Italy held its much anticipated 1st auction under the MACSE scheme on 30th Sep, with 15 year capacity contracts on offer to support BESS investors. 10 GWh of BESS capacity cleared at an average price of 13,000 €/MWh, 65% below the auction ceiling price (37,000 €/MWh) and well below market expectations.

The auction outcome confirms MACSE as a successful mechanism for delivering high volumes of BESS capacity. It also has important implications for Italian BESS investor strategy as well as for the BESS investment & policy landscape more broadly across Europe.

In today’s article we review what happened, why the prices came in so low, and what investors should watch going forward.

Auction summary: capacity, prices, and market concentration

Terna’s first MACSE auction cleared 10 GWh of lithium-ion BESS capacity for delivery in 2028 through a pay-as-bid tender. A total of 15 projects were selected across Italy’s southern and island zones, with storage durations ranging from 6 to 8.5 hours. Over 40 GWh of bids competed, leaving many qualified projects unsuccessful.

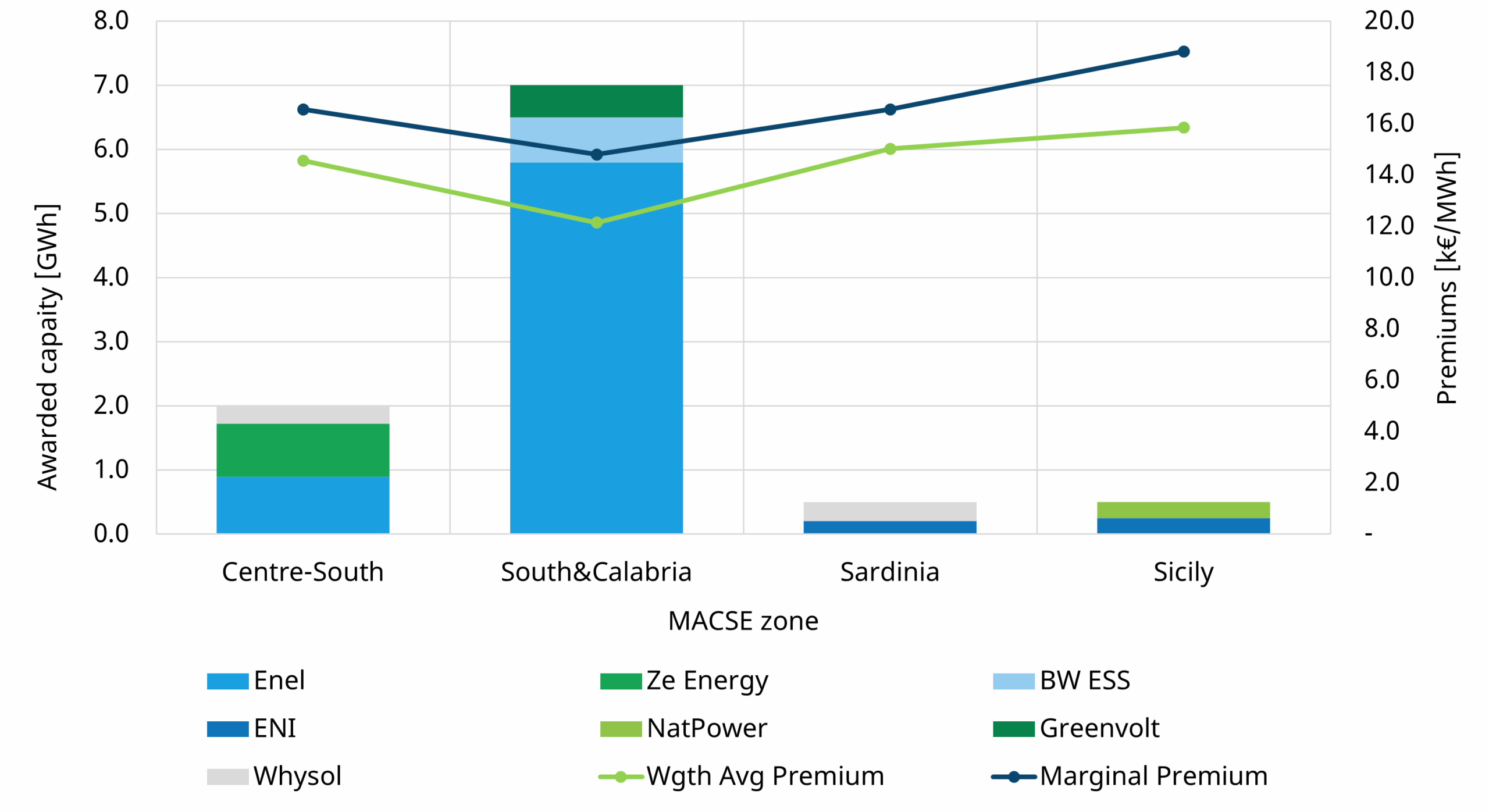

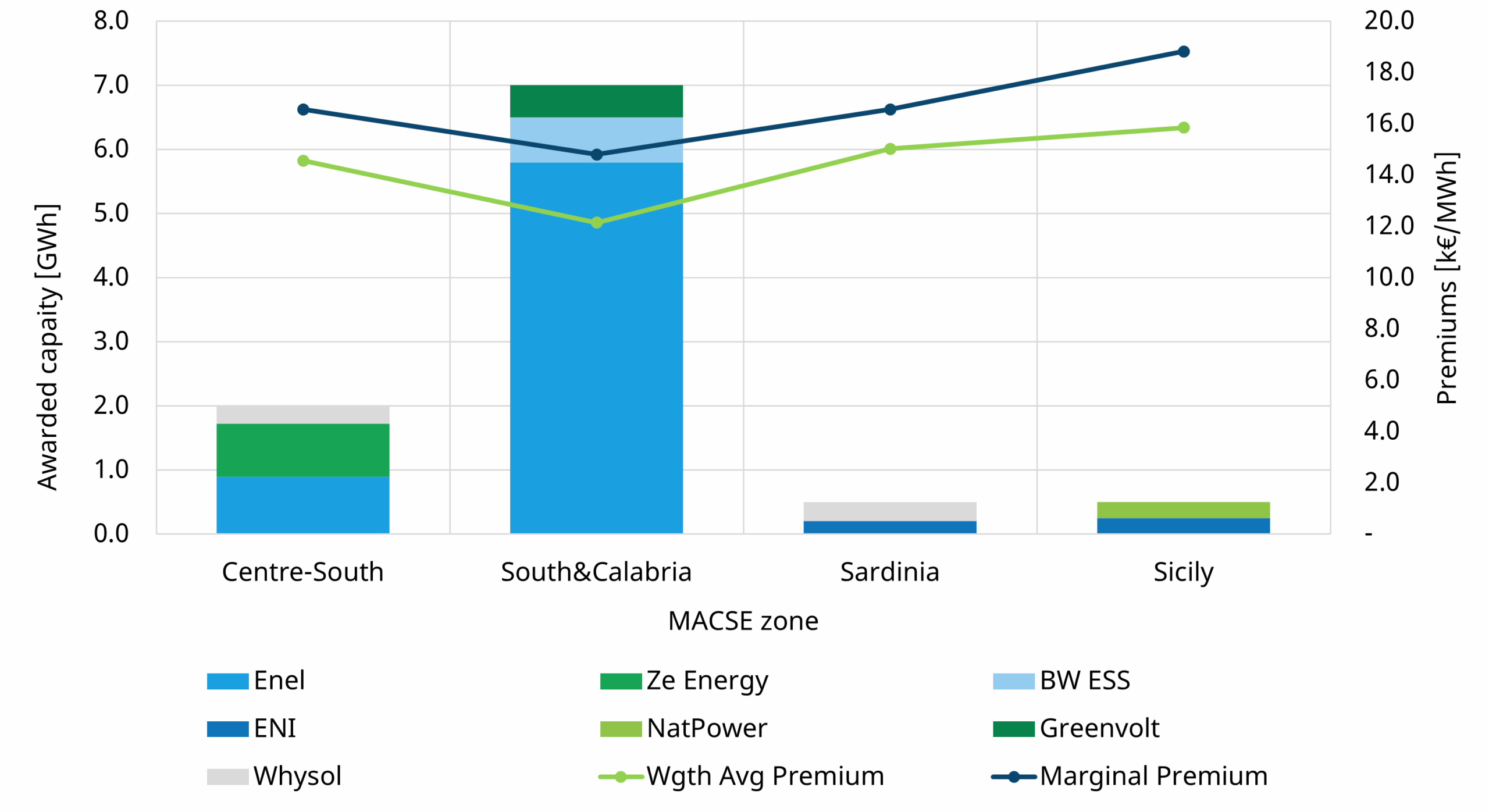

Around 1.5 GW of capacity was successful in the auction as summarized in Chart 1. Project sizes ranging from ~40 MW / 250 MWh to ~550 MW / 3.5 GWh. If the merchant tranches of awarded projects are included, total deployed capacity may reach up to 2 GW.

Chart 1: Awarded capacity, prices and market concentration

Source: Timera, MASE, Terna

Despite a ceiling price of €37,000/MWh/year, marginal price expectations for the tender were around €25,000, factoring in brownfield advantages and intense competition. Actual clearing prices came in far lower, with a weighted average of €13,000/MWh – beating even the most aggressive forecasts.

- South & Calabria saw the lowest prices (avg: €12,146 | marginal: €14,800), hitting its full 7 GWh cap

- Sicily & Sardinia cleared higher (marginals: €18,816 and €16,557), driven by minimum 0.5 GWh volume constraints

- Centre-South cleared at €14,566 on average

Market concentration was very high, with Enel dominating with 2/3 of total capacity and over 80% of South & Calabria capacity (including Enel’s recent ACL Energy project acquisitions). Enel will de facto control over 1 GW / 6.5 GWh of the BESS capacity deployed in the South and Centre-South market zone.

