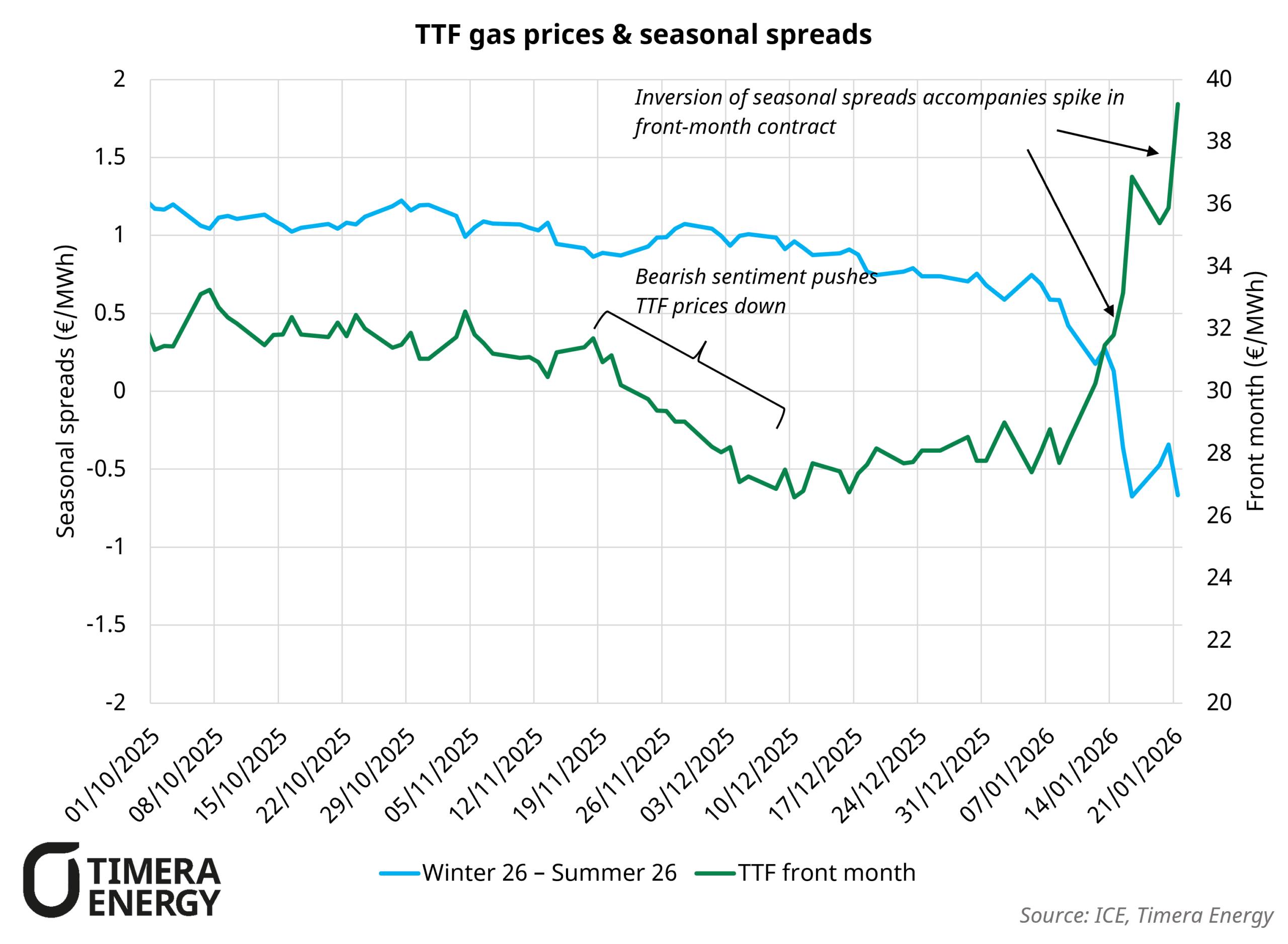

Europe is again facing potential difficulties in filling gas storage as W26–S26 seasonal spreads have inverted. A sustained price decline was reversed last week when the TTF February contract surged almost 50% to 39 €/MWh, driven by colder weather and storage levels nearly 10bcm lower than at the same point last year.

This price rally has flowed through into the forward curve, which has shifted higher across 2026., with the strongest upward movement at the prompt end. An additional 58 mtpa of additional LNG export capacity is expected to come online across 2026, the majority towards the second half of the year. This new supply puts greater downward pressure on late 2026/early 2027 prices. As a result, seasonal spreads have inverted with TTF Summer 2026 contracts now trading more than 0.5€/MWh above Winter 2026

With the seasonal forward curve inverted, storage operators lack an intrinsic economic incentive to inject gas ahead of winter 2026, complicating efforts to meet the EU’s storage mandate of 80% fill by the start of December 2026. TTF has now experienced prolonged periods of inverted seasonal spreads in three of the past four years, undermining the merchant business case for storage operators. Increasing curve backwardation as LNG supply continues to come online over the coming 5 years is likely to further exacerbate this challenge. Given storage’s importance for European security of supply, policy makers may be compelled to respond.