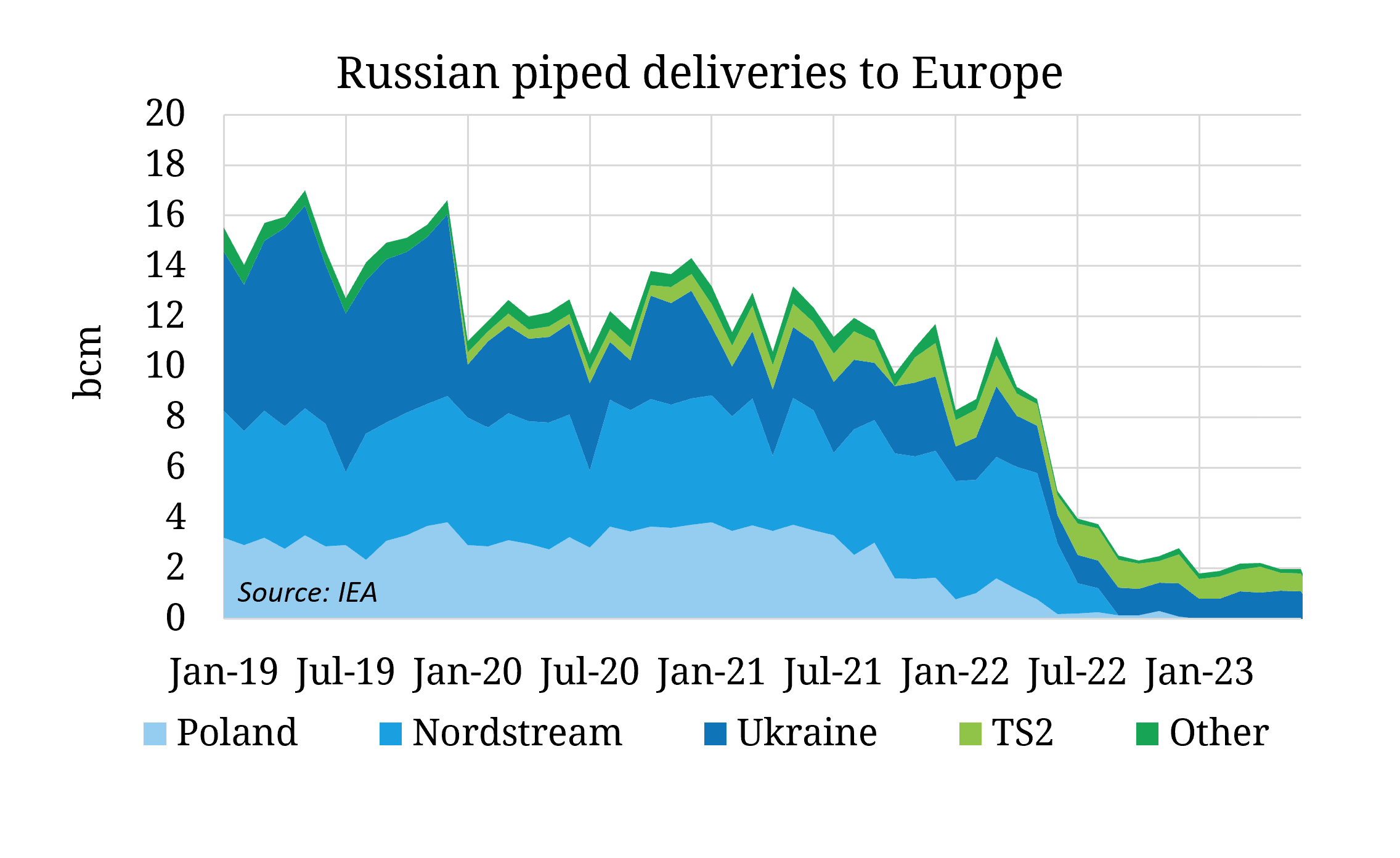

Following the Wagner mutiny two months ago, we covered the key tail risks to Russian gas & oil exports. In today’s piece we take a step back and review the current landscape of Russian pipeline gas exports to Europe.

Since 2019 (~173 bcma) Russian pipeline gas exports have fallen precipitously led by:

- The drop in 2020, following renegotiation of the transit agreement via Ukraine and on the back of low prices in Europe

- The fall of flows via Poland from Q4’21 as Russia began to ramp up pressure on the European energy system

- The cessation of Nordstream 1 flows in September 2022, post Russia’s invasion of Ukraine

We are now left with Russian piped exports to Europe via two key routes:

- ~12 bcma via Ukraine; transit to end in Dec 2024, arbitration & war risks could bring flows to a halt before then

- ~12 bcma via Turksteam; less likely to be at risk given the geopolitical alignment of countries receiving the gas via this route

Russia has played most of its cards, driving a massive European pivot to LNG and a period of unprecedented price formation over the past 18 months. While further downside to their piped exports is limited, continued tightness through 2025 means that disruption to remaining Ukrainian flows remains a key upside risk to absolute price levels, with the uncertainty over their outlook supportive of continued volatility.