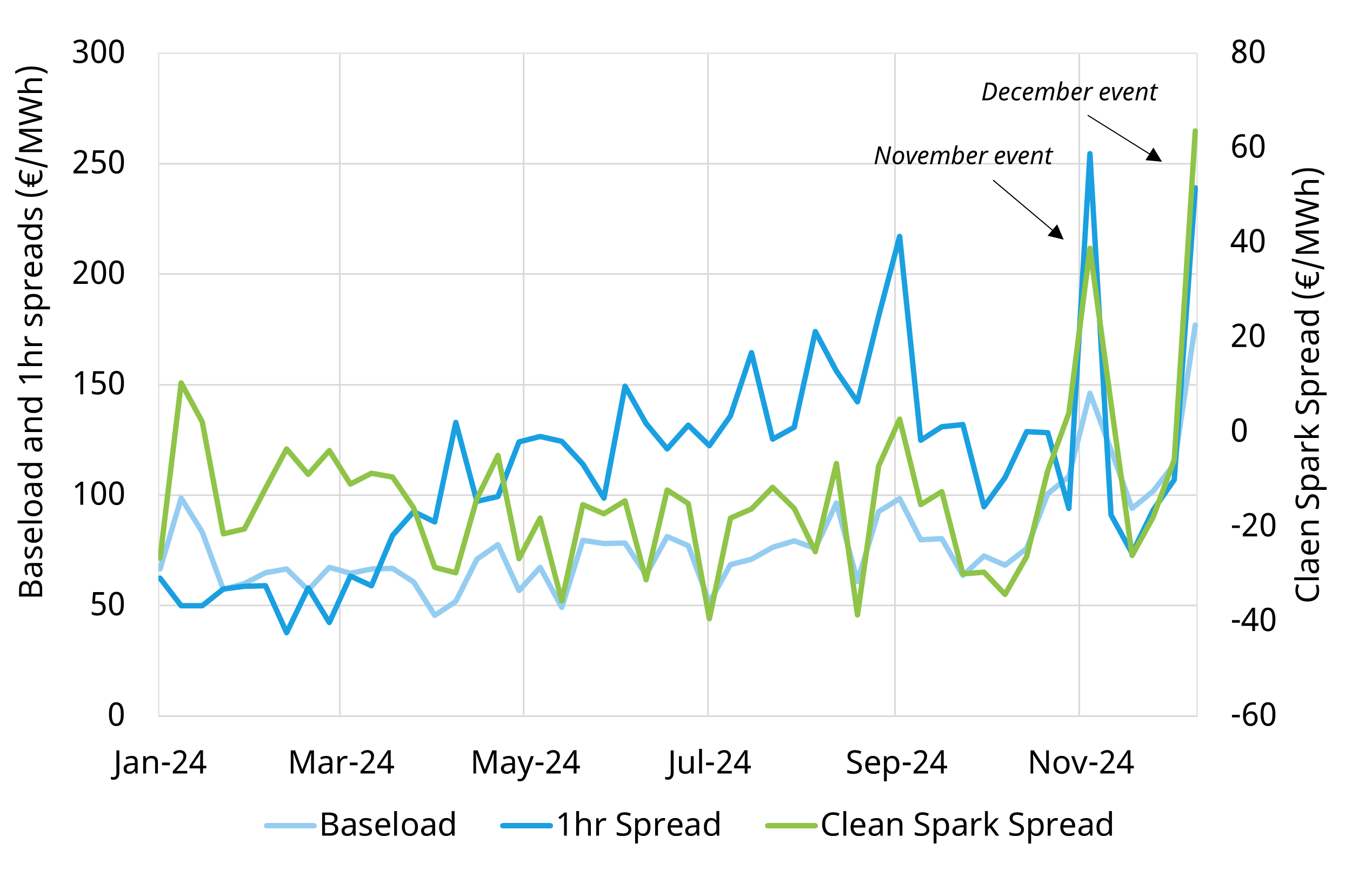

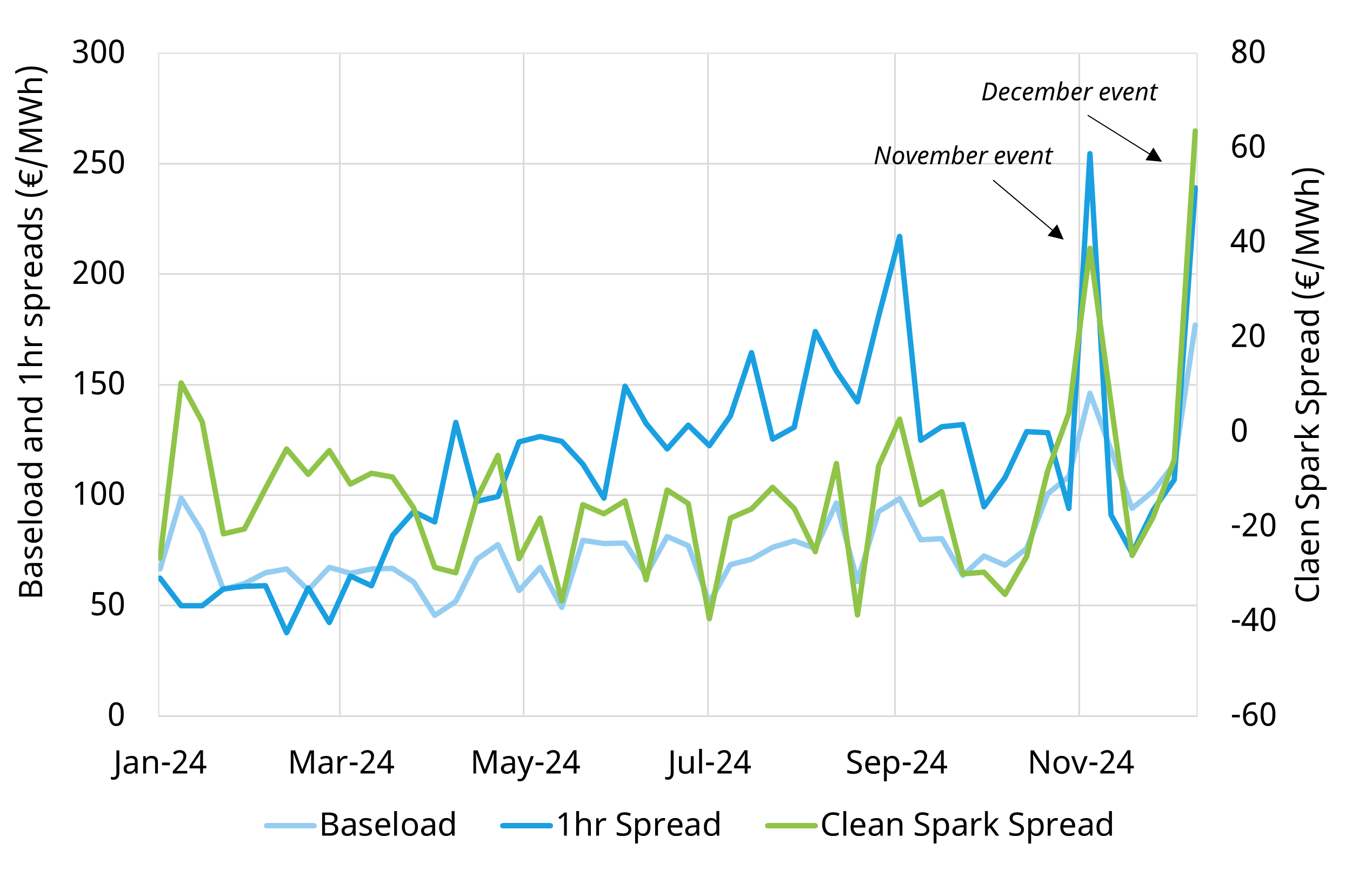

Chart 1: German price dynamics in 2024

Source: Timera Energy, ENTSOE, Spectron

Let’s summarise the two Dunkelflaute events.

Event 1: November 2024

- German baseload prices surged to over 145 €/MWh.

- 1-hour price spreads exceeded 250 €/MWh.

- Clean spark spreads climbed above 35 €/MWh.

High intra-day volatility created substantial opportunities for short-duration storage assets (e.g. BESS) to arbitrage price spreads in the day-ahead market.

Event 2: December 2024

- German baseload prices rose even higher, exceeding 175 €/MWh.

- 1-hour price spreads peaked at 235 €/MWh.

- Clean spark spreads surged to over 60 €/MWh.

While intra-day volatility was slightly lower than in November, high average clean spark spreads persisted even during midday hours. This offered lucrative opportunities for longer-duration storage and less-efficient flexible gas assets such as OCGTs and engines.

