The pricing terms of long term contracts on flexible gas & power assets are typically the subject of lengthy negotiations. They also often remain a closely guarded commercial secret. This is reflective of the bespoke nature of these contracts and the large sums of money involved.

Long term contracts are used to underwrite investment in a wide range of flexible assets including midstream gas assets (e.g. pipelines, storage facilities and LNG terminals) as well as thermal power plants and electricity interconnectors. Pricing terms vary widely across different asset types and counterparties. But behind the negotiation of individual contract pricing terms there are a set of common principles that apply.

We recently published our first article in a series on the long term contracting of flexible assets. In our second and third articles in this series we focus on the drivers of contract pricing. In today’s article we consider the motivations of the contract sellers and buyers at the negotiating table, in order to understand how these impact the pricing of contracts. We then set out a practical explanation of the 5 key drivers of contract prices in our next article in the series.

Seller motivations

The sellers of long term contracts are typically asset owners. Contract sales may be to support the development of a new asset (e.g. a CCGT tolling deal) or to manage the margin of an existing asset (e.g. sale of pipeline or storage capacity). Either way long term contracts involve the structural transfer of asset exposures from seller to buyer. This means exposure management plays an important role in shaping the motivations of contract sellers.

There are three important factors that drive seller negotiation of contract pricing terms:

- Risk tolerance

- Return on capital

- Route to market

The first two of these factors are intimately related. The seller of a long term contract is principally focused on how pricing terms will impact the risk/return profile of the underlying asset (as we set out in detail here). The contract price level needs to support an adequate return on capital employed. But the pricing structure also needs to deliver that return within a tolerable level of risk.

Take for example a gas storage operator looking to sell long term capacity to support the incremental expansion of a storage facility. Current weakness in market price signals (seasonal spreads and spot volatility) make it challenging to sell long term capacity contracts at a price level that supports investment. In order to increase returns, the storage operator can seller a lower volume of long term contracts (i.e. retain more market risk). Or alternatively they can introduce some degree of market indexation into contract pricing terms (e.g. spread indexation). But either way these decisions impose additional risk on debt and equity capital invested in the project. Seller’s negotiation of contract pricing terms revolves around balancing these risk/return considerations.

Route to market (factor 3. above) only applies to a subset of long term contract negotiations. It relates to using the counterparty (or buyer) to access the commercial capabilities required to monetise asset value (e.g. a trading capability). This is typically only a concern for asset owners that do not have an internal marketing and trading function. But route to market agreements are becoming an increasingly common feature of long term contract negotiations, given the growing importance of infrastructure investors without a market facing capability.

Route to market contract terms typically cover a fixed service fee combined with variable execution fees. These may be negotiated separately from the structural pricing terms of long term contracts. However it is often the case that both pricing and route to market terms are agreed at the same negotiating table with the same counterparty. This means that route to market capability and cost competitiveness can influence a seller’s attitude to contract price terms.

Buyer motivations

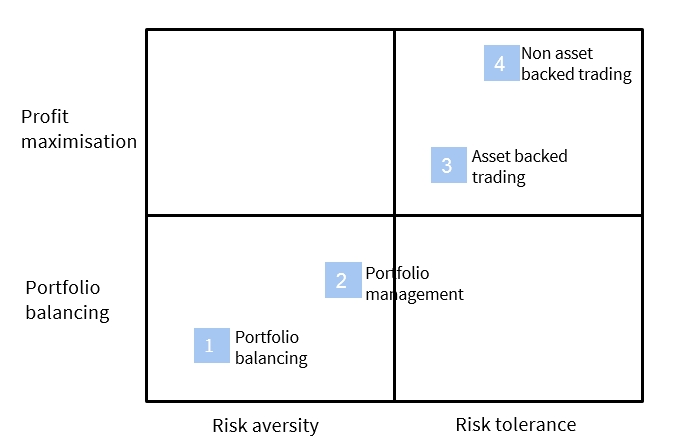

While long term contract sellers can typically be characterised as asset owners, there are a number of different types of contract buyers. To understand buyer motivation in negotiating contract pricing terms, it helps to group buyers into four categories:

- Portfolio balancing (e.g. system operators)

- Portfolio management (e.g. physically focused suppliers)

- Asset backed trading desk (e.g. utility or producer trading desks)

- Non asset backed trading desk (e.g. commodity trader or bank intermediaries)

Like for sellers, exposure management considerations play an important role in shaping buyer motivations. The characteristics of these buyer types are summarised in Chart 1.