Gas-fired generation accounts for 15-20% of European generation output, depending on weather conditions. This is a similar level to wind output (around 17%).

The role of gas plants has come back into focus in 2025, driven in part by recent system stress events such as the ‘Dunkelflaute’ price spikes in Q4 2024 and the major Spanish power system outage in Q2 2025.

Gas plants play two important roles in enabling energy transition:

- Providing key balancing flexibility to enable wind & solar to scale, while ensuring security of supply.

- Enabling the closure of higher emissions coal & lignite capacity.

However gas plant economics are becoming more complex as wind & solar penetration increases. Plants are running lower load factors and need to optimise more flexible dispatch profiles to capture value.

Despite these challenges, the implied returns on a range of gas plant investments are actually increasing, supported by a diminishing pool of capital targeting the space.

In this article we explore the changing landscape facing gas plant investors and look at both the challenges & opportunities that are emerging.

The role of gas: security of supply

If someone asked you to explain to a Golden Retriever why gas plants are key to security of supply, a reasonable response would be something like: “sometimes it’s neither windy nor sunny”.

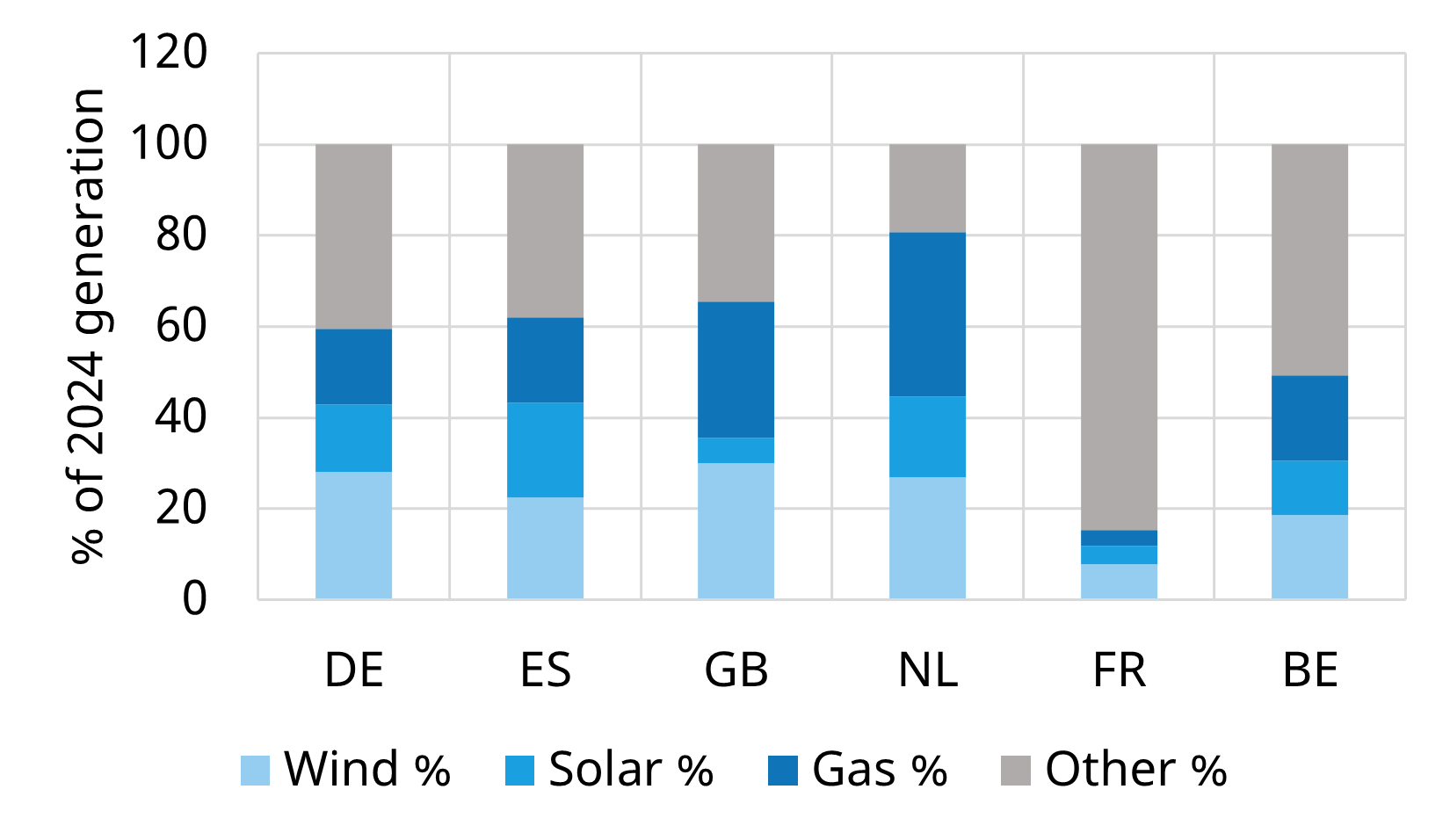

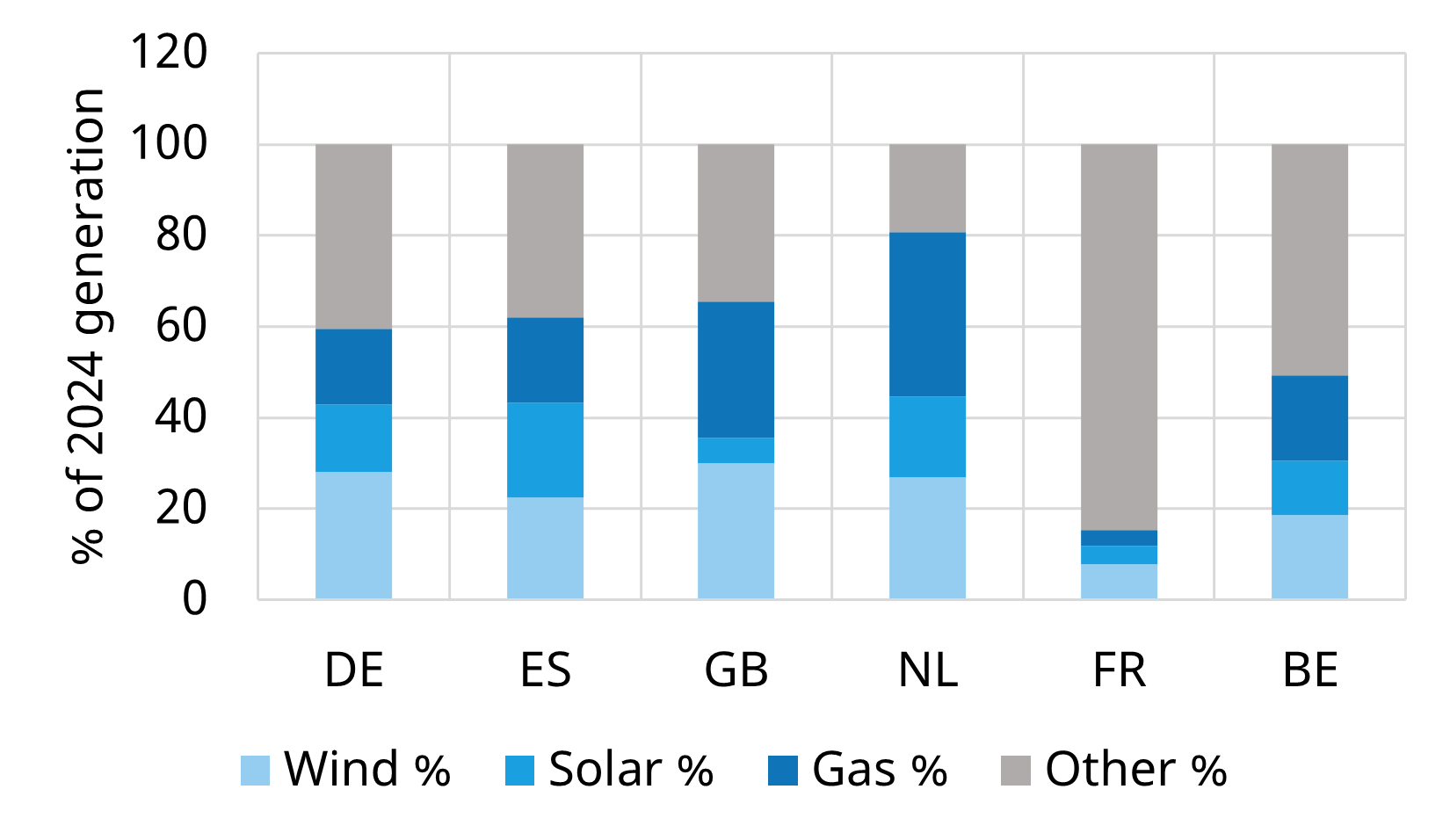

European power markets are increasingly sourcing generation from wind & solar capacity. The sum of these sources makes up almost 30% of European supply, with a higher % contribution in many larger power markets as shown in Chart 1.

Chart 1: Output share of wind, solar & gas in some key power markets

Source: ENTSOE, Timera Energy

As RES penetration increases, power markets need to be resilient for:

- regular periods of relatively low wind & solar output

- large & rapid fluctuations in output (e.g. due to changes in wind speed & cloud cover).

