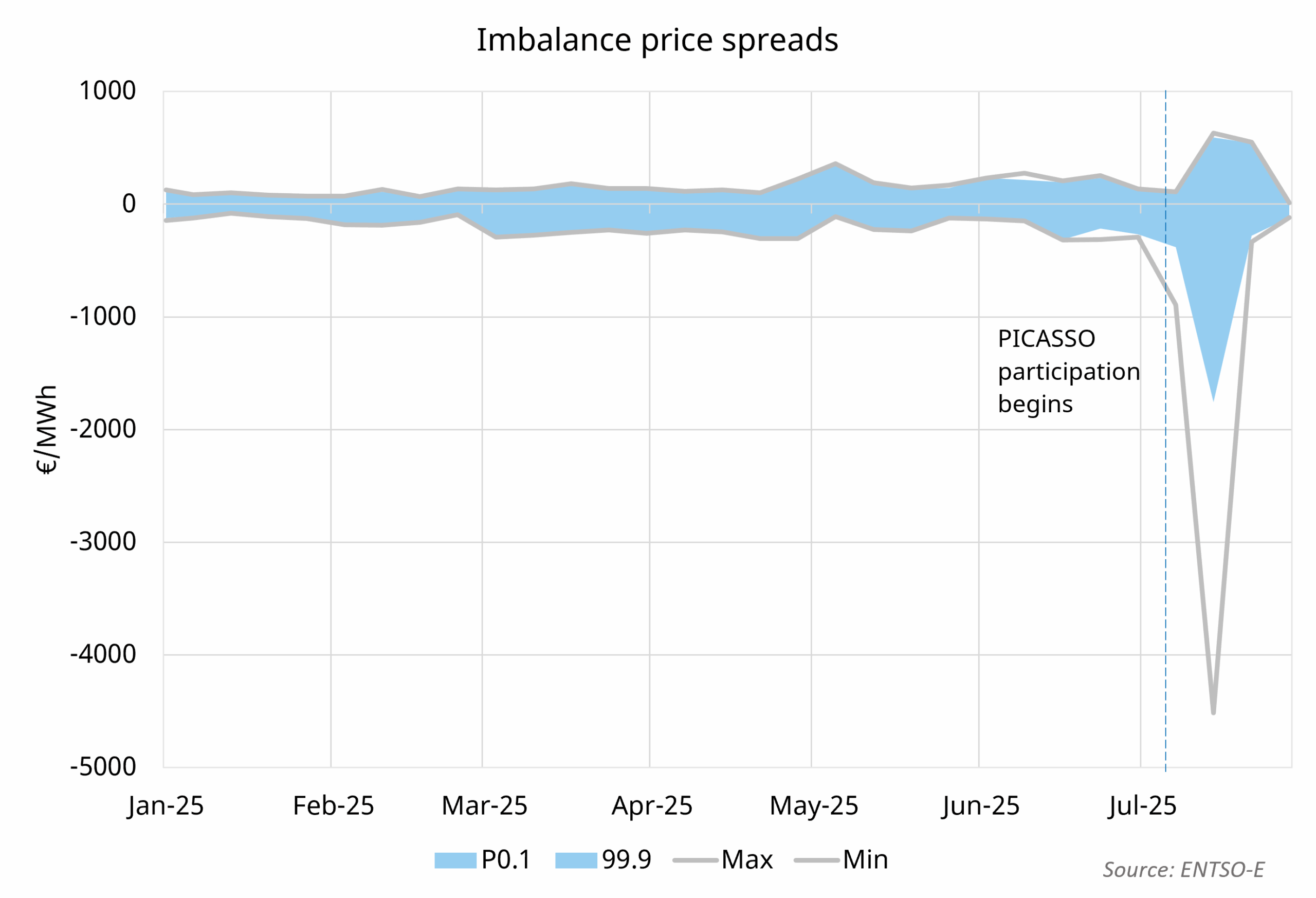

The Polish electricity system operator, PSE, recently joined the European PICASSO aFRR platform on 11 July 2025, marking the next key milestone in the evolution of Poland’s Ancillary market. This follows the broader reforms in June 2024 that aligned balancing markets arrangements with standard EU frameworks, boosting the Polish BESS business case.

Shortly after joining PICASSO, Polish imbalance prices hit an extreme low of nearly -800€/MWh on 11 July 2025. Another extreme low of around -4,500 €/MWh was recorded on 20 July 2025. Changes in imbalance price volatility have been observed in other countries after PICASSO integration, leading to caution and regulatory assessment on the best practices for including aFRR PICASSO prices within the computation of imbalance prices. This became a core topic after the dramatic impact seen in Italy on imbalance prices and RES business case after PICASSO integration in 2023-2024. (Italy suspends Picasso aFRR participation – Timera Energy)

Price volatility has huge imbalance risk for market participants, especially for RES generation and more heavily when BRP rely on the same weather forecasts to trade their capacity. BESS assets can instead benefit from this volatility either through balancing activation or through active imbalance strategies, if allowed in the reference market.

Want more analysis & investment insights?

Timera supports investment analysis and commercial due diligence for BESS and other flexible assets in Poland. For more information or to discuss how we can support your project, please contact steven.coppack@timera-energy.com.