Valuing LNG contracts used to be a one-dimensional exercise. Intrinsic value was the focus. Extrinsic value from contract flexibility terms was either ignored or heavily discounted for valuation purposes. It was nice to have when it turned up, but nothing to ‘pay up’ for when signing a contract.

“The case study shows that although the contract is ‘out of the money’ on an intrinsic basis…

…it is firmly ‘in the money’ when flex terms are appropriately valued”

This focus on intrinsic value meant for years that embedded flexibility in LNG contracts worth millions of dollars, changed hands for close to nothing. This was particularly the case with large & complex long term contracts signed directly between producers and end users.

This is no longer the case. The rapid growth in mid-market trading entities over the last 3 to 5 years is driving an evolution in the pricing of LNG contract flexibility.

In this article we look at how LNG contracts are being valued, defining 5 categories of contract flexibility that drive value. We also set out a practical case study that quantifies the build-up of contract value by key flexibility terms.

LNG contract flex value is becoming much more important

As the LNG market matures, participants are taking a more structured approach to valuing supply contracts and flex terms. While this is being driven by traders, more physically focused producers & end-users are responding fast, in order to prevent giving away unnecessary value to intermediaries.

Low market prices across 2019-20 have also increased commercial focus on extracting extrinsic value, in what has been a low intrinsic margin environment.

The upshot is that valuing flexibility in LNG contracts is becoming much more important as a source of value capture and competitive advantage. It impacts for example for:

- Portfolio investment decisions e.g. in monetising the value of production & midstream assets

- Traders & originators e.g. in accurately pricing contracts & creating value

- Risk managers e.g. in quantifying contract mark to market and measuring associated risk.

The challenge in tackling LNG contract flexibility is defining a structured & transparent approach to quantifying value.

Deconstructing LNG contract flexibility

It is not straightforward deconstructing and valuing LNG contract flexibility, given the complex nature of physical supply deals. An important place to start is a structured definition of the sources of flexibility that underpin contract valuation.