Hydro flexibility helps, but it is limited and very difficult to build new capacity to scale with RES. Battery storage (BESS) is excellent for providing shorter duration flexibility, but has an average of around 2 hours of discharge potential (duration) before it is empty and needs recharging. The remainder of the system balancing requirements sit with thermal plants, primarily gas.

Gas plants provide (i) energy (vs storage which is a net energy consumer) and (ii) flexibility, both of which are key to enabling RES capacity to scale.

The role of gas: emissions

Gas plants also play an important role in reducing emissions by displacing higher emission coal & lignite plants. This is best illustrated by a couple of simple charts.

Coal plants account for around 55% of total European power sector emissions, with these emissions focused in several key markets e.g. Germany, Poland & Czechia.

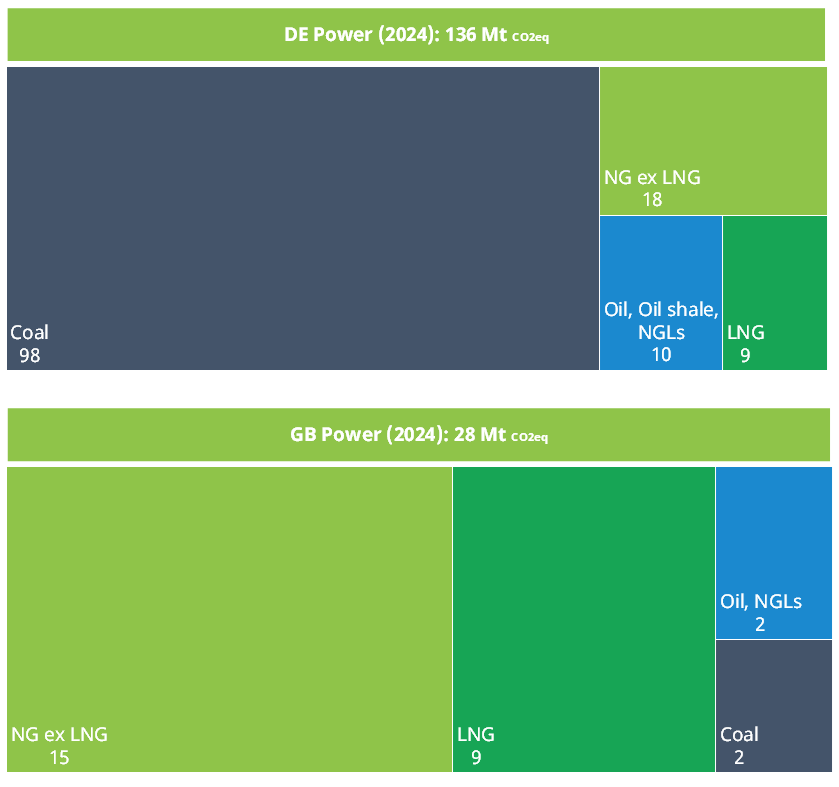

In Chart 2 we compare power sector emissions in:

- Germany – a market still heavily dependent on coal & lignite.

