In a decree released this week, the Italian government have confirmed plans for the implementation of a PSV – TTF “liquidity service”, aimed at reducing the premium the Italian PSV market typically holds over North-West Europe (TTF). In 2025, the month-ahead PSV-TTF spread averaged €1.89/MWh.

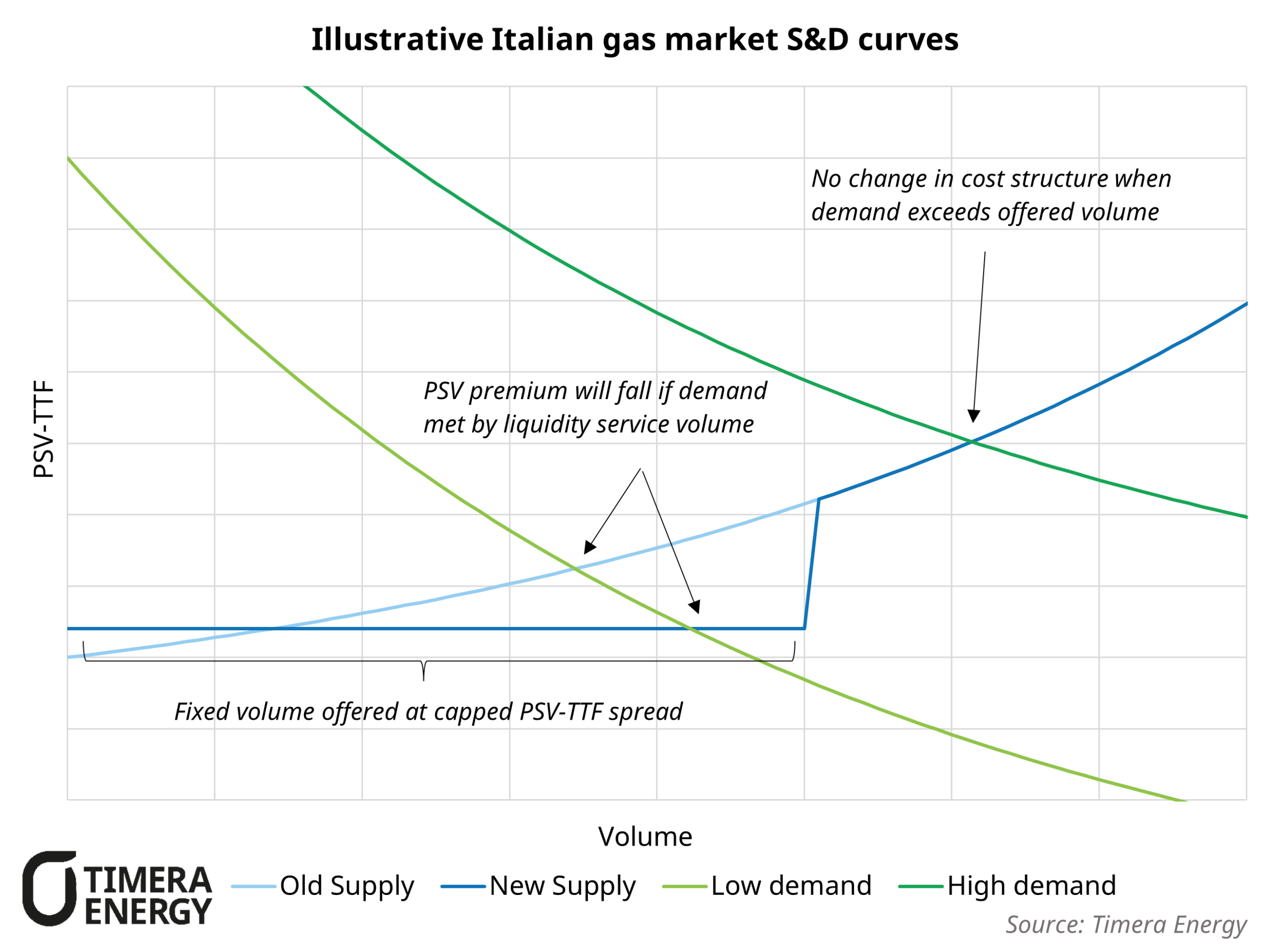

The new liquidity service mechanism will allow pre-selected operators to act in the mechanism auction. They must offer volumes at TTF plus a competitively determined premium, with the objective to anchor PSV pricing closer to TTF.

As can be seen in the illustrative S&D curves, this spread may not be capped if demand outstrips the liquidity provision, with price formation then reverting back to marginal gas supply and demand flexibility.

The decree has allocated a budget of €200m to implement this service. As an illustrative benchmark, if the entire budget was allocated to Italy’s 2025 annual gas demand of 63.1 bcm, the reduction in premium would be approximately €0.30/MWh.

There is still missing information to be announced which will be key to how players in the market react to this new mechanism. Factors such as allocated volume, calculated premium, future budget provision, product tenor etc. will have a large impact on how these volumes are optimised.

This news comes from a large wave of activity from the Italian government this week, who are considering changes to EUA payments for CCGTs and emitters in the power market, which has seen Italian forward power prices fall up to 20% for January 2027 delivery.

For more detailed market commentary, or questions you may have regarding the changes to Italian Gas & Power markets, please contact Luke Cottell (Associate Director) at luke.cottell@timera-energy.com, or David Duncan (Director, LNG & Gas) at david.duncan@timera-energy.com.