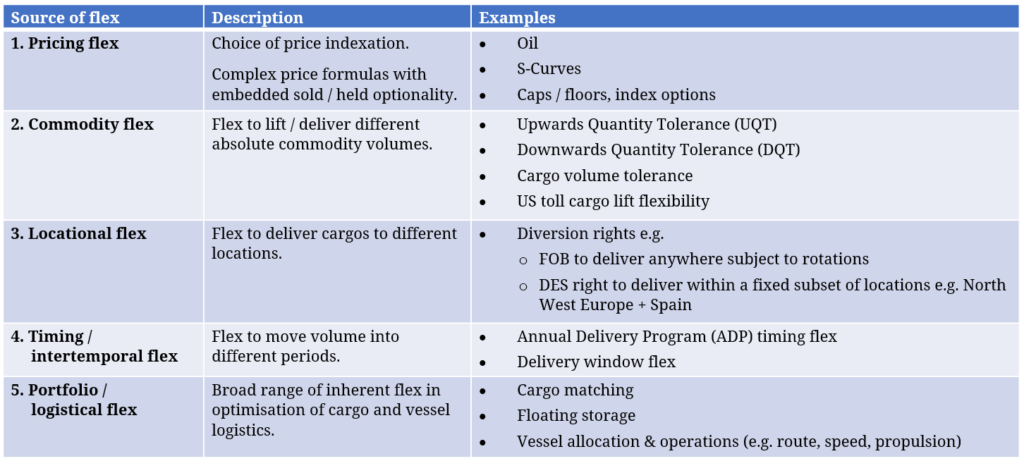

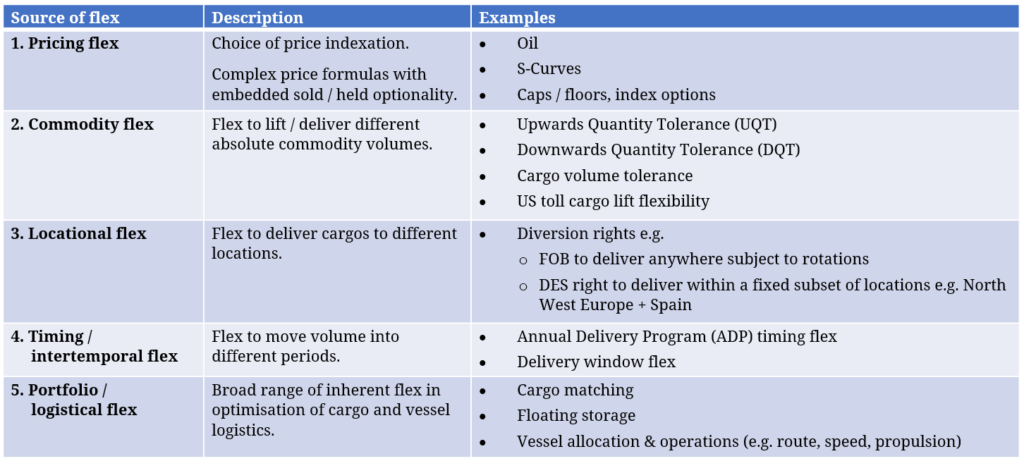

In Table 1 we define 5 key types of flexibility that underpin a range of LNG contract structures.

Table 1: 5 key categories of LNG contract flexibility

An important feature of LNG contracts is that flexibility is often held by both buyer & seller and it needs to be valued accordingly. This differs from conventional gas swing contracts where flex is typically held by the buyer.

Many LNG contract terms also implicitly grant flexibility to one party. As a simple example, a Free on Board (FOB) deal grants the buyer the