Italy has emerged as one of the most attractive European markets for Battery Energy Storage System (BESS) investment. Much of the attention has centered around the bankability opportunity offered by the MACSE capacity payment scheme. However there are deeper structural dynamics in play making Italy attractive for BESS investors – including the country’s rapid solar expansion, zonal price volatility, and grid flexibility needs.

This article sets out current key trends shaping BESS value in Italy, from renewables rollout and arbitrage value to historical asset performance and the upcoming MACSE auctions.

1. Renewable capacity development

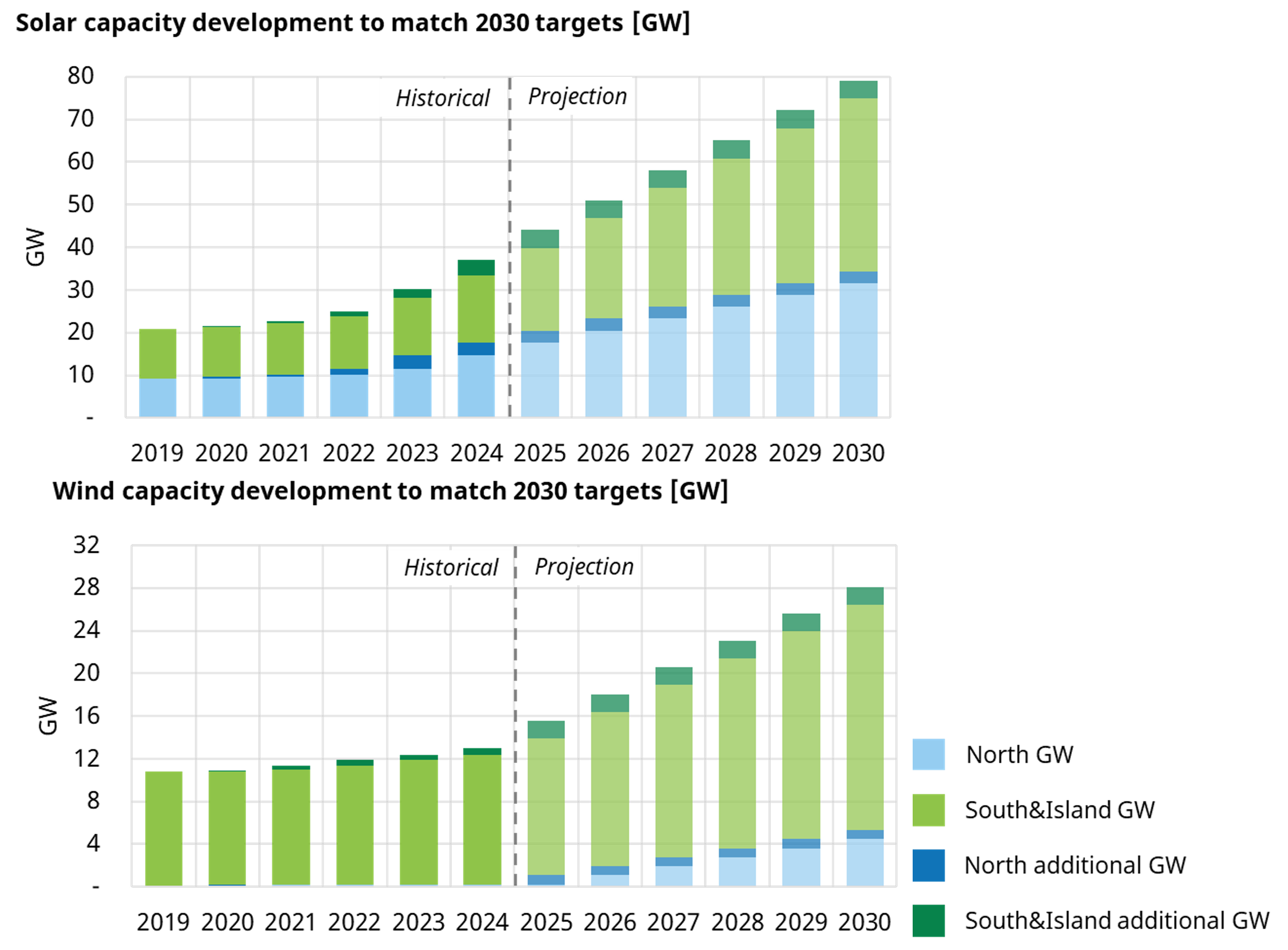

