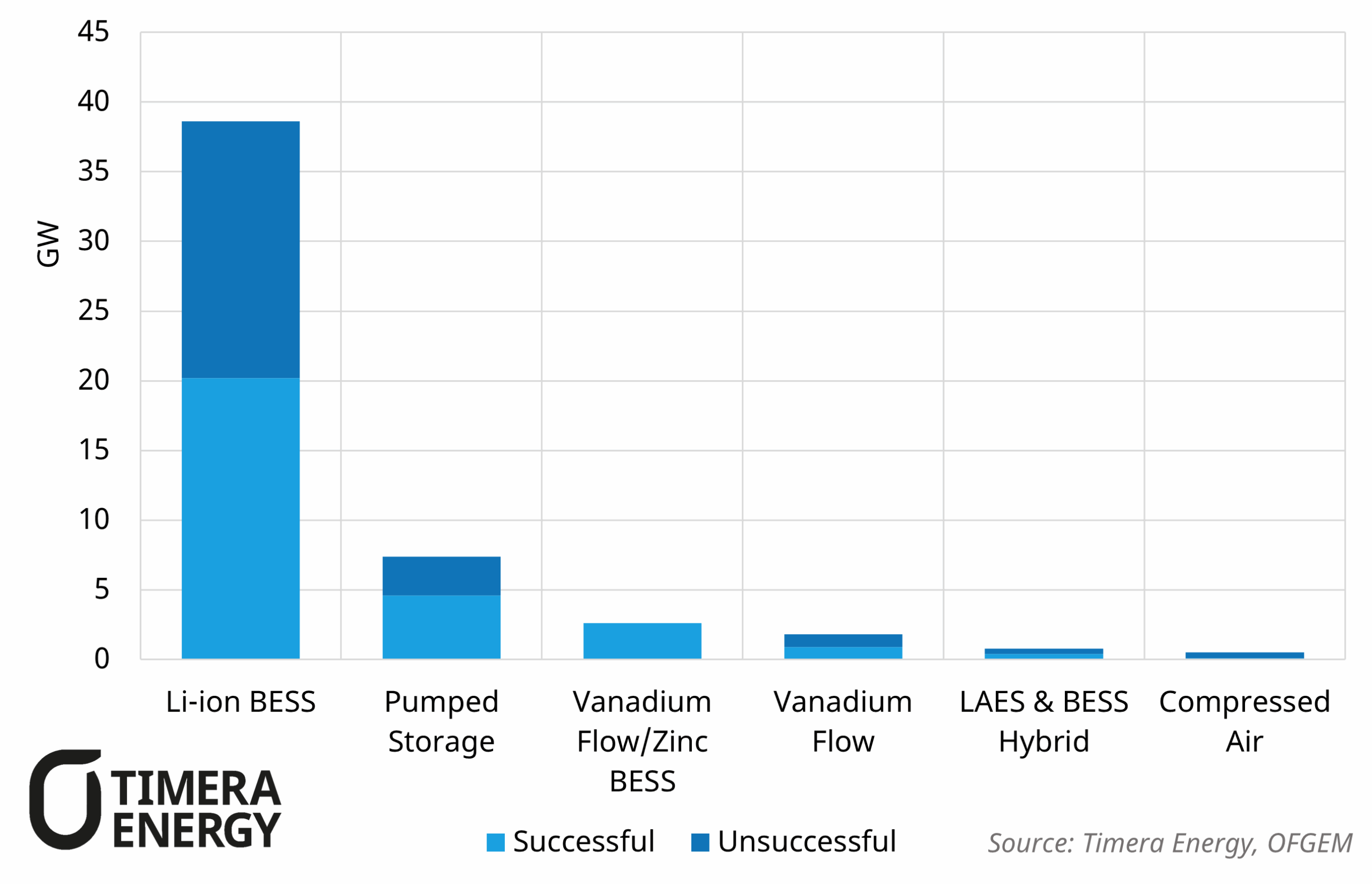

The first Long Duration Electricity Storage (LDES) cap-and-floor window has delivered a step-change in investable pipeline. Ofgem cleared 77 projects (28.7 GW) for assessment, setting the stage for a new revenue model that mirrors the proven interconnector regime.

Several projects emerged favourably from the auction:

– Li-ion BESS dominates (20 GW, 48 projects), showing bankability and grid-readiness for near-term build.

– Pumped Hydro saw just five projects passing, but with ~16% of total GW cementing its strategic role with Coire Glas and Earba among the largest schemes.

– Vanadium-flow batteries (3.5 GW) emerge as credible alternatives, while Highview’s LAES and a Storelectric CAES pilot diversify the mix.

However, not all applicants were successful as almost half the applicant pool (94 projects) failed eligibility. Notably absent were: iron-air, sodium-sulphur and hydrogen battery technologies, suggesting weak deliverability against Ofgem’s criteria.

The cap-and-floor framework has three key implications:

- Policy certainty (for investors): Removes merchant risk while preserving upside.

- Scale of projects: With most capacity in Track 1 to 2030, capital can be deployed rapidly and at scale.

- Diversification: A maturing technology mix improves resilience, though near-term returns remain concentrated in Li-ion and pumped-storage hydro.

For successful projects, the next step is an economic assessment phase, with Ofgem due to publish results in Q1 2026 alongside the final list of cap & floor recipients. Beyond GB, comparable LDES schemes are progressing: Italy’s MACSE held its first round this week on 30 September, and Ireland is consulting on a potential auction in 2027. This reflects a growing recognition by governments that LDES is critical to system security and flexibility in increasingly RES dominated power systems.

For investors looking to enter these auctions, robust stochastic LDES modelling, capturing daily/weekly renewable patterns, demand dynamics, correlated price volatility and system constraints is essential to quantify risk adjusted value. At Timera, our in-house modelling suite is purpose built to do exactly that. If you are interested in full stochastic analysis of LDES or other flexible assets, feel free to reach out to our Power Director Steven Coppack for further details (steven.coppack@timera-energy.com).

GB BESS Subscription Q3 update released

We have recently released our Q3 update of our GB BESS subscription which includes:

- Our latest Q3 GB BESS revenue curves in our configurable Battery Investment Tool, with the new additional of thermal constraint driven BM system uplift

- Long form report including special features on BESS revenue drives and congestion uplift for BESS as well as deep dives into the GB BESS market landscape and key policy considerations

- A workshop with our team to discuss the report and revenue projection

If you are interested in our GB subscription feel free to get in touch with Arshpreet Dhatt (arshpreet.dhatt@timera-energy.com).

Join our upcoming webinar on GB power market

Topic: Impact of the Jul 25 decision to kill Locational Marginal Pricing (LMP) on GB BESS investors

Time: 09:00 BST (10:00 CET) Tue 7th Oct

Registration: Pre-registration required (access is free); webinar registration link – register here

Coverage:

- 3 key locational value drivers for GB BESS

- Investor landscape post LMP

- Quantifying BM system value capture

- How to frame locational value in investment cases