- GB – a market that has retired its coal fleet over the last decade.

The numbers are a stark contrast, even recognising that the GB power market is a bit smaller than Germany. German power emissions are almost 5 times those of GB, with coal accounting for more than 70% of German emissions.

Gas plants do not solve the emissions challenge, but they do provide a step reduction in emissions. Then as RES penetrations increases gas plant emissions can decline with falling load factors, switch to low carbon fuels (e.g. biogas, H2) and potentially abatement technologies (e.g. CCUS).

Unless a game changing low carbon & economically viable generation technology emerges, gas is set to play a key role as flexible balancing capacity for decades to come.

Gas plant value capture challenge

Gas plant output in Europe is dominated by CCGTs, with gas peakers (e.g. OCGTs & engines) playing an important lower load factor flex provision role.

CCGTs traditionally ran a baseload or a ‘two-shifting’ peak profile. This no longer makes sense in a world of rapidly increasing RES output.

Clean Spark Spreads (CSS) are the benchmark for generation margin a gas plant captures, measuring power price revenue minus gas & carbon cost for a specified plant efficiency.

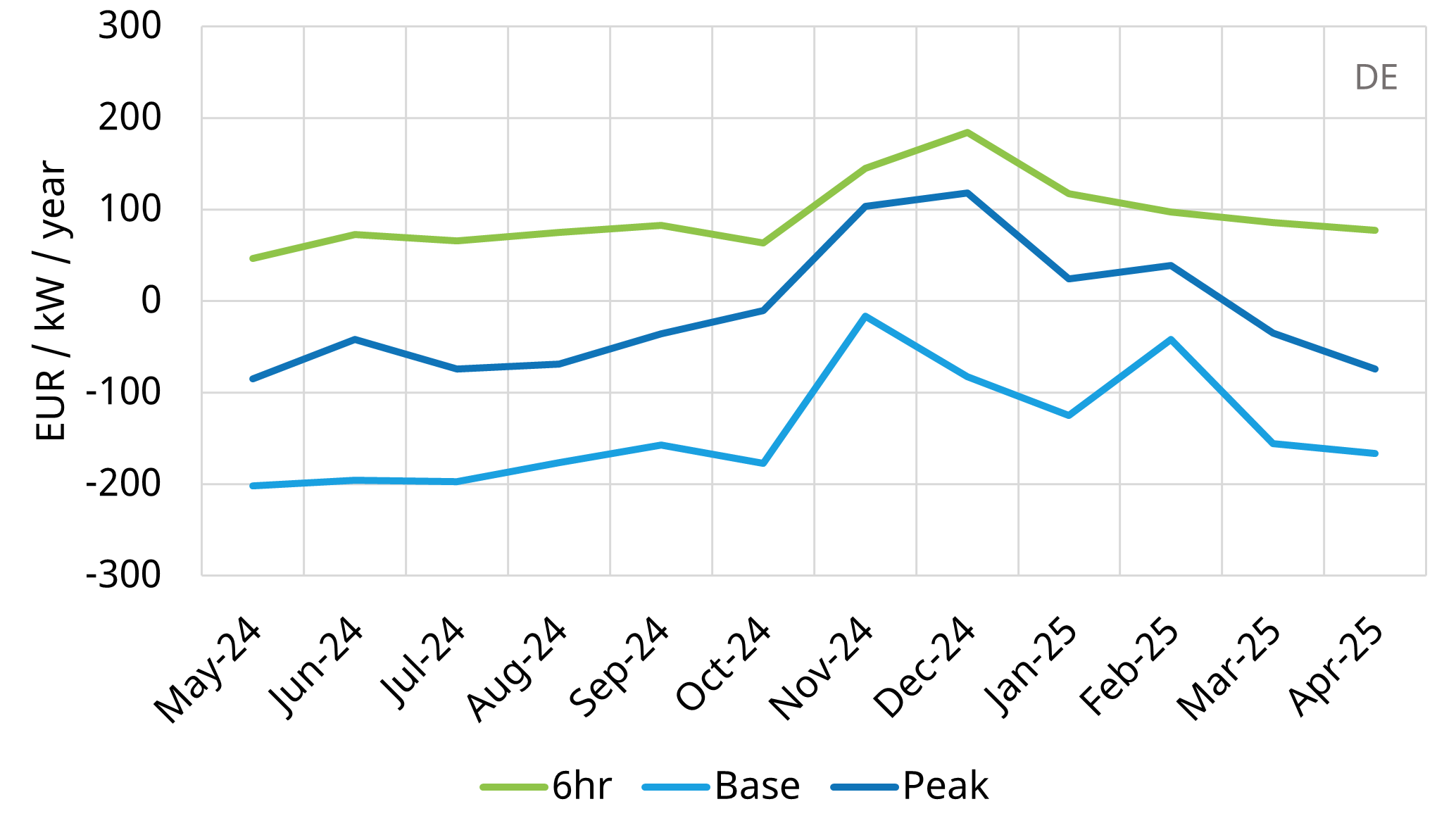

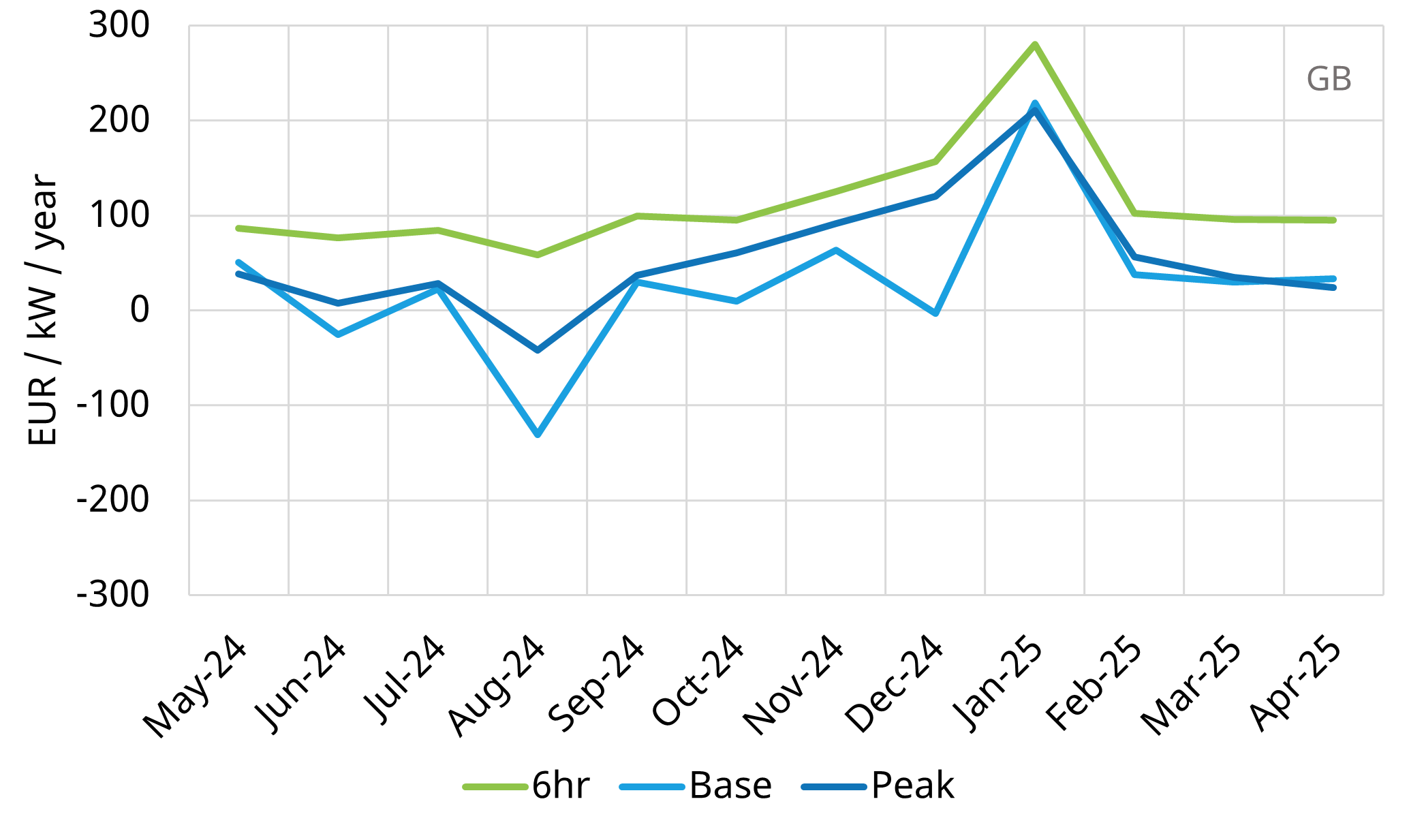

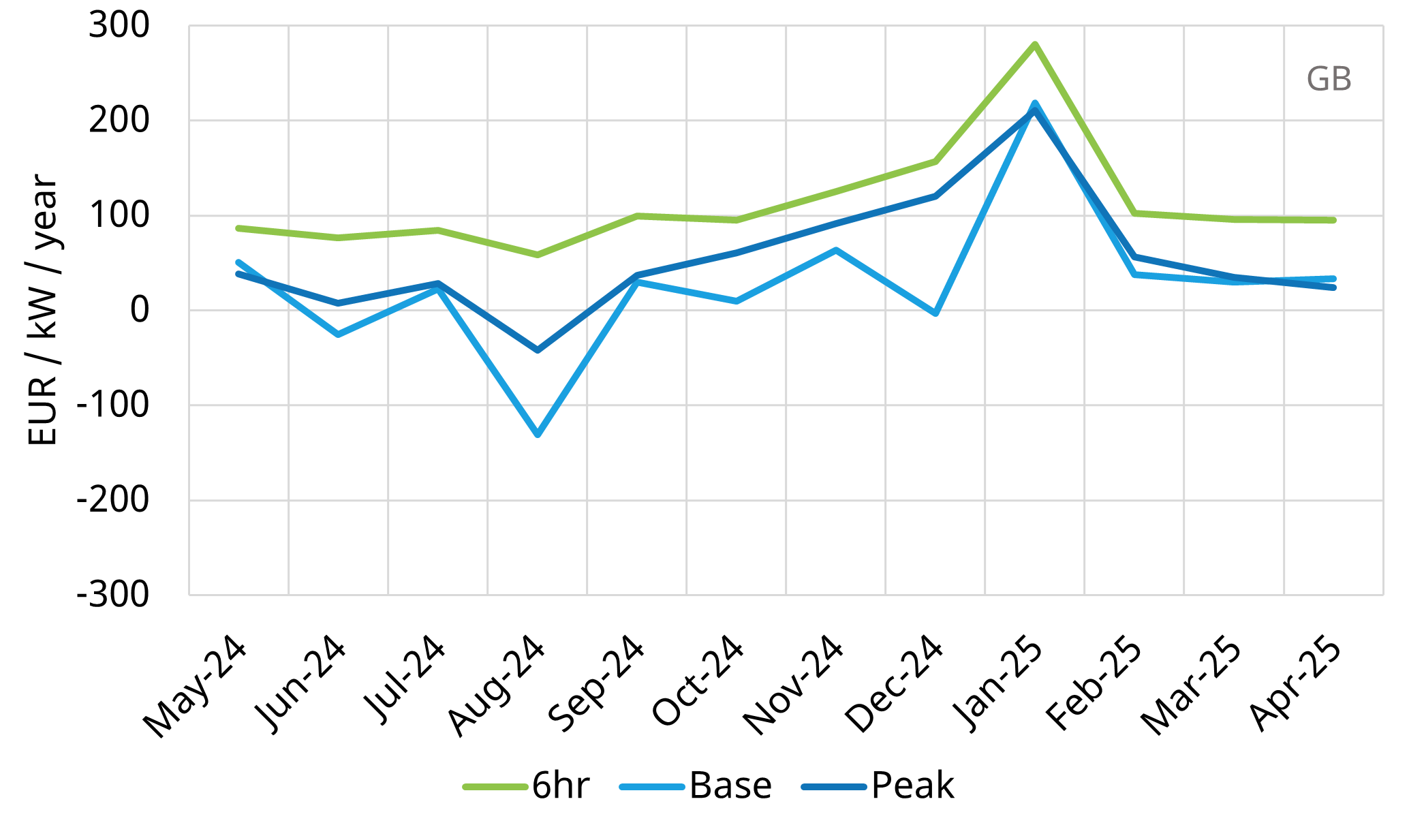