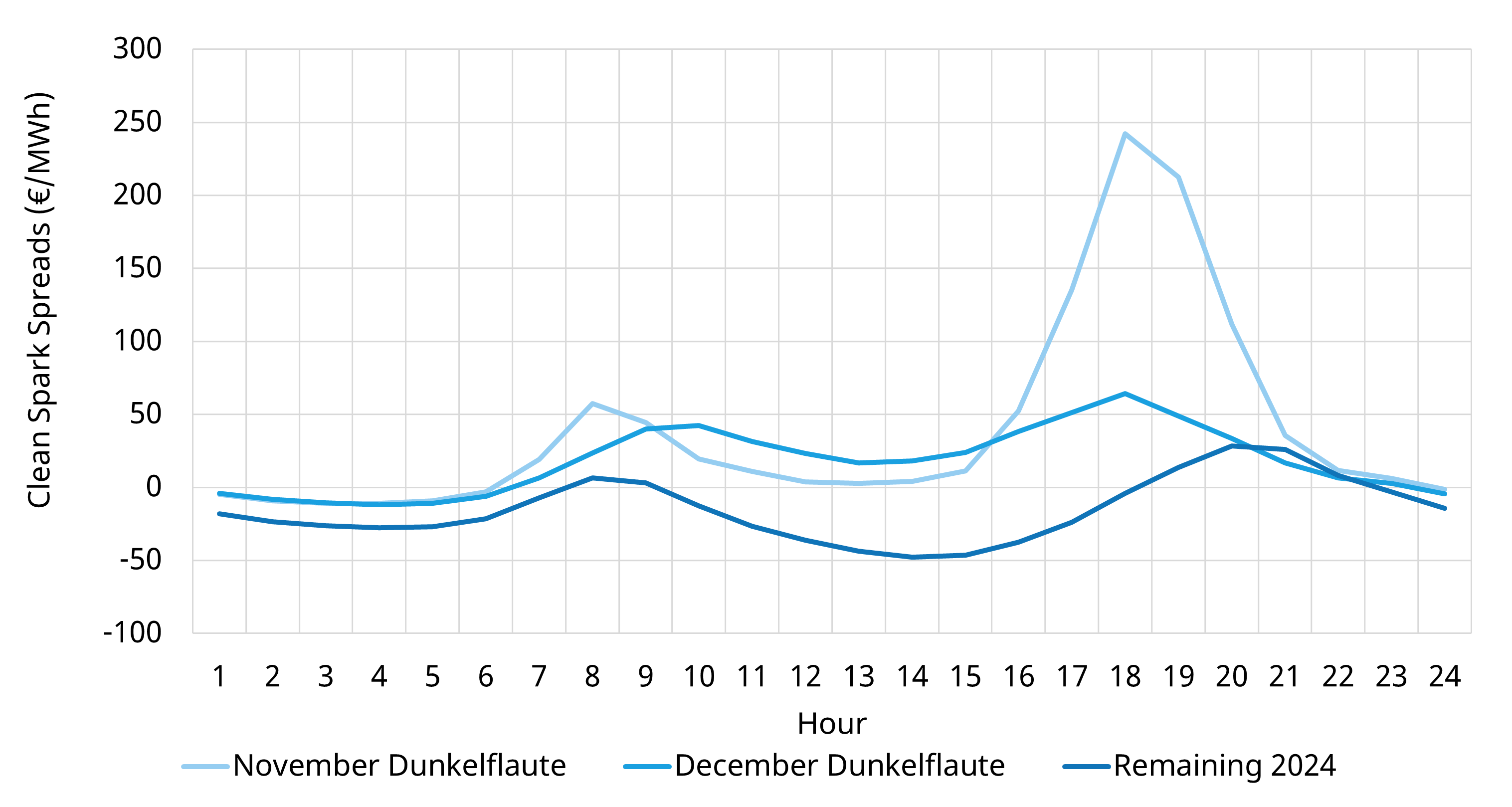

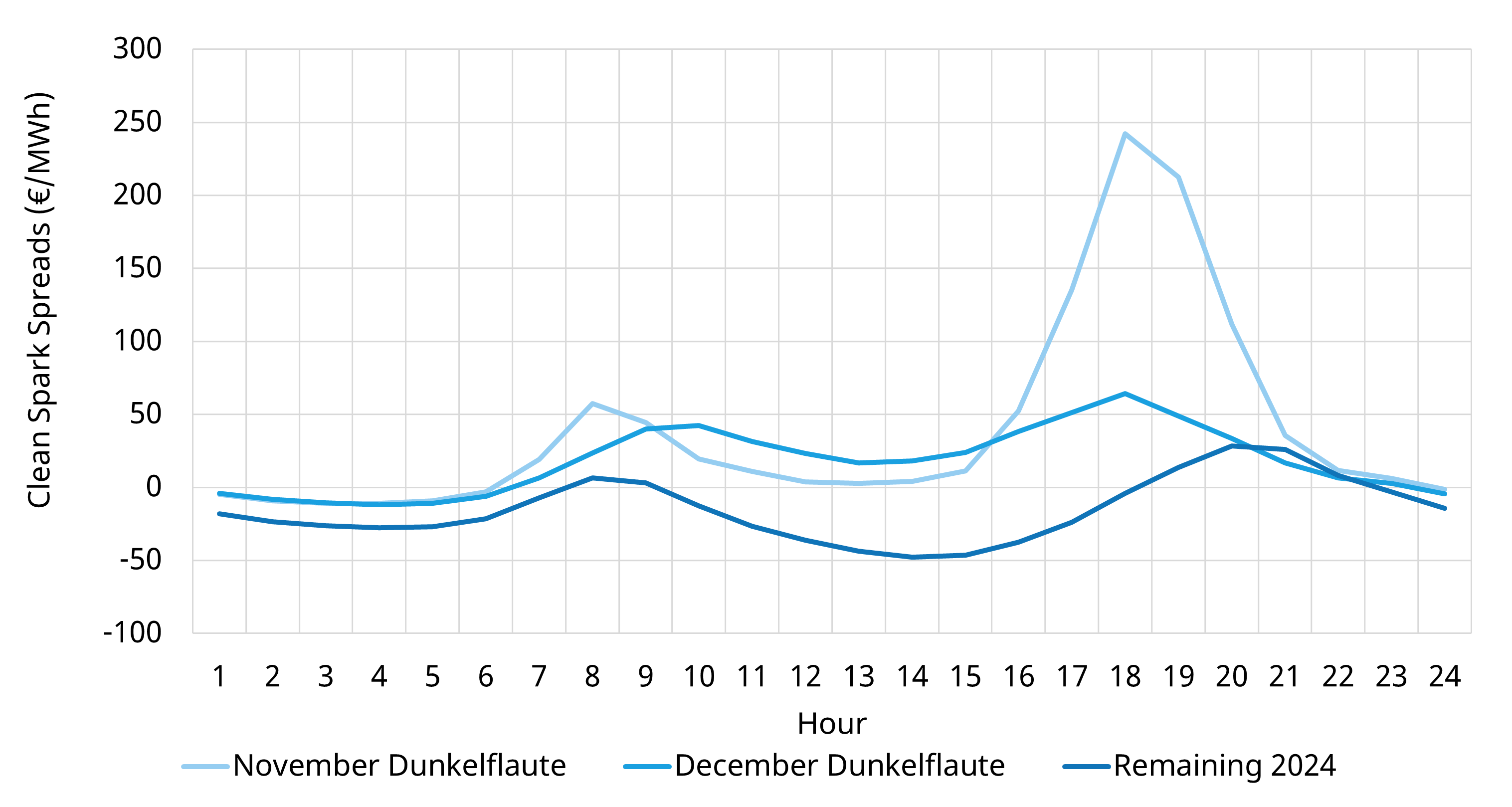

Chart 2 illustrates the impact of the two events on intraday CSS compared to average conditions across the rest of 2024.

Chart 2: German weekly average within-day CSS distribution

Source: Timera Energy, ENTSOE, Spectron

Diverging dynamics of the two events

The November Dunkelflaute was characterised primarily by extreme within-day volatility, which created price spikes (mainly in the evening) and wider intraday price spreads. In contrast, the December Dunkelflaute exhibited:

- Sustained high clean spark spreads across the day, reflecting prolonged renewable shortfalls coupled with higher German (THE) gas prices, which contributed to increased price premiums at the margin.

- Slightly lower intra-day volatility, favouring storage assets with longer-duration flexibility and gas peakers that could capture more consistent price premiums.

These two cases illustrate differences in the impact of low RES events depending on their timing and duration. What they have in common is a positive impact on flex asset value capture.

Impact on flexible power assets

Both events resulted in significant surges in extrinsic value for flexible power assets. Let’s take a look at the impact on BESS & gas-fired assets one at a time.

