European gas storage assets experienced a surge in margins across 2021-22. The energy crisis saw seasonal price spreads widening and extreme price volatility, powerful drivers of storage value capture.

Storage returns have eased across 2023-25 but remain significantly above pre-crisis levels. A major post-crisis challenge has been backwardated (downward sloping) forward curves. These have acted to erode the summer/winter price spreads which are the key driver of storage intrinsic value.

However despite a more difficult intrinsic value environment, post-crisis storage returns have been supported by structurally higher price & spread volatility.

In today’s article we set out analysis of the evolution of storage returns and key value drivers.

Checking the pulse of storage commercial drivers

The client work we are doing with storage asset owners & capacity buyers is a useful indication of current commercial issues in the market.

Most of the key commercial focus areas we are seeing in 2025 relate to the shift in storage value capture from intrinsic (e.g. seasonal price spreads) to extrinsic value (price volatility generated returns). Some examples:

- A return of storage asset transaction activity, reflecting the post crisis evolution of asset risk / return profile

- Re-assessment of long term asset valuations given post-crisis market conditions

- Changes in offtake contract structuring to reflect shifts in intrinsic / extrinsic value

- Evolving capacity management & optimisation approaches in response to changing market dynamics.

In terms of current market drivers, there is a focus on:

Now let’s have a look at some analysis of how these drivers are impacting storage returns.