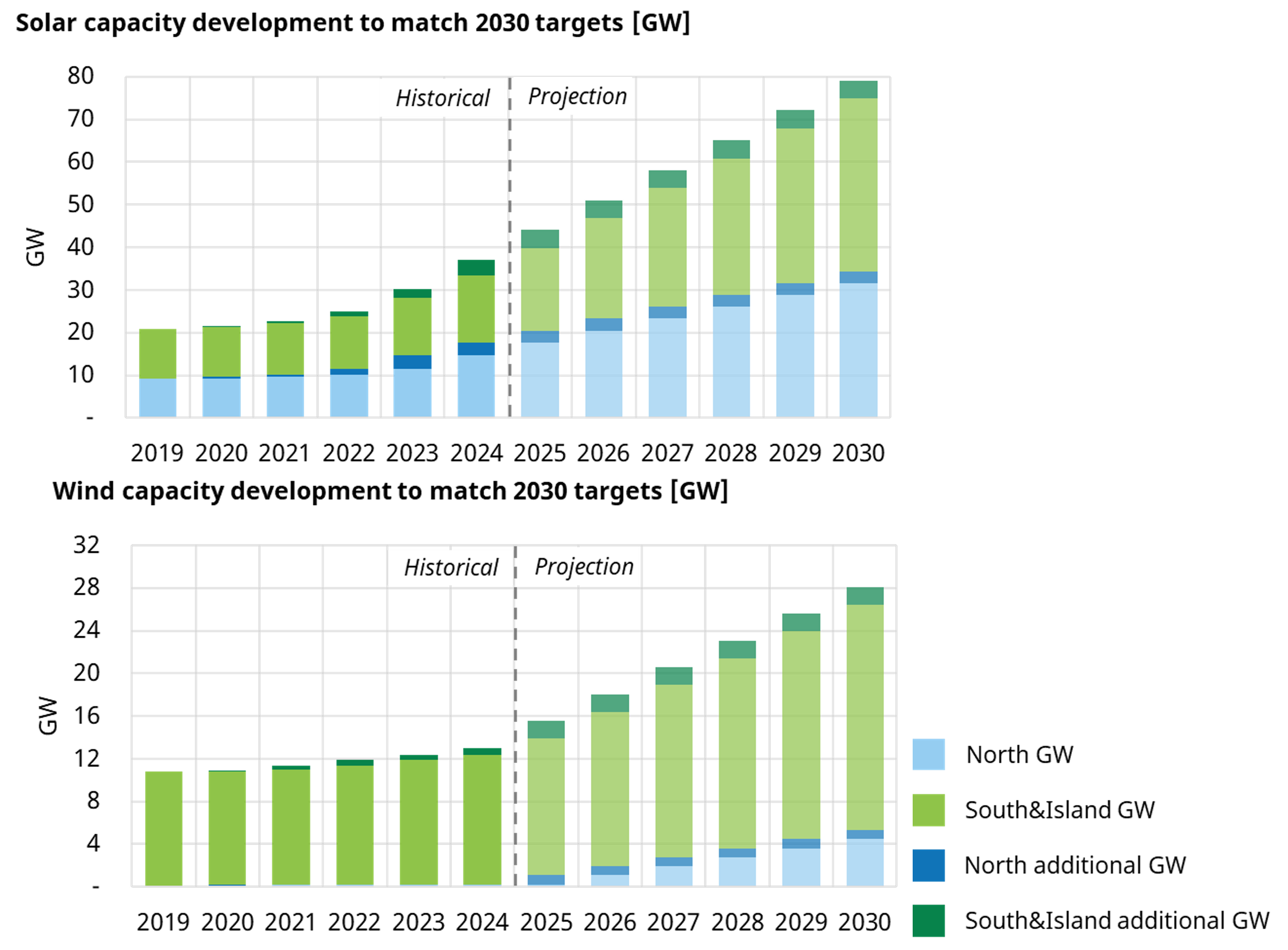

Italy’s 2030 National Energy and Climate Plan (NECP) targets a doubling of solar and wind capacity. As shown in Chart 1, solar deployment is progressing well across both Northern and Southern regions, broadly tracking the pace needed to hit targets. Wind, however, is lagging and requires a significant acceleration to stay on course.

Chart 1: Italian 2030 NECP targets for solar and wind capacity vs historical development

Source: Timera, MACSE, Terna

This surge in RES is key to unlocking BESS value – especially as solar saturation and grid constraints increase power price volatility and inter-zonal price spreads.

