ARERA have just launched a public consultation on the methodology for defining the reserve auction premium . This contains a proposed auction reserve premium of 32 k€/MWh sized on 4-hour BESS assets’ assumptions.

This came below market expectations (~35 k€/MWh) due to ARERA’s CAPEX assumptions and has further shaped bidding strategy discussions. The final premium may change after consultation, but the message from the Italian regulator is clear: expect fierce competition for this auction.

Some key takeaways from our latest webinar & the ARERA consultation

1. Auction design and timelines are finalised

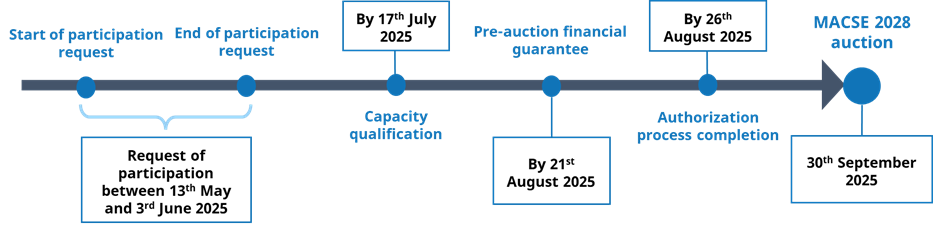

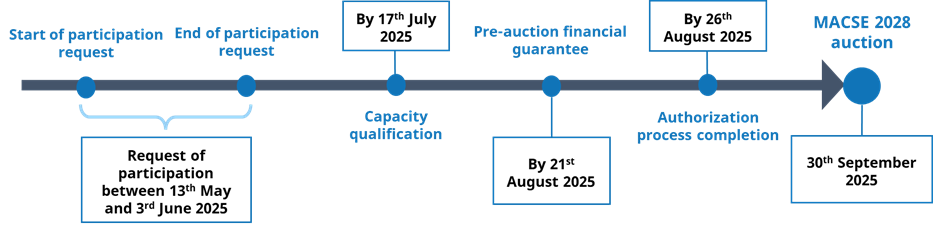

Terna’s timeline set the first auction for 30th September 2025, targeting 2028 delivery. Key investor deadlines span June to August, creating a tight pre-auction window.

Diagram 1: MACSE auctions timelines

Source: Timera Energy, Terna

2. Potential participation

At least 13 GWh of permitted standalone BESS capacity is currently eligible for the auction and PAS-permitted projects may lift this figure further. Final auction participation will depend on both new authorisations released by end-August and on the amount of capacity that participants will decide to strategically qualify for the auction.

3. Auction competition

With eligible capacity now exceeding 12.5 GWh, the 80% rule is less likely to effectively limit the auction quota. Unless qualified volumes fall short, the market expects full allocation of the 10 GWh target—setting up a competitive auction environment, with some zones facing a potential higher price pressure due to higher expected participation.

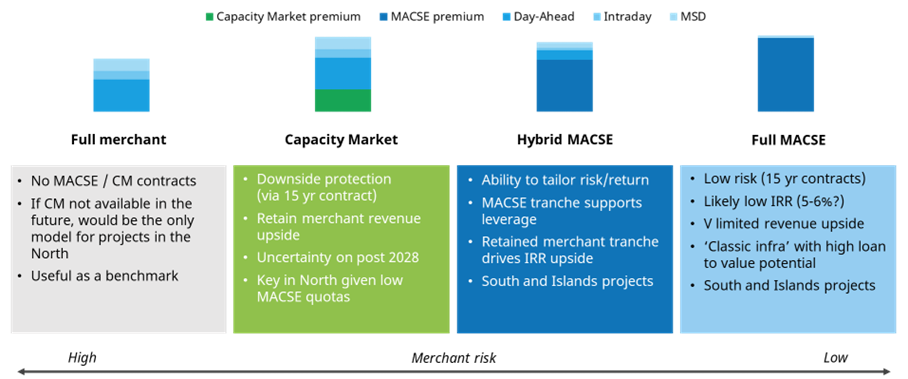

4. The MACSE and merchant strategic equilibrium

Hybrid MACSE models are a central part of investor strategy. In this model investors qualify only part of their total capacity to the auction, enabling stacking of long-term fixed MACSE revenues with merchant revenues. This flexibility is also valuable for managing the risk driven by MACSE’s performance and degradation constraints. The recent decline in Capacity Market prices further increase the strategic significance of Hybrid MACSE models to combine debt leverage opportunities with merchant exposure.

5. Reserve premium strategic considerations

ARERA’s proposed cap of 32 k€/MWh may constrain MACSE-backed returns compared to previous market expectations. According to the Italian regulator’s assumptions, this level should enable ~8% nominal unlevered IRR over the 15-year contract horizon. While competition could further reduce investment return, merchant exposure could increase it while still enabling bankability and debt leverage. It may also help mitigate the inflation risk embedded in real MACSE returns—indeed, just 20% of the MACSE premium will be indexed to Italian CPI, introducing inflation risk asymmetries on the contracted long-term real revenues.

6. Investor focus on M&A and auction strategy

With deadlines nearing, investor attention is turning to project transactions and capacity qualification strategy. The required pre-auction financial guarantee—12.8 k€/MW for 4hr BESS if the proposed premium is confirmed—will aim to disincentivise speculative behaviour, as it won’t be returned to qualified capacity that fails to deliver on the MACSE contract after being awarded for the auction.

Watch the webinar

Missed the webinar? You can catch the recording of “MACSE start gun has been fired” and access to the slides.

Click here for a recording of the webinar.

Click here for a copy of the webinar slides.

Supporting you on IT BESS investment

We have launched an Italian BESS subscription service designed to support MACSE investors through this process. It contains:

- A highly configurable Italian Battery Investment Tool with BESS revenue stack projections for different asset configurations in all zones and nodes

- Detailed zonal level projections of the Italian power market evolution to 2050

- Comprehensive Italian BESS Investment Report covering policy & market drivers, MACSE & CM and 4 alternative BESS business models

The service also includes a full update of the above revenue projections and information as the 1st auction approaches.

Contact our Power Director (steven.coppack@timera-energy.com) for a free sample copy of a recent report.