Price signals and strategic insights

The auction played out as a classic game-theoretic contest. The low awarded prices reflecting a common-value auction dynamic, where bidders anticipate aggressive undercutting and adjust accordingly. In this landscape, the key success factors were:

- Leveraging locational synergies (e.g. Enel, with 5.2 GWh on existing thermal plant sites in Puglia and Lazio)

- Secure supply chain advantages, design-to-cost strategies and developer advantage backed by local market knowledge & experience

- Low cost of capital

- Accept thinner margins in exchange for first-mover advantage, long-term optionality, scale, and future market positioning

Three key themes emerged:

- Fragmented cost base: varying CAPEX, OPEX and WACC assumptions reflect a complex landscape, with differentiation across supply chains & EPC access, financing, and cost visibility.

- Brownfield premium: lower development and grid costs gave a clear edge to project developed in existing industrial sites, especially where grid connection is a major CAPEX item in Southern Italy.

- Strategic bidding behaviour: larger players may have bid below normal IRR thresholds to gain presence and portfolio synergies, particularly in MSD/MBR (ancillary and balancing) markets where portfolio dominance can drive value & information advantage. It is important to note that BSP will retain full MSD trading control of MACSE capacity despite giving up 80% of margins.

Merchant tranches important

Every awarded project retained at least some portion of merchant capacity exposure. There were three main reasons:

- Marginal awards: bid capacity was partially awarded because priced at a marginal premium. These projects may opt out from auction commitment, incurring no penalty or loss of pre-auction guarantee (awarded capacity could drop by up to 0.5 GWh)

- Degradation compliance: to meet MACSE’s flat 1%/year degradation tolerance, participants left part of their project merchant to compensate for higher degradation rates and preserve MACSE contracted capacity.

- Strategic exposure: using MACSE contracts to enable debt financing, while retaining merchant upside – this strategy is especially attractive for players lacking scale to spread merchant risk across a portfolio via access to Capacity Market contracts.

An effective merchant tranche strategy will be key to building viable Italian BESS investment cases going forward.

What next for BESS investors: CM auctions & next MACSE rounds

Next up on investor’s radar is the Capacity Market (CM) auction for 2028 delivery. Attention here shifts to merchant revenue stacks and zonal price risk. This auction represents an opportunity not just for Northern authorised projects, but also for Southern projects excluded from MACSE that may pivot to CM.

There are three key factors to consider for CM strategy:

- Zonal competition: with 10 GWh already contracted under MACSE in the South, CM clearing prices may come under pressure across the peninsula, especially in southern regions.

- Competing with existing assets: assessing competitive risk within the complex Italian CM auction clearing mechanism is key to forecast marginal price formation and competitive positioning (see further details here on outcome of previous capacity market auctions).

- Tolling agreements: the Italian tolling market is starting to evolve – e.g. two major contracts were signed in Sep 2025, supporting the financing of two Northern BESS projects. However, time-shifting product market will represent an alternative route to tolling contracts for offtakers after 2028.

Looking ahead, at least two more MACSE auctions are expected (for 2029 and 2030 COD), with additional auctions for Pumped Hydro targeting delivery in the early 2030s.

Auction volumes may shrink in these next auctions if CM and merchant projects absorb more system flexibility needed by Terna, or if RES rollout and interconnector plans shift. This is why the CM auction represents a key strategic option for BESS investors, in order to bring projects to market and hedge against downward MACSE price pressure.

MACSE impact on BESS investment landscape

The first MACSE auction was a clear success for Italian energy policy: Terna secured 10GWh of long-duration flexibility at low cost.

The auction may have much broader policy implications across Europe. Investment in long duration storage is a key pillar of energy transition and the success of MACSE may lead to other markets considering similar long term contract support frameworks.

Within Italy MACSE is acting to reshape the storage landscape. MACSE is emerging less as a broad incentive tool and more as a selective accelerator for:

- Projects with brownfield advantages, particularly industrial sites or retiring assets (e.g. coal)

- Players with low cost of capital, economies of scale, robust supply chains, and established market access

- Developers with locational value driver advantage in the Italian power system.

At the same time, capacity market auctions, merchant exposure, and tolling contracts will become a key focus for BESS investors going forward. As grid connection reform approaches, Italy’s 300 GW BESS pipeline may shrink sharply – raising the bar for project quality and merchant value.

Ultimately, investor success will hinge on robust quantification of merchant optionality. Future winners will be those able to navigate Italian market shifts driven by TIDE, EU ancillary platform integration, flow-based coupling, and the disruptive FER-X and FER-Z renewable incentive schemes.

Timera has deep expertise in the Italian storage market

We support investors, developers and lenders through our Italian BESS subscription service and bespoke consulting work.

Our subscription service provides a comprehensive investment toolkit for the Italian market, including:

- A flexible BESS Investment Tool to model revenues projections across all markets for any duration, in all market zones/nodes and any commercial strategies

- A detailed BESS Investment Report with MACSE/CM strategies, BESS project pipeline analysis, merchant value analysis and regulatory insights

- Zonal details on the future evolution of the Italian power system under Timera’s Central Scenario, with details on baseload and captured price curves

Alongside the subscription service, Timera also delivers tailored advisory support and due diligence on project evaluation, auction strategy and merchant risk management. Feel free to reach out to steven.coppack@timera-energy.com and alessio.cunico@timera-energy.com.