2. BESS capacity development

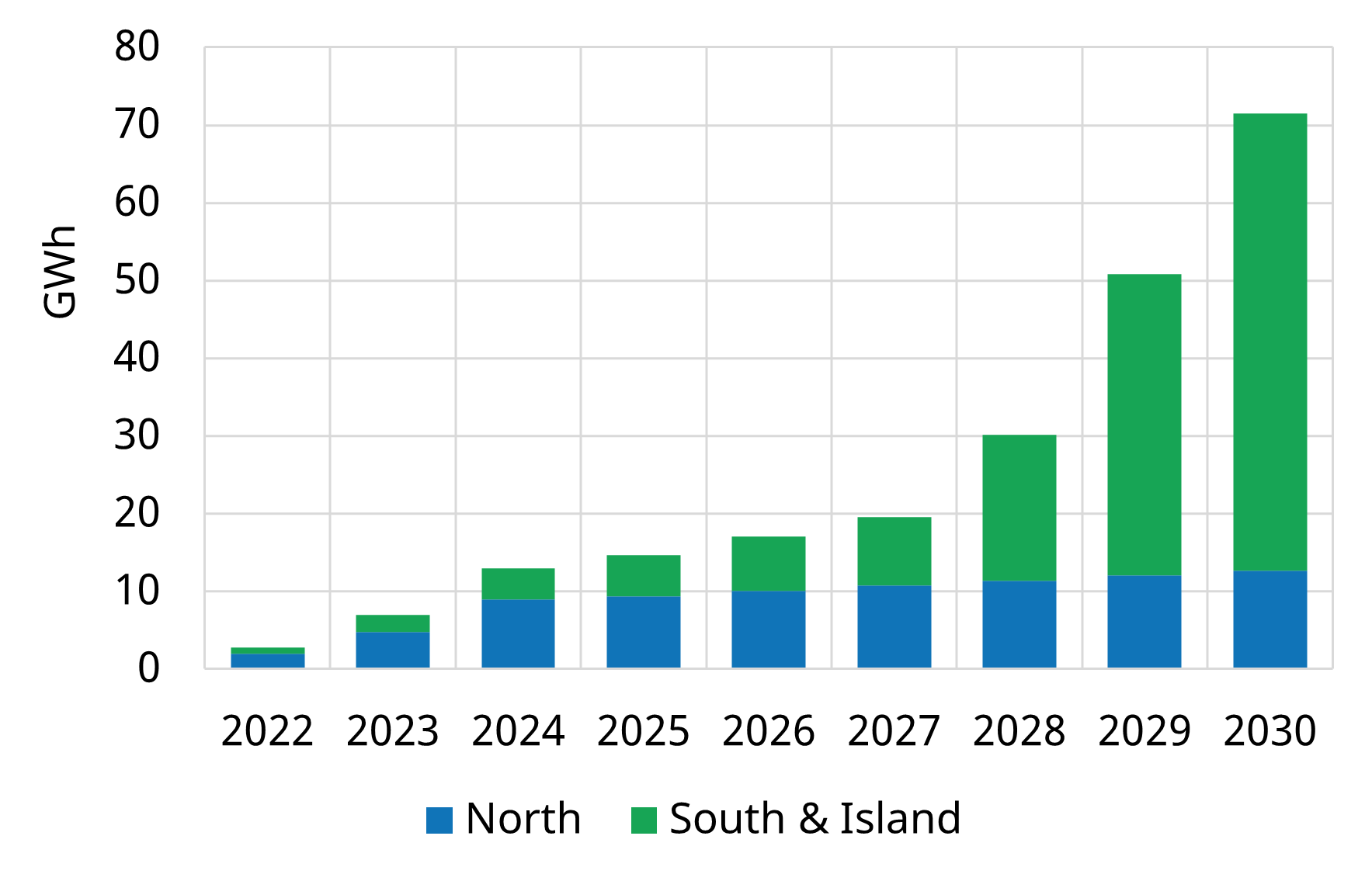

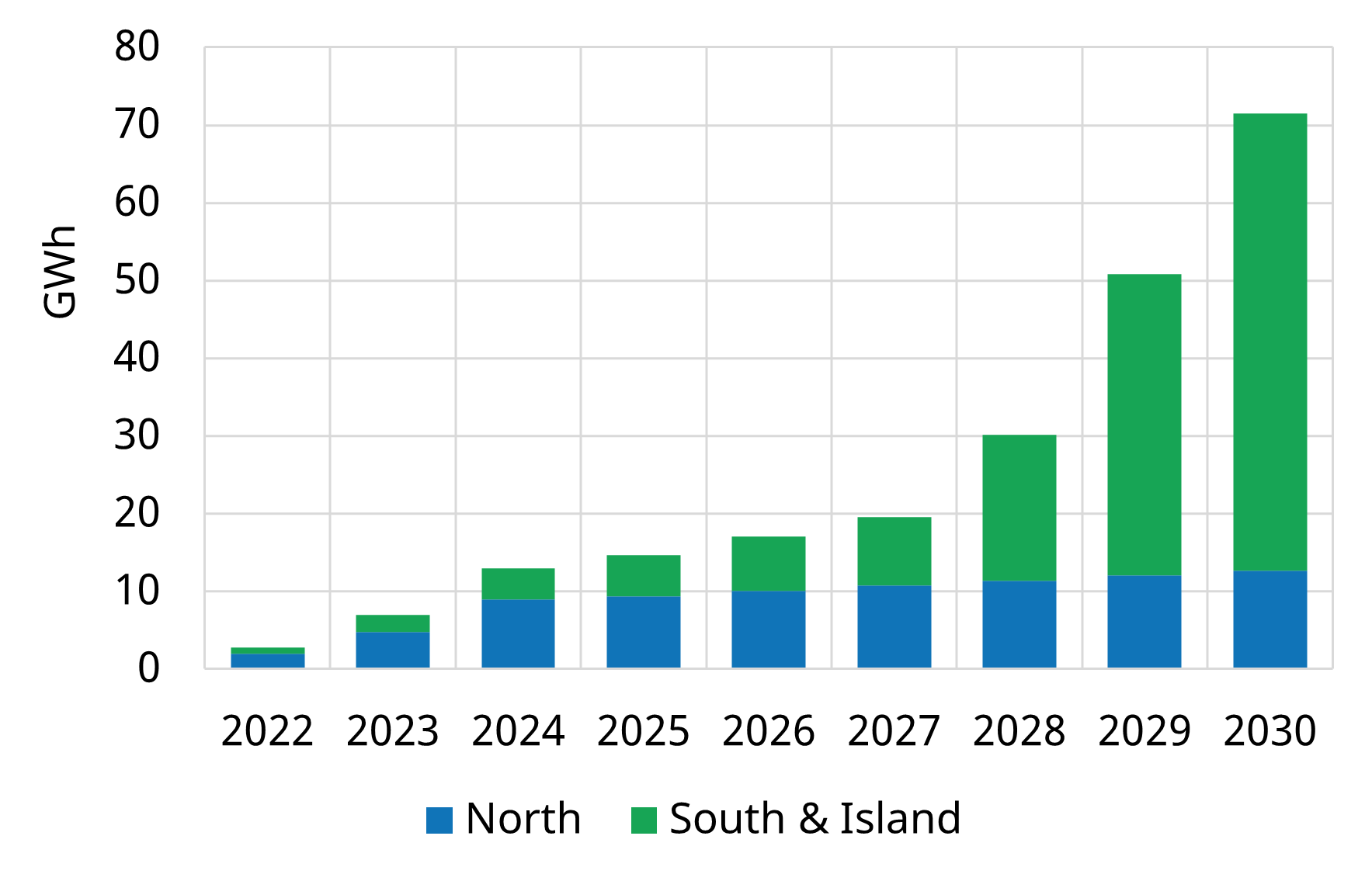

Total BESS installations in Italy now exceed 6 GW / 14 GWh, but this is mostly behind-the-meter storage co-located with rooftop solar in the North zone. Terna’s plans aim for over 70 GWh by 2030 to achieve Italy’s NECP RES targets — a fivefold energy capacity increase (Chart 2).

