Welcome to the new Timera website. We have redesigned the site to provide easier access to more of our views & publications, as well as more information on our client work, services & methodology. Some new features:

- A homepage with a regularly updated range of our latest articles, snapshots, webinars, publications & client project case studies

- A blog page with search & filter functionality through our blog & snapshot articles (spanning more than 10 years)

- A new summary of our power, LNG & gas & hydrogen services, client case studies & analytical methodologies

- Info on our clients, team & job opportunities.

Take a look around and see what you think. We always welcome feedback via info@timera-energy.com.

Italy rolls out new model for BESS investment

Battery deployment across Europe to date has been dominated by a merchant investment model. Battery (BESS) flexibility is optimised against wholesale & ancillary service markets to generate returns that can vary significantly month on month.

Italy is paving a new way with its new long term contract based policy support mechanism for storage. System operator backed tenders could see Italy deploying BESS capacity faster than all other European markets across the next 5 years.

As the new Italian mechanism becomes a reality, with first tenders likely in Dec 2024, we take a closer look at what it means for BESS investors.

Crafting a new market design

Italy’s push towards a regulated framework for BESS investments is anchored in the MACSE (Electricity Storage Capacity Procurement Mechanism). This innovative regulatory mechanism is designed to provide long-term investment signals for electricity storage assets. It recognises the pivotal role of BESS and Pumped Hydro Storage (PHS) in Italy’s energy future given what is set to be a very high penetration of intermittent solar capacity.

While there is broad enthusiasm for MACSE and electricity storage investments in Italy, some industry participants are expressing concerns over the perceived “over-regulation” and its potential impact on merchant opportunities.

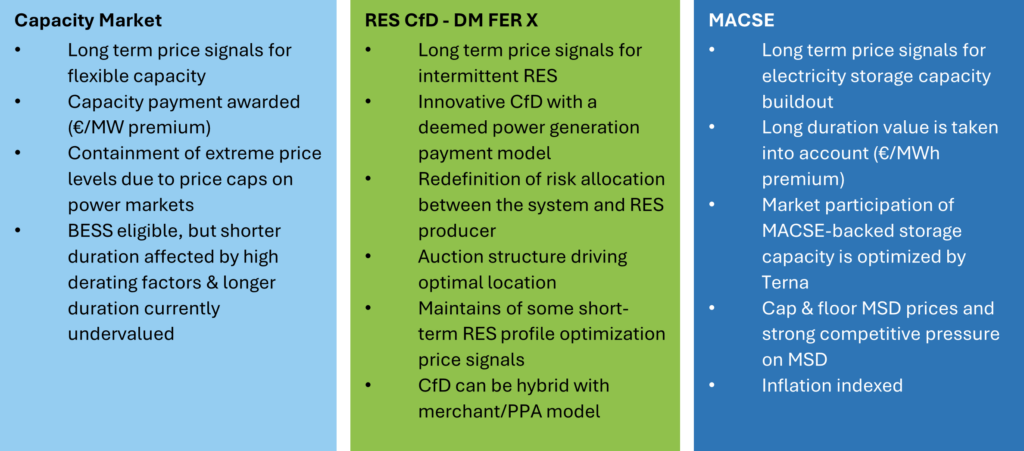

Italy is embarking on an innovative policy strategy aimed at reshaping its power market design to support energy transition with mechanisms on top of spot market providing long-term investment signals. The strategy rests on three pillars:

- the Capacity Market to ensure overall security of supply

- the innovative RES CfD mechanism “DM FER X” to incentivise intermittent RES investment

- the MACSE mechanism to incentivise storage investment, with focus on longer durations

Each of these mechanisms has distinct but complementary objectives towards ensuring system adequacy, supporting decarbonization with intermittent renewables, and ensuring enough electricity storage capacity in order to support decarbonisation, as summarised in Table 1.

Table 1: 3 Pillars of Italian power market policy

Today we focus on MACSE and storage investment, but we will come back to the other two mechanisms in future articles to provide a more comprehensive overview of Italy’s regulatory environment.

MACSE reflects Italy’s unique challenges

The transition towards a more sustainable energy landscape represents a huge challenge for most European countries. Italy however faces several unique obstacles that are critical to understanding MACSE’s role and the current regulatory landscape.

Italy’s transition is strongly dependent on rapid deployment of solar. A significant portion of solar and almost all wind capacity development will be focused in the south of Italy and islands, exacerbating existing congestion issues on the grid. So investment in storage is not a ‘nice to have’ solution, it is a key enabler of the Italian transition plan already in the next 5 years.

There are however several important hurdles that present a challenge for merchant deployment of storage at the pace required. We summarise these in Table 2 and they are a key reason behind why long term contract support is being introduced to support storage investment under the MACSE scheme.

Table 2: Current hurdles for merchant Italian BESS investment

While it is important to flag these challenges, Italy also offers one of the largest opportunities in Europe for storage investors. MACSE is set to provide a strong foundation for the Italian battery investment case – especially in southern & island zones – and many of the hurdles may diminish as the Italian market evolves, presenting interesting merchant opportunities in the future.

