“3 factors have driven the recent price decline”

Surge followed by significant correction

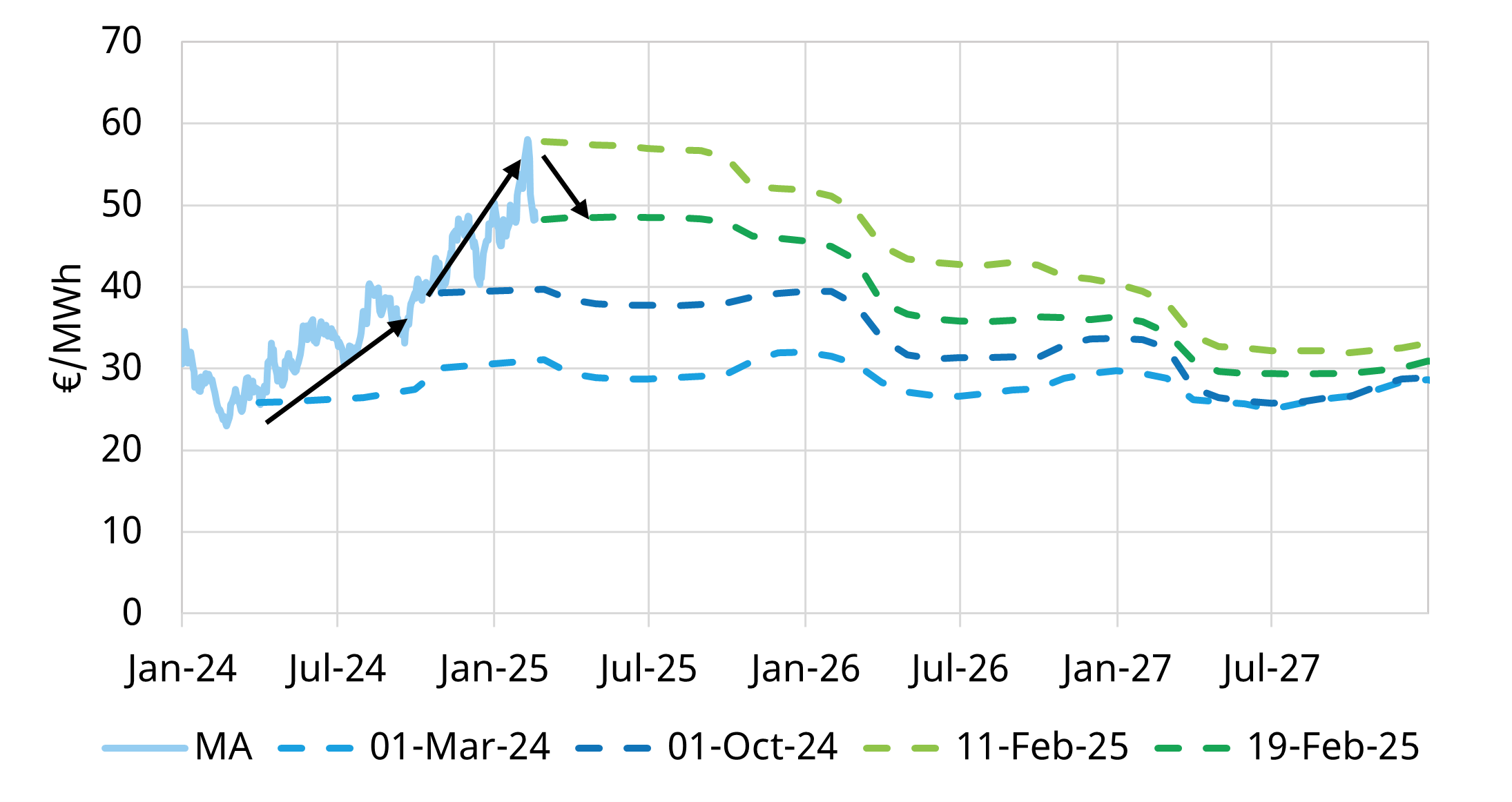

The front of the TTF gas curve started the winter around 40 €/MWh. Prices then surged 45% to 58 €/MWh by early February, with Summer 2025 prices particularly strong given the impact of storage refill mandates on summer injection demand.