Chart 2: Italian 2030 NECP targets for BESS capacity vs historical development

Source: Timera, Terna, projection considering Terna targets and expected MACSE auction quotas

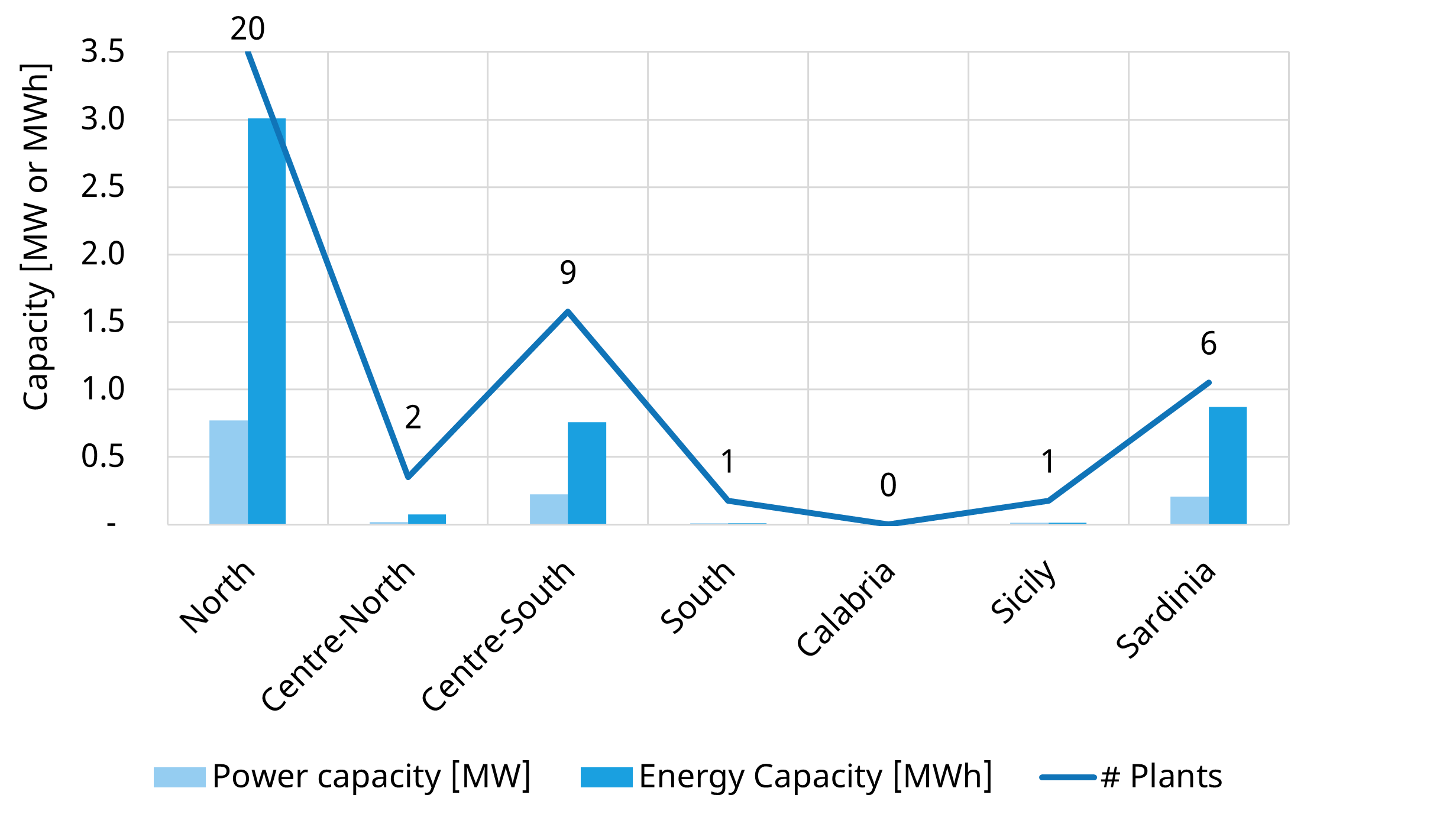

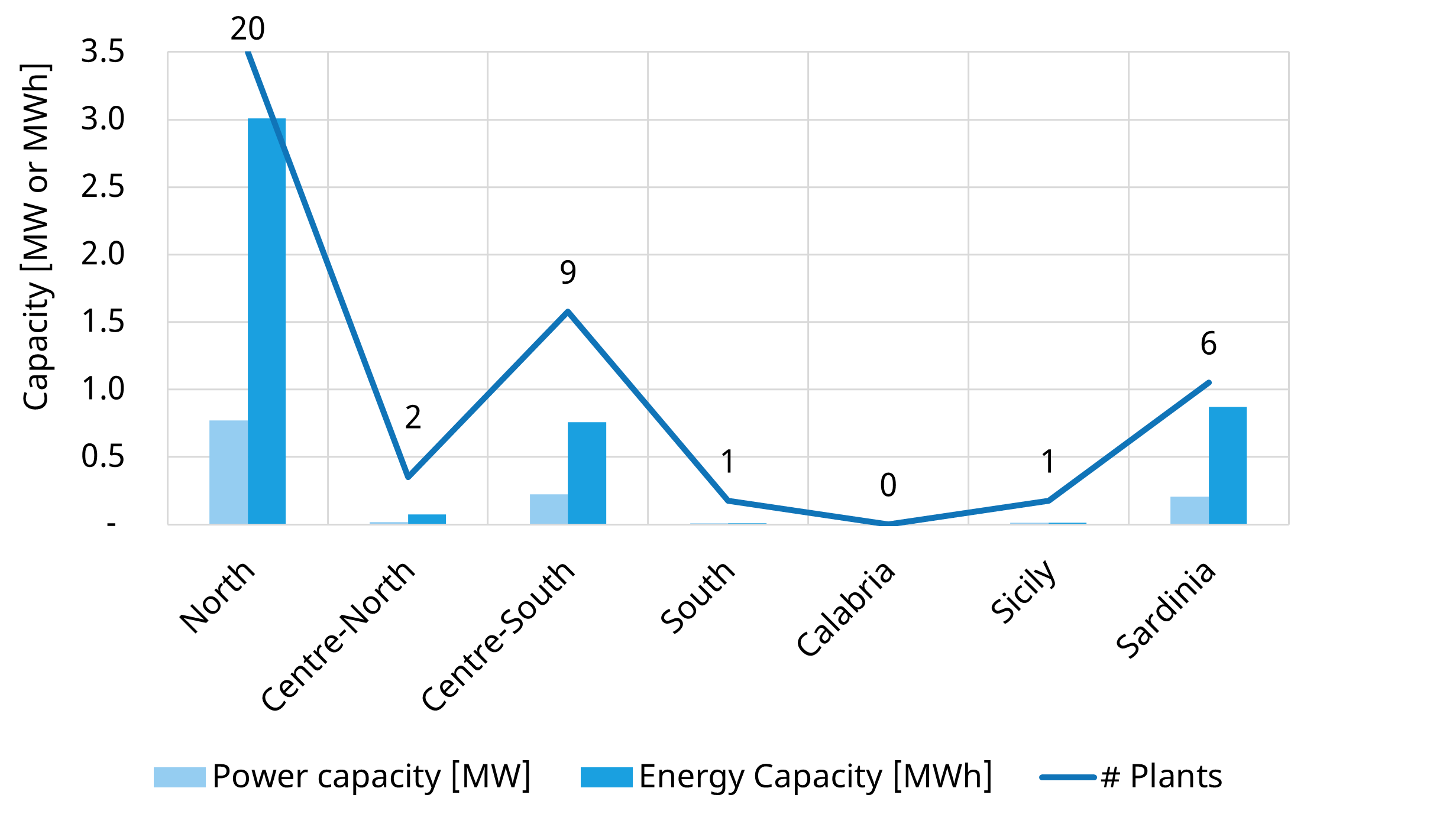

Utility-scale standalone projects currently represent just 1.2 GW / 4.7 GWh, most of which was financed via 2024 Capacity Market auctions held in 2022. Nearly all of this is located in the North, Centre-South and Sardinia zones, with average durations of around 4 hours (Chart 3).

Chart 3: Geographical distribution of Italian utility scale BESS plants

Source: Timera, Terna

The rapid scaling of storage capacity going forward will be mainly financed with the underpinning of MACSE contract revenues. This will support up to 50 GWh of storage capacity in the South & Island zones by end of 2030. This scale of capacity deployment supported by non-merchant investment signals could reduce future expected merchant opportunities, especially in Southern zones and in less deep markets (e.g. MSD – to be called Balancing and Redispatching Market or MBR in future).

3. Day-Ahead volatility

Italy still trails other EU markets in Day-Ahead (D-A) arbitrage value for BESS (Chart 4). This is mainly due to:

- Lower RES penetration compared to main EU markets currently

- A highly flexible conventional generation mix dominated by CCGTs and hydro

- Significant availability of pumped hydro storage (4 GW / 53 GWh), particularly in the North

- Good penetration of small-scale distributed BESS contributing to residual load peak shaving

These factors dampen within-day volatility and compress spreads in Italian D-A markets.

That said, D-A spreads are stronger in Southern Italian zones, where higher RES penetration and grid constraints are driving more volatility when zonal price decoupling happens (since beginning of 2024 it occurred for almost 30% of the total hours).

