“Italy offers 4 BESS investment models”

Our feature content this week is video based. You can meet some of the Timera power team in a recording of our recent webinar “MACSE strategy” focused on key Italian BESS investment case drivers & commercial strategy for MACSE & the Capacity Market.

Click here for the slide pack from the webinar.

Click here to watch the webinar video recording.

Interested in some of the content covered? Here is a taster of a couple of excerpts from the webinar:

BESS investment model structures in Italy

We discuss the challenges facing investors as they look to build bankable BESS investment cases via (i) MACSE and (ii) Capacity Market routes, including:

- 4 key BESS investment models

- Targeting risk/return profiles

- The importance of merchant tranches to support a viable return

- Why the Capacity Market is a better route than MACSE for some assets

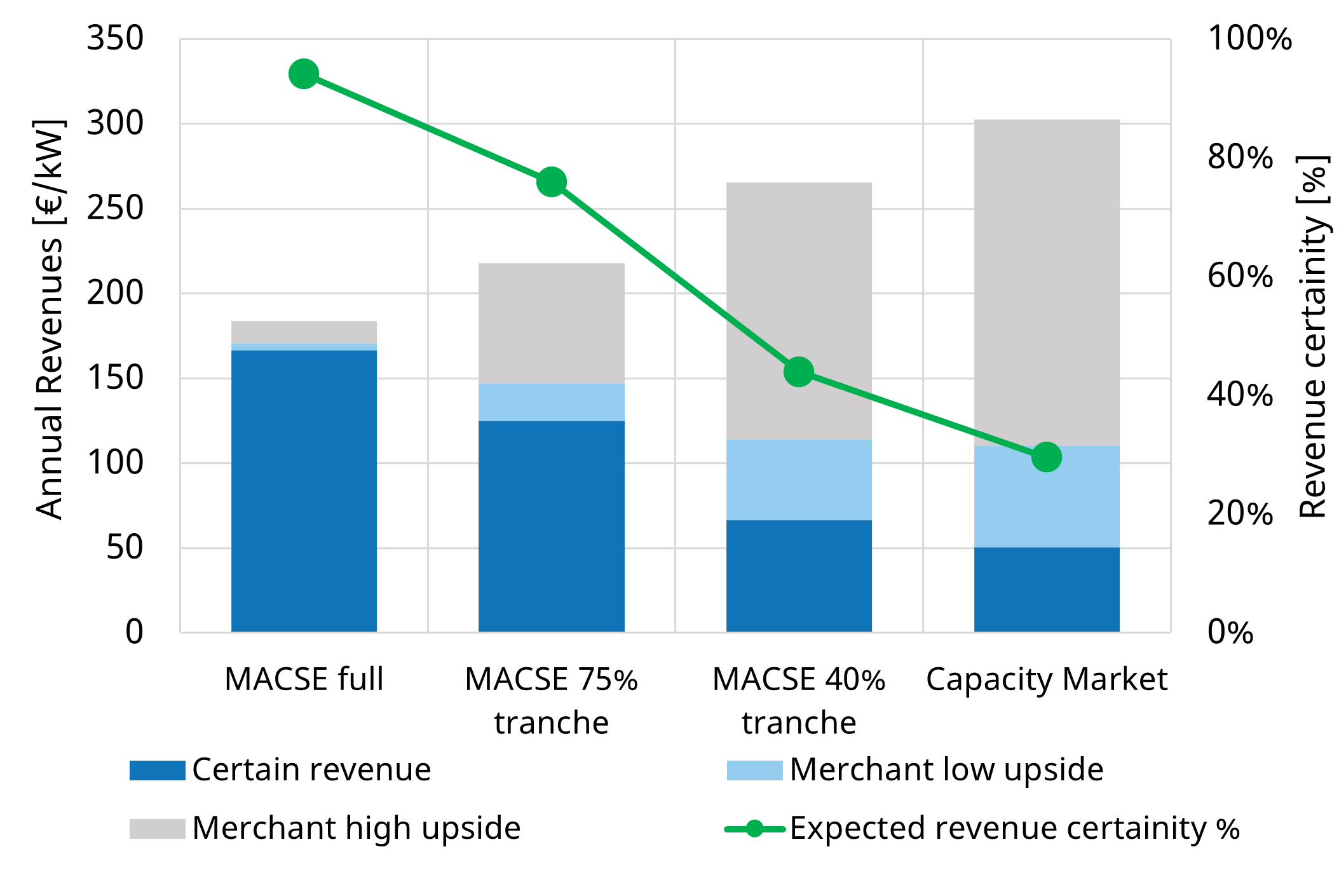

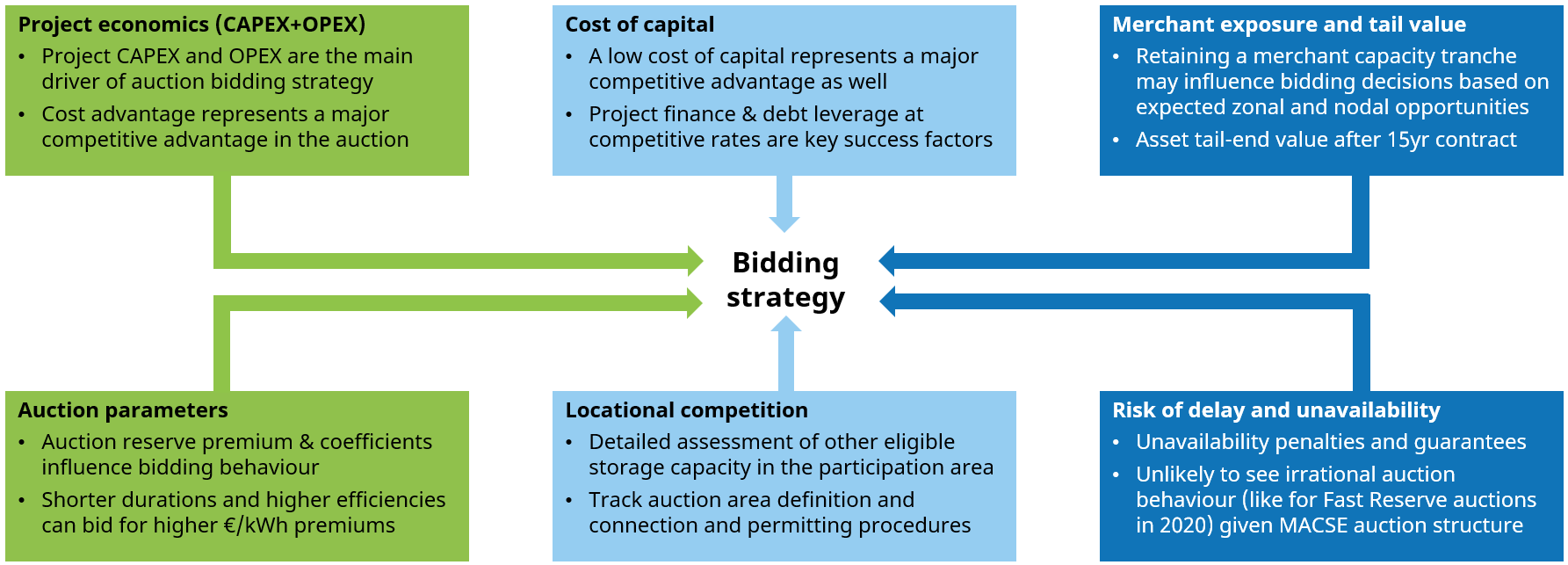

We illustrate different investment route options (Chart 1) and their impact on risk / return & financing. We also discuss the key drivers of MACSE bidding strategy (Chart 2).

How is the Italian BESS revenue stack evolving

We discuss key drivers of Italian BESS revenue capture across the last 2 years including:

- Day-ahead price spreads

- Intraday & ancillary (MSD) changes

- Zonal differences in revenues.

