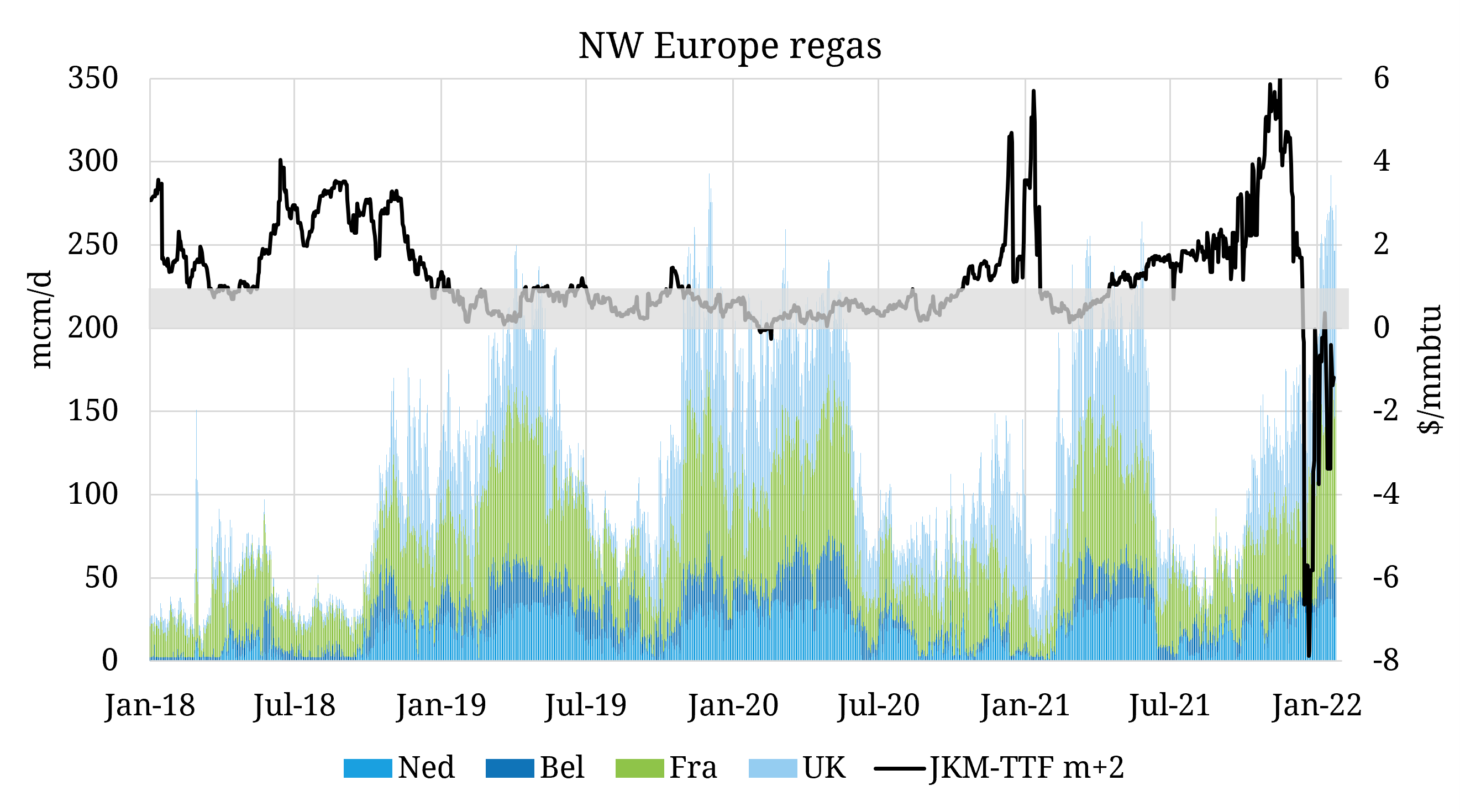

In our first snapshot of 2022, we focussed on the inverted JKM-TTF spreads signalling significant diversions of LNG on the water towards Europe. In the chart above we have included a stylised range (grey area) in which the typically marginal US molecule is more economic to go to Europe historically (dependent on freight rates). Since mid December we can see this range has been smashed through, with spreads as far negative as -8 $/mmbtu. These dynamics are now materialising in the regasification volume data in the NW European countries of Netherlands, Belgium, France and the UK. On 19th Jan, NW European sendout of 292 mcm/d touched the all-time high levels seen back in December 2019.

While the market is signalling that LNG imports are likely to remain elevated across the next few months (e.g. while JKM-TTF spreads for April have recovered slightly, they remain close to flat), focus is also on the geopolitical situation in Russia. In our feature article on Monday, we will look back at the curve evolution across the last few years as well as the current drivers of TTF pricing.