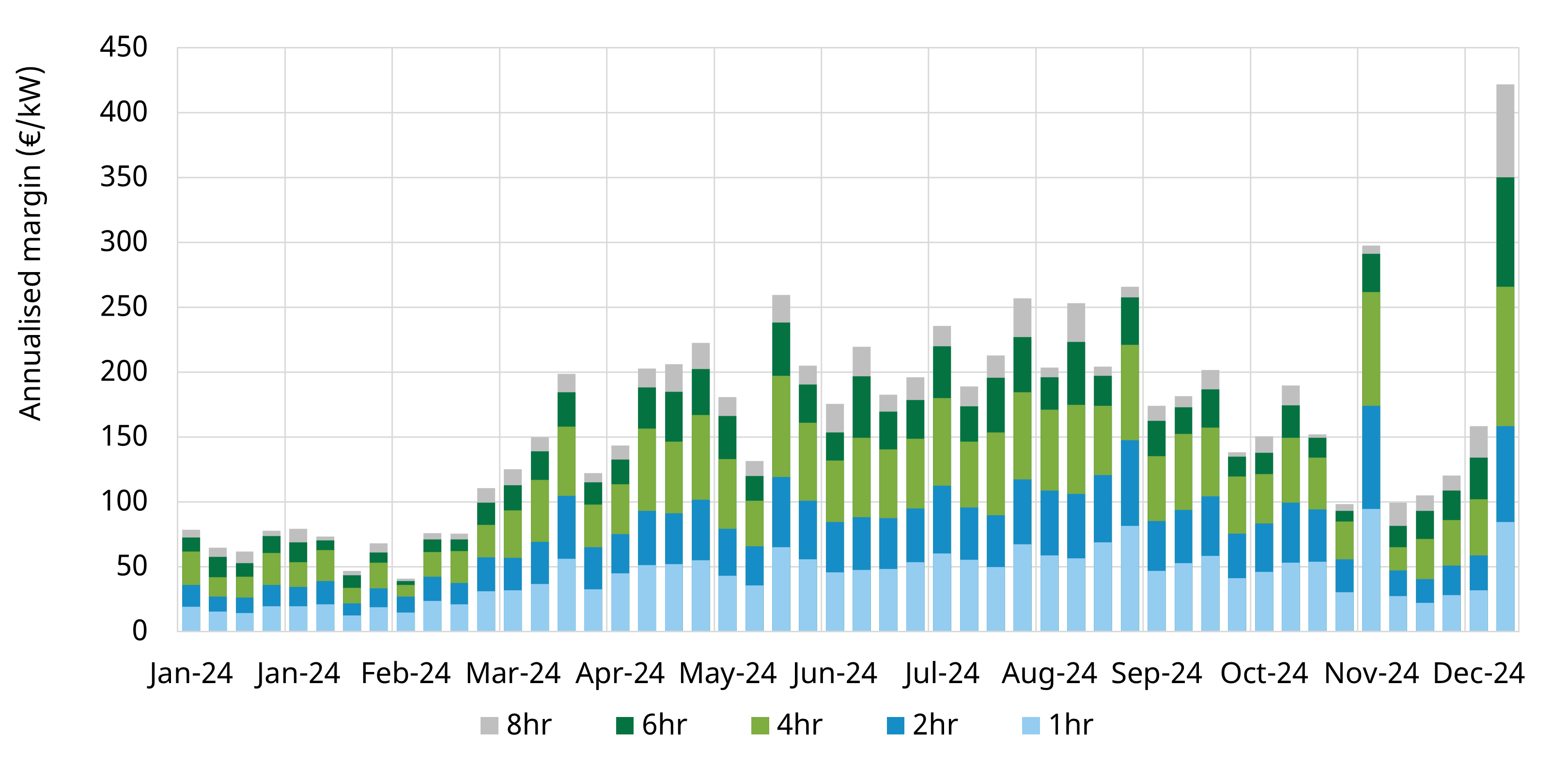

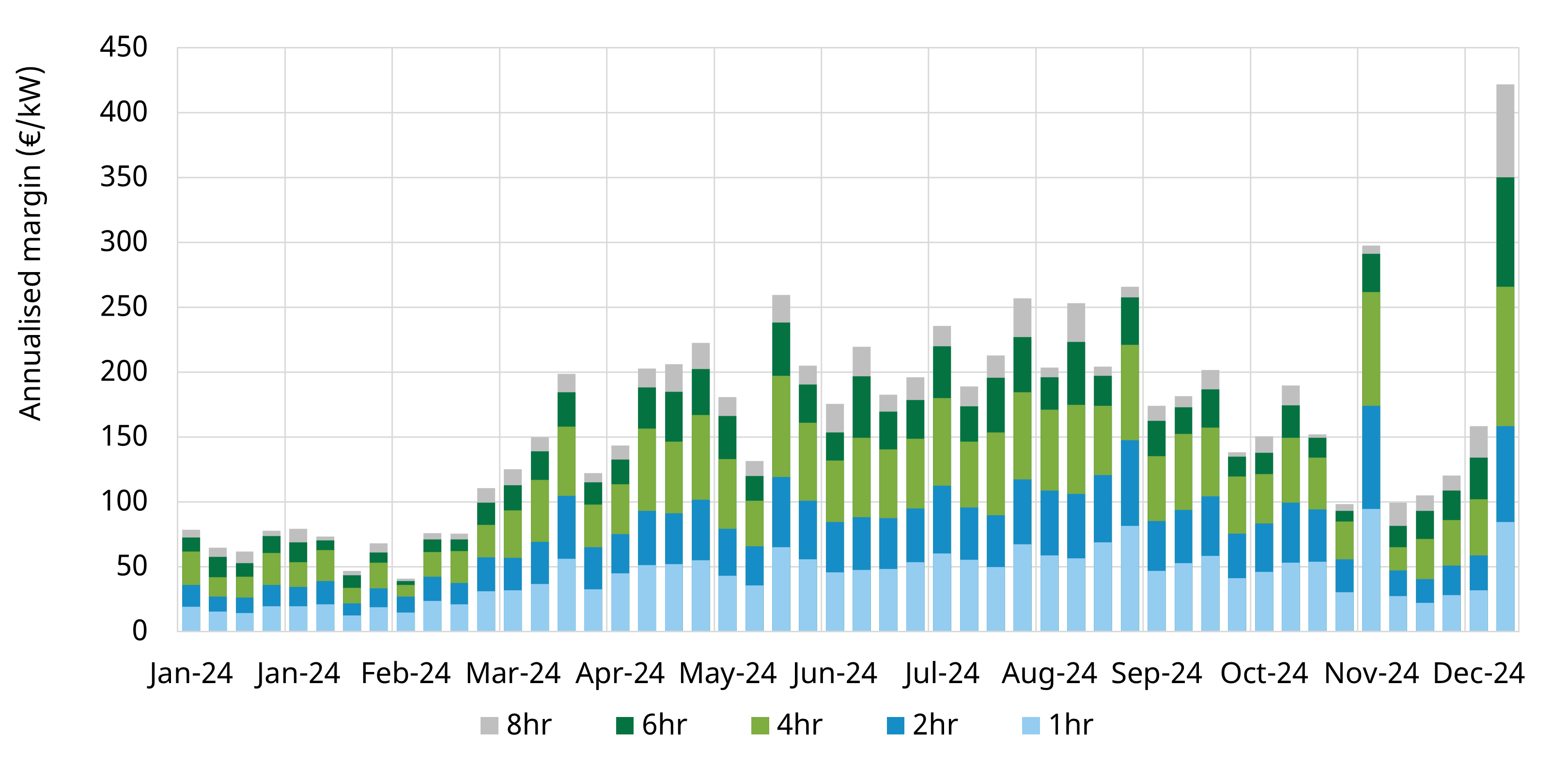

BESS value capture:

Shorter duration storage (e.g. 1 – 2 hr duration) benefitted from volatile day-ahead spreads in November, driving strong arbitrage gains as we show in Chart 3.

Chart 3: German BESS incremental Day-ahead arbitrage value capture by duration in 2024

Source: Timera Energy; Note value calculations assume a simple D-A arbitrage capture strategy with visibility across a monthly horizon (efficiency 85%) - analysis only covers D-A value, not intraday and other revenue streams.

