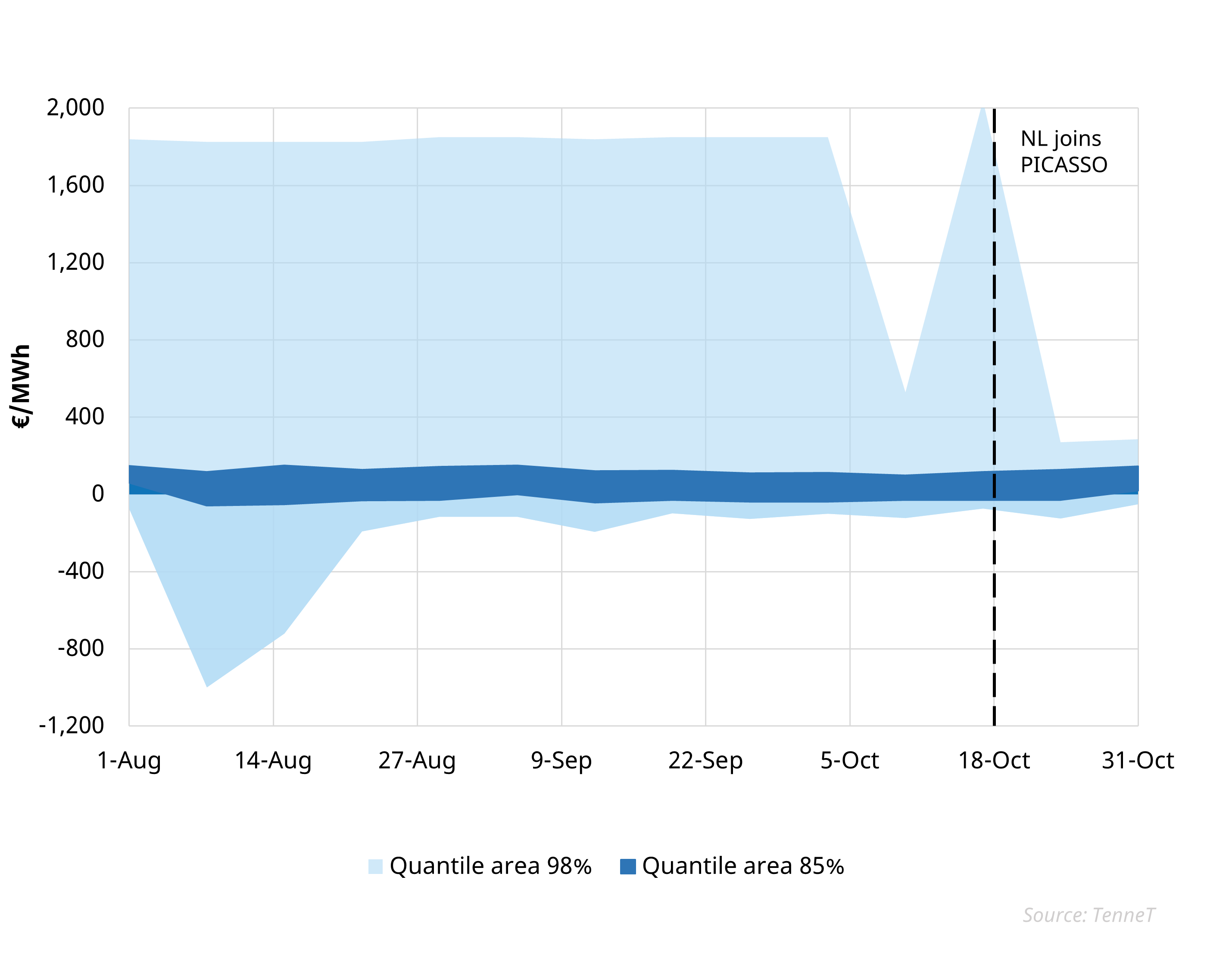

Chart shows weekly imbalance price distribution in the Netherlands – 98% quantile area

- Dutch TSO TenneT joined the cross-border (aFRR) balancing platform PICASSO on October 18, making the Netherlands, alongside Denmark, the first country to integrate with PICASSO since Italy’s suspension in March 2024.

- The Netherlands’ integration into PICASSO could stabilize Dutch imbalance prices, potentially resulting in a less volatile price environment.

- PICASSO promotes a merit order across multiple aFRR markets, which may reduce the highest-priced balancing energy bids within the Netherlands. Unlike Italian TSO Terna, TenneT has opted to base imbalance prices solely on the highest-priced bid activated domestically, thereby shielding Dutch imbalance prices from foreign price volatility that impacted Italy earlier this year.

- The chart above illustrates the quantile distribution of Dutch imbalance prices over recent weeks. Observing at the quantile area displayed, there is an apparent reduction in imbalance price volatility since the Netherlands joined PICASSO. Continued monitoring of pricing dynamics in the coming weeks will provide further insights into the longer-term effects of PICASSO participation on Dutch imbalance prices.

- Given a sharp reduction in peak imbalance prices, BESS trading an active imbalance strategy may see less opportunity going forwards following the implementation of PICASSO.