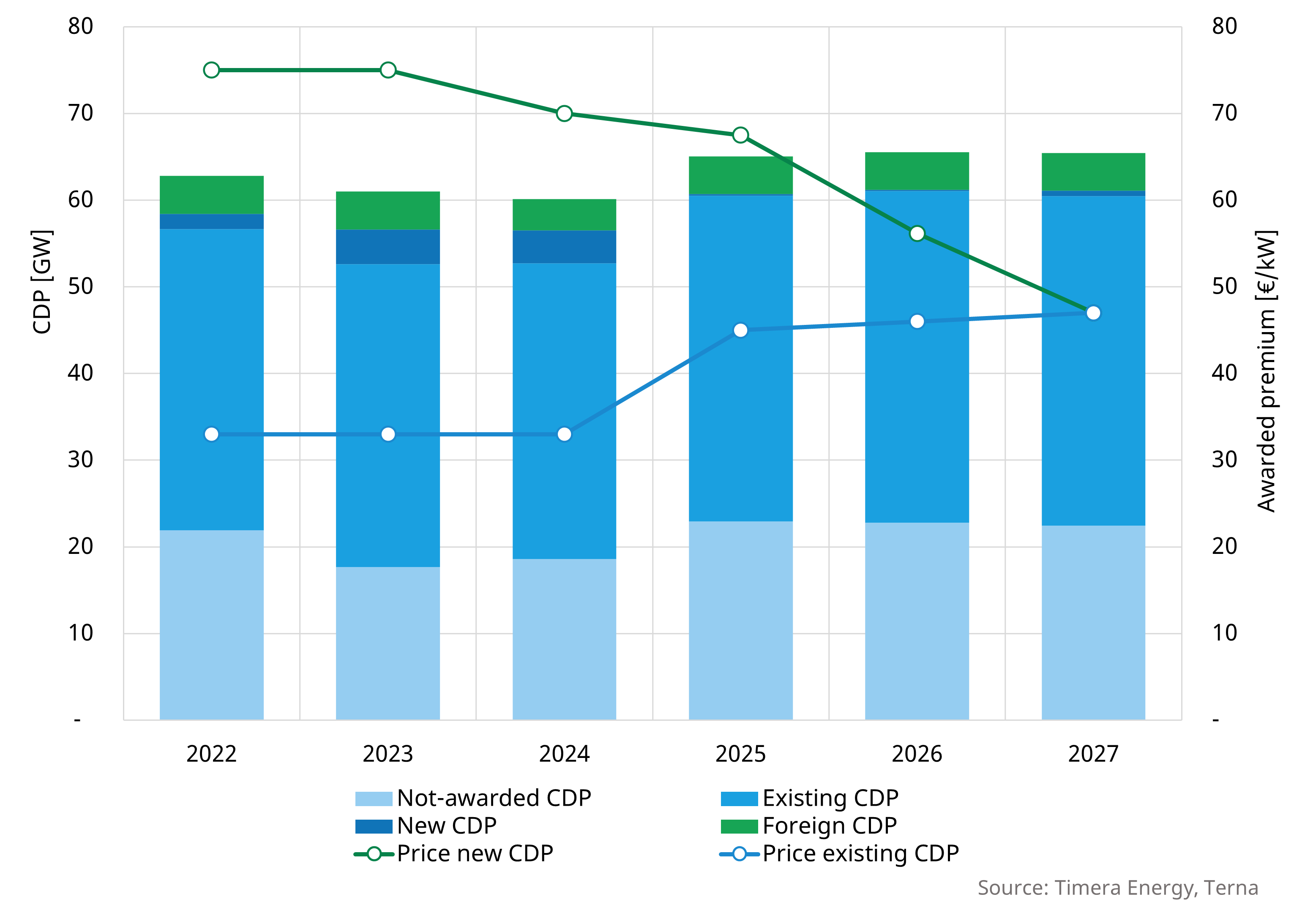

On 26th February 2025, Terna held Italy’s Capacity Market (CM) auction for the 2027 delivery year, assigning 38 GW of derated capacity (CDP) in 1-year contracts and almost 600 MW of new CDP in 15-year contracts—95% of which were BESS assets. This auction marked a shift as the premium for existing and new capacity equalized for the first time at 47€/kW, aligning with the latest price cap for existing capacity and setting a market floor.

This auction saw a significant increase in awarded new capacity, reversing the trend of sub-200 MW new awards in 2025 and 2026. Depending on asset duration, this ~560 MW of derated BESS CDP could translate to 800-1200 MW of nominal BESS capacity.

Key market takeaways

1. No zonal price decoupling, yet lower not-awarded capacity

- Prices cleared equally across all zones, maintaining the pattern from previous auctions.

- 200 MW reduction in awarded existing capacity compared to the 2026 auction, confirming the avoidance of operators to risk a lower premium in exchange for securing additional capacity.

- Not-awarded capacity declined for the third consecutive auction, despite expected rising subsidised RES penetration acting to sustain the value of not-awarded capacity.

2. MACSE and future BESS market competition

- The first MACSE auction (2028 delivery) has been approved by the Italian Energy Ministry (MASE) on the 28th of February 2025, and it will happen potentially in six months targeting 10 GWh of BESS.

- The MACSE auction quota for 2028 will be set at the lower of either the 80% of auction-qualified capacity or 10 GWh of Terna capacity target, with potential increasing access to the auctions due to the expected expansion of the authorized stand-alone project pipeline.

- Some MACSE areas may see more intense competition then others given the current authorized project pipeline, and due to zonal targets released by MACSE for the upcoming auction.

3. MACSE’s influence on CM outcomes

- With MACSE’s on the way, the projects in Northern Italy (with North zone awarded with 77% of the new CDP during last auction) opted for CM participation given the confirmed expectation of 0 GWh Terna requirements in North and Centre-North zones under MACSE auction.

The upcoming MACSE auction introduces new opportunities for BESS risk management, especially in the South and Islands.

With Terna’s targets shaping capacity dynamics, future CM auctions will likely see further shifts. Stay connected as we provide in-depth updates on the MACSE auction and Italy’s evolving BESS market.

Timera Energy at KEY – The Energy Transition Expo 2025, Rimini

Timera Energy will be speaking at the Key to Energy conference in Rimini on the 6th March 2025. James Laudage (Senior Analyst) and Alessio Cunico (Associate Director) will be presenting “How to build a successful bankable BESS business case in Europe”.

Please get in touch with James or Alessio if you wish to find out more about Timera’s presence in the Italian market, our outlook on Italian market development, or have any other questions.

MACSE strategy

Timera Energy delivered a webinar on “MACSE strategy” – key Italian BESS investment case drivers & commercial strategy for MACSE & Capacity Market, which took place on Tuesday 12th November at 10AM CET (9AM GMT).

Click here for the recording of the webinar.

Click here for the webinar slides.

If you are interested in (1) accessing a sample copy of our Italian BESS Investment Report or (2) understanding how we are supporting clients in the Italian market, please contact Alessio Cunico (Associate Director, Analytics) alessio.cunico@timera-energy.com or Steven Coppack (Director, Power) steven.coppack@timera-energy.com.