“RES to provide structural support for wholesale value”

Poland is emerging as a serious contender for scalable deployment of BESS investment capital.

The first phase of BESS investment in Poland across 2022-24 was driven by attractive capacity market contracts. Recent reductions in capacity market derating factors (from 95% in 2022-23 to 13% in 2025) have been a headwind for BESS participation.

However BESS investment momentum remains strong, with value focus shifting to merchant revenues as the primary driver of value.

The Polish market has attractive near-term revenues driven by ancillary services, coupled with a strong longer term outlook underpinned by rapid renewable energy growth. This is driving a structural requirement for investment in flexible capacity.

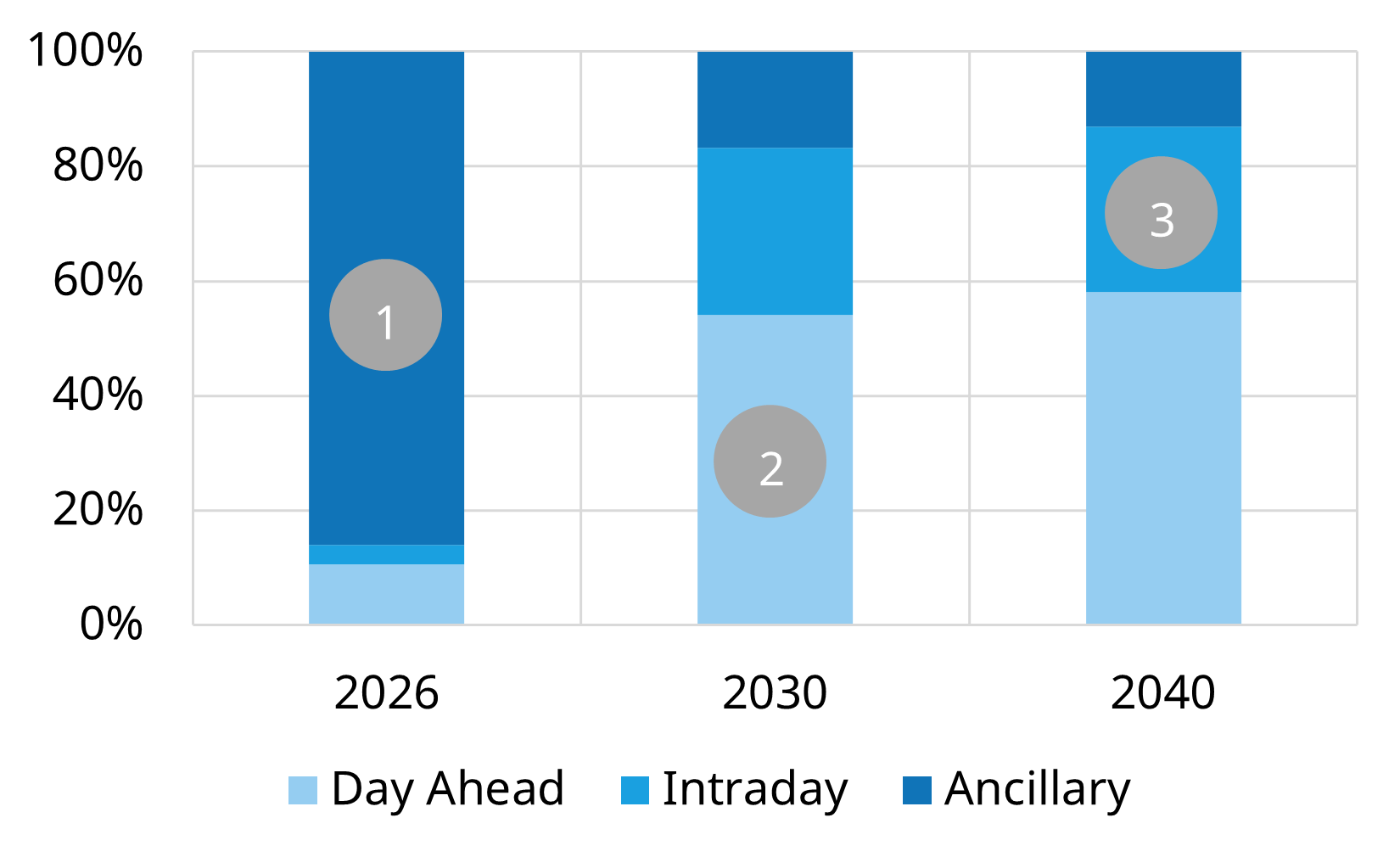

Unpacking the revenue stack

The Polish BESS revenue stack is currently heavily ancillary-led. High ancillary returns mean the contribution from day-ahead (DA) and Intraday (ID) arbitrage is relatively low.

