Demand has historically been difficult to project, and Germany is a clear case in point. For years, forecasts assumed a faster electrification driven rebound from EVs and heat pumps, yet demand has instead stagnated and at times declined. A key driver of this for DE has been weaker industrial demand, reflecting structural pressures such as international competition, notably from China in the automotive sector. More recent data from the Federal Statistics Office shows manufacturing orders picking up into late-2025, potentially reflecting a mix of factors including the introduction of the industrial power price subsidy and broader fiscal stimulus, but it remains too early to judge whether this marks a durable shift in the power demand trend. Looking ahead, this uncertainty is reflected in revised Government forecasts which now assumes demand of around 600–700 TWh by 2030, down from its previous 650–750 TWh range (against ~520TWh at the start of 2026).

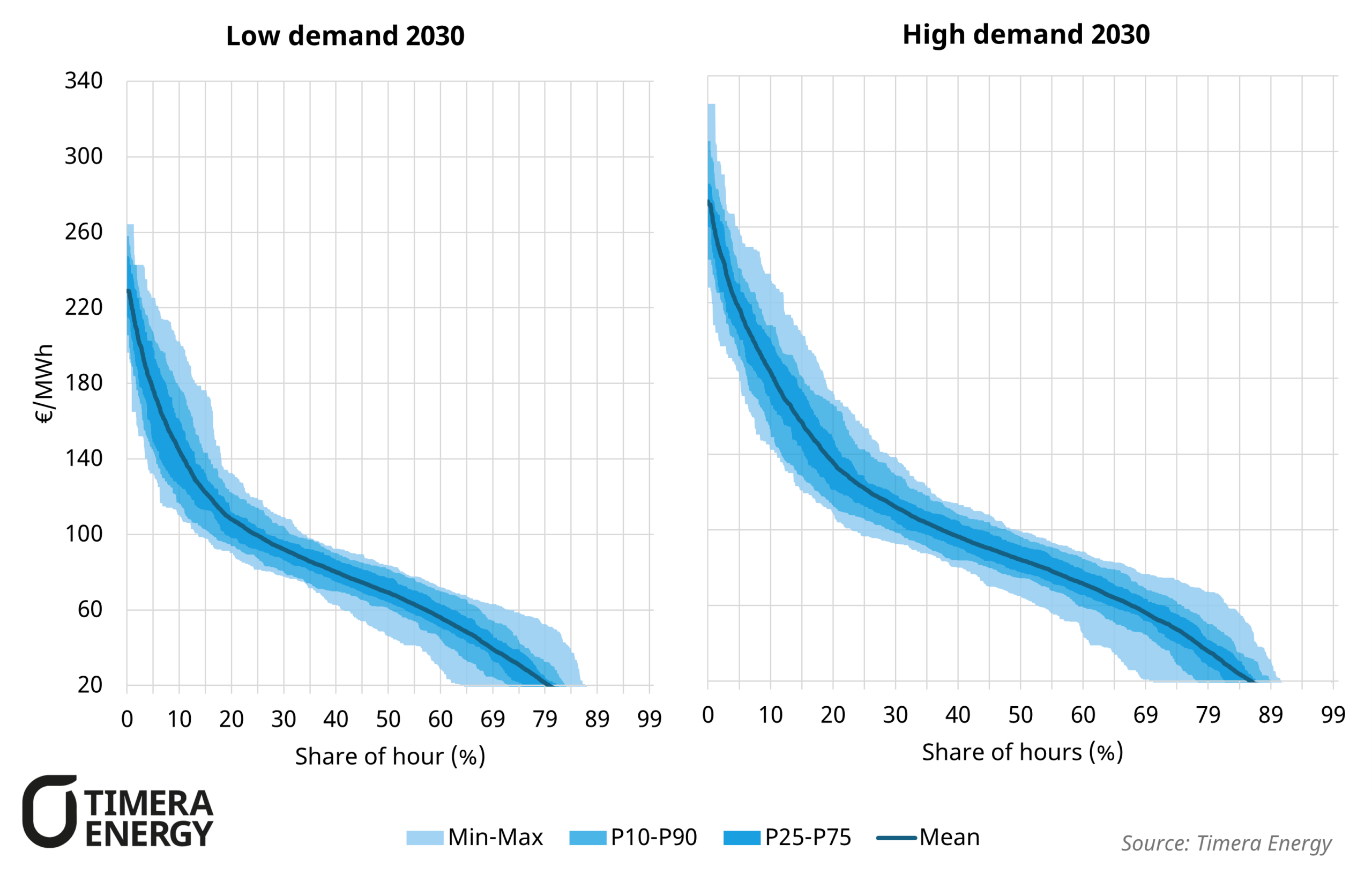

To illustrate the impact of demand shifts we have modelled a low demand growth case (540 TWh by 2030) and a higher demand growth case (650 TWh by 2030), with the 2030 PDCs displaying the resulting power price formation (note: all other assumptions kept static).

In the higher demand case, the PDC shifts up and the upper tail widens as scarcity pricing becomes more frequent. Importantly, higher demand does not just lift average prices as expected, but also broadens the range of outcomes at the top end of the distribution, reflecting increased market volatility and a greater incidence of tight system conditions.

This has a direct impact on the economics of flexible assets: higher baseload levels and fatter price tails improve value capture for gas plant, with base Clean Spark Spreads rising from ~2 €/MWh in the low demand case to ~9 €/MWh in the high. For BESS, 1hr spreads are around 20% higher in the high demand case compared with the low case. We highlighted a similar dynamic in our Monday blog, which explored different RES and gas build-out pathways in the GB market, illustrating how stochastic modelling can capture shifts in volatility and scarcity effects that are typically missed in a deterministic approach.

Stochastic modelling of various market scenarios is increasingly critical for capturing both value and risk in flexible asset investments, particularly in the context of a rapidly evolving German power market and regulatory landscape. If you’d like to discuss our modelling approach in more depth or our views of DE and European power markets, feel free to reach out to Sam Kayne (Principal) sam.kayne@timera-energy.com.