Enhancing MACSE returns with merchant uplift

We have summarised the benefits that the MACSE scheme offers BESS investors in a previous article, but a quick recap on key features:

- 12-14 year fixed price long term contracts, indexed to inflation (similar to a tolling agreement) with Terna (system operator) as counterparty (very strong credit rating)

- 71 GWh (12-15GW) of Terna storage tenders targeted by 2030.

First auctions are scheduled for December 2024, with the first capacity delivery year for BESS likely to be 2027. This is now approaching fast and is sharpening focus of storage investors on participation strategy and developing a viable Italian storage investment case.

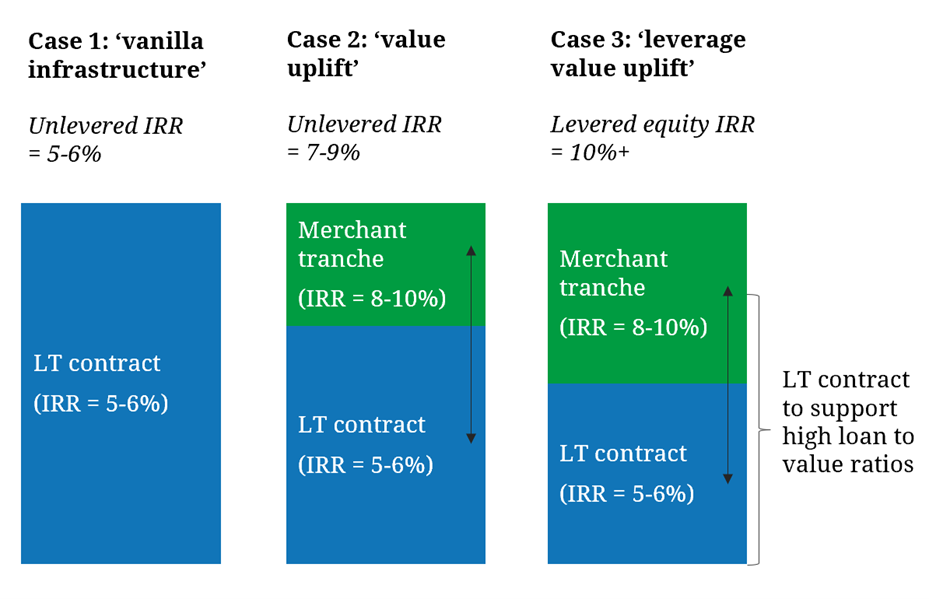

One key consideration that is also in focus is the ability to enhance long term contract returns by retaining a merchant tranche of capacity on BESS projects as we set out in Diagram 1.

Diagram 1: Merchant value uplift to enhance returns

Long term contracts are likely to underpin MACSE investment cases. However attractive contract terms are likely to drive strong competition in the tenders, which is in turn set to drive down investor returns (project IRRs).

The diagram illustrates how adding a merchant tranche into a BESS project may allow investors to (i) enhance project returns (ii) bid more competitively in the auctions. The benefit of the MACSE long term contracts is they are very attractive for facilitating debt financing with high loan to value ratios, particularly given the credit quality of Terna as a counterparty. So even if merchant BESS returns in Italy are lower than other European markets, they may drive significant equity IRR uplift.

Under this model the merchant value of the tranche under long term contract is very low. Terna is effectively tolling the battery for a fixed fee. However the BESS owner is free to optimise the merchant tranche against market price signals to generate value. In doing so the asset faces competitive pressure from Terna contracted capacity, particularly in driving down MSD returns, but may still earn a significantly higher return than that of the contracted portion (albeit with associated merchant risk).

Broader implications of the Italian storage support model

There is strong momentum behind BESS investments across Europe. Yet each market is facing its own challenges with how to support rapid scaling of both short & long duration storage required to balance renewable growth.

Across the last few weeks Timera has presented at both the Energy Storage Summit in London and the Key Energy conference in Italy. From both events we see a cross-section of investors faced with challenges including merchant revenue variability, financing & downside protection, market redesign, grid fees changes & effective asset monetisation.

Italy’s innovative regulatory landscape, characterized by MACSE and other mechanisms, underscores a proactive stance towards addressing the multifaceted challenges of energy transition and the key role storage in balancing renewables.

There is a good chance that elements of the Italian approach are adopted in other European markets, creating tailwinds for both short & long duration storage investors. In the meantime there will be a strong investor focus on Italian storage this year in the lead up to the first auction.

Join our upcoming webinar on the Italian BESS investment case

Topic: “A new model” – how the MACSE mechanism is set to turbo charge Italian storage investment

Time & access: Wed 24th Apr 10:00 GMT (11:00 CET)

Registration: Pre-registration required (access is free); webinar registration link – register here

Focus:

- Terna’s plan to tender for 71 GWh (12-15GW) of storage by 2030 under MACSE

- How MACSE mechanism works & its impact on BESS investment cases

- Building a viable BESS investment case & enhancing returns with a merchant tranche

- Financing, IRR and market access considerations

- Key investment case risks & pitfalls

Any Qs please contact steven.coppack@timera-energy.com