However, our revenue modelling shows an approaching structural shift towards arbitrage driven returns, which underpin value over an investment case horizon as shown in Chart 1.

Near term ancillary boost to shift with saturation

Ancillary services currently dominate the BESS revenue stack in Poland, providing a strong boost to near-term project economics. This has been in part driven by Poland’s integration into the PICASSO aFRR platform which has expanded cross-border participation, leading to greater price dispersion and less predictable clearing outcomes. This volatility has supported ancillary revenues for flexible assets such as BESS, reinforcing the attractiveness of early deployment.

However, BESS capacity growth is set to saturate ancillary demand. As BESS participation continues to grow, early signs of price normalisation have begun to emerge across the second half of 2025. This is consistent with patterns observed in more mature BESS markets such as GB.

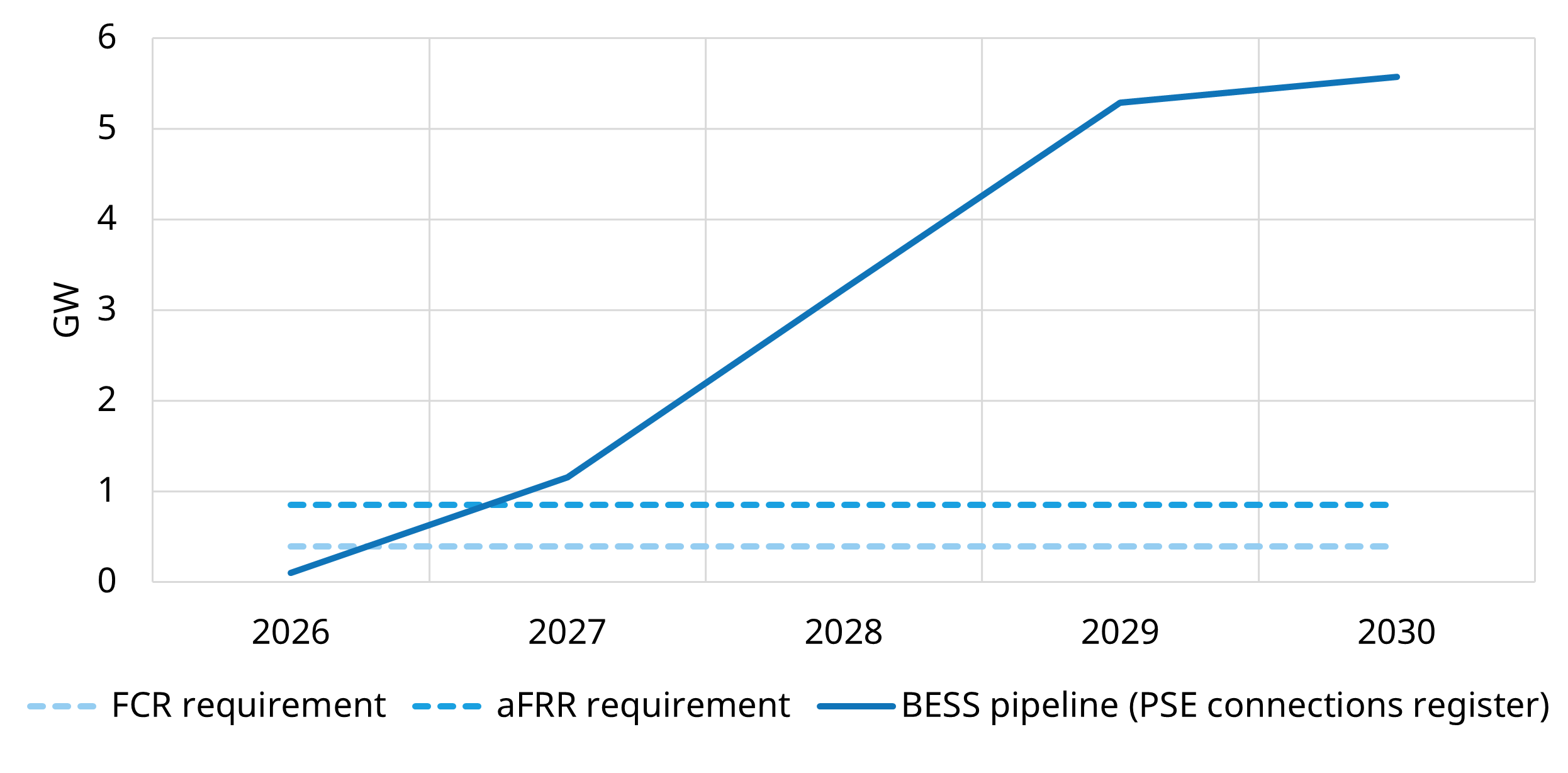

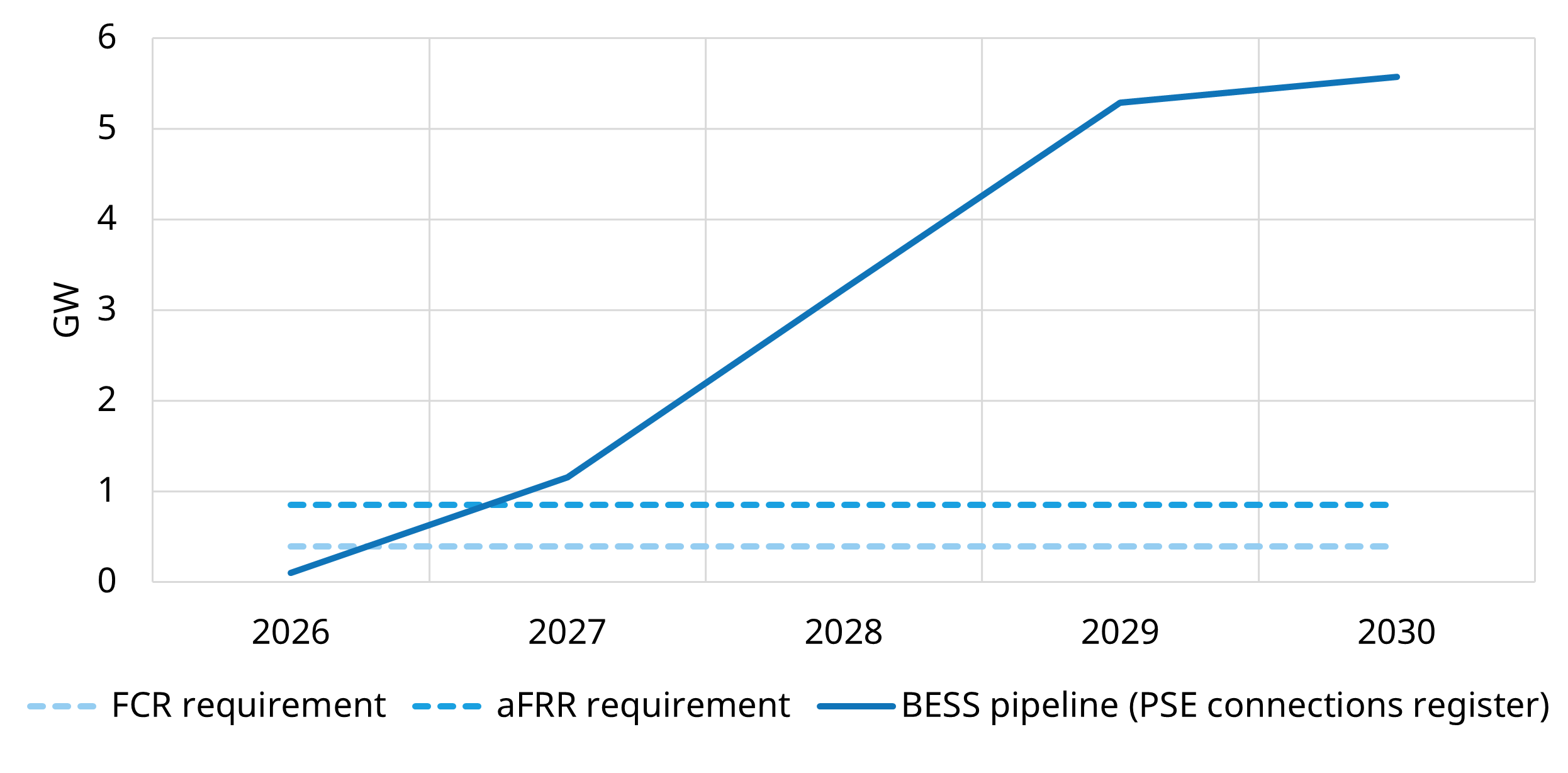

Chart 2 shows benchmarks for FCR and aFRR demand at less than 1GW versus a rapidly growing BESS capacity pipeline.

Chart 2: PSE's BESS connection pipeline vs avg. 2026 ancillary demand (GW)

Source: PSE, Timera Energy

Note: While total installed BESS capacity will likely quickly exceed FCR & aFRR volume requirements across the next few years, exact timing of ancillary saturation is highly dependent upon timing of individual projects coming online, which can often be subject to delays.

This does not undermine the investment case for BESS in Poland, but it does signal a gradual shift in the revenue stack. As reliance on ancillary services diminishes, value focus shifts to wholesale arbitrage and intraday optimisation as sustainable sources of revenue.