Evolution of storage returns

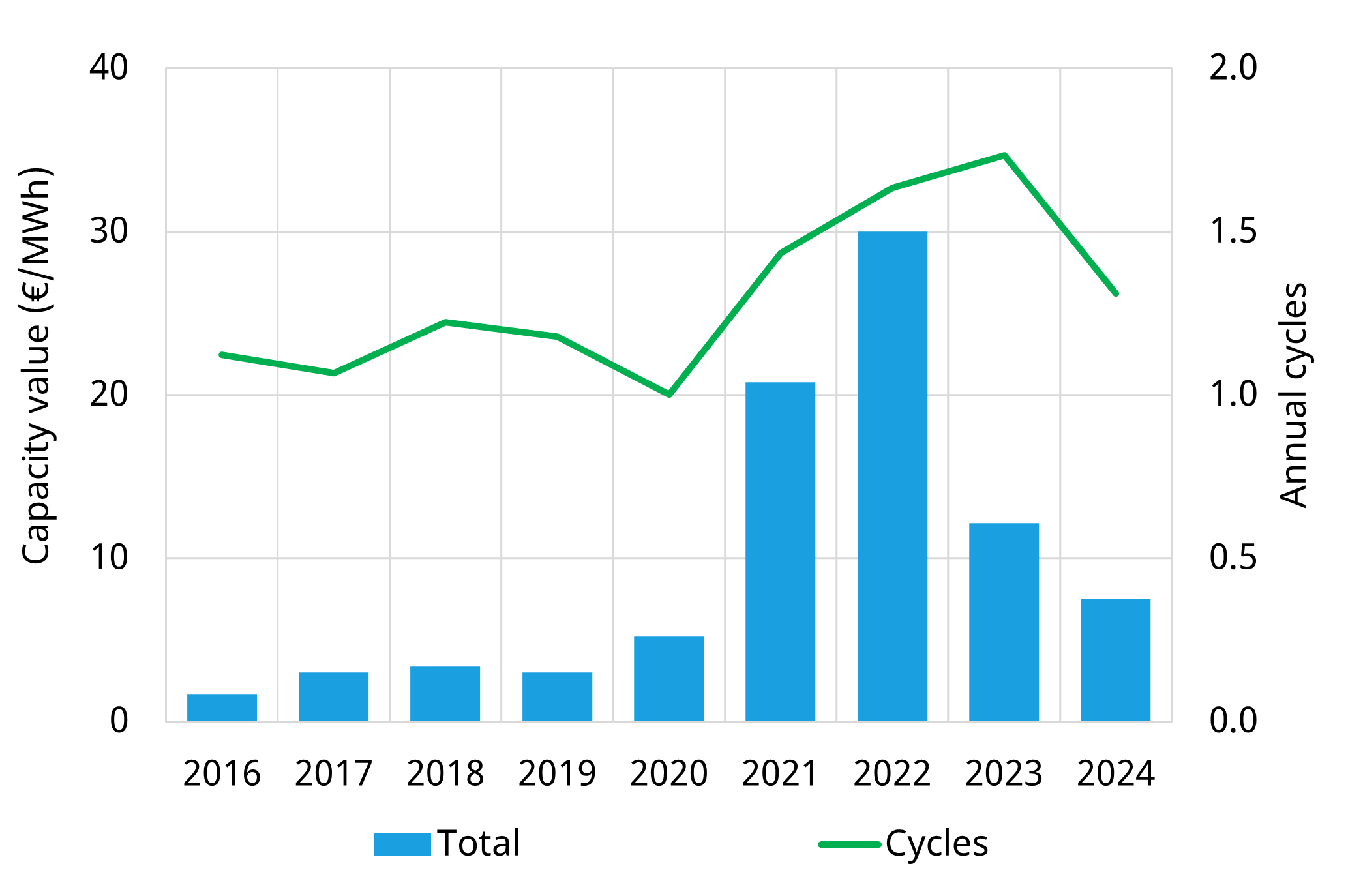

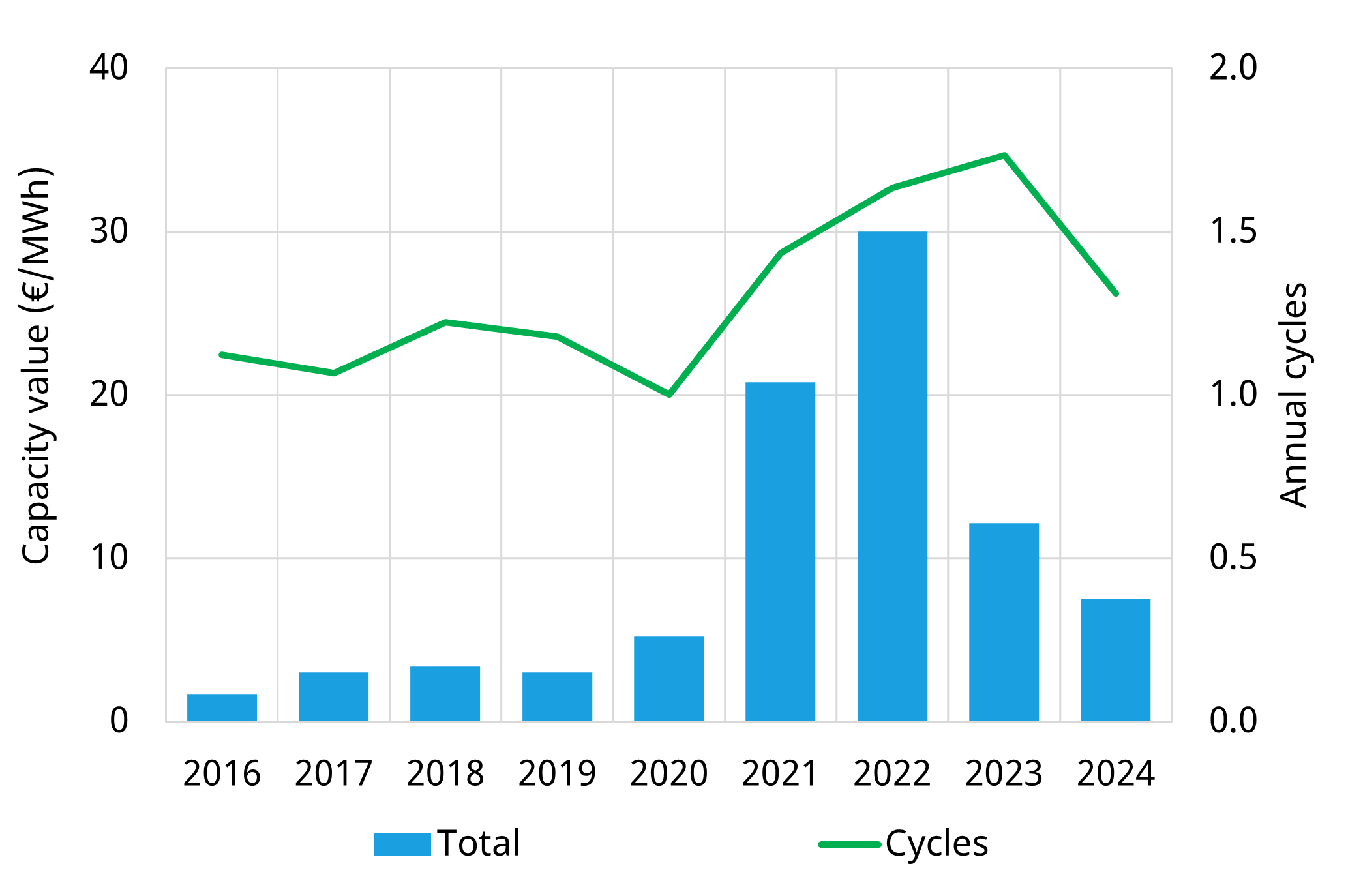

It is easiest to understand the evolution of storage asset value capture by looking at a case study asset. In Chart 1 we use our rolling intrinsic gas storage model to show the annual returns of a generic seasonal storage asset (180 day cycling time) with access to the TTF price hub.

Returns are shown for storage years i.e. 2024 represents 1st Apr 2024 to 31 Mar .

Chart 1: Revenue capture from a 180 day cycle storage asset

Source: Timera rolling intrinsic gas storage model; note: years are Apr-Mar storage years

We use our gas storage modelling framework to analyse value capture from a rolling intrinsic strategy based on available forward price information across each day of the storage year. We assume modelled storage capacity starts and finishes the storage year with zero inventory (consistent with a one year storage contract).

In our last article on storage, we discussed how gas storage asset value remained structurally higher compared to pre-crisis levels despite market tightness easing. Value capture is being supported by ongoing volatility in price spreads rather than extreme structural price divergences (as seen in 2022). This allows storage capacity owners to capitalise on trading opportunities arising from within-year price volatility vs relying on the traditional seasonal spread driven trading strategy.

The 2024 storage year saw continuation of market trends from 2023, as observed price volatility diminished and forward curve market structure shifted back to historical norms.

Results from last year showed an increase in intrinsic value (closer to pre-crisis levels). This has been due to a return to structural contango & seasonal spreads, while extrinsic value decreased with price volatility vs crisis years (21/22), although higher than pre-crisis levels given structurally higher volatility.

Results from our backtest of storage year 2024 demonstrate a continuation of this trend. Backtested value decreased by 38% in 2024 (to €7.5/MWh) relative to 2023 (€12.2/MWh), however returns in 2024 are at least double those of pre-crisis years.

