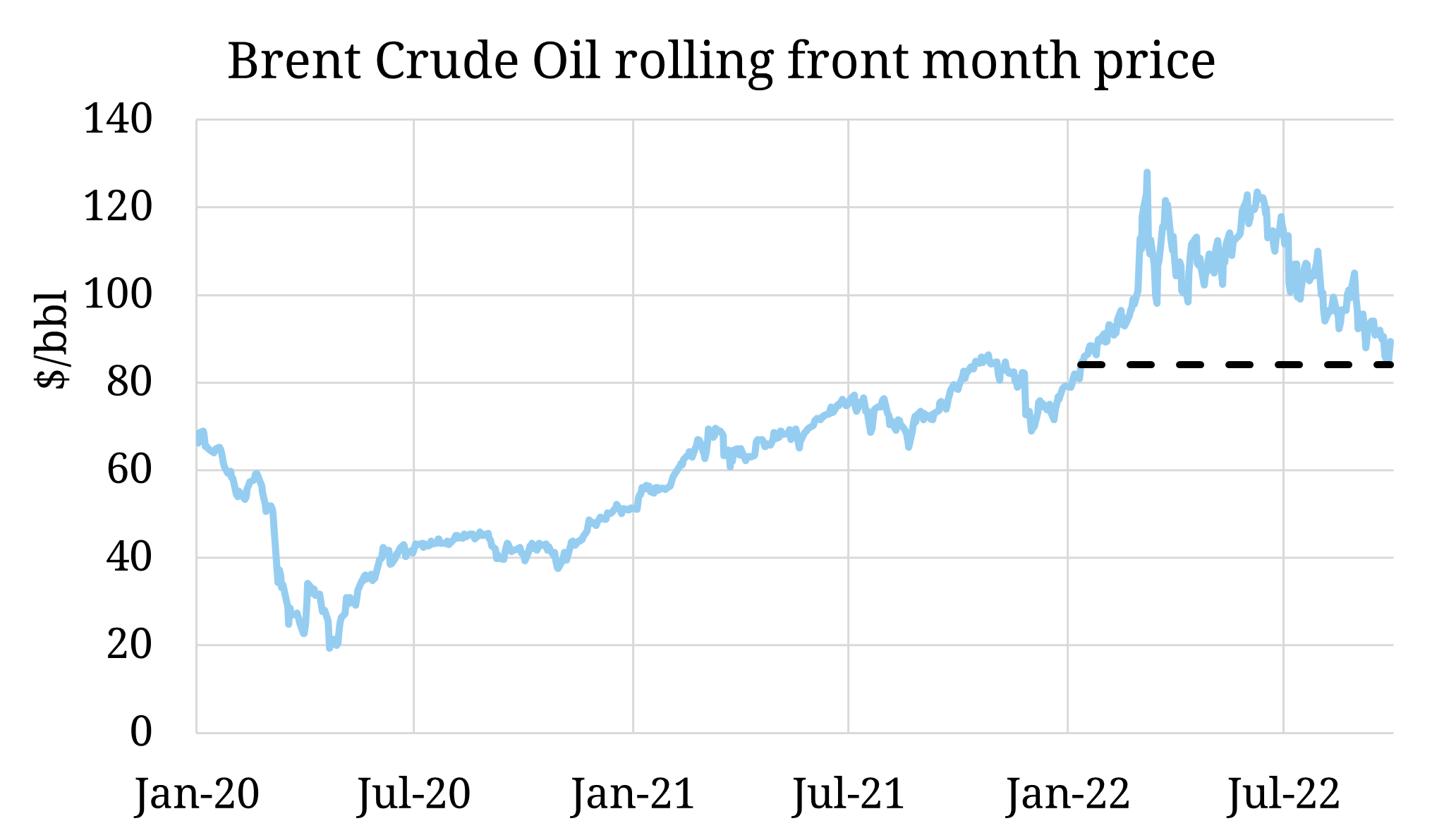

While European power and global gas market prices remain eye-wateringly high by historical standards, the Brent Crude Oil front month benchmark has been trending lower since mid-June to reach 8 month lows earlier this week.

The recent drop was preceded by a strong upwards trend since the twin strike of Covid & Saudi output increases in H1 2020. Rebounding economic growth and underperforming OPEC+ supply was exacerbated by Russia’s invasion of Ukraine, leading to highs of ~ 128 $/bbl in March.

The outlook has since softened considerably, due to a combination of (i) weak Chinese demand following zero-Covid policy (ii) strengthening value of the dollar (iii) risk of global recession (the world economy contracted in August for the first time since Q2 2020) (iv) US strategic petroleum reserve (SPR) release. The OPEC response has already begun. Production will be cut in October by 0.1 mbbl, with talks beginning for a further output cut in the next meeting on 5th October. Further support may come from impacted supply chains from December following EU sanctions on Russian oil.