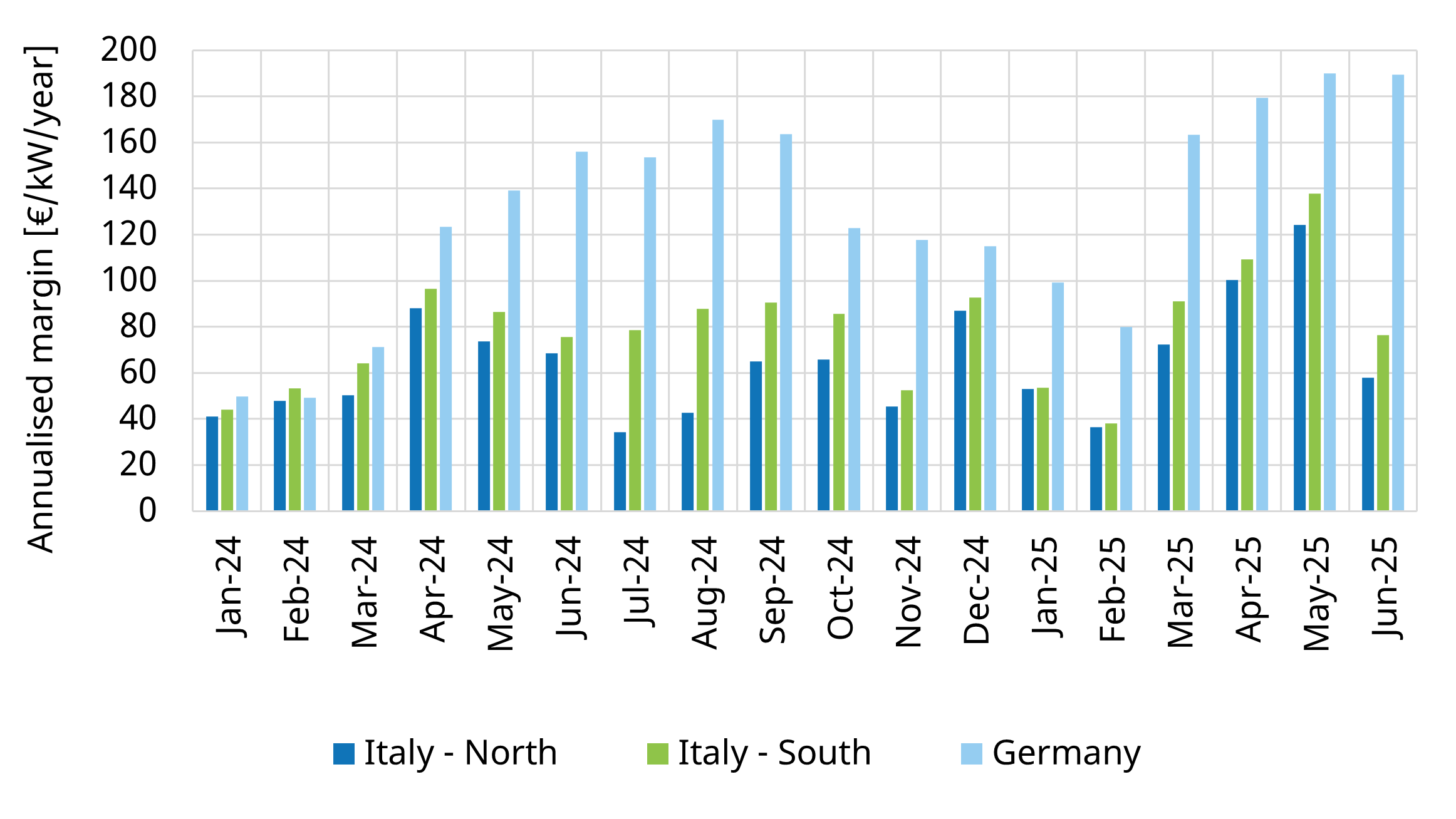

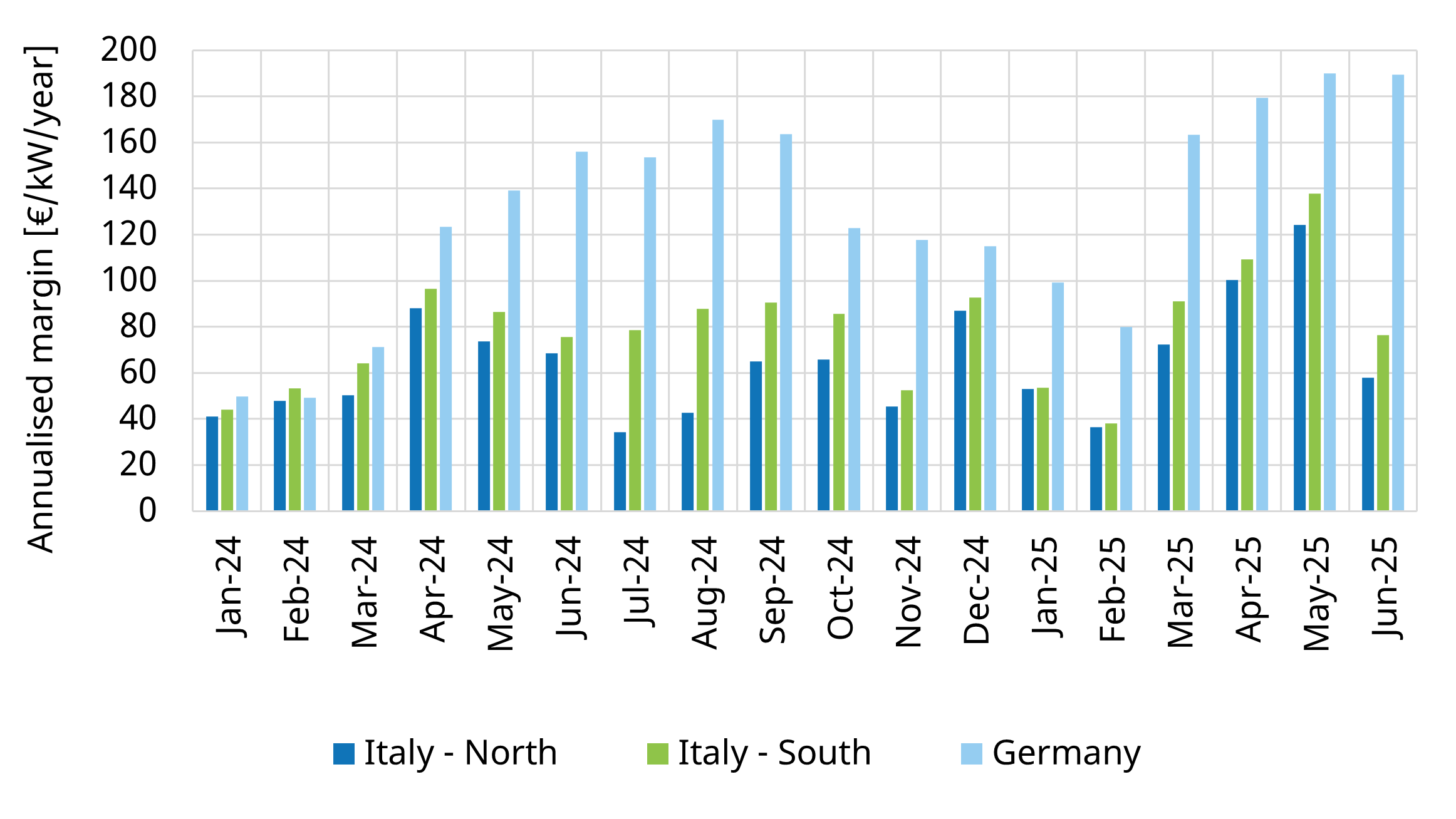

Chart 4: Comparison between Italian and German Day-ahead arbitrage value capture

Source: Timera, Entsoe; Note value calculations assume a simple D-A arbitrage capture strategy - analysis only covers D-A value not Within-Day & other revenue streams.

