In the latest Review of Electricity Market Arrangements (REMA) update, published on the 10 th July 2025, the UK government confirmed it will not proceed with zonal pricing, but will move ahead with a reformed national pricing model. This decision, while anticipated, reflects the government’s focus on maintaining investor confidence and avoiding near-term market disruption which could de-rail its Clean Power 2030 goals.

The need for robust locational pricing signals remains a central challenge in GB. The government’s preferred route to achieve this within a national pricing framework is through reforming Transmission Network Use of System (TNUoS) charges, alongside more systematic planning and grid access reforms. This will be delivered through TM04+ reforms and the development of the Strategic Spatial Energy Plan (SSEP), which aims to direct infrastructure investment to locations that maximise system value.

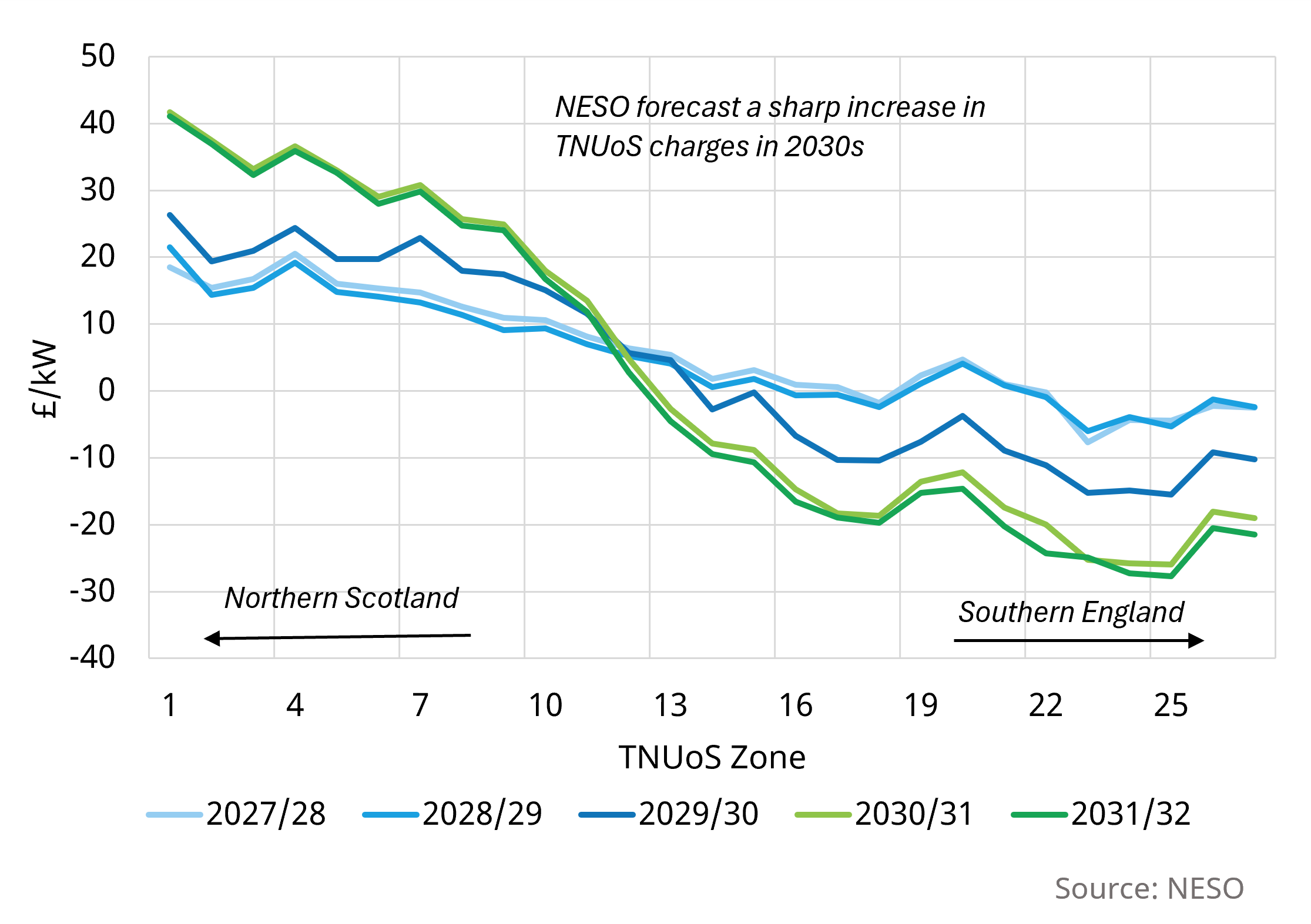

TNUoS prices are forecast to rise sharply and remain volatile through the 2030s, making it difficult to forecast long-term project economics, and is particularly challenging for developments in areas facing higher charges (e.g. Scotland). Conversely, potential for BESS margin uplift through congestion driven opportunities in the Balancing Mechanism remain relevant now that national pricing is to be retained.

The proposal under CMP444, which suggested a temporary cap and floor on TNUoS charges to reduce this uncertainty, is currently not supported by Ofgem. Ofgem instead favours enduring reform and has signalled that a robust new framework should be in place by 2029. In the meantime, the lack of clarity on TNUoS reform will be a major area of market uncertainty for developers.

Beyond national pricing reforms, other key areas of REMA reform to watch are:

- Shortening imbalance settlement periods from 30 to 15 or 5 minutes, a reform that will sharpen price signals and be particularly beneficial for BESS

- Capacity Market reform to better support long-duration storage, demand side response (DSR) and low-carbon technologies, potentially shifting capacity value away from gas assets like CCGTs and engines.

- Lowering the Balancing Mechanism (BM) participation threshold, opening up access for smaller-scale batteries and distributed assets to directly provide balancing services.

- Restricting trading post gate closure, which could limit the ability of flexible assets such as BESS to re-optimise positions in real-time, reducing their ability to capture late market value.

If you would to discuss the commercial impacts of these changes, or if you have any other questions, please get in touch with our Power Director, Steven Coppack (steven.coppack@timera-energy.com).

Want more analysis & investment insights?

We offer subscription service products tailored for BESS investors in GB, Germany, the Netherlands, and Italy. Our GB package subscription will take a more detailed look at what the latest REMA update means for BESS projects. Feel free to get in touch if you would like more details or free sample material.