Global interest rate markets are shouting recession. Commodity prices are falling in sympathy. Energy markets are likely to be strongly impacted by how macro drivers such as interest rates & inflation unfold across the next 6-12 months.

“Commodity market weakness is contributing to pressure on European gas & power prices”

In today’s article we look at what is driving market recession fears, why the banking crisis is re-emerging and the impact of these drivers on energy markets.

Looming recession?

The risk of recession is being driven by inflation & interest rates. Central banks around the world are facing acute political pressure to fight inflation given its impact on voting consumers. This has led central banks to:

- Hike interest rates aggressively across the last 12 months (e.g. since Mar 2022, the US by 5.0% and Germany by 3.5%)

- Push a strong message to markets of ‘higher interest rates for longer’.

Markets are calling ‘bullshit’.

Central banks control overnight interest rates, but markets control the rest of the interest rate curve out over a 30+ year horizon beyond this.

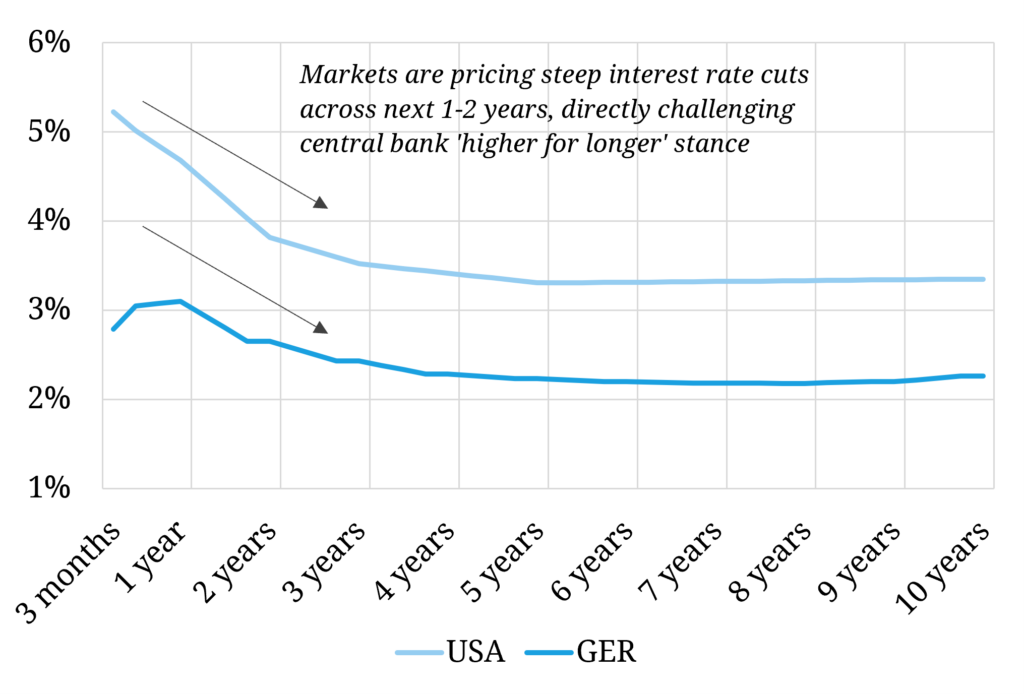

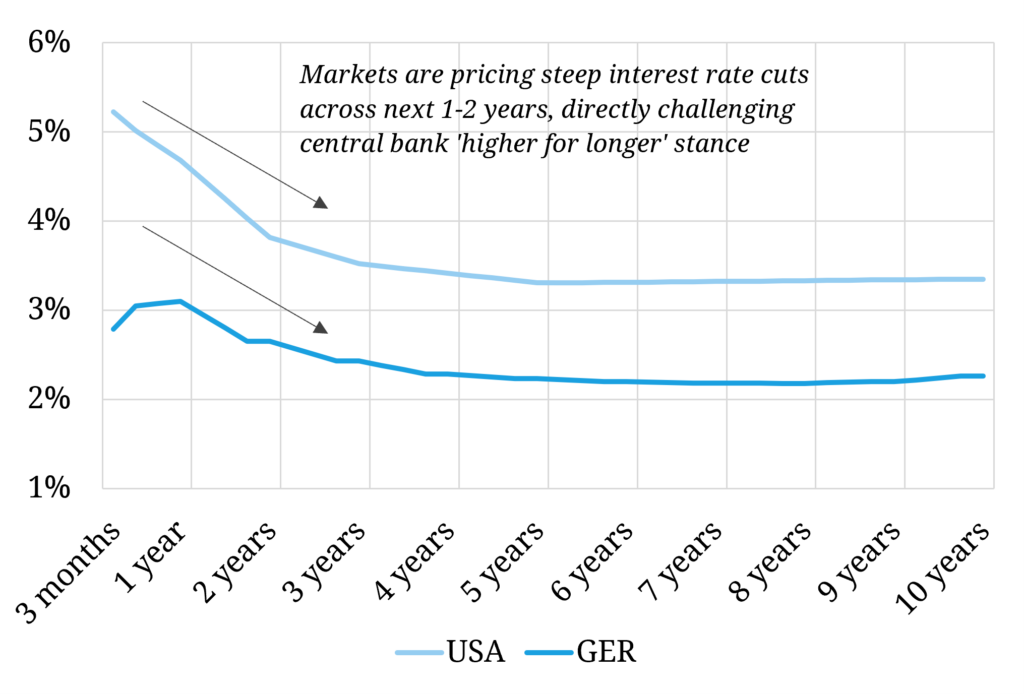

Chart 1 shows both US and European interest rate markets pricing in rapid and aggressive interest rate cuts across the next 2 years.

Chart 1: Yield curves for US & European government debt

Source: US Treasury, German Bundesbank

This steep decline in interest rates being priced into yield curves is the market flagging an imminent recession (probably in the second half of 2023), triggering a rate cut response. So why this disagreement between central bankers and markets?

Why recession & rate cuts are likely

Central banks are caught between a rock and a hard place. Political pressure to be proactive on inflation means continuing to hike rates and provide hawkish forward guidance (‘higher for longer’) until clear evidence emerges of both:

- falling inflation

- a cooling labour market (given the threat of wage inflation).

The challenge is that both of these indicators have substantial lags (e.g. 9-12 mths). So the aggressive rate hikes that started a year ago are only just starting to feed through into these indicators. And the impact of most of the hiking will likely not show until later this year… by which time many economies may be in recession.

The other factor that is exacerbating recession risk is a contraction in credit conditions (e.g. bank lending) due to the banking crisis that emerged two months ago and reignited last week with further US regional bank failures.

Banking crisis (part 2)

In March we flagged the threat to energy markets posed by a rapidly spreading banking crisis. This crisis is strongly linked to the interest rate dynamics shown in Chart 1.

The business model of commercial banks is built around borrowing short term (from depositors) to lend long term (e.g. via business loans & mortgages). The current yield curve environment where short term rates are substantially higher than long term rates (yield curve inversion) is poisonous for bank profitability.

