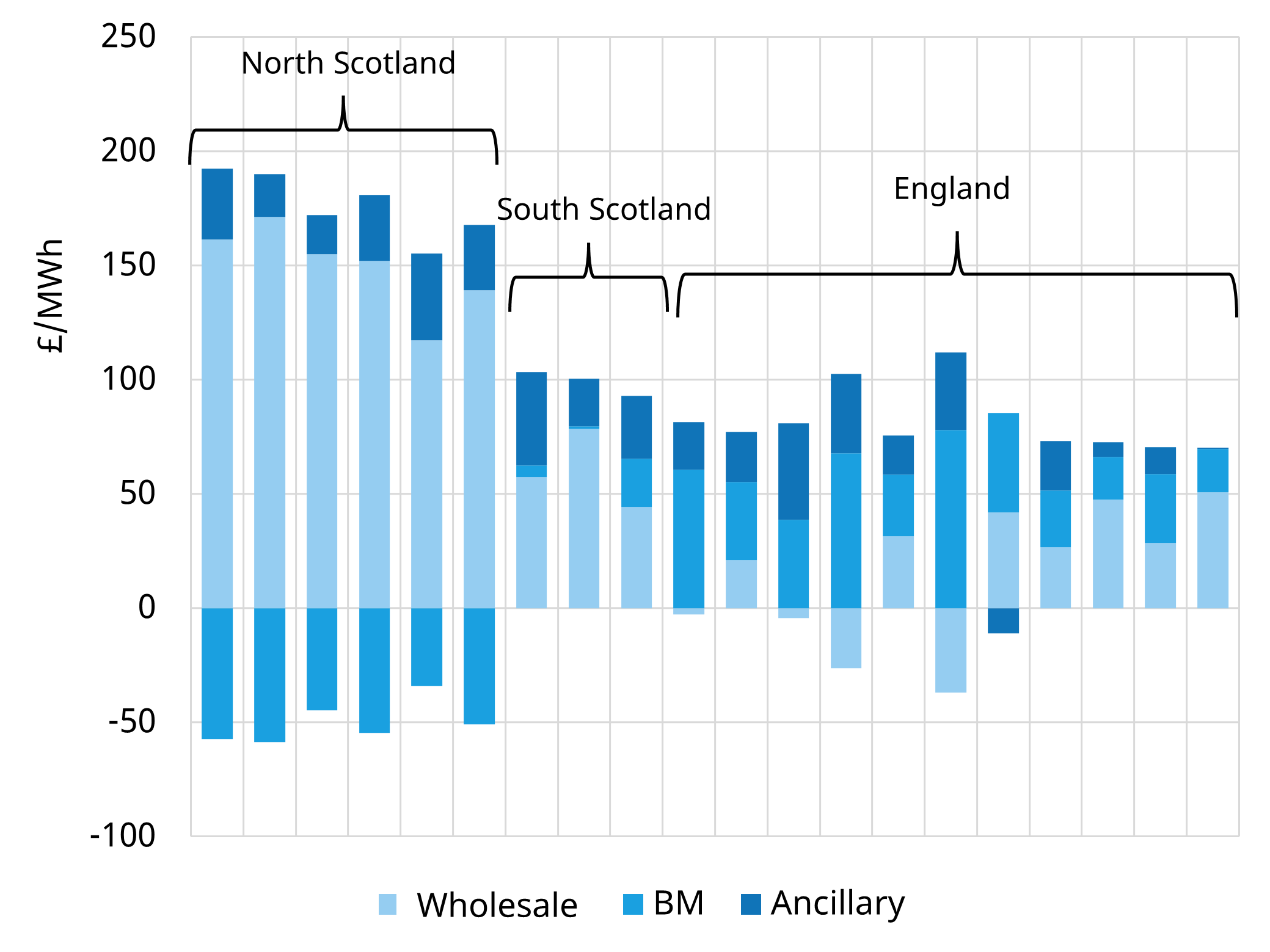

Battery revenues in GB are showing increasingly location-specific patterns, driven by the wholesale and balancing mechanism (BM) interactions.

- In North Scotland, BESS assets leverage their position behind key transmission constraints to secure high wholesale revenues, often submitting long Final Physical Notifications (FPNs) that are bid down in the BM—resulting in negative BM margins but strong overall returns.

- South Scotland follows a similar trend, albeit with slightly lower wholesale capture; BM revenues here are more evenly split between bids and offers, contributing to a lower net BM revenue.

- In contrast, many batteries in England & Wales experience stronger BM revenues through accepted offers but often face weaker wholesale returns than Scottish BESS—with some even posting negative wholesale margins by using Quick Reserve to submit FPNs they expect to be unwound (link to blog).

These variations show the critical role of locational strategy in BESS monetisation. Timera can support offering both commercial insights into BM uplift potential from constraint-driven dynamics and forward-looking modelling of a zonal market structure in anticipation of REMA reforms.