4. Italian BESS historical performances

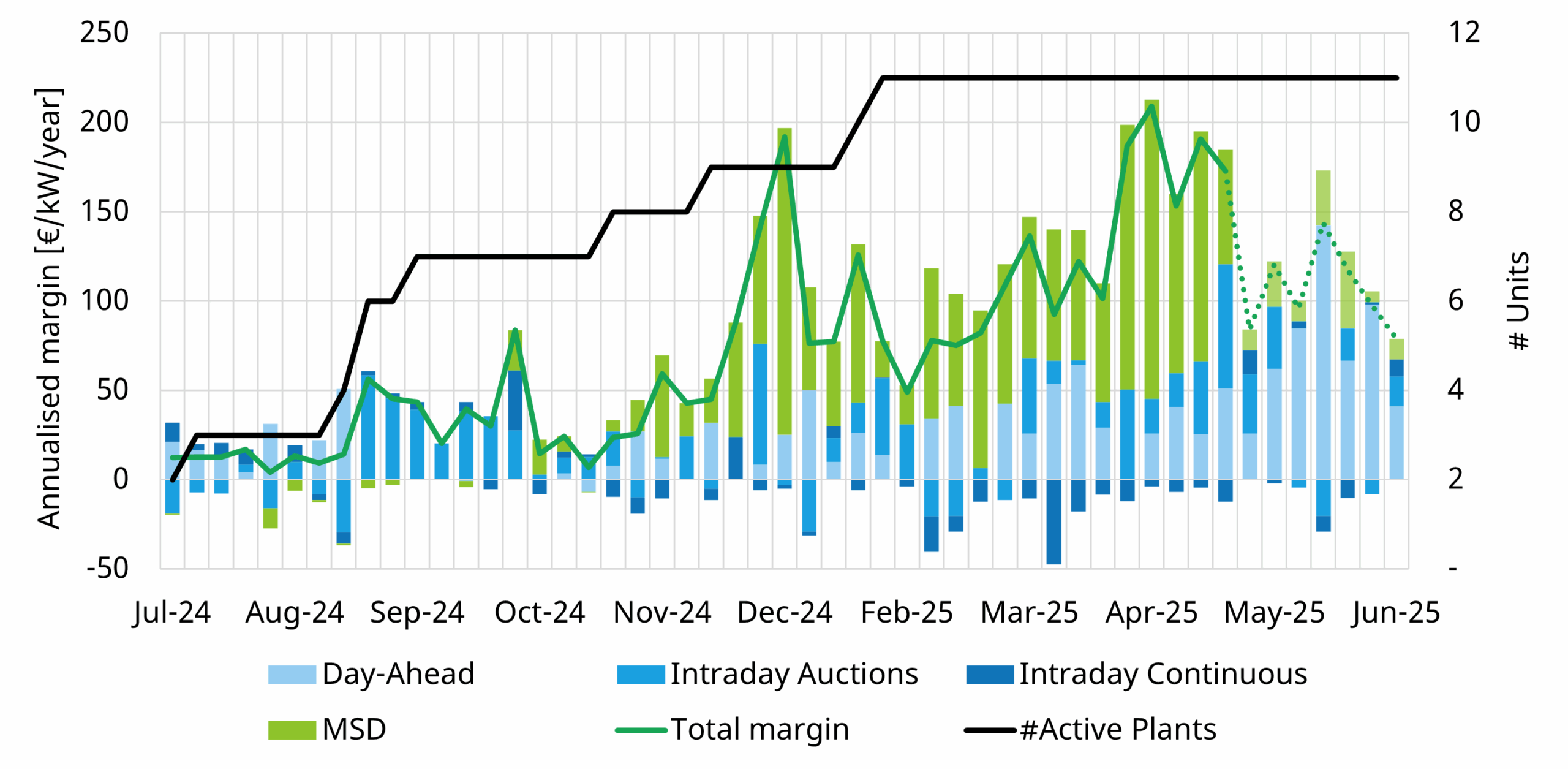

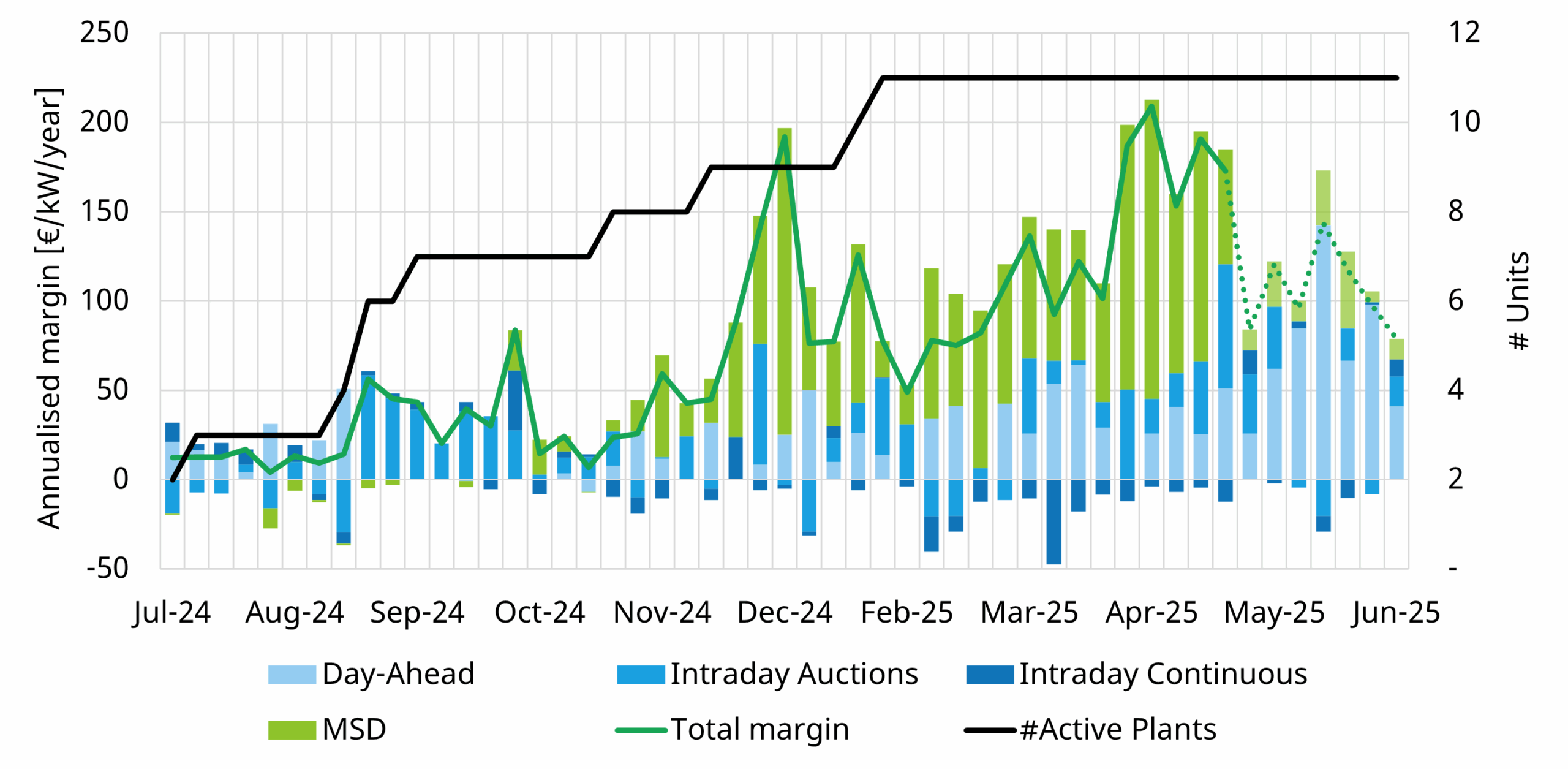

Chart 5 displays Timera’s analysis of the best weekly performances of the 11 largest 4hr Italian standalone BESS assets in the North zone since July 2024. The chart shows clear signs of improving potential performances.

- In 2024, most plants struggled to approach the €100/kW annualised margin threshold.

- Since end of 2024 many assets regularly exceeded that level, with peaks above €200/kW during Spring of 2025.

-

Chart 5: Annualised total margins of the weekly best performing Northern Italian 4hr BESS

Source: Timera, Terna, GME; every bar shows the stacked margins by market in €/kW of the best performing asset in Italy North zone.

Note that total margins displayed in May & June 2025 in the chart lack MSD margins coming from Balancing and Secondary Reserve due to the 2-months delay in Balancing market data publication by the Italian NEMO GME. Therefore, May & June 2025 total margins are underrepresented.

This performance boost reflects two key shifts:

- Improved operator optimisation strategies as the Italian BESS market matures

- Greater TSO (Terna) familiarity with BESS, enabling lower MSD skip rates — especially in the North, which remains Italy’s most liquid zone for balancing and ancillary services market – even with grid node nuances.

It’s important to note that Day-Ahead arbitrage is only part of the value stack. Intraday, balancing, and ancillary services (the latter two included in MSD market) offer material upside — though with more uncertainty due to lower market depth and liquidity. Moreover, most of the assets considered for the analysis receive a CM payment of around 47 €/kW/year from 2024 up to 2038.