right to deliver the cargo to the highest priced market (subject to logistical constraints).

The best way to illustrate how these categories of flex interact in practice is to to quantify value via a case study.

The case study contract

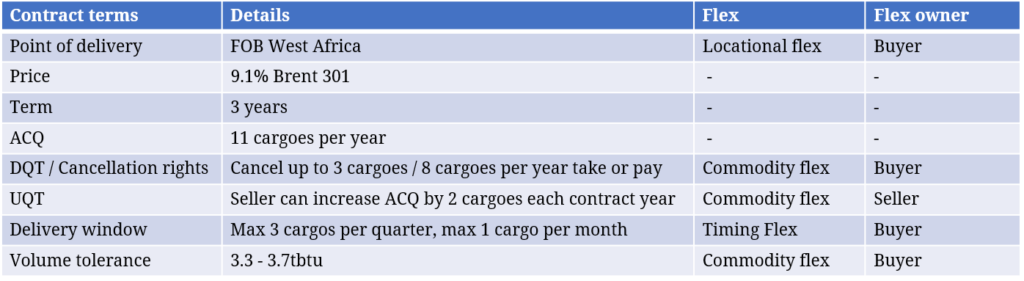

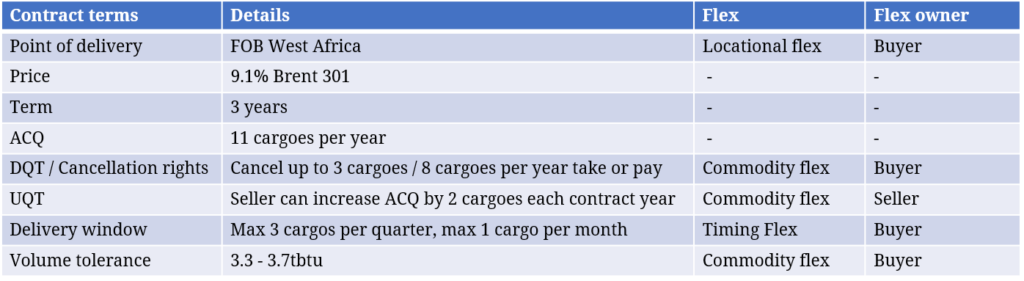

Our case study contains many common LNG contract features. It is based on a 3 year Brent crude indexed supply contract sourcing 11 cargoes a year from West Africa. Supply is on an FOB basis which gives the buyer locational flexibility to deliver the cargo to destination of choice.