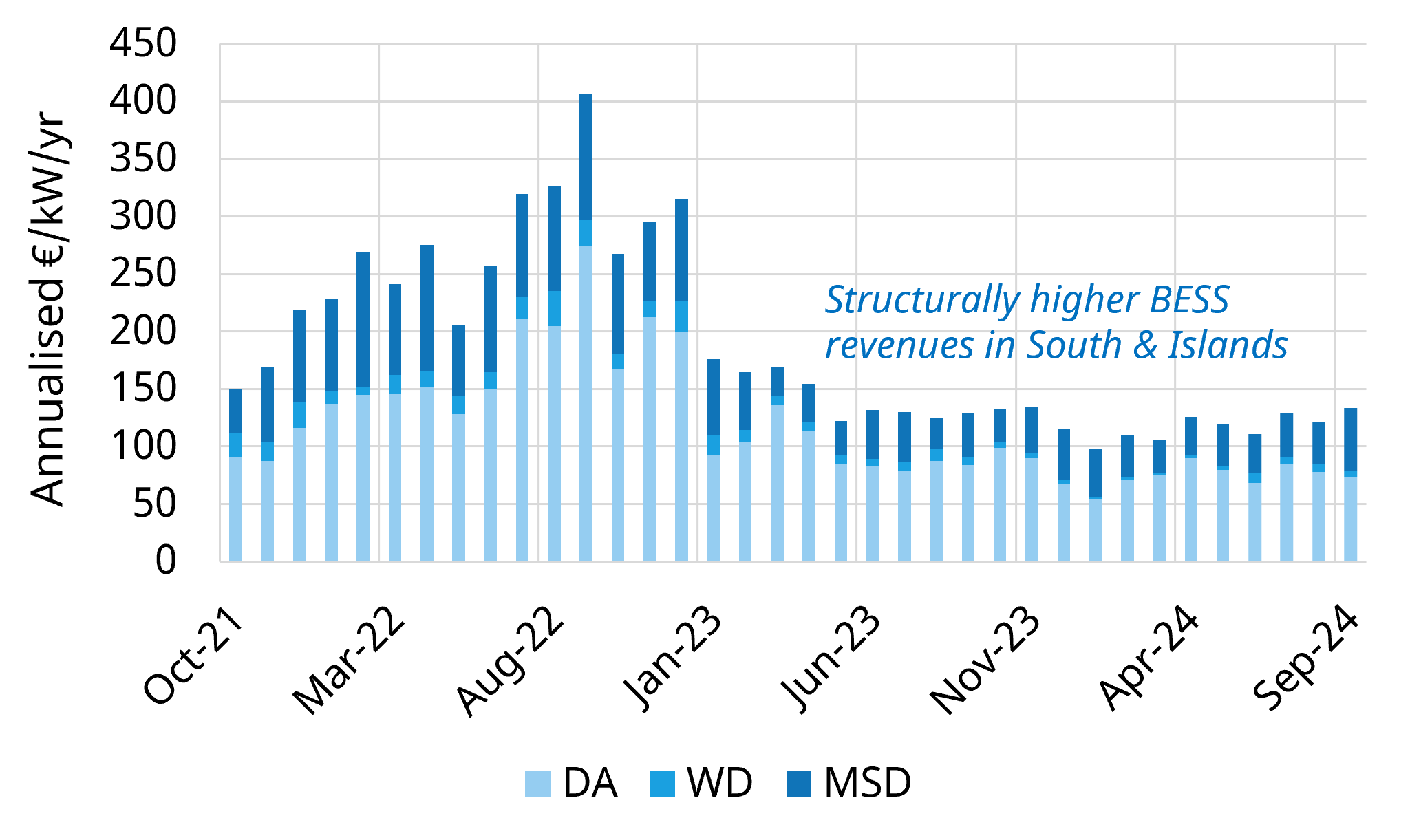

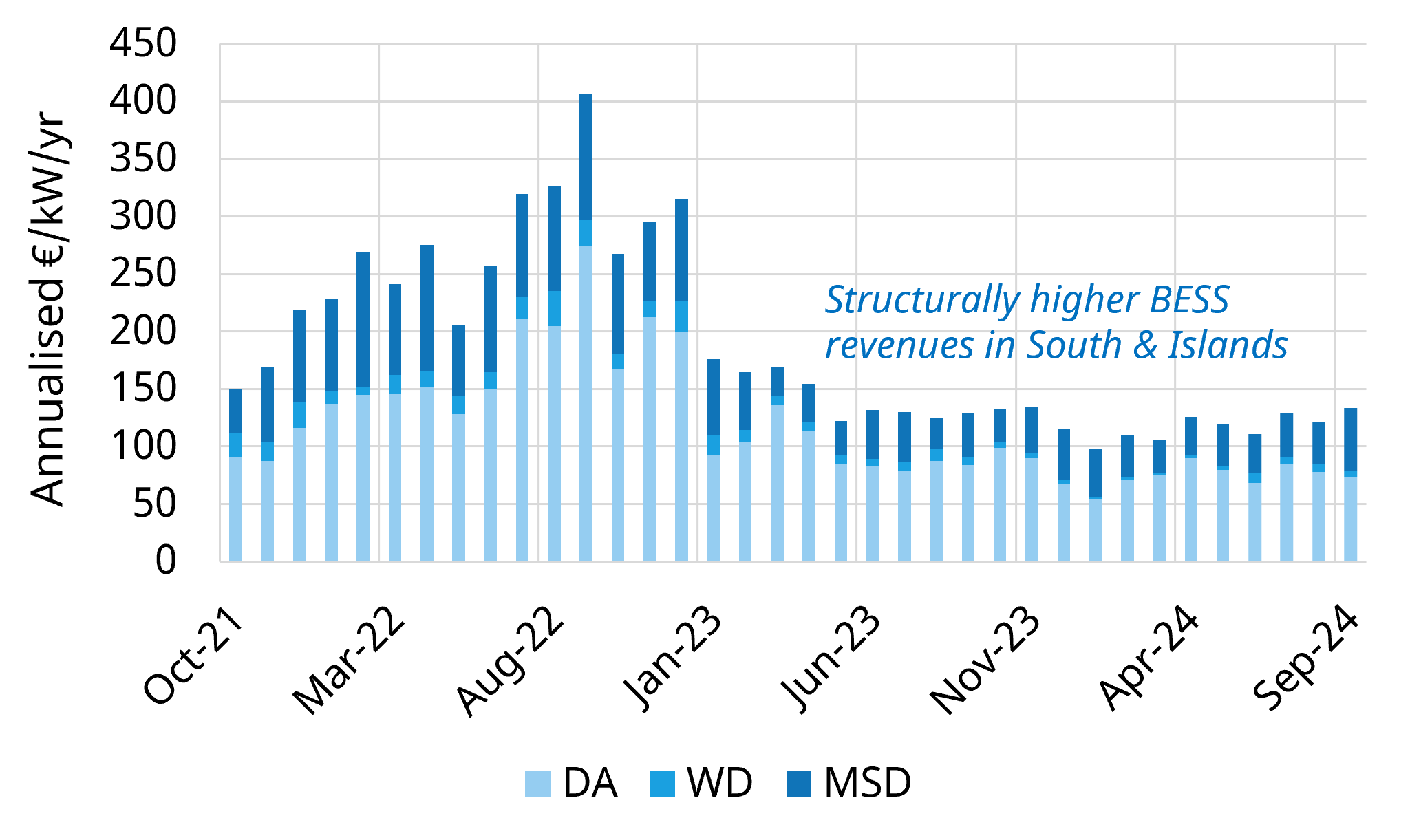

We also set out a revenue backtest as shown in Chart 3, assuming optimal optimisation of asset trading strategy based on historical price data.

