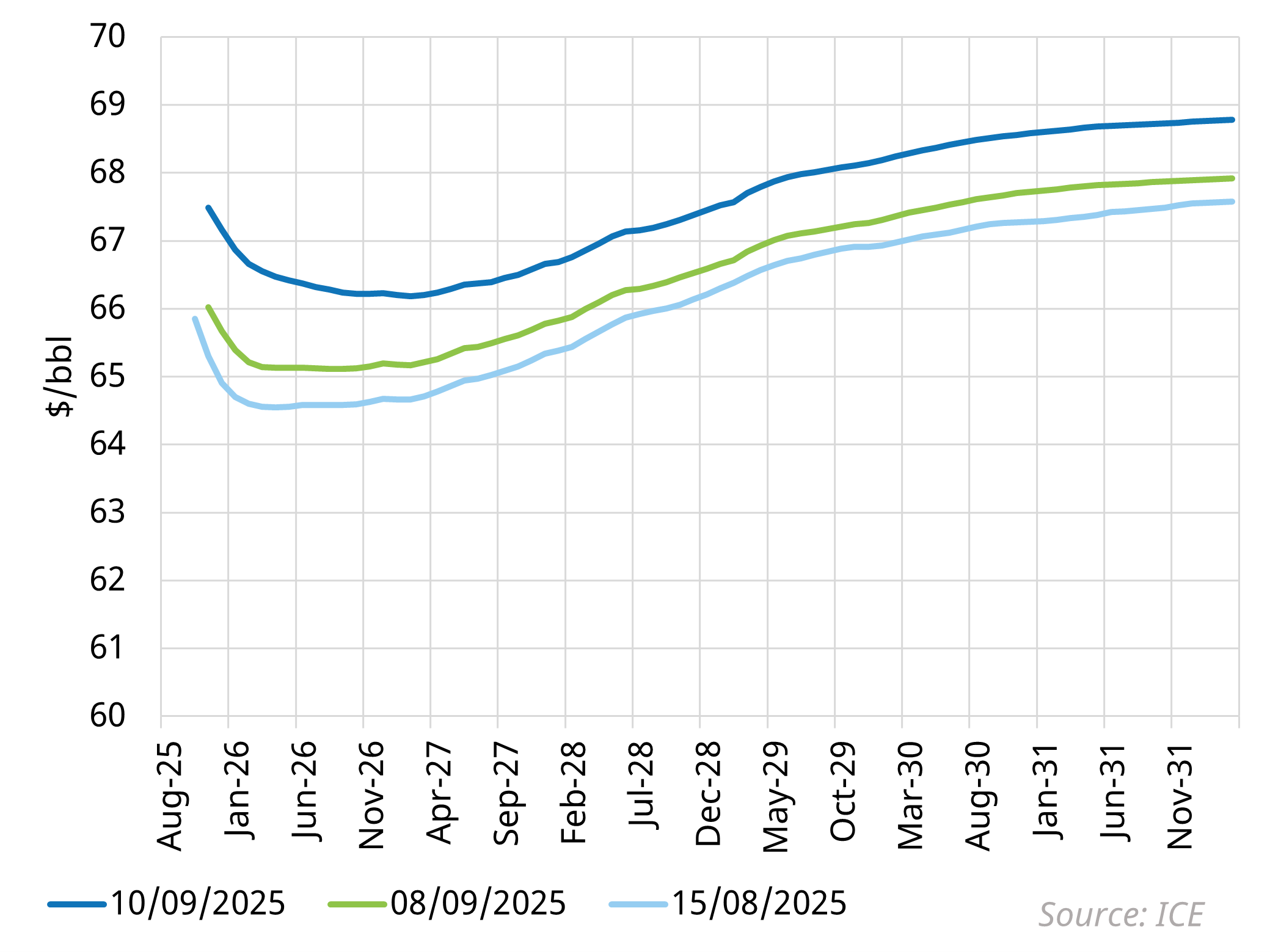

OPEC+ is set to increase supply after members agreed to further unwind production cuts. Despite the decision, market reaction has been relatively muted, with investors already pricing in the risk of additional Russian sanctions and the prospect of higher output. Brent forward curves have remained firm, defying any expectation of a correction lower.

For the gas market, Brent prices continue to hold relevance due to numerous factors, including:

- The strike price of Brent-indexed SPA deals and associated flex (i.e. take or pay flex strike price)

- The price at which we see switching gas and oil indexed products (i.e. in the industrial, power and transport segments)

- The production of associated gas in the US is tied to Brent prices, with related knock-on effects for Henry Hub (and thus US LNG delivered prices)