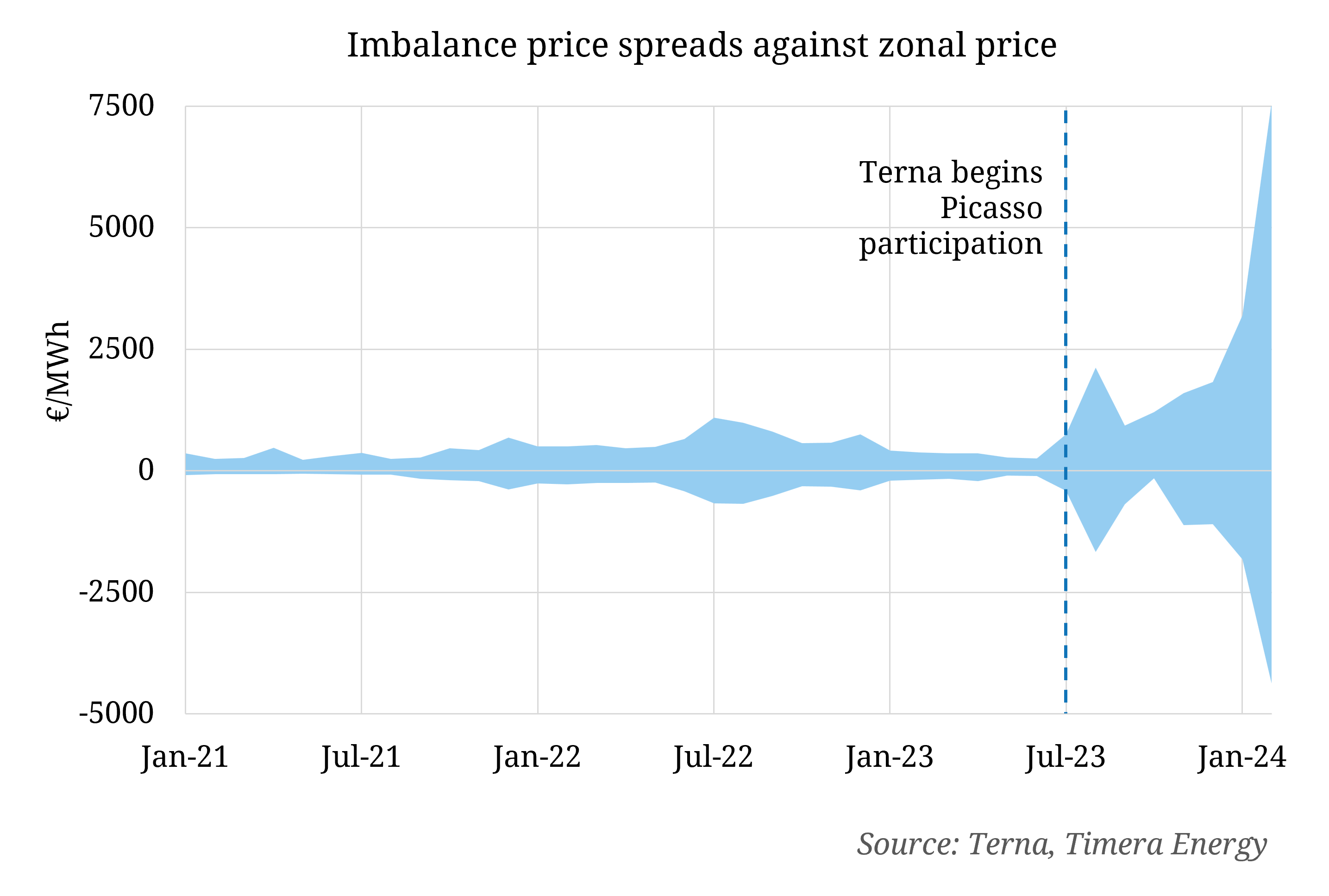

Chart shows imbalance price spreads against zonal price in the North Imbalance Macrozone – 99.8% quantile area.

The Italian Regulatory Authority for Energy, Networks, and Environment (ARERA) has decided to suspend Terna’s involvement in the European Picasso aFRR platform in response to detected anomalies in imbalance price formation.

These decisions follow complaints from market participants after extreme imbalance price volatility since Italy integrated with the aFRR (Picasso) platform (as illustrated in the chart). These price incidents, attributed to very high (or very low) bid prices and the platform’s marginal price valuation, led to the last accepted offer setting the price for all interconnected systems.

Price volatility has driven huge imbalance risk for market participants. This has been a particular issue for RES assets – this risk can be tracked looking at distribution tails of the price spread between positive and negative imbalance prices and the day-ahead prices.

The above chart shows a surge in such spreads in the tails of the distribution, representing an unprecedented market price risk exposure. Theses issues have been particularly acute across the last 3 months.

ARERA has confirmed that these extreme imbalance price dynamics are being caused by Terna’s aFRR requirements under Picasso, contributing to the imbalance price through a weighted average.

The only measures identified to mitigate positive and negative price spikes and their impact on national imbalance valuation include increasing national aFRR resources shared on Picasso and reducing Terna’s requirements on the same platform.

Terna has been instructed to suspend operational participation in Picasso as soon as possible and by March 15, 2024, pending the approval and implementation of mitigation measures proposed by European TSOs.