Shale gas has been a pet interest of the UK Prime Minister David Cameron and his Chancellor George Osborne. The top two Tories have been painting a picture of a potential UK shale gas revolution, with investment in unconventional gas production dramatically reducing Britain’s energy costs.

In the words of the Prime Minister in July 2013:

In America they are now almost self-sufficient in gas. Their gas prices to business are now less than half as much as ours are and the reason for this is they have put a lot of investment into unconventional gas.

Having presided over a period of uncomfortable rises in energy bills, a US style shale gas revolution must seem like an attractive prospect. But the prospect of UK shale production having a substantial impact on UK energy prices is nonsense, given the UK’s interconnection with the European and global gas markets. Despite this fact, sections of the UK government and UK press have jumped on a consultant report released by DECC as evidence of the potential for UK shale gas production to reduce gas prices. This misrepresents the findings of the report and illustrates the growing gap between the government’s rhetoric and reality on shale gas.

UK shale gas in context

There have recently been some positive signs for shale gas development in the UK. The British Geological Survey announced a substantial rise in UK shale gas resource estimates to 1300 tcf (36 TCM) in June. While a large portion of those reserves may never be economically recoverable, Centrica’s 25% investment in the UK’s largest shale gas company Cuadrilla has provided a boost to the commercial prospects for UK shale.

But two big hurdles remain for UK developers in the form of environmental and infrastructure planning constraints. Evidence from the US and Australia suggests that if the public is going to remain onside, it is important for the government to ensure robust and transparent regulation of these areas. Recognising these constraints, it makes sense for the government to provide tax breaks for development of the UK’s unconventional gas reserves to replace the rapidly declining reserves in the UK North Sea. But the government’s mistake is trying to drum up support for shale gas based on a false premise. This is about jobs and security of supply, not lower UK gas prices.

DECCs report does not link UK shale with lower prices

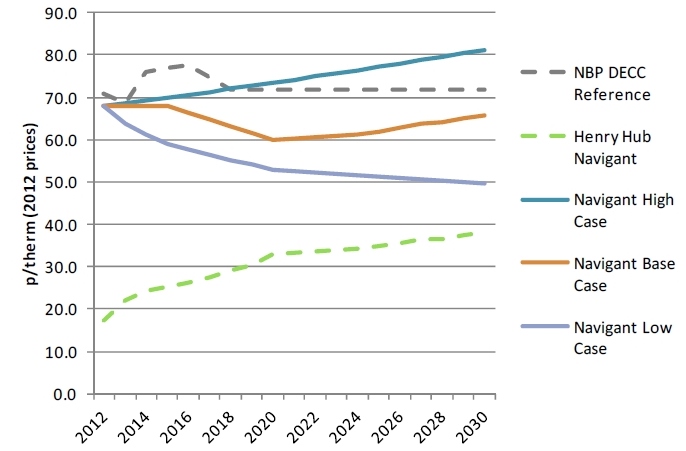

Cameron and Osborne announced a flurry of supportive statements on UK shale gas in July, coinciding with the release of a report commissioned by DECC on the pricing impacts of unconventional gas. The report from US consultants Navigant contained the usual High, Base and Low scenario forecast for UK gas prices over a 2030 time horizon shown in Chart 1 below