The global gas market looks to remain finely-balanced across the near-term, with weather risk and potential supply disruptions driving uncertainty into this winter. Equally, expectations of a 2025 demand recovery set against a supply-constrained backdrop could create further market tightness until the new wave of LNG ramps up from Q4 2025.

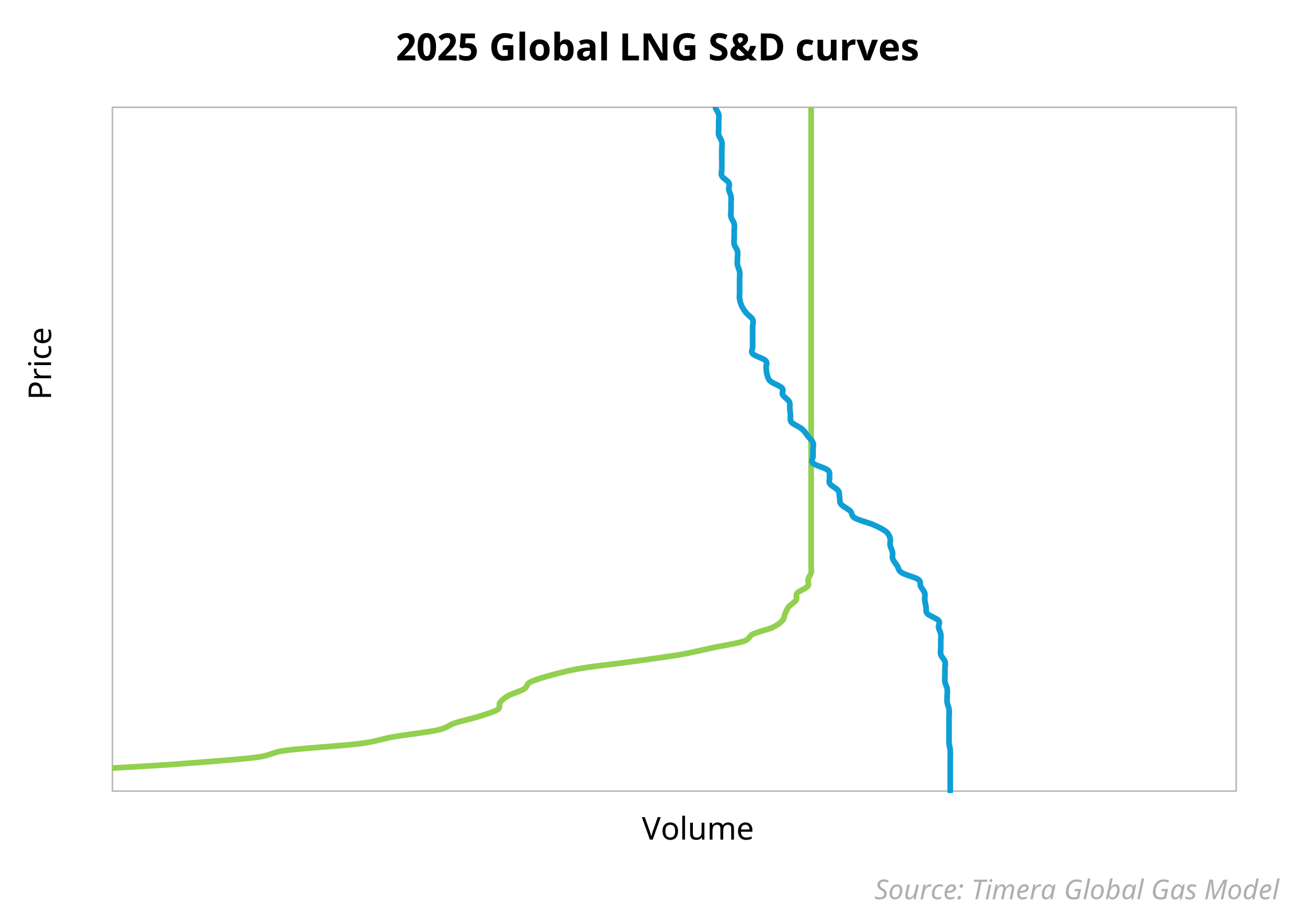

The chart above illustrates our modelled global market supply & demand balance for 2025. This is an output from our Global Gas Model which has a full representation of supply & demand balance across (i) the LNG market & (ii) the European gas market. The chart shows relatively inelastic sources of demand setting marginal price (e.g. Asian demand flex) and supporting price volatility. Elasticity risk remains asymmetric to the upside, but with demand focused downside risks also having potential to swing prices.

There are a few key sources of marginal flexibility that drive marginal pricing dynamics:

- European power switching (coal-to-gas): TTF futures are currently sat toward the top of the coal-to-gas switching channel, which remains the dominant marginal price setting mechanism anchoring global gas prices.

- Asian LNG demand flexibility: Fuel-switching & industrial price response impact Asian import volumes across a range of prices. This was evident across Q2 2024 when Asian buyers showed increased appetite for spot purchases as prices weakened. Price-sensitivity of emerging Asian buyers could cap the extent of price strengthening across 2025.

- US export flexibilities: Large volumes (100+ mtpa) of US LNG exports can be shut-in as prices fall, representing strong & elastic price support. This is unlikely to impact near-term dynamics as the market is currently balancing on inelastic supply (see intersection of S&D curves), but will grow in importance as we transition into a more oversupplied market regime (supply curve shift to the right).