8 of the 11 cargoes are under a ‘take or pay’ obligation, the rest can be cancelled by the buyer. The buyer also has flexibility to define delivery windows and cargo volumes, within defined constraints.

The seller then has the flexibility to increase the Annual Contract Quantity (ACQ) by 2 cargoes per year e.g. to sell extra volume in a lower price environment. The case study deal terms are summarised in Table 2.

Table 2: Case study deal summary

Quantifying a build-up of contract value

To value the case study deal we use Timera’s LNG Bridge model. Bridge is an LNG portfolio analysis model that allows companies to quantify & manage the interdependent value of LNG assets within a portfolio. It has quickly evolved into an industry leading solution, and is employed across a broad range of LNG portfolios (see bottom of the article for further details if you’re interested).

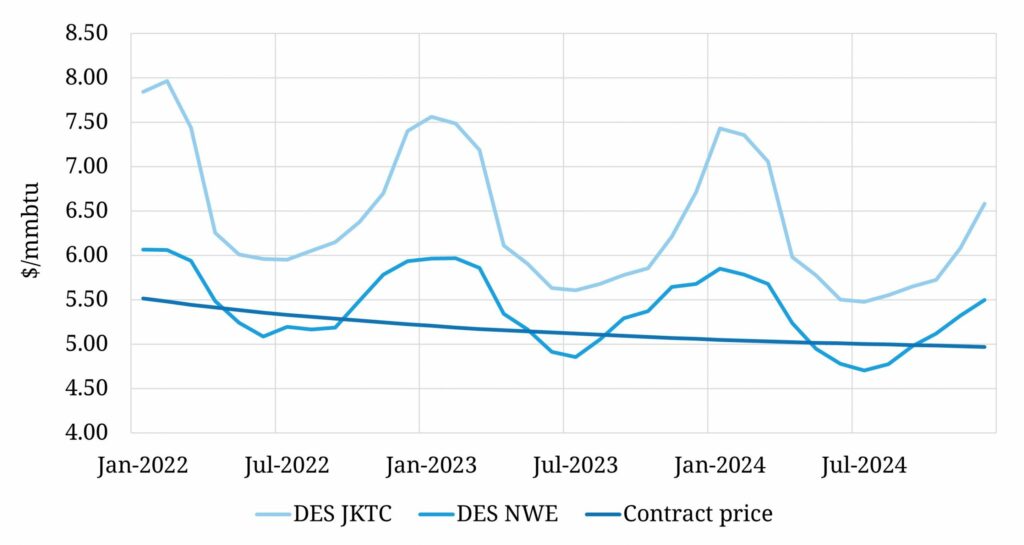

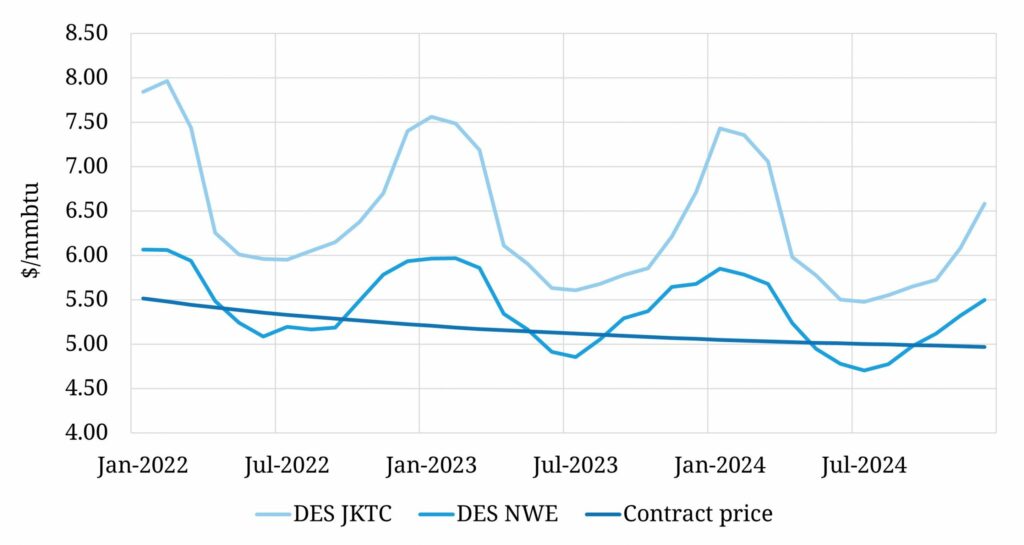

In order to value the contract, we use the curves shown in Chart 1 (based on current forward market prices). These cover Brent crude and European & Asian LNG delivery points: DES (Delivery Ex-Ship) NW Europe and DES JKTC (Japan, Korea, Taiwan, China).

Chart 1: Brent indexed contract price vs modelled JKTC & NW Europe forward curves

In order to calculate a simple intrinsic valuation of the contract, the curves in Chart 1 are adjusted in the Bridge model for shipping, port and transaction costs. To start with we also strip out all contract flexibility terms. This yields a ‘No flex’ intrinsic value of -0.08 $/mmbtu, in other words the contract is ‘out of the money’ on an intrinsic basis.

In order to calculate the extrinsic value of the contract we use the LNG market price simulation engine in LNG Bridge to generate 500 correlated price paths (e.g. for Brent, TTF, JKM). The contract is then optimised and valued against each price path to generate a value distribution.

