Plant closure decisions are usually driven by expected profit. But a simple assessment of plant profitability is usually an inadequate approach to inform a plant closure decision.

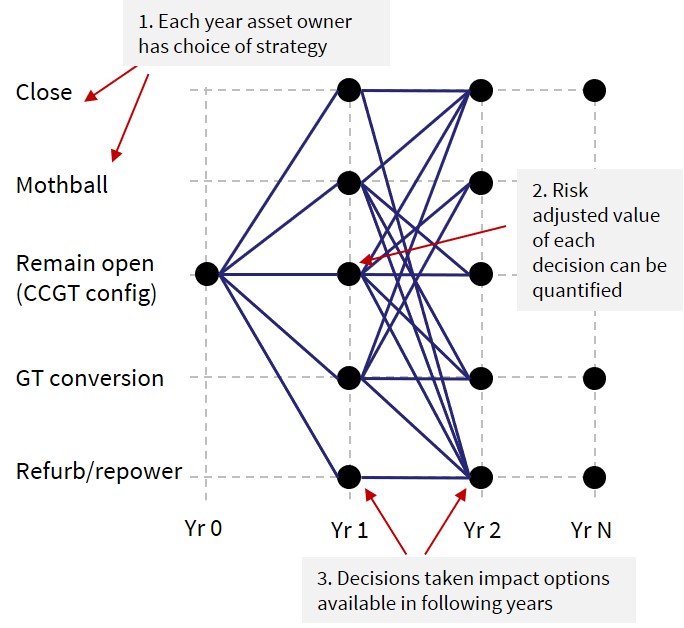

This needs to be couched within a structured investment decision framework that maps out:

- Alternative options (e.g. cost restructuring, refurb, conversion, mothball, repower, reserve contracts)

- Timing of exercise (often driven by external factors e.g. technical, policy or market related)

- Cost of exercise & in some case cost of carrying options

- Risk adjusted value of exercise (using a probabilistic approach)

A robust investment decision framework allows a plant owner to quantify and assess the risk/return distributions of alternative options as the plant progresses towards closure.

Today we follow on from last week’s article on drivers of plant closure by exploring a practical case study of CCGT end of life investment decisions.

CCGT closure vs life extension

CCGT plants usually face a key investment decision around 25 years of age. The exact timing depends on technology, run hours and operation profiles. But life extension beyond this point typically requires major capex spend e.g. relating to replacement of steam generator components.

This life renewal capex hurdle may trigger plant closure if analysed in isolation, but there are usually several other options available to plant owners, for example:

- GT conversion: Bypassing the steam generator to run the gas turbines alone (lower efficiency but often with associated fixed cost reductions)

- Refurb: capex spend to extend plant life and increase flexibility e.g. reducing minimum stable generation levels and start costs to enable greater capture of prompt, balancing & ancillary revenues

- Repower: Replacement of existing generators with new equipment, but re-using site infrastructure

- Mothball: Substantially reducing fixed costs to retain the option of reopening the plant in the future (this only makes sense for certain assets and market conditions e.g. Netherlands and Germany both have significant mothballed CCGT capacity in anticipation of a tightening capacity balance).

A structured approach is required to properly quantify and compare the relative risk/return of these different options. This requires a robust probabilistic plant modelling framework that generates realistic distributions of asset margin under each of the alternative options.

A nodal decision tree can then be constructed to estimate risk adjusted values for different investment options as illustrated in Chart 1.