Price spread evolution

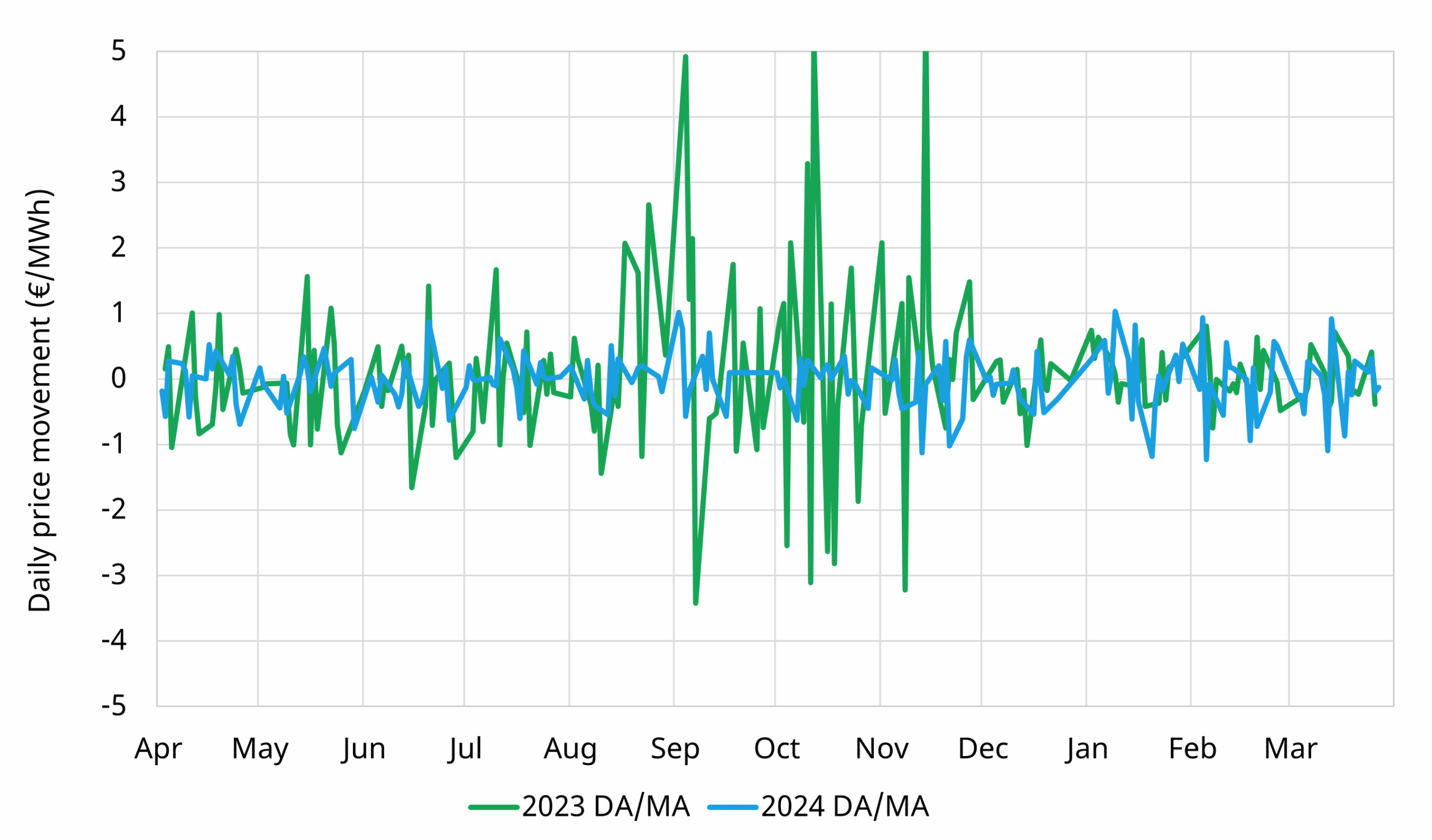

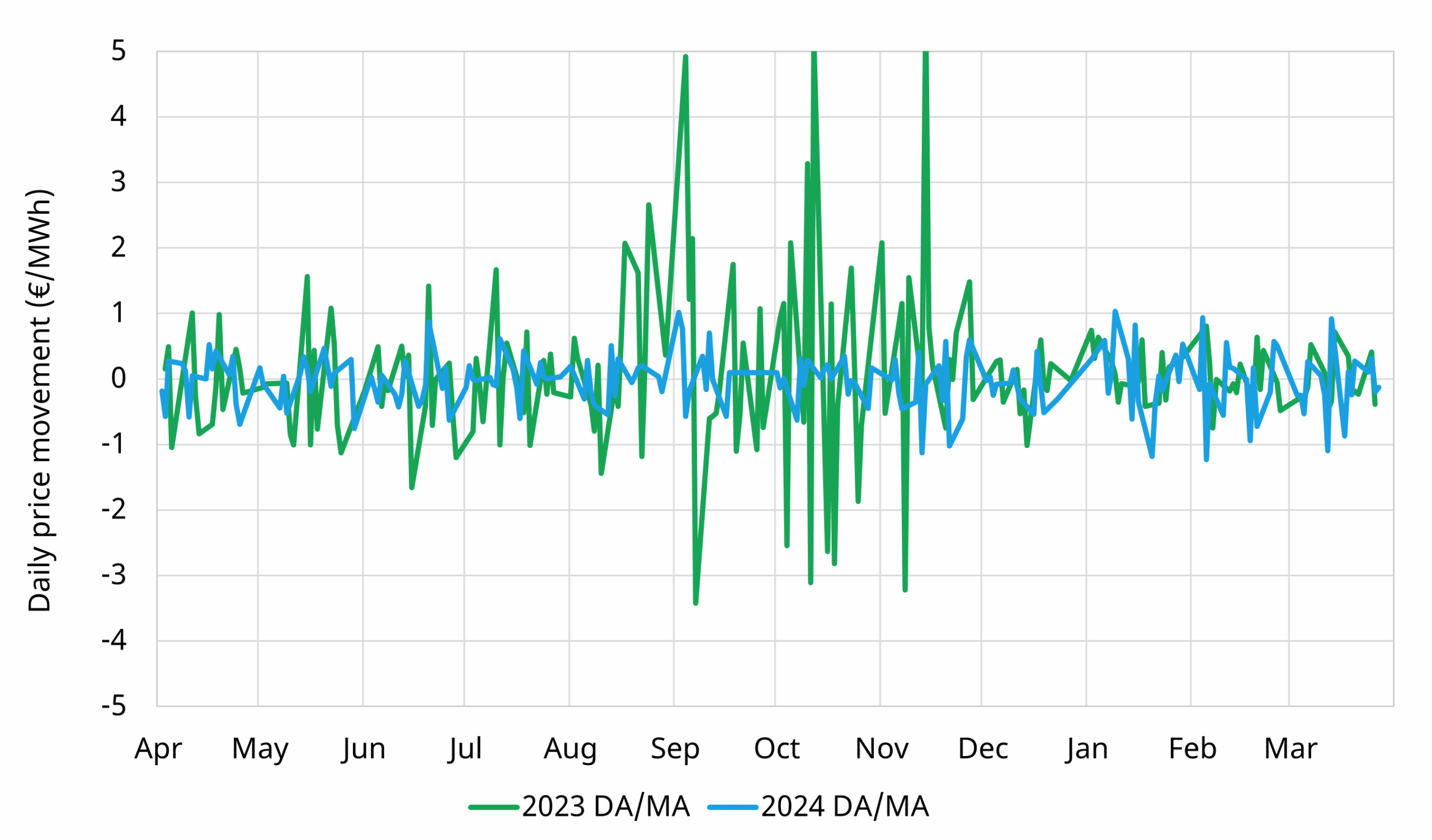

The level and volatility of price spreads underpin storage value capture. In Chart 2 we show the historical evolution of the important Day-Ahead vs Month-Ahead spread.

Chart 2: TTF Day-Ahead vs Month-Ahead price spread evolution (2023-2024)

Source: Spectron, Timera Energy

Chart 2 shows that average daily price movements of the day ahead to month ahead spread in storage year 2024 (€0.03/MWh) were less than half those in 2023 (€0.07/MWh). Storage year 2023 showed periods of steep structural contango across Q4-23 into the beginning of Q1-24 as the market priced in high forward risk premium in Month-Ahead vs secure near-term supply outlook.

There were periods in storage year 2024 where a relatively large contango emerged (Sep, Nov), but the magnitude is significantly lower than storage year 2023 due to erosion of forward market risk premium as market tightness eased.