5. The way forward

The upcoming MACSE auctions are central to Italy’s BESS investment landscape. The first auction, targeting 2028 delivery, is scheduled for 30 September 2025, with project capacity qualification required by 17 July. In the coming years, at least other 2 auctions are expected for BESS targeting 2029 & 2030 delivery years.

Key considerations:

- Massive Italian expected RES capacity deployment can contribute to the surge of storage merchant value in Italy, while MACSE-backed storage deployment contains such surge even though with different impacts between Wholesale and Ancillary/Balancing market levels.

- The structuring of merchant exposure can represent an important opportunity for auction participants to increase expected returns and manage degradation constraints while maintaining MACSE bankability opportunity as discussed in our previous webinars and blog contents.

- Capacity offered in auction may be lower than total qualified capacity, allowing players flexibility on strategic merchant exposure design during auction participation.

- Ahead of auction financial guarantees are tied to qualified MWh, so players having already a clear merchant exposure strategy could achieve a liquidity advantage on MACSE participation.

- All the previous considerations must be informed by an assessment of the expected zonal competition in the auction and by the expected project economics based on the final auction reserve price.

If you are interested in more details and free sample material from Timera’s Italian BESS subscription service, feel free to reach out to Alessio Cunico (alessio.cunico@timera-energy.com).