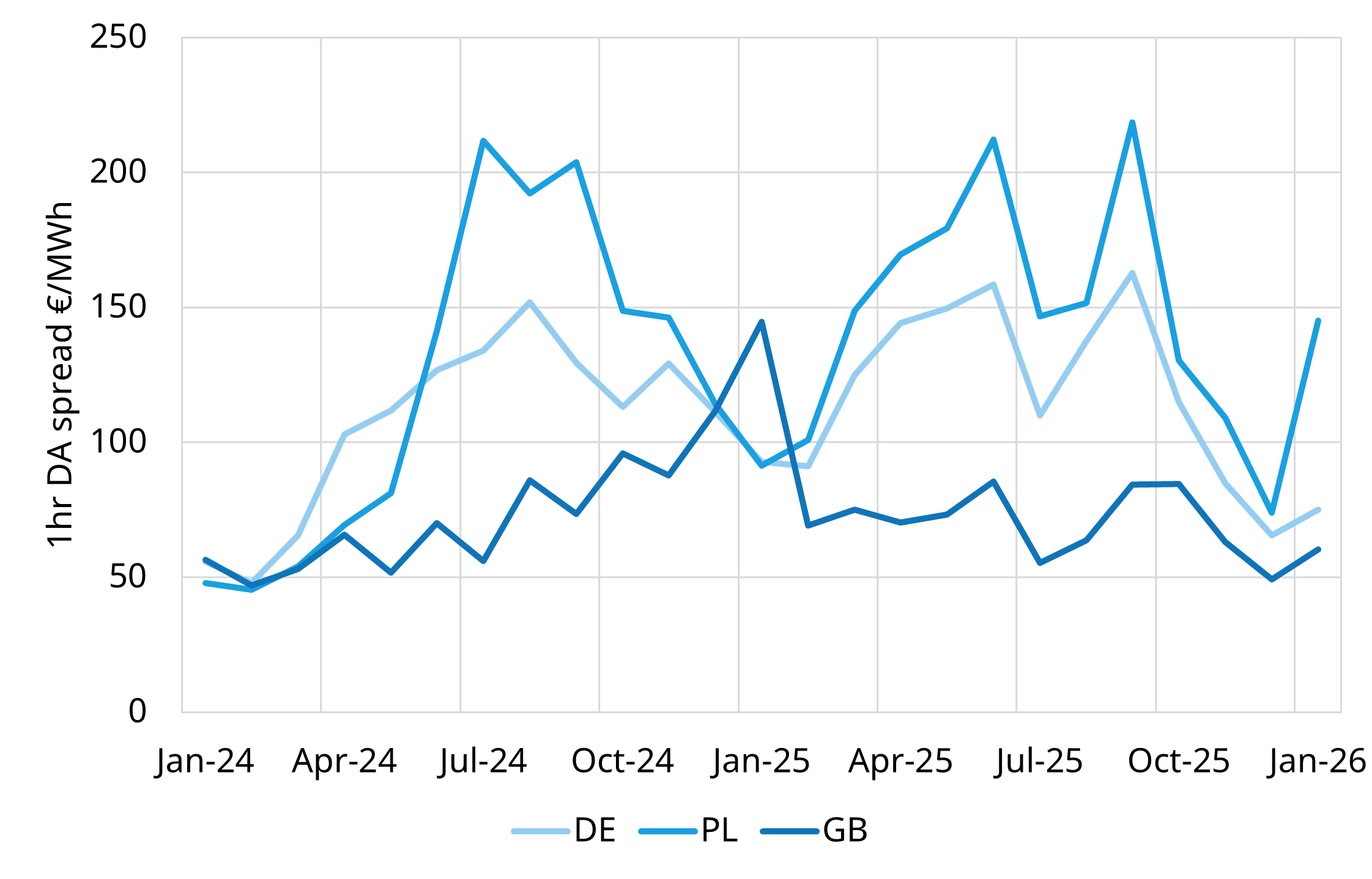

Strong day-ahead arbitrage signals

Over the past two years, elevated Day-Ahead (DA) spreads have reflected tightening system conditions, growing renewable penetration, and a generation mix still dominated by less flexible thermal plants. In June 2025, Poland reached a key milestone as renewable generation exceeded coal-fired output for the first time, signalling a clear shift in market dynamics.

Chart 3 shows relatively strong DA spreads in Poland vs for example leading BESS investment markets Germany and GB.

Although the current BESS revenue stack is dominated by lucrative ancillary opportunities, strong DA spreads bodes well for storage investment cases.

DA spreads are structurally supported by Poland’s significant renewable rollout, with wind and solar capacity projected to roughly double over the next 15 years.

Growing intraday reoptimisation opportunity

Intraday markets in Poland remain relatively illiquid compared to neighbouring systems, limiting near-term opportunities for BESS reoptimisation and material intraday revenues. In 2024, continuous intraday traded volumes in Poland totalled 1.1 TWh, significantly lower than in more mature European markets such as Belgium (6.3 TWh), the Netherlands (16.3 TWh), Great Britain (37.3 TWh), and Germany (91.3 TWh). This reflects both limited market depth and the more constrained role of intraday auctions, resulting in fragmented liquidity and lower intraday value capture for BESS today.

However RES penetration and storage flex optimisation is set to be a strong driver of intraday liquidity growth, as we have seen in markets like Germany and GB.

Rising renewable penetration is increasing aggregate forecast error between day-ahead schedules and real-time system conditions, while electrification-driven load growth is adding further uncertainty to demand profiles.