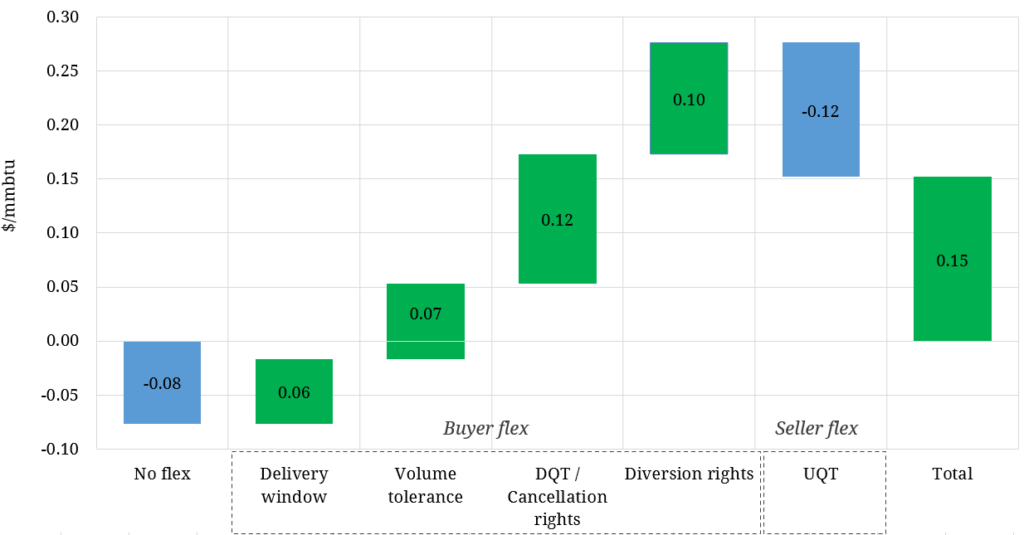

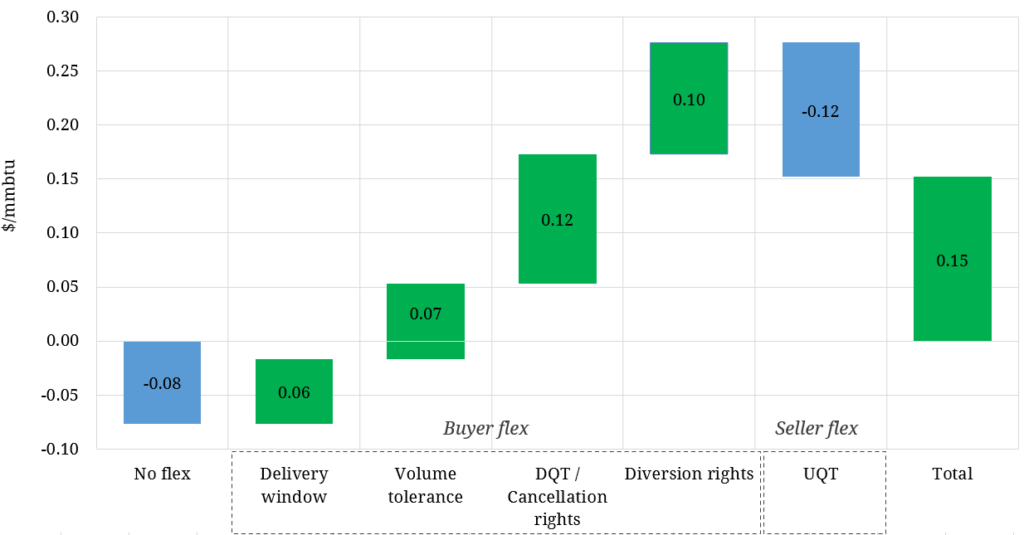

Chart 2 shows a waterfall chart build up of modelled case study contract value including flex terms. Value is split out by key flex value buckets, measured in $/mmbtu from the contract buyer’s perspective.

Chart 2: Build up of LNG contract value by source of flexibility (contract buyer’s perspective)

Source: Timera Energy’s LNG Bridge model

The build-up of contract value buckets in Chart 1 can be summarised as follows:

- No flex: intrinsic value with all flex stripped out (-$0.08).

- Delivery window: value of buyer flex to shape timing of cargo delivery into higher priced periods (+$0.06).

- Volume tolerance: value of buyer flex to nominate up & down cargo volumes in response to market pricing dynamics (+$0.07).

- DQT / Cancellation rights: value of buyer flex to cancel up to 3 cargoes a year e.g. to avoid losses in high Brent index vs gas price windows (+$0.12).

- Diversion rights: value of buyer flex to divert FOB cargoes to highest value markets, eg addition of DES NW.E market (+$0.10).

- UQT / Sold flex: value of seller flex to nominate increased cargo volume (embedded put option for the seller), effectively a cost to the buyer (-$0.12) .

The case study illustrates that although the contract is ‘out of the money’ on a core intrinsic basis, it is very much in the money when flex terms are appropriately valued.