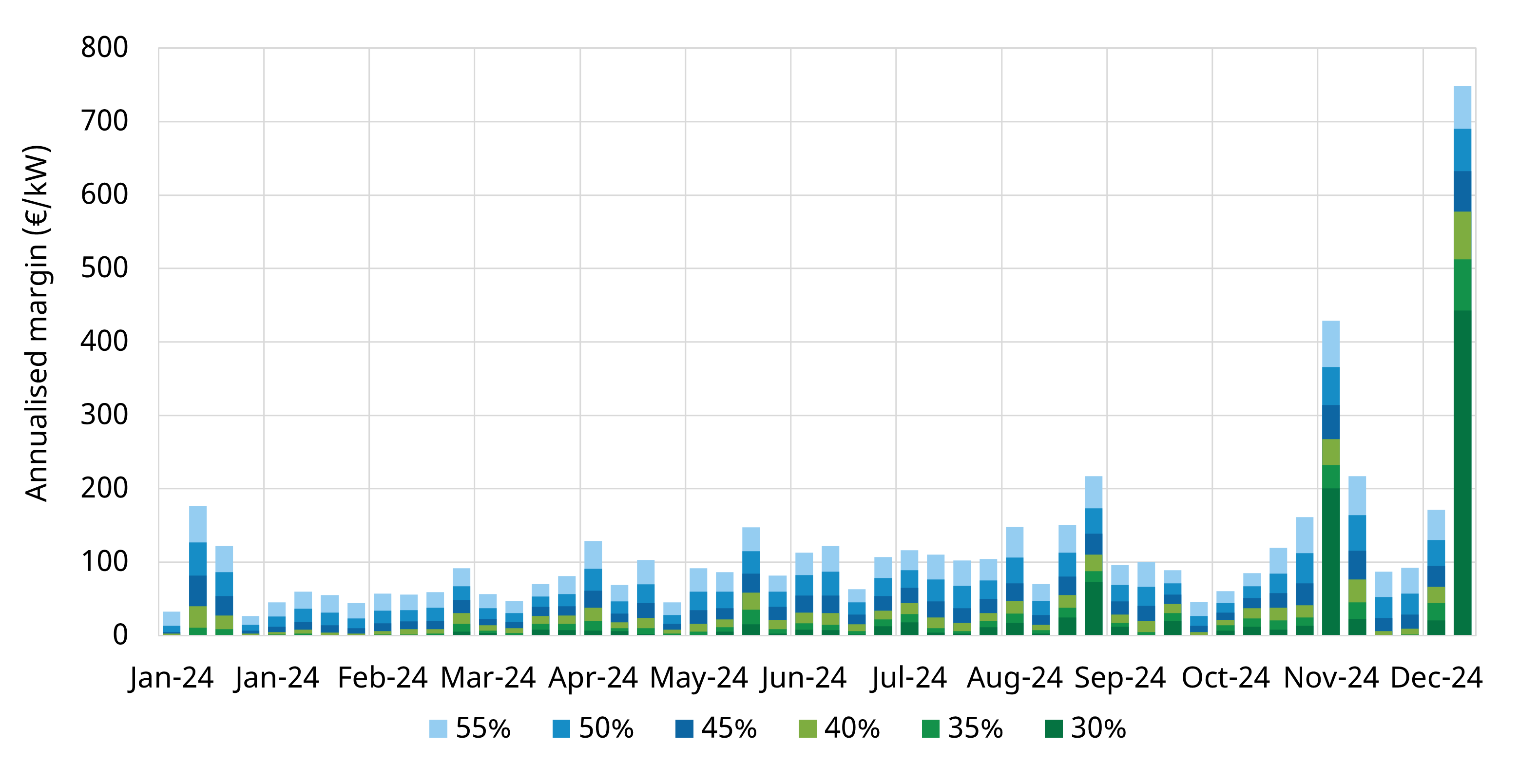

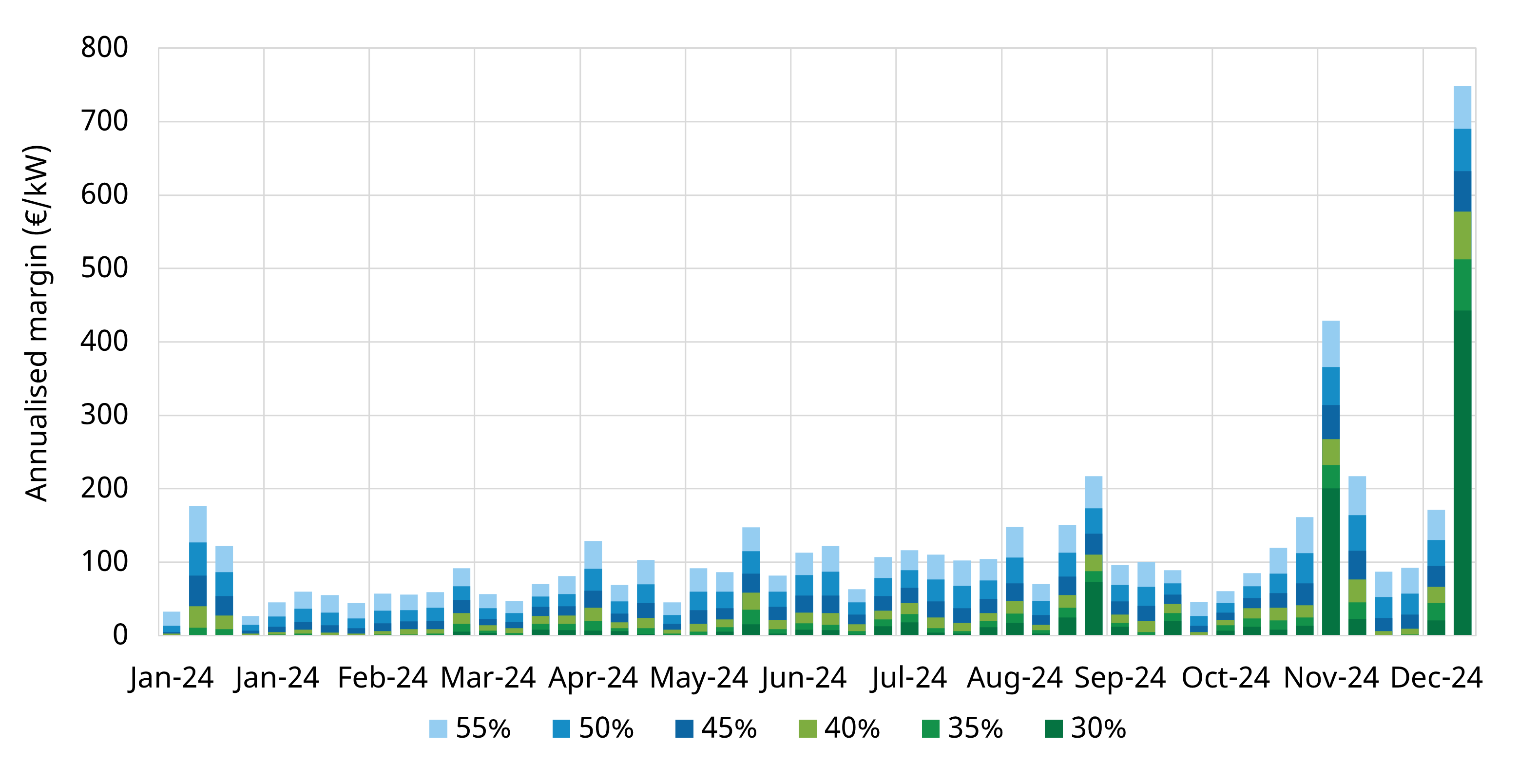

Gas plant value capture:

Gas engines and OCGTs (e.g. with typical efficiencies in the 30-40% range) saw a pronounced extrinsic value uplift in December. Lower efficiency gas assets captured most of the value from price jumps, due to sustained price signals across the day.

CCGTs (e.g. 50%+ efficiency) captured some incremental value from higher efficiencies, but this gain was a relatively small ‘add on’ to the value captured by peaking assets.

Chart 4: German gas plant Day-ahead incremental margin capture by plant efficiency in 2024

Source: Timera Energy; Note analysis show the gross margin capture of gas-fired plants based on hourly spot power prices & daily gas & carbon prices. Importantly in this relatively simple analysis we do not account for the ramping & start constraints of assets. But the analysis provides a reasonable benchmark for relative gas plant value capture across markets.

The December event particularly highlighted the emerging role of longer-duration storage and thermal flexibility in responding to multi-hour renewable shortfalls.

Looking ahead: Dunkelflaute and future flexibility

As Europe’s renewable penetration grows, Dunkelflaute events are set to become more frequent and severe, impacting power markets across Europe. This should drive:

1. Price signals that favour flexible assets capable of responding to prolonged scarcity

2. More dynamic and non-linear competitive dynamics in power markets, driven by portfolio trading strategies that increasingly will try to profit from renewable scarcity events and from more complex market coupling dynamics due to flow-based mechanisms

3. More volatile and complex power price dynamics at the margin, requiring all market operators to review their analytical methodologies to better understand the European power markets and value capture

4. Greater reliance of flexible asset value capture on volatile revenue streams with asymmetric upside in revenue distributions.

For assets like gas engines, OCGTs, and CCGTs, investment cases will increasingly depend on their ability to profit from these price spike opportunities and sustained intraday price spreads during these events, while stacking with capacity market revenues.

