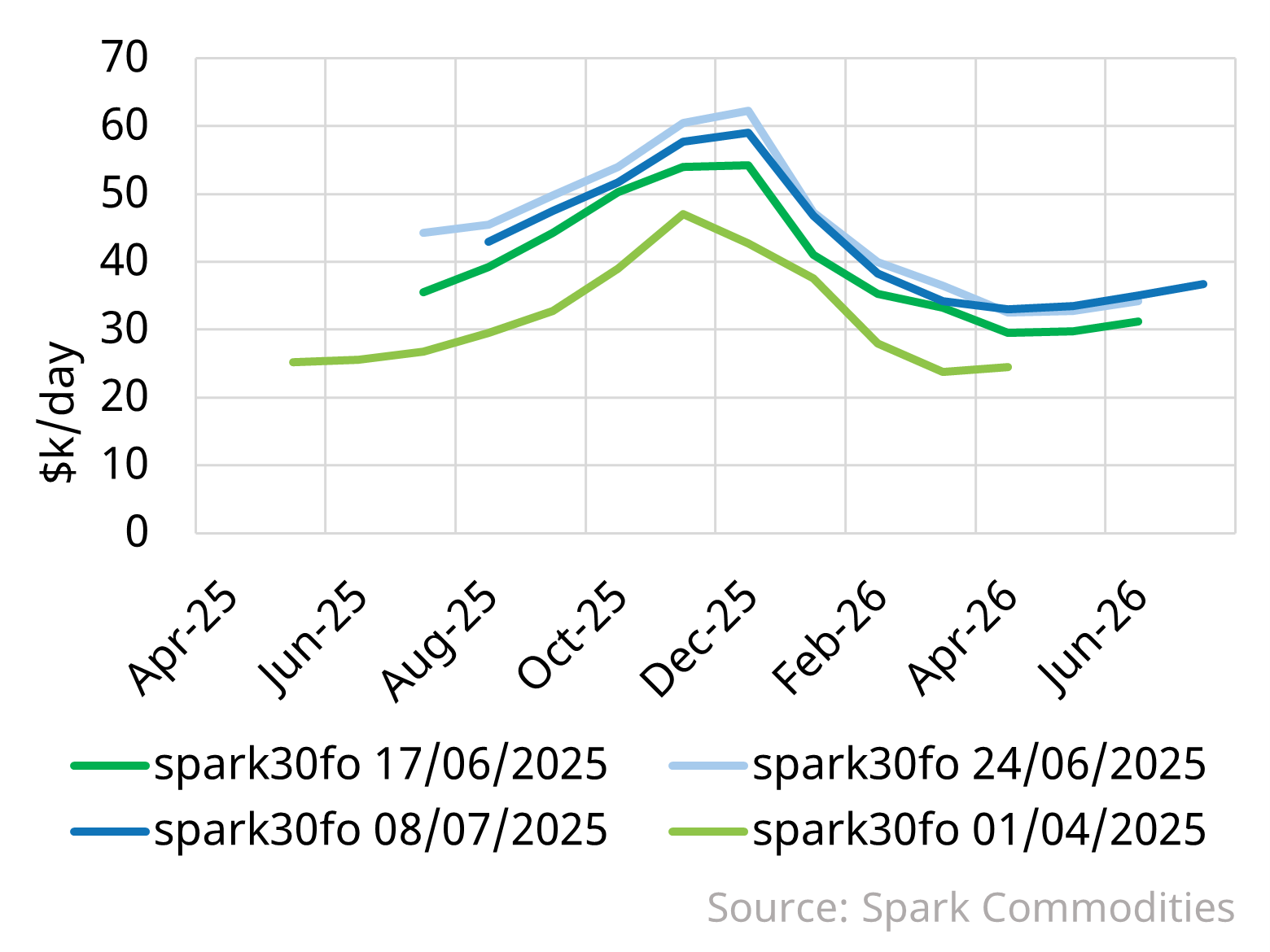

LNG freight prices have remained raised compared to early June even as global gas prices have fallen in the aftermath of a ceasefire between Isreal and Iran. On July 8th, the Spark 30 August 2025 forward assessment still stood at $43,000 per day, only slightly below the $45,500 per day level seen on June 24. The forward curve had jumped significantly from June 17 to June 24 as brokers priced in a potential scramble for LNG tonnage in the event of a Strait of Hormuz closure.

Throughout 2025, freight forward curves have been trending upward, supported by increased volatility in the gas market stemming from geopolitical conflicts and US tariffs. Increased volatility enhances the extrinsic value associated with flexible spot shipping, incentivising market participants to secure optionality.

The JKM-TTF spread has widened since the start of June, bringing more Atlantic Basin cargoes to Asia and providing some support to freight rates due to a tightening of available tonnage.

Despite the recent firmness, the Spark freight forward curve remains seasonally flat and relatively low vs the long term average. This reflects a shipping overhang, as new vessel deliveries outpace demand in anticipation of the forthcoming unprecedented expansion in LNG export capacity.