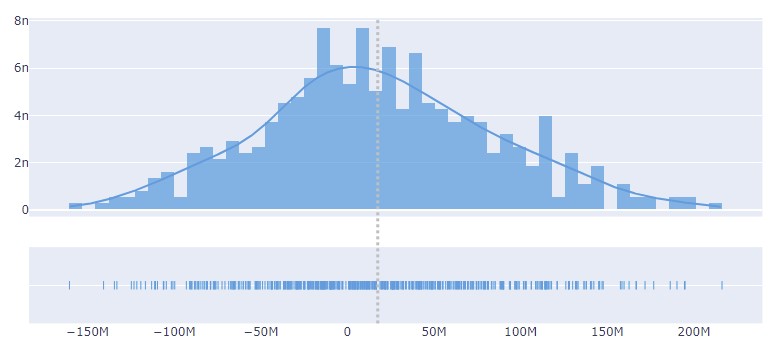

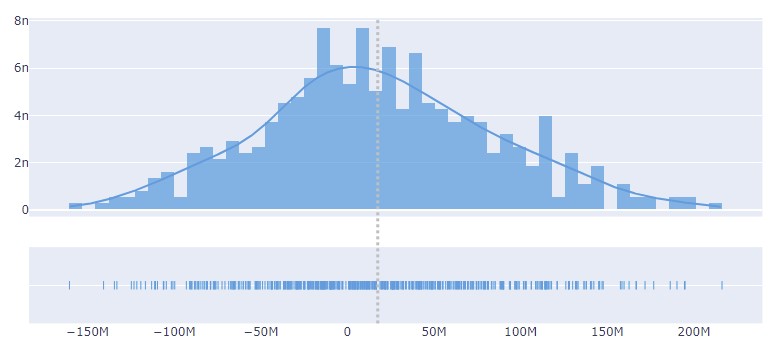

This is illustrated in Chart 3 which shows the contract value distribution generated by LNG Bridge measured in $m. The expected value of the contract including extrinsic value is $18m (equating to 0.15 $/mmbtu shown in Chart 2) with a P10 value of -$68m and P90 value of $111m.

Chart 3: Distribution of contract value (contract buyer’s perspective)

Source: Timera Energy’s LNG Bridge model

Takeaways on contract flex value from the case study

Now we set out a bullet summary covering 5 key takeaways on contract value. These are relevant to this case study contract, but many also apply more broadly to the valuation of LNG contract flex.

1.Big numbers with significant risk

- There is an $86m potential value downside from expected to P10 contract value. A single cargo can have a notional value as low as $10m or upwards of $50m.

- LNG contracts involve large value numbers, which are typically very sensitive to market pricing dynamics (e.g. evolution of Brent vs JKM curves).

- This risk can be partially mitigated via hedging forward price exposures.

2.Commodity & locational flex are most valuable

- UQT / DQT and diversion flex are typically the biggest contract value drivers.

- Commodity flex value (e.g. DQT and volume tolerance) is important given:

- It acts as downside protection (e.g. narrows the spread between expected value and P10)

- It allows access to value from the seasonality of gas / LNG curves vs the Brent curve.

- Diversion flex value is important given it allows value capture from regional price volatility (but is sensitive to loading port location & portfolio structure / logistics).

- Need to consider both held and sold flex

- It is easy to focus on the single largest bucket of contract flex (either held or sold).

- But it is also important to consider offsetting impacts e.g. sold UQT flex in the case study reduces contract value by more than 40%.

- Exercise timing drives value

- As a rule, the closer to cargo delivery that flexibility is exercised, the greater its value e.g. due to higher price volatility near to delivery.

- Flex value can be very sensitive to contractual terms that restrict the timing of flex exercise (e.g. post ADP change restrictions, nomination deadlines etc).

- Portfolio scheduling and logistics may also further restrict flex value.

- Importance of market conditions

- Value of different types of contract flex strongly depend on market conditions e.g. tight vs well supplied market.

- Market dynamics drive the ‘in the moneyness’ of optionality and the relative ratio of intrinsic vs extrinsic value (e.g. if a contract is deep ‘in the money’ from a buyer perspective, there is little value from buyer cancellation rights).

- Market illiquidity can have a real impact on practical value capture. This is important to capture when valuing contracts.

Quantifying LNG asset & portfolio value

Valuing LNG supply contracts is not something you can do in your head. Indeed it is difficult to robustly quantify the value of most LNG contracts in a spreadsheet, no matter how good your quant or coding skills are.

Valuing LNG contracts on a standalone basis is also typically only half the challenge. It is important to be able to quantify how the contract interacts with other portfolio assets to drive value (e.g. other supply contracts, shipping & regas capacity).

Our answer to this challenge is LNG Bridge. This is a model that we have developed & implemented in collaboration with a number of leading LNG companies, including oil & gas majors, utilities, producers & traders. If you want to find out more about how we approach it click here.