However, capacity market design in some countries may include price cap measures for awarded capacity (e.g. Italian Capacity Market). This can act to cap more extreme power price spikes, substituting merchant value uplift for regulated long-term capacity payments.

Flex investment remains key

The recent Dunkelflaute events underscore the critical role of flexible power assets in a renewable-dominated energy system. These periods not only stress-test the grid but also provide clear price signals for investment in:

1. BESS assets to provide intraday balancing flex

2. Thermal generation flex to provide the energy output required to plug renewable shortfalls.

3. Longer-duration storage solutions to help bridge more sustained dips in RES output.

As Dunkelflaute events become more common, the extrinsic value of flexibility will be further amplified, presenting both opportunities and challenges for asset owners and investors.

Timera German, GB & Italian BESS services

We provide a comprehensive quarterly investment support service for German & GB BESS investors. This includes:

- Battery Investment Tool populated with latest projections of revenue stack, opex & capex to 2050 covering a broad range of BESS configurations delivered quarterly

- Timera Battery Report with detailed up to date analysis of market & asset value drivers

- ‘One on one’ workshops with Timera’s team of storage experts to review & challenge Tool & Report

We have also recently launched an Italian BESS investor support product covering a full range of zonal asset revenue stack projections & detailed analysis of MACSE & CM bidding strategies.

If you would like a sample copy of a report and Battery Investment Tool feel free to contact our Power Director Steven Coppack (steven.coppack@timera-energy.com).

Timera Energy is sponsoring & presenting at the 2025 Energy Storage Summit on 17-19th February in London.

We will have a stand & meeting room at ESS and our Power Director, Steven Coppack, will be speaking on:

Building a Bankable BESS Investment Case

- Cross market BESS investment case comparison

- Revenue stack state of play + 3 key structural drivers

- Innovation in BESS offtake & financing

- Quantifying & managing downside risk

- Key challenges in building a bankable investment case

It would be great to catch up face to face if you are coming along – feel free to contact Steven steven.coppack@timera-energy.com.