“No smoke without fire, no flow without spread.”

Europe’s gas market is an increasingly complex network of interlinked supply infrastructure & price hubs.

Cross-border pipeline capacity enables rapid flow response to shifting supply and demand. Price spreads between hubs act as important signals to incentivise efficient allocation of gas across the continent.

Nowhere is this more evident than in Italy, where the PSV hub often trades at a premium to its northern counterparts to pull in flexible gas volumes via interconnectors. Italy’s gas balance is maintained through a mix of LNG imports, pipeline deliveries, and storage flexibility. With domestic production limited, these external levers are crucial to meet both base and incremental demand.

Understanding how these price signals interact with physical pipeline flows is key to interpreting market dynamics – particularly in periods of system stress or shifting seasonal demand.

LNG versus pipeline

LNG plays a foundational role in Italy’s supply stack. Italy imports significant volumes via it’s regas terminals such as Panigaglia and Adriatic LNG, and the recently expanded FSRU fleet in Livorno, Piombino, and Ravenna. These deliveries form a significant portion of Italian gas supply – particularly during summer months when global spot LNG is more readily available. However, LNG is much less responsive to short-term price signals than pipeline flows, as cargoes are typically secured on longer-term schedules, thus giving them different fundamental roles in the balance.

In contrast, pipeline imports from neighbouring countries, especially from France and Germany (both via Switzerland) and Austria, offer a more immediate and flexible source of marginal supply. The responsiveness of this pipeline infrastructure is increasingly vital as European gas markets become more volatile and short-term driven.

The Italian flexibility requirement

As Italy continues to rely on gas for power generation, heating, and currently for storage injection, the PSV hub has become a key signal for flexibility needs.

In periods of system tightness, whether from demand spikes or limited local supply, Italy leans on neighbouring markets to provide additional volumes.

This requires specific signals from gas hub prices: PSV must rise above central European hubs like THE (Germany’s gas hub) to attract piped imports across borders, such as through the Griespass interconnection point, which connects the German and French transmission systems into Northern Italy.