Banks cannot afford to lift short term interest rates paid to depositors to match the yield on short term government securities. This is causing ‘deposit flight’, particularly from US regional banks, to safer & higher yielding government securities.

The result is a series of old fashion bank runs. The policy cure is likely to be a combination of (i) interest rate cuts (possibly emergency ones) and (ii) more quantitative easing. That’s ultimately likely to support commodity prices, but there may be some pain first.

What this means for energy markets

The simplest near term impact of a recession and credit contraction is a negative demand shock in commodity markets. The crude market got a sniff of this last week as both the US Federal Reserve and European Central Bank (ECB) hiked rates, retained their hawkish stance on inflation & appeared disinclined to acknowledge a growing banking crisis.

Brent crude fell back towards 70 $/bbl, giving up most of its gains since the recent OPEC production cut announcement. The crude market appears set to test OPEC’s resolve as economic growth slows. Economic worries are also weighing on coal & carbon market pricing. From a battery perspective, Lithium prices continue to plunge, now down 70% in the last 6 months.

This broader commodity market weakness is contributing to the pressure on European gas & power prices across 2023. As we set out in last week’s article, gas prices face a particular downside risk across summer given high storage inventory levels and inelastic sources of demand response setting prices.

US LNG projects are also being hit by both the banking crisis and weakening energy prices. Banks are tightening lending conditions, for example requiring US projects to sell a higher proportion of production volumes upfront. This is increasingly challenging against a backdrop of falling European & Asian gas prices.

If markets are right about a recession, its shape & size will be an important barometer for the scale of an associated demand shock. And the scale of policy response (in the form of monetary stimulus) will likely determine when commodity and energy prices resume what appears to be a multi-year structural uptrend.

Join our upcoming webinar

Title: “What next?” – a framework for analysing LNG market evolution & portfolio value drivers in a post-crisis world

Date: Wed 14th Jun 09:00 BST (10:00 CET, 16:00 SGT)

Registration link here, free to attend

Focus:

- Market regime framework for price evolution to 2035

- Downside risks e.g. 2023 and 2026-28 vs potential re-tightening e.g. 2024-25

- How marginal pricing dynamics are shifting post-crisis (e.g. JKM vs TTF vs DES NWE)

- Why price volatility is structurally increasing

- Implications of new market dynamics for LNG portfolio value (e.g. US tolls, regas, shipping)