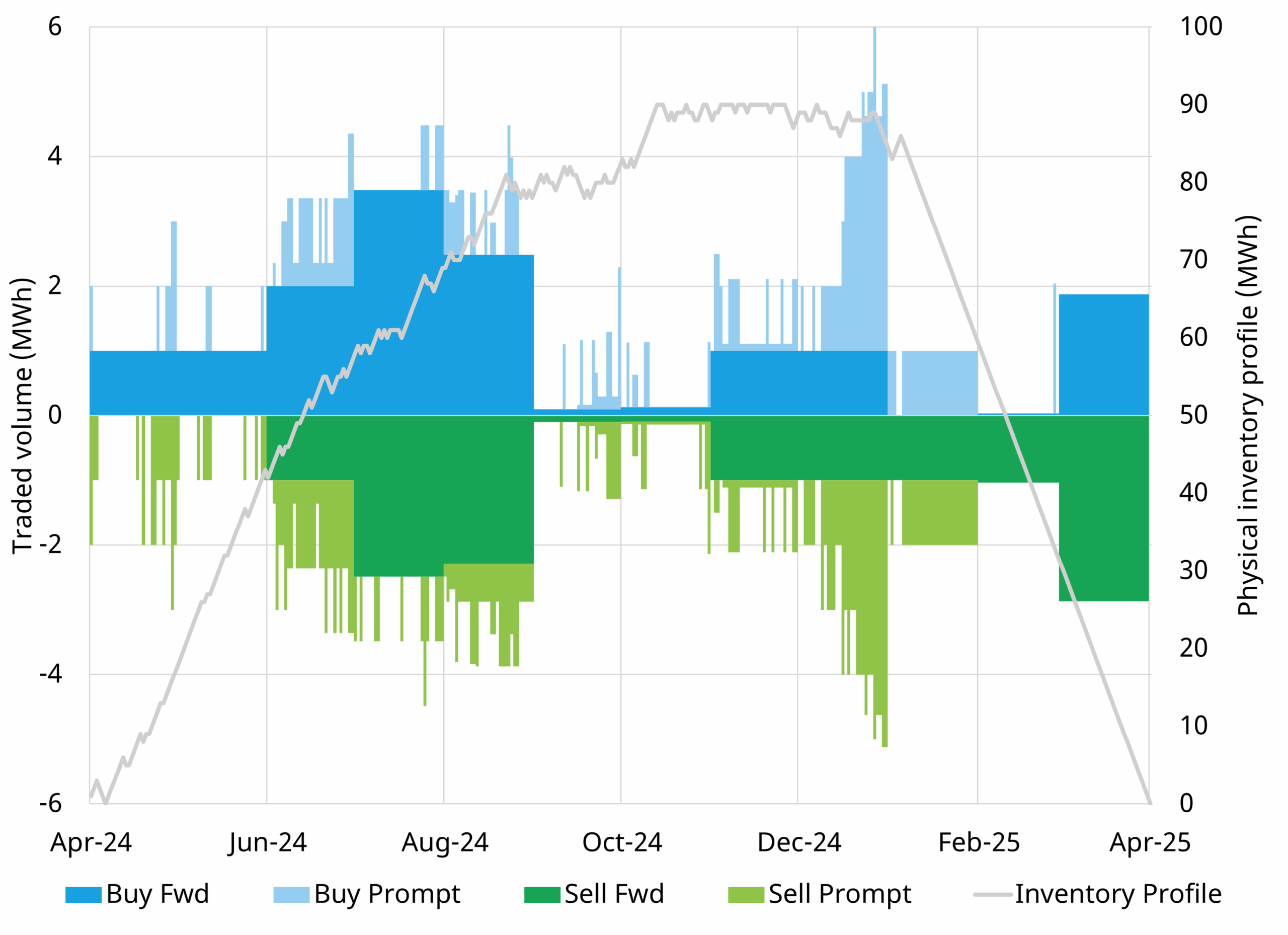

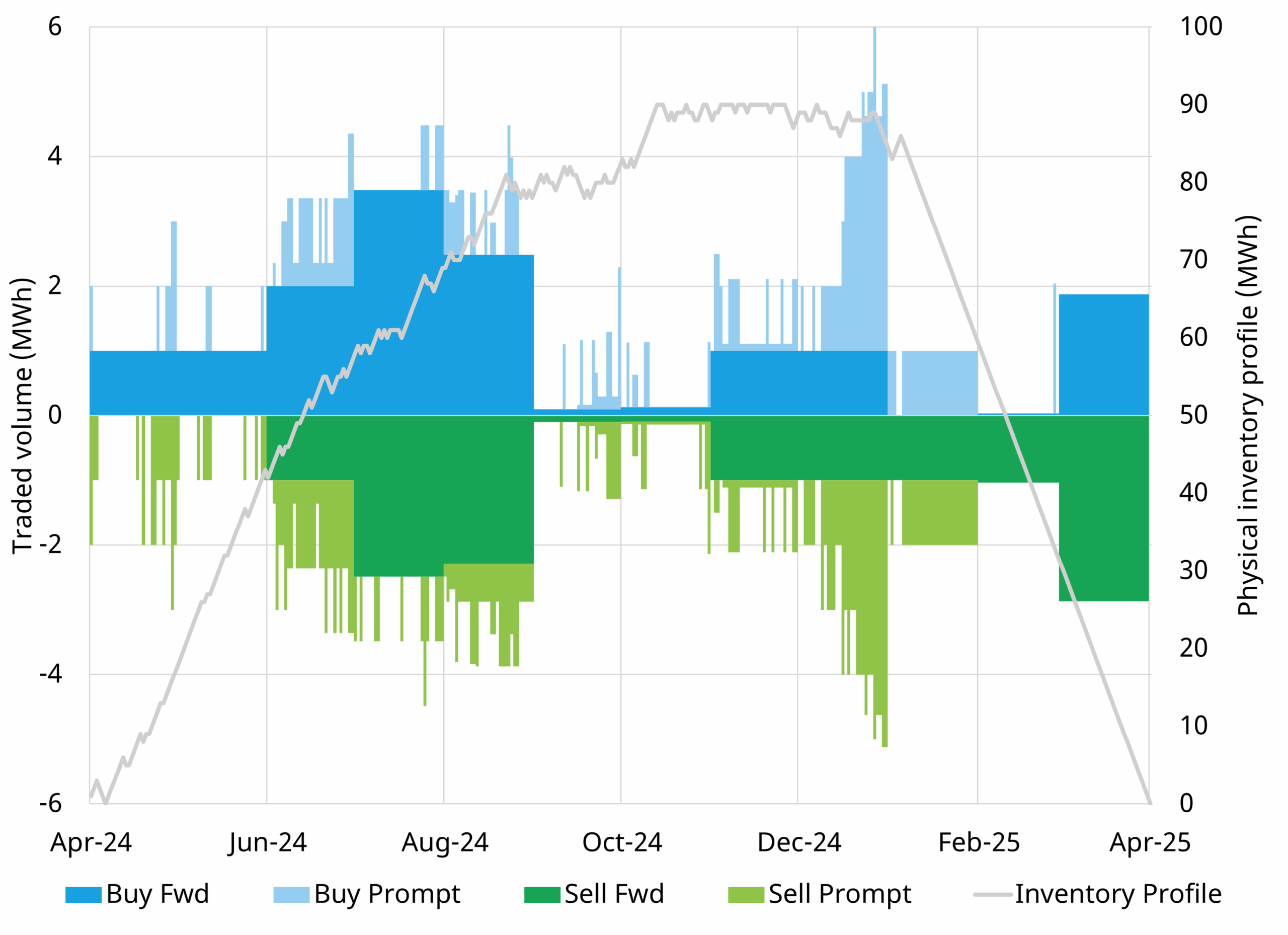

In Chart 3 we illustrate how the 180 day asset we modelled for Chart 1 is cycling and capturing value via a rolling intrinsic trading strategy.

Chart 3: Storage asset cycling & trading churn activity

Source: Timera rolling intrinsic gas storage model

Chart 3 illustrates the theoretical backtested trading activity required to monetise the storage value across 2024. It shows a combination of forward trading (month ahead trades shown in dark blue and green) to lock in value form seasonal shape and within-month trades (shown in light green and blue) to generate additional value from short term volatility.

The key takeaway here? Storage value capture is being underpinned by more agile commercial and valuation strategies given the relative shift from intrinsic to extrinsic value in a post-crisis world.

Post crisis, gas storage has become an important source of flexibility for managing national and European energy security of supply. A structural shift in market conditions has boosted storage value capture relative to pre-crisis levels. Despite this it is a challenging time for storage asset owners given a higher portion of value capture accruing to capacity buyers, rapidly changing market dynamics and higher earnings & regulatory risk.

For more information on our services in the gas storage space, please contact David Duncan (Director, LNG & Gas) at david.duncan@timera-energy.com.