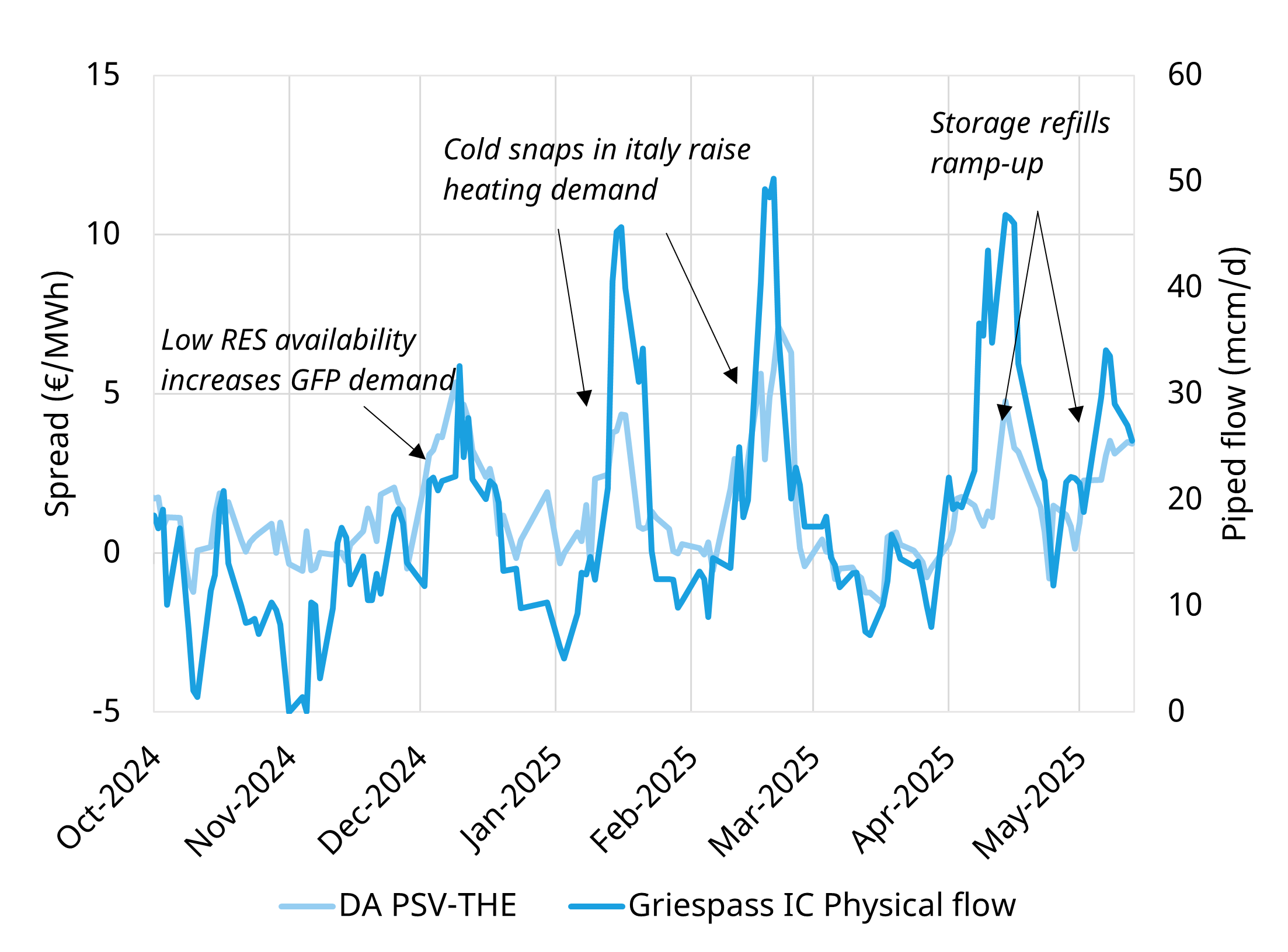

Chart 1 shows how the PSV-THE day-ahead spread and Griespass physical flow volumes have moved in tandem over the past winter.

The chart shows how the PSV-THE day-ahead price spread and Griespass physical flow volumes have moved in tandem over the past winter. Spreads widening to over €5/MWh coincide with spikes in piped volumes, which in extreme cases exceed 40 mcm/d.

These flows represent the marginal response to Italian tightness. The flexibility of this supply hinges on a responsive and liquid cross-border price signal.

From late November through March, several cold weather spells and periods of low RES availability drove strong demand for heating and gas-fired generation. These episodes translated into sustained periods of wide spreads – at times exceeding €5/MWh – and elevated interconnector flows into Northern Italy.

Critically, one structural shift which is exacerbating this dynamic is the decline of Russian pipeline imports into Italy. Flows via the Tarvisio point (from Austria) have greatly decreased since late 2022. A reduction in Russian gas entering Europe has placed more pressure on alternative import routes, such as via Griespass, to balance the Italian system.

These dynamics underscore the structural role of northern European supply in providing flexibility to Italy in periods of supply shortfalls, or when storage is constrained.

The way forward for Italy

As the system transitions into summer, the nature of Italian gas tightness is shifting. With heating demand out of the picture, the current driver of spread and flow volatility is increasingly tied to storage injections. Recent peaks in PSV-THE spreads through April and May suggest that Italian buyers are paying up to secure summer volumes for storage fill, as a few key players are increasing competition for molecules around Europe.

As Europe’s gas system becomes more dependent on flexible, short-term responses to regional imbalances, the role of pipelines is becoming more commercially dynamic.

Increasing volatility in hub spreads—driven by weather, renewable power generation, flexible LNG availability, and storage dynamics—translates into sharper, more frequent price signals to move gas.

This volatility enhances the option value of interconnector capacity, turning pipelines into critical enablers of cross-border arbitrage and flexibility. As a result, the commercial value of pipeline infrastructure is shifting from “intrinsic” stable baseload flow to “extrinsic” high-value responsiveness in volatile conditions.

Using our stochastic modelling framework, we are able to unpack the issue and help our clients understand the challenges in valuing this option. The ability to understand daily variability from renewables, and the competition pipelines face from LNG optimisation is key to pricing the pipeline’s capacity.

Feel free to reach out to Ellen Doherty (Senior Analyst, ellen.doherty@timera-energy.com) if you wish to discuss our approach to modelling pipeline flexibility, or for any other questions on drivers of gas pipeline value.

Gas flexibility webinar

We’ve recently discussed how changing flow patterns in the European market are changing asset value, and how this is triggering gas asset infrastructure owners, investors, and capacity owners to update valuations and challenge commercial strategies.

Click here for a recording of the webinar.

Click here for a copy of the webinar slides.

Feel free to reach out to David Duncan (LNG & Gas Director) for a free sample copy of our Global Gas Report with more details on current drivers of LNG & European gas market pricing dynamics (david.duncan@timera-energy.com).