Chart 3 shows three CSS value capture indices for a CCGT in Germany (top panel) and GB (bottom panel) running:

- Baseload profile (24-7)

- Peak profile (12 hour weekday peaks)

- A simple optimised profile against hourly day-ahead auction prices (with 6-hour minimum run time & 6-hour minimum down time)

Source: Timera Energy, ICE, Spectron

The chart illustrates how Baseload & Peakload CSS are no longer useful benchmarks for gas plant value capture. The green line in the chart shows how CCGTs capture substantially more value optimising against day-ahead hourly auction prices vs blocky baseload & peak profiles (which can often have deeply negative CSS levels).

Value capture in the German power market reflects higher RES penetration, with gas plants harvesting margin from price shape & volatility. Gas plant load factors and average margins tend to be higher in the GB market, with lower RES penetration but also less extreme price shape & volatility. GB assets also benefit from substantial capacity prices.

Gas plants are effectively a strip of options on the CSS and need to be valued as such. This means stochastic modelling of plant dispatch, optimised against a distribution of hundreds of potential price paths that capture the uncertainty of price outcomes e.g. due to fluctuations in wind, solar & load profiles.

The ‘smart money’ we see looking at gas plant investment recognises this challenge and is adapting investment case analysis accordingly.

Gas plant investment economics: challenges & opportunities

A reasonably pervasive narrative developed during the early 2020s that gas plants in Europe were ‘uninvestable’. In some cases this was right, but an oversimplified narrative like this often spells opportunity.

Implied returns on a range of gas fired assets have actually been increasing across the last 3-5 years, helped by lower acquisition costs for existing assets. This is evidenced by a growing private equity interest in the space (with typical unlevered IRR requirements of 15%+).

There are two main drivers for this increase:

- A diminishing pool of strategic, infrastructure & pension capital able to invest in gas, e.g. given ESG constraints

- A perceived increase in regulatory & decarbonisation risk for gas assets.

The former definitely represents an opportunity. The latter is an important consideration but one where the risk landscape is evolving, with a policy refocus on a balance of decarbonisation, security of supply & consumer energy costs / competitiveness.

Two tangible examples of this:

- The new German government’s recognition that it cannot close coal without at least partially replacing it with new gas, underpinned by major Dunkelflaute incidents in Q4 2024 (with similar impacts across other European markets).

- The major Spanish outage in Apr 2025 which has led to major system operation concerns and the higher load factor running of gas plants to try & stabilise a system with high solar penetration.

Gas plant investment remains complex – the successful investment opportunities we see working with clients often have a clear source of competitive advantage e.g. private wire (to reduce grid fees), ancillary revenues, financing structure advantages (e.g. given capacity payments) or locational benefits.

However opportunities vary by country and asset type e.g. gas engine investment opportunities in GB and CCGT investments in Poland.

If you want to see more detailed analysis & discussion on gas plant investment economics, opportunities & risks, join our 17th Jun webinar (see details below).

Join our webinar: “Building a viable gas plant investment case”

Topic: The role of gas-fired capacity in the energy transition and investment opportunities & challenges across Europe

Time & access: Tues 17th June 10:00-10:30 CET (09:00-09:30 BST)

Registration: Pre-registration required (access is free); webinar registration link – register here

Coverage:

- Changing role of gas powerplants in enabling energy transition

- Summary of investment options across Europe

- Breakdown of a viable CCGT margin stack structure

- Gas peaker vs CCGT margins

- 5 key drivers of a viable gas plant investment case