However, over the past two weeks, TTF prices have corrected by more than 20%, falling back to around 46 €/MWh. Across the same period the steep price backwardation in Summer 25 vs Winter 25/26 prices has eased more than 2.5 €/MWh.

Three key factors have triggered the recent price decline:

- Peace talks: The US pushing for a Russia/Ukraine peace settlement.

- Storage mandates: Calls from EU countries, notably Germany and France, to relax gas storage refill mandates (easing forward injection demand).

- Weather: Forecasts of warmer / windier weather across the remainder of this winter.

Chart 1 illustrates TTF forward curve volatility since the start of winter in the context of the price rally across the last 12 months.

What’s driving price volatility?

The recent price swings highlight the structural fragility in the European gas market, driven by two core factors:

- Inelastic supply & demand: the European gas & LNG markets currently face relatively inelastic supply & demand i.e. small changes in market balance have a big impact on price

- Winter demand: the European gas market has been tight this winter given a rapid recent decline in storage inventories against the backdrop of a colder weather vs recent years.

For more analysis on current gas price dynamics, see our recent article with 5 charts outlining the current state of play in the gas market.

Impact of a peace deal & storage mandate changes

Could a peace deal between Russia and Ukraine lead to increased Russian gas flows into Europe? There is unlikely to be any substantial increase in import volumes given:

- Political hurdles: Directing funds toward Russian energy remains politically toxic for Europe.

- Supply security concerns: European governments remain deeply wary of re-establishing energy dependence on Russia.

- Transit challenges: The cessation of the Ukrainian transit agreement complicates any direct flow increase.

Beyond a peace deal there is also a morass of legal conflict to be resolved between Gazprom and its EU counterparties (e.g. €13 bn in damages to Uniper still unpaid; RWE, Engie, Eni cases still ongoing). Any incremental Russian volumes would likely need to flow indirectly, e.g. via Turkstream (which is already near capacity).

What about the price impact of relaxing storage mandates?

- 2025 price relief: Reducing mandated injection demand eases price pressure on Summer 2025 contracts.

- Next winter: Less gas in storage at the start of winter may widen risk premiums for next winter, but to help offset this new LNG supply is expected to ramp up into year end.

- Summer-winter spreads: Loosening mandates supports a recovery of summer-winter price spreads (which have been in deep backwardation) – a key focus of our recent midstream gas asset client work.

- 2026 and beyond: Beyond next winter, the impact of storage policy adjustments is more limited.

If storage refill mandates are reduced this year, the main impact will be to ease pressure on summer prices. Storage mandate changes are not going to result in any substantial volumes of new supply.

Price correction or inflection?

The prospect of changes to storage mandates and a peace deal have helped take the steam out of what has been a sustained rally in TTF prices across the last 12 months. But so far this is a price correction not a major market inflection point.

The practical details of storage mandate changes may have an important impact on 2025 prices, because of the within year tightness caused by injection demand. Alongside this, the gas demand impact of temperatures & wind conditions across the rest of winter are just as important.

However neither a peace deal nor storage mandate changes are likely to add significant incremental supply volumes into the European gas market.

A structural easing in market tightness requires substantial new LNG supply volumes. And with US LNG project delays this is not on the horizon until 2026.

Join our webinar on the changing role & value of midstream asset flex (pipelines, storage & regas)

Topic: European flexible gas asset value in a post crisis world

Time & access: Tue 18th Mar 09:00 – 09:30 GMT (10:00 – 10:30 CET, 17:00 – 17:30 SGT)

Registration: Pre-registration required (access is free); webinar registration link – register here

Scope:

- How EU gas flow patterns have changed since Russian supply cuts

- Structural changes in flexible gas asset use since the crisis

- The role of flexible gas assets in balancing European markets

- Impact on flexible gas asset revenue and extrinsic value capture

- Our views on how asset value will evolve

For any questions, please contact David Duncan (Gas & LNG Director) david.duncan@timera-energy.com