Forward-looking scenarios from PSE indicate annual electricity demand growth of around 1.9–2.5%, significantly above the ~0.6% average observed since 1990, reflecting a structural shift in demand rather than cyclical growth. Electric vehicles, heat pump deployment and industrial electrification are all set to contribute to higher and more variable system load.

Together these dynamics support material growth in intraday BESS value capture into the 2030s, as within day system balancing requirements structurally increase.

A new growth market for European BESS

Poland is emerging as a distinct next-phase growth market for European BESS investment.

Strong renewable build, early-stage high ancillary value, and a developing wholesale arbitrage opportunity combine to create an increasingly attractive risk-return profile for storage. While the capacity market provides a degree of baseline revenue support, reduced derating factors mean that value creation is shifting to Day-Ahead and Intraday revenues as the market matures.

While early projects benefit from first-mover advantages in ancillary markets, Poland’s BESS investment case increasingly rests on wholesale arbitrage revenues supported by structural system change.

Interested in more details?

Poland is one of the core power markets we cover. We provide market analysis, revenue analysis for BESS and other flexible power assets (e.g. CCGTs, peakers, hydro), as well as investment & transaction support.

If you would like more information on Polish BESS investment, or on how Timera Energy supports clients across the storage value chain, please contact Lucienne Hill Smith, Senior Analyst lucienne.hill.smith@timera-energy.com.