Chart 3: Evolution of Italy South BESS revenue stack (2 hr duration asset)

Source: Timera BESS dispatch optimisation model

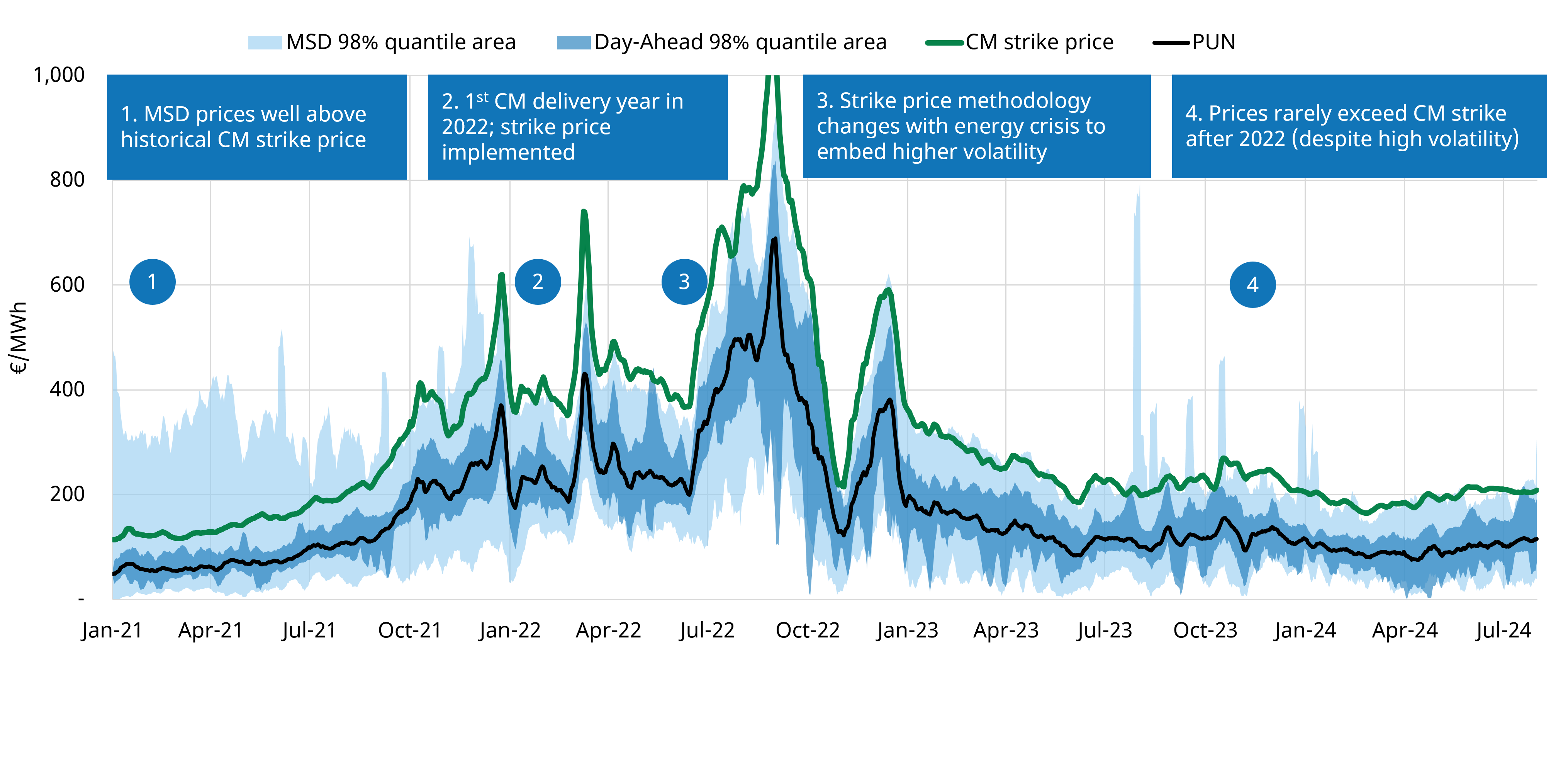

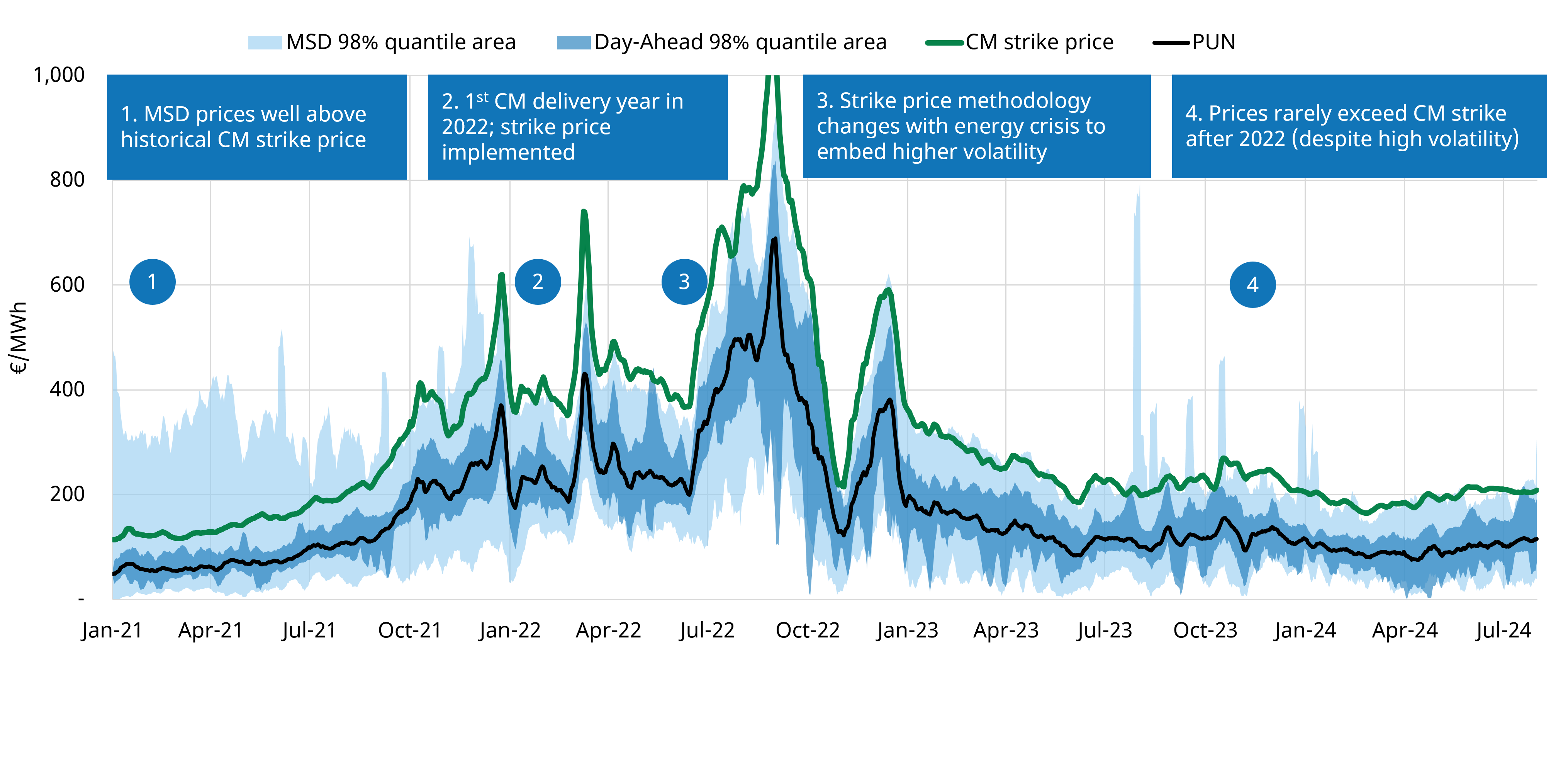

We also discuss how the Capacity Market price cap and policy changes are impacting Italian market price evolution & BESS value capture (see Chart 4), and how the MACSE is going to contribute to such evolution.

Chart 4: Changing distributions of Italian power price evolution

Source: Timera, GME, ARERA

Click on the link at the start of the article to view the webinar.

If you are interested in a sample copy of our Italian BESS Investment Report, feel free to contact Alessio Cunico (Senior Analyst) alessio.cunico@timera-energy.com or Steven Coppack (